The Ether Fund Announces Normal Course Issuer Bid

25 Fevereiro 2021 - 10:00AM

3iQ Corp. is pleased to announce that The Ether Fund (TSX:QETH.U,

QETH.UN) (the “Fund”) has filed a Notice of Intention to make a

normal course issuer bid to purchase up to 1,018,610 Class A Units,

representing approximately 10% of the public float of 10,186,100

Class A Units as of February 18, 2021. The Fund may purchase up to

204,345 Class A Units in any 30 day period which is 2% of the

10,217,275 Class A Units issued and outstanding as at February 18,

2021.

The Class A Units may be purchased for

cancellation from March 1, 2021 to February 28, 2022 through the

facilities of the TSX and/or alternative Canadian trading systems

at a price per Class A Unit not exceeding the last published net

asset value per Class A Unit. The Directors of the 3iQ Corp., the

manager of the Fund, believe that such purchases are in the best

interest of the Fund and are a desirable use of its available

funds. The Fund has not purchased any Class A Units during the

previous year pursuant to any issuer bid.

About 3iQ Corp.

Founded in 2012, 3iQ Corp. (“3iQ”) is Canada’s

largest digital asset investment fund manager with more than C$2.2

billion in assets under management. 3iQ was the first Canadian

investment fund manager to offer a public listed bitcoin investment

fund, The Bitcoin Fund (TSX:QBTC). Gaining access to digital assets

such as bitcoin and Ether can be daunting, costly, and

inconvenient. 3iQ offers investors convenient and familiar

investment products to gain exposure to digital assets. For more

information about 3iQ, The Bitcoin Fund and The Ether Fund, visit

www.3iQ.ca or follow us on Twitter @3iQ_corp.

Contact InformationFred Pye – Chairman and

CEOE: fred.pye@3iQ.caP: +1 (416) 639-2130

You will usually pay brokerage fees to your

dealer if you purchase or sell units of the Fund on the Toronto

Stock Exchange or other alternative Canadian trading system (an

“exchange”). If the units are purchased or sold on an exchange,

investors may pay more than the current net asset value when buying

units of the Fund and may receive less than the current net asset

value when selling them.

There are ongoing fees and expenses associated

with owning units of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

fund. You can find more detailed information about the Fund in its

public filings available at www.sedar.com. Investment funds are not

guaranteed, their values change frequently and past performance may

not be repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the Fund, to the future outlook of

the Fund and anticipated events or results and may include

statements regarding the future financial performance of the Fund.

In some cases, forward-looking information can be identified by

terms such as “may”, “will”, “should”, “expect”, “plan”,

“anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof and we assume no

obligation to update or revise them to reflect new events or

circumstances.

IMPORTANT NOTICES

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED

THEREIN, IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR

DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR

INTO OR FROM THE UNITED STATES OR ANY JURISDICTION IN WHICH THE

SAME WOULD BE UNLAWFUL.

The distribution of this announcement and any

offering or issue of the Company’s securities in any jurisdiction

other than Canada may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about and observe any such restrictions. Any failure to

comply with any such restrictions may constitute a violation of the

securities laws or regulations of such jurisdictions.

In particular, subject to certain exceptions,

this announcement should not be distributed, forwarded, transmitted

or otherwise disseminated in or into the United States. This

announcement does not constitute an offer to sell or issue or the

solicitation of an offer to buy or subscribe for securities in the

United States or any other jurisdiction. The Company’s securities

have not been and will not be registered under the United States

Securities Act of 1933, as amended (the “Securities Act”), or under

the applicable securities laws of any state or other jurisdiction

of the United States, and may not be offered, sold, resold,

transferred or delivered, directly or indirectly within, into or in

the United States, absent registration or an applicable exemption

from, or except in a transaction not subject to, the registration

requirements of the Securities Act and in compliance with the

securities laws of any relevant state or other jurisdiction of the

United States. Neither this announcement, nor the fact that it has

been disseminated, shall form the basis of, or be relied upon in

connection with, any future information that we

distribute.

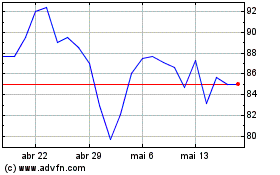

The Bitcoin (TSX:QBTC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

The Bitcoin (TSX:QBTC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024