Koss Corp. Releases Third Quarter Results

12 Maio 2021 - 6:15PM

Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based

high-fidelity headphone company, has reported its third

quarter results for the quarter ended March 31, 2021.

Sales for the third

quarter were $3,987,452, which is a 16.7% decrease

from sales of $4,789,441 for the same three month period one

year ago. The three month net loss was $474,168, compared

to a net loss of $97,373 for the third

quarter last year. Diluted and basic loss per common

share for the quarter was $0.06 compared to a loss per

common share of $0.01 for the same three month period one

year ago.

Sales for the nine months ended March 31, 2021,

decreased 1.7% to $14,125,537 compared to $14,362,862 in the same

period last year. The nine month net income was $161,651 compared

to a net loss of $623,835 for the same period last year. Diluted

and basic income per common share was $0.02 for the nine months

ended March 31, 2021 compared to a loss per common share of $0.08

for the same nine month period one year ago.

"Net sales in the first nine months had a

different composition than last year. We saw a shift to US

distributors, European distributors and domestic direct to consumer

sales and a sharp decline in US mass retail," Michael J. Koss,

Chairman and CEO, said today. "The business has shifted away from a

concentration in mass market retailers to more consumer direct,

specialty and distributor based channels. The net decline in the

quarter's sales revenue can largely be attributed to the sporadic

service disruptions of freight carriers."

"Gross margins are improving with the shift in

sales," Koss explained. "Domestic mass mart retailers typically

yield lower gross margins than the other channels. The net loss in

the quarter included some unusual non-recurring items that

increased administrative costs."

Koss Corporation markets a complete line of

high-fidelity headphones, wireless Bluetooth® speakers, computer

headsets, telecommunications headsets, active noise canceling

headphones, wireless headphones, and compact disc recordings of

American Symphony Orchestras on the Koss Classics® label.

This press release contains forward-looking

statements. These statements relate to future events or our future

financial performance. In some cases, you can identify

forward-looking statements by terminology such as "anticipates,"

"believes," "estimates," "expects," "intends," "plans," "may,"

"will," "should," "forecasts," "predicts," "potential," "continue,"

or the negative of such terms and other comparable terminology.

These statements are based on currently available operating,

financial and competitive information and are subject to various

risks and uncertainties. Actual events or results may differ

materially. In evaluating forward-looking statements, you should

specifically consider various factors that may cause actual results

to vary from those contained in the forward-looking statements,

such as general economic conditions, in particular, consumer demand

for the Company's and its customers' products, competitive and

technological developments, foreign currency fluctuations, and

costs of operations. Shareholders, potential investors and other

readers are urged to consider these factors carefully in evaluating

the forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements made herein are only made as of the date of this press

release and the Company undertakes no obligation to publicly update

such forward-looking statements to reflect subsequent events or

circumstances or new information. In addition, such uncertainties

and other operational matters are discussed further in the

Company's quarterly and annual filings with the Securities and

Exchange Commission.

KOSS

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31 |

|

March 31 |

| |

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Net sales |

$ |

3,987,452 |

|

|

$ |

4,789,441 |

|

|

$ |

14,125,537 |

|

|

$ |

14,362,862 |

|

| Cost of goods sold |

|

2,569,900 |

|

|

|

3,199,665 |

|

|

|

9,453,860 |

|

|

|

10,061,544 |

|

| Gross profit |

|

1,417,552 |

|

|

|

1,589,776 |

|

|

|

4,671,677 |

|

|

|

4,301,318 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

2,271,615 |

|

|

|

1,687,676 |

|

|

|

5,393,211 |

|

|

|

4,938,983 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from operations |

|

(854,063 |

) |

|

|

(97,900 |

) |

|

|

(721,534 |

) |

|

|

(637,665 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

378,805 |

|

|

|

— |

|

|

|

885,505 |

|

|

|

— |

|

|

Interest income |

|

1,139 |

|

|

|

6,631 |

|

|

|

1,748 |

|

|

|

19,955 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before income tax provision |

|

(474,119 |

) |

|

|

(91,269 |

) |

|

|

165,719 |

|

|

|

(617,710 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Income tax provision |

|

49 |

|

|

|

6,104 |

|

|

|

4,068 |

|

|

|

6,125 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(474,168 |

) |

|

$ |

(97,373 |

) |

|

$ |

161,651 |

|

|

$ |

(623,835 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.06 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.02 |

|

|

$ |

(0.08 |

) |

|

Diluted |

$ |

(0.06 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.02 |

|

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of

shares: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

8,100,730 |

|

|

|

7,404,831 |

|

|

|

7,633,722 |

|

|

|

7,404,831 |

|

|

Diluted |

|

8,100,730 |

|

|

|

7,404,831 |

|

|

|

9,188,002 |

|

|

|

7,404,831 |

|

|

CONTACT: |

Michael J. Koss |

| |

Chairman & CEO |

| |

(414) 964-5000 |

| |

mjkoss@koss.com |

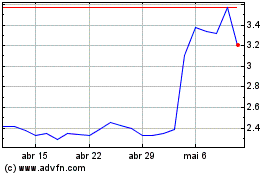

Koss (NASDAQ:KOSS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

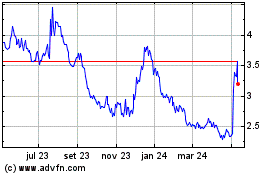

Koss (NASDAQ:KOSS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024