NuVista Energy Ltd. Announces Issuance of $230 Million of Senior Unsecured Notes and Call of Existing 2023 Notes

13 Julho 2021 - 8:49PM

NuVista Energy Ltd. (“NuVista” or the “Company”) (TSX:NVA) is

pleased to announce today that it has entered into an underwriting

agreement to sell, on a private placement basis, $230 million

aggregate principal amount of 7.875% senior unsecured notes due

July 23, 2026 (the "Notes"), which was increased from the

previously announced offering of $200 million. The Notes will be

issued at $989.89 expressed as a price per $1,000.00 principal

amount under a new trust indenture, and will be direct senior

unsecured obligations of NuVista ranking equal with all other

present and future senior unsecured indebtedness of the Company.

The Notes were offered in each of the provinces of Canada and in

the United States on a private placement basis without the filing

of a prospectus or registration statement (the "Offering"). Closing

of the Offering is expected to occur on or about July 23, 2021,

subject to satisfaction of customary closing

conditions. Certain directors and officers of NuVista

have elected to purchase $3.0 million of the Notes.

Subject to the completion of the Offering, the

net proceeds of the Offering, together with borrowings under the

Company’s credit facility, will be used to redeem all of the

Company's existing $220 million senior unsecured notes due 2023

(the "2023 Notes") at a redemption price of 101.625%, plus accrued

and unpaid interest.

CIBC Capital Markets and RBC Capital Markets are

acting as joint bookrunners for the Offering.

This release is not an offer of securities of

the Company for sale in the United States. The Notes of have not

been and will not be registered under the U.S. Securities Act of

1933, as amended, and the Notes may not be offered or sold in the

United States except pursuant to an applicable exemption from such

registration. No public offering of securities is being made in the

United States.

Forward-Looking Information and

Statements

This news release contains certain

forward-looking information and statements within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" “forecast” and similar

expressions are intended to identify forward-looking information or

statements. In particular, but without limiting the foregoing, this

news release contains forward-looking information and statements

pertaining to the following: the completion of the Offering on the

terms anticipated, or at all; the anticipated use of proceeds of

the Offering; and timing of closing of the Offering, the proposed

redemption of the 2023 Notes and the source of funds therefor.

Forward-looking statements or information are

based on a number of material factors, expectations or assumptions

of NuVista which have been used to develop such statements and

information but which may prove to be incorrect. Although NuVista

believes that the expectations reflected in such forward-looking

statements or information are reasonable, undue reliance should not

be placed on forward-looking statements because NuVista can give no

assurance that such expectations will prove to be correct.

The forward-looking information and statements

contained in this news release speak only as of the date of this

news release, and NuVista does not assume any obligation to

publicly update or revise any of the included forward-looking

statements or information, whether as a result of new information,

future events or otherwise, except as may be required by applicable

securities laws.

FOR FURTHER INFORMATION

CONTACT:

|

Jonathan A. Wright |

Ross

L. Andreachuk |

Mike

J. Lawford |

| President and CEO |

VP, Finance and CFO |

Chief Operating Officer |

| (403) 538-8501 |

(403) 538-8539 |

(403) 538-1936 |

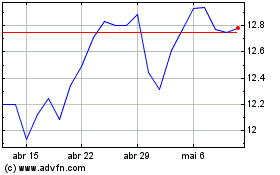

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024