Acadian Timber Corp. (“Acadian” or the “Company”) (TSX:ADN) today

reported financial and operating results1 for the three months

ended March 27, 2021 (the “first quarter”).

Acadian generated $5.0 million of Free Cash Flow

and declared dividends of $4.8 million to our shareholders during

the first quarter.

“The benefit of strong demand for our softwood

and hardwood sawlogs was offset by temporary road closures caused

by unseasonably warm weather at the end of the quarter, reduced

trucking capacity in Maine, and weak regional softwood pulpwood

demand,” commented Erika Reilly, Chief Executive Officer. “We

expect to catchup on a portion of this volume when road conditions

improve. Looking forward, we continue to focus on harvesting

and merchandizing our products for the highest margin opportunities

while actively working with our contractors to ensure there is

adequate trucking capacity to deliver products to our

customers.”

Acadian’s balance sheet continues to be solid

with $23.6 million of net liquidity as at March 27, 2021, which

includes funds available under our credit facilities.

Health and safety remained a key focus during

the quarter. Acadian experienced no recordable safety incidents

among employees and no incidents among contractors. Acadian also

continued to monitor COVID-19 related developments in the regions

in which it operates and updated its COVID-19 operating plan

accordingly.

Review of Operations

Operating and Financial

Highlights

|

(CAD thousands, except per share information) |

March 27, 2021 |

|

March 28, 2020 |

|

Sales volume (000s m3) |

|

290.0 |

|

|

|

374.9 |

|

|

Sales |

$ |

25,892 |

|

|

$ |

31,408 |

|

|

Operating earnings |

|

6,740 |

|

|

|

8,263 |

|

|

Net income / (loss) |

|

5,824 |

|

|

|

(3,711 |

) |

|

Adjusted EBITDA |

$ |

6,874 |

|

|

$ |

8,329 |

|

|

Adjusted EBITDA margin |

|

27 |

% |

|

|

27 |

% |

|

Free Cash Flow |

$ |

4,990 |

|

|

$ |

6,565 |

|

|

Dividends declared |

|

4,839 |

|

|

|

4,839 |

|

|

Payout Ratio |

|

97 |

% |

|

|

74 |

% |

|

Per share – basic and diluted |

|

|

|

Net income / (loss) |

$ |

0.35 |

|

|

$ |

(0.22 |

) |

|

Free Cash Flow |

|

0.30 |

|

|

|

0.39 |

|

|

Dividends declared |

|

0.29 |

|

|

|

0.29 |

|

During the first quarter, Acadian generated

sales of $25.9 million, compared to $31.4 million in the prior year

period. Sales volume, excluding biomass, decreased 21% primarily

due to temporary road closures caused by unusually mild weather,

reduced trucking capacity in Maine, and lower pulpwood sales.

Weighted average selling price, excluding biomass, was flat

year-over-year as increased sawlog pricing was offset by weaker

pulpwood pricing and a stronger Canadian dollar.

Operating costs and expenses were $19.2 million

during the first quarter, compared to $23.1 million in the prior

year period, reflecting lower volumes and lower administrative

costs. Weighted average variable costs, excluding biomass,

decreased 1%, reflecting a stronger Canadian dollar.

Adjusted EBITDA was $6.9 million during the

first quarter, compared to $8.3 million in the prior year period.

Adjusted EBITDA margin for the quarter was consistent with the

prior year period at 27% and benefited from lower administrative

costs. Free Cash Flow was $5.0 million compared to $6.6 million in

the same period in 2020.

Net income for the first quarter totaled $5.8

million, or $0.35 per share, compared to a net loss of $3.7

million, or $0.22 per share in the same period in 2020. The

variance in net income from the prior year period is primarily due

to a non-cash unrealized foreign exchange gain on long term debt of

$1.2 million compared to a loss of $8.2 million in the prior year

period. Net income was also impacted by a combination of

lower interest expense and gains on non-cash items such as fair

value adjustments in 2021 compared to 2020.

Segment Performance

New Brunswick Timberlands

The table below summarizes operating and

financial results for New Brunswick Timberlands.

| |

Three Months Ended March 27, 2021 |

Three Months Ended March 28, 2020 |

| |

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

Results ($000) |

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

Results ($000s) |

|

Softwood |

98.2 |

86.5 |

45 |

% |

$ |

5,567 |

|

116.5 |

113.4 |

45 |

% |

$ |

6,632 |

|

|

Hardwood |

81.0 |

74.1 |

39 |

% |

|

5,811 |

|

103.8 |

96.0 |

38 |

% |

|

7,765 |

|

|

Biomass |

29.6 |

29.6 |

16 |

% |

|

1,209 |

|

44.8 |

44.8 |

17 |

% |

|

1,493 |

|

| |

208.8 |

190.2 |

100 |

% |

|

12,587 |

|

265.1 |

254.2 |

100 |

% |

|

15,890 |

|

|

Timber services and other |

|

|

|

5,734 |

|

|

|

|

|

5,807 |

|

|

Sales |

|

|

|

$ |

18,321 |

|

|

|

|

$ |

21,697 |

|

| Adjusted

EBITDA |

|

|

|

$ |

5,079 |

|

|

|

|

$ |

5,878 |

|

|

Adjusted EBITDA margin |

|

|

|

28 |

% |

|

|

|

|

27 |

% |

Sales for New Brunswick Timberlands were $18.3

million, compared to $21.7 million during the prior year period.

Sales volume, excluding biomass, decreased 23% relative to the same

period in 2020, primarily due to lower pulpwood sales. During the

first quarter, New Brunswick’s operations were impacted by mild

weather conditions that caused temporary road closures and by

slower softwood pulpwood deliveries due to the impact of sawmill

residuals on the softwood pulpwood market. Biomass sales volume

decreased 34% during the quarter due to reduced biomass production

as more efficient harvesting equipment is now being used, resulting

in less residual fiber being recovered as biomass. The weighted

average selling price, excluding biomass, for the first quarter was

$70.83 per m3, or 3% higher than the prior year period, as a result

of strong softwood sawlogs prices and a higher value product mix

offset by lower pulpwood prices. The margin on biomass was up

39% year-over-year.

Operating costs and expenses were $13.3 million

during the first quarter, compared to $15.9 million in the prior

year period due to lower volumes and administrative costs. Weighted

average variable costs, excluding biomass, were flat

year-over-year.

Adjusted EBITDA for the quarter was $5.1 million

compared to $5.9 million during the prior year period and Adjusted

EBITDA margin was 28% compared to 27% in the prior year period.

Adjusted EBITDA decrease was driven by lower sales volumes for the

reasons described above, partially offset by lower administrative

costs.

There were no recordable safety incidents

amongst employees or contractors during the first quarter of

2021.

Maine Timberlands

The table below summarizes operating and

financial results for Maine Timberlands.

| |

Three Months

Ended March 27, 2021 |

Three Months Ended March 28, 2020 |

| |

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

Results ($000) |

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

Results ($000s) |

|

Softwood |

76.0 |

76.0 |

76 |

% |

$ |

5,718 |

|

92.0 |

92.2 |

76 |

% |

$ |

7,255 |

|

|

Hardwood |

26.9 |

23.5 |

24 |

% |

|

1,753 |

|

30.4 |

28.4 |

24 |

% |

|

2,335 |

|

|

Biomass |

0.3 |

0.3 |

0 |

% |

|

5 |

|

0.1 |

0.1 |

0 |

% |

|

2 |

|

| |

103.2 |

99.8 |

100 |

% |

|

7,476 |

|

122.5 |

120.7 |

100 |

% |

|

9,592 |

|

|

Timber services and other |

|

|

|

95 |

|

|

|

|

|

119 |

|

|

Sales |

|

|

|

$ |

7,571 |

|

|

|

|

$ |

9,711 |

|

| Adjusted

EBITDA |

|

|

|

$ |

2,028 |

|

|

|

|

$ |

3,050 |

|

|

Adjusted EBITDA margin |

|

|

|

27 |

% |

|

|

|

|

31 |

% |

Sales for Maine Timberlands totaled $7.6

million, compared to $9.7 million for the same period last year.

Sales volume, excluding biomass, decreased by 17%. Mild weather

conditions caused temporary road closures and reduced trucking

capacity which in turn slowed production and deliveries during the

first quarter.

The weighted average selling price, excluding

biomass, in Canadian dollar terms was $75.09 per m3, compared to

$79.54 per m3 in 2020. In U.S. dollar terms, the weighted average

selling price, excluding biomass, was flat year-over-year at $59.28

per m3 with higher sawlog prices offset by lower prices for

pulpwood. The 6% price decrease in Canadian dollar terms is

due to changes in the foreign exchange rate compared to the prior

year period.

Operating costs and expenses for the first

quarter were $5.6 million, compared to $6.7 million during the same

period in 2020. This year-over-year decrease reflects lower

volumes and variable costs. Weighted average variable costs,

excluding biomass, decreased 2%, benefiting from a stronger

Canadian dollar partially offset by higher log handling costs.

Adjusted EBITDA for the quarter was $2.0 million

compared to $3.0 million during the prior year period and Adjusted

EBITDA margin was 27% compared to 31% in the prior year period.

Adjusted EBITDA margin was impacted by lower volumes and a

stronger Canadian dollar.

There were no recordable safety incidents

amongst employees or contractors during the first quarter of

2021.

Market Outlook

The following contains forward-looking

information about Acadian Timber Corp.’s market outlook for the

remainder of fiscal 2021. Reference should be made to the

section entitled “Cautionary Statement Regarding Forward-Looking

Information and Statements” section of this news release. For

a description of material factors that could cause actual results

to differ materially from the forward-looking statements in the

following, please see the Risk Factors section of our Management’s

Discussion and Analysis of Acadian’s most recent Annual Report and

Annual Information Form available on our website at

www.acadiantimber.com or filed with SEDAR at

www.sedar.com.

The outlook for softwood and hardwood sawlogs

remains positive, while we expect steady demand for hardwood

pulpwood and biomass, and continued weakness for softwood

pulpwood.

North American softwood lumber consumption, the

end use market for softwood sawlogs, is expected to benefit from

continued strong repair and remodeling activity and a revival in

home construction. Low interest rates, old and underbuilt

housing stock, and favorable demographics are supporting this

outlook.

Regionally, softwood sawlog inventories are

high, but sawmills are running steady. As mills draw down

their inventory through the spring, we expect continued steady

demand as we restart operations in early summer.

Strong end use markets for hardwood lumber and

low hardwood sawlog inventories regionally are expected to support

continued strong demand and pricing for our hardwood sawlogs.

Hardwood pulpwood demand is expected to remain

stable with mills running steady, while softwood pulpwood demand is

likely to remain weak. Continued high inventories regionally

and significant competition from sawmill residuals limit prospects

for near term improvement.

Longer term, we expect regional hardwood

pulpwood markets to strengthen with Louisiana Pacific’s recently

announced investment to convert their Houlton mill to manufacture

engineered wood siding products. Production of this new

product at that facility is slated to begin 2022.

Demand for biomass from Acadian’s New Brunswick

operation, which is mostly hardwood, continues to be steady.

Management Team Changes

Acadian will be promoting Mr. Adam Sheparski,

Acadian’s current Chief Financial Officer, to President and Chief

Executive Officer of Acadian effective July 30, 2021.

“Acadian’s Board of Directors is pleased to

announce Mr. Sheparski as our next President and CEO,” stated

Malcolm Cockwell, Chairman of the Board. “With his financial acumen

and leadership skills, the Board is confident that he will drive

the Company’s initiatives forward and deliver shareholder value

while providing strong leadership to the organization.”

“The Board would like to thank Ms. Erika Reilly

for leading the organization through its transformation to a

self-managed company and for pursuing a number of initiatives that

position Acadian for future success. Erika has agreed to join

the Board of Acadian and we look forward to continuing to work with

her.”

Acadian also announced today that Ms. Susan Wood

will become Chief Financial Officer on July 30, 2021 in conjunction

with Mr. Sheparski becoming President and CEO. Ms. Wood is a

Chartered Professional Accountant and the current Director of

Finance at Acadian, leading all reporting, taxation, and treasury

functions.

Quarterly Dividend

Acadian is pleased to announce a dividend of

$0.29 per share, payable on July 15, 2021 to shareholders of record

on June 30, 2021.

Acadian Timber Corp.

(“Acadian”, the “Company” or “we”) is one of the largest timberland

owners in Eastern Canada and the Northeastern U.S. and has a total

of approximately 2.4 million acres of land under management.

Acadian owns and manages approximately 761,000 acres of

freehold timberlands in New Brunswick (“New Brunswick Timberlands”

or “NB Timberlands”), approximately 300,000 acres of freehold

timberlands in Maine (“Maine Timberlands”) and provides timber

services relating to approximately 1.3 million acres of Crown

licensed timberlands in New Brunswick. Acadian’s products

include softwood and hardwood sawlogs, pulpwood and biomass

by-products, sold to approximately 90 regional customers.

Acadian’s business strategy is to maximize cash

flows from its existing timberland assets through sustainable

forest management and other land use activities while growing its

business by acquiring assets on a value basis and actively managing

these assets to drive improved performance.

Acadian’s shares are listed for trading on the

Toronto Stock Exchange under the symbol ADN.

For further information, please visit our

website at www.acadiantimber.com or

contact:

Adam SheparskiChief Financial OfficerTel:

506-737-2345 Email: ir@acadiantimber.com

Cautionary Statement Regarding

Forward-Looking Information and Statements

This management discussion and analysis

(“MD&A”) contains forward-looking information and statements

within the meaning of applicable Canadian securities laws that

involve known and unknown risks, uncertainties and other factors

that may cause the actual results, performance or achievements of

Acadian Timber Corp. and its subsidiaries (collectively,

“Acadian”), or industry results, to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking statements. When used in this

MD&A, such forward-looking statements may contain such words as

“may,” “will,” “intend,” “should,” “suggest,” “expect,” “believe,”

“outlook,” “forecast,” “predict,” “remain,” “anticipate,”

“estimate,” “potential,” “continue,” “plan,” “could,” “might,”

“project,” “targeting” or the negative of these terms or other

similar terminology. Forward-looking information is included

in this MD&A and includes statements made in this MD&A in

sections entitled “Dividend Policy of the Company,” “Liquidity and

Capital Resources,” and “Market Outlook” and without limitation

other statements regarding management’s beliefs, intentions,

results, performance, goals, achievements, future events, plans and

objectives, business strategy, growth strategy and prospects,

access to capital, liquidity and trading volumes, dividends, taxes,

capital expenditures, projected costs, market trends and similar

statements concerning anticipated future events, results,

achievements, circumstances, performance or expectations that are

not historical facts. These statements, which reflect management’s

current expectations regarding future events and operating

performance, are based on information currently available to

management and speak only as of the date of this MD&A. All

forward-looking statements in this MD&A are qualified by these

cautionary statements. Forward-looking statements involve

significant risks and uncertainties, should not be read as

guarantees of future performance or results, should not be unduly

relied upon, and will not necessarily be accurate indications of

whether or not such results will be achieved. Factors that could

cause actual results to differ materially from the results

discussed in the forward-looking statements include, but are not

limited to: general economic and market conditions; changes in U.S.

housing starts; product demand; concentration of customers;

commodity pricing; interest rate and foreign currency fluctuations;

seasonality; weather and natural conditions; regulatory, trade or

environmental policy changes; changes in Canadian or U.S. income

tax law; the economic situation of key customers; disease outbreak;

Acadian’s ability to source and secure potential investment

opportunities; the availability of potential acquisitions that suit

Acadian’s growth profile; and other risks and factors discussed

under the heading “Risk Factors” in the Annual Report dated

February 10, 2021 and in each of the Annual Information Form dated

March 26, 2021 and the Management Information Circular dated March

26, 2021 and other filings of Acadian made with securities

regulatory authorities, which are available on SEDAR at

www.sedar.com. Forward-looking information is based on various

material factors or assumptions, which are based on information

currently available to Acadian. Material factors or assumptions

that were applied in drawing a conclusion or making an estimate set

out in the forward-looking information may include, but are not

limited to: forecasts in the housing market; anticipated financial

performance; anticipated market conditions; business prospects; the

economic situation of key customers; strategies; regulatory

developments; exchange rates; the sufficiency of budgeted capital

expenditures in carrying out planned activities; the availability

and cost of labour and services; and the ability to obtain

financing on acceptable terms. Readers are cautioned that the

preceding list of material factors or assumptions is not

exhaustive. Although the forward-looking statements contained in

this MD&A are based upon what management believes are

reasonable assumptions, Acadian cannot assure readers that actual

results will be consistent with these forward-looking statements.

The forward-looking statements in this MD&A are made as of the

date of this MD&A and should not be relied upon as representing

Acadian’s views as of any date subsequent to the date of this

MD&A. Acadian assumes no obligation to update or revise these

forward-looking statements to reflect new information, events,

circumstances or otherwise, except as may be required by applicable

law.

Acadian Timber

Corp.Interim Condensed Consolidated Statements of

Net Income / (Loss)(unaudited)

|

Three Months Ended(CAD thousands, except per share data) |

|

March 27, 2021 |

|

March 28, 2020 |

|

Sales |

|

$ |

25,892 |

|

|

$ |

31,408 |

|

|

Operating costs and expenses |

|

|

|

|

Cost of sales |

|

|

17,447 |

|

|

|

20,861 |

|

|

Selling, administration and other |

|

|

1,640 |

|

|

|

2,217 |

|

|

Silviculture |

|

|

3 |

|

|

|

1 |

|

|

Depreciation and amortization |

|

|

62 |

|

|

|

66 |

|

|

|

|

|

19,152 |

|

|

|

23,145 |

|

|

Operating earnings |

|

|

6,740 |

|

|

|

8,263 |

|

|

Interest expense, net |

|

|

(755 |

) |

|

|

(1,291 |

) |

|

Other items |

|

|

|

|

Fair value adjustments and other |

|

|

425 |

|

|

|

(1,019 |

) |

|

Unrealized exchange gain

/ (loss) on long-term debt |

|

1,216 |

|

|

|

(8,210 |

) |

|

Gain on sale of timberlands |

|

|

72 |

|

|

|

— |

|

|

Earnings / (loss) before income taxes |

|

|

7,698 |

|

|

|

(2,257 |

) |

|

Current income tax expense |

|

|

(1,106 |

) |

|

|

(902 |

) |

|

Deferred income tax expense |

|

|

(768 |

) |

|

|

(552 |

) |

|

Net income / (loss) |

|

$ |

5,824 |

|

|

$ |

(3,711 |

) |

|

Net income / (loss) per share – basic and diluted |

|

$ |

0.35 |

|

|

$ |

(0.22 |

) |

Acadian Timber Corp.Interim Condensed

Consolidated Statements of Comprehensive

Income(unaudited)

|

Three Months Ended(CAD thousands) |

March 27, 2021 |

|

March 28, 2020 |

|

Net income / (loss) |

$ |

5,824 |

|

|

$ |

(3,711 |

) |

|

Other comprehensive (loss) / income |

|

|

|

Items that may be reclassified subsequently to net income: |

|

|

|

Unrealized foreign currency translation (loss) / gain |

|

(1,433 |

) |

|

|

11,624 |

|

|

Comprehensive income |

$ |

4,391 |

|

|

$ |

7,913 |

|

Acadian Timber Corp.Interim Condensed

Consolidated Balance

Sheets(unaudited)

|

As at(CAD thousands) |

|

March 27, 2021 |

|

December 31, 2020 |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash |

|

$ |

11,202 |

|

$ |

10,258 |

|

Accounts receivable and other assets |

|

|

7,869 |

|

|

7,731 |

|

Current income taxes receivable |

|

|

— |

|

|

415 |

|

Inventory |

|

|

2,675 |

|

|

957 |

|

|

|

|

21,746 |

|

|

19,361 |

|

Timber |

|

|

386,091 |

|

|

388,005 |

|

Land, roads, and other fixed assets |

|

|

99,331 |

|

|

99,892 |

|

Intangible asset |

|

|

6,140 |

|

|

6,140 |

|

Total assets |

|

$ |

513,308 |

|

$ |

513,398 |

|

Liabilities and shareholders’ equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

7,764 |

|

$ |

8,640 |

|

Current income taxes payable |

|

|

2,287 |

|

|

— |

|

Dividends payable to shareholders |

|

|

4,839 |

|

|

4,839 |

|

|

|

|

14,890 |

|

|

13,479 |

|

Long-term debt |

|

|

100,012 |

|

|

101,185 |

|

Deferred income tax liabilities |

|

|

105,613 |

|

|

105,493 |

|

Shareholders’ equity |

|

|

292,793 |

|

|

293,241 |

|

Total liabilities and shareholders’ equity |

|

$ |

513,308 |

|

$ |

513,398 |

Acadian Timber Corp.Interim Condensed

Consolidated Statements of Cash

Flows(unaudited)

|

Three Months Ended(CAD thousands) |

March 27, 2021 |

|

March 28, 2020 |

|

Cash provided by (used for): |

|

|

|

Operating activities |

|

|

|

Net income / (loss) |

$ |

5,824 |

|

|

$ |

(3,711 |

) |

|

Adjustments to net income / (loss): |

|

|

|

Income tax expense |

|

1,874 |

|

|

|

1,454 |

|

|

Depreciation and amortization |

|

62 |

|

|

|

66 |

|

|

Fair value adjustments and other |

|

(425 |

) |

|

|

1,019 |

|

|

Unrealized exchange (gain) / loss on long-term debt |

|

(1,216 |

) |

|

|

8,210 |

|

|

Gain on sale of timberlands |

|

(72 |

) |

|

|

— |

|

|

Income taxes received |

|

1,586 |

|

|

|

— |

|

|

Net change in non-cash working capital balances and other |

|

(1,856 |

) |

|

|

(306 |

) |

|

|

|

5,777 |

|

|

|

6,732 |

|

|

Financing activities |

|

|

|

Repayment of short-term debt |

|

— |

|

|

|

(7,013 |

) |

|

Issuance of long-term debt |

|

— |

|

|

|

19,795 |

|

|

Repayment of long-term debt |

|

— |

|

|

|

(9,729 |

) |

|

Deferred financing costs |

|

— |

|

|

|

(510 |

) |

|

Dividends paid to shareholders |

|

(4,839 |

) |

|

|

(4,839 |

) |

|

|

|

(4,839 |

) |

|

|

(2,296 |

) |

|

Investing activities |

|

|

|

Additions to timber, land, roads, and other fixed assets |

|

(69 |

) |

|

|

(8 |

) |

|

Proceeds from sale of timberlands |

|

75 |

|

|

|

— |

|

|

|

|

6 |

|

|

|

(8 |

) |

|

Increase in cash during the period |

|

944 |

|

|

|

4,428 |

|

|

Cash, beginning of period |

|

10,258 |

|

|

|

7,601 |

|

|

Cash, end of period |

$ |

11,202 |

|

|

$ |

12,029 |

|

Acadian Timber

Corp.Reconciliations to Adjusted EBITDA and Free

Cash Flow

|

(CAD thousands) |

March 27, 2021 |

|

March 28, 2020 |

|

Net income / (loss) |

$ |

5,824 |

|

|

$ |

(3,711 |

) |

|

Add (deduct): |

|

|

|

Interest expense, net |

|

755 |

|

|

|

1,291 |

|

|

Current income tax expense |

|

1,106 |

|

|

|

902 |

|

|

Deferred income tax expense |

|

768 |

|

|

|

552 |

|

|

Depreciation and amortization |

|

62 |

|

|

|

66 |

|

|

Fair value adjustments and other |

|

(425 |

) |

|

|

1,019 |

|

|

Unrealized exchange (gain) / loss on long-term debt |

|

(1,216 |

) |

|

|

8,210 |

|

|

Adjusted EBITDA |

$ |

6,874 |

|

|

$ |

8,329 |

|

|

Add (deduct): |

|

|

|

Interest paid on debt, net |

|

(712 |

) |

|

|

(854 |

) |

|

Additions to timber, land, roads, and other fixed assets |

|

(69 |

) |

|

|

(8 |

) |

|

Gain on sale of timberlands |

|

(72 |

) |

|

|

— |

|

|

Proceeds from sale of timberlands |

|

75 |

|

|

|

— |

|

|

Current income tax expense |

|

(1,106 |

) |

|

|

(902 |

) |

|

Free Cash Flow |

$ |

4,990 |

|

|

$ |

6,565 |

|

|

Dividends declared |

$ |

4,839 |

|

|

$ |

4,839 |

|

|

Payout Ratio |

|

97 |

% |

|

|

74 |

% |

1 This news release makes reference to Adjusted EBITDA, Adjusted

EBITDA margin, Free Cash Flow and Payout Ratio which are key

performance measures in evaluating Acadian’s operations and are

important in enhancing investors’ understanding of Acadian’s

operating performance. Adjusted EBITDA and Adjusted EBITDA margin

are used to evaluate operational performance. Free Cash Flow is

used to evaluate Acadian’s ability to generate sustainable cash

flows from its operations while the Payout Ratio is used to

evaluate Acadian’s ability to fund its distribution using Free Cash

Flow. Acadian’s management defines Adjusted EBITDA as earnings

before interest, taxes, fair value adjustments, recovery of or

impairment of land and roads, realized gain/loss on sale of other

fixed assets, unrealized exchange gain/loss on debt, depreciation

and amortization and Adjusted EBITDA margin as Adjusted EBITDA as a

percentage of its total revenue. Free Cash Flow is defined as

Adjusted EBITDA less interest paid, current income tax expense, and

capital expenditures plus net proceeds from the sale of fixed

assets (selling price less gains or losses included in Adjusted

EBITDA). Payout Ratio is defined as dividends declared divided by

Free Cash Flow. As these performance measures do not have

standardized meanings prescribed by International Financial

Reporting Standards (“IFRS”), they may not be comparable to similar

measures presented by other companies. As a result, we have

provided in this news release reconciliations of net income, as

determined in accordance with IFRS, to Adjusted EBITDA and Free

Cash Flow.

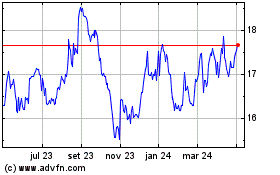

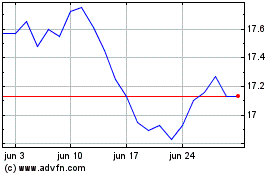

Acadian Timber (TSX:ADN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Acadian Timber (TSX:ADN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024