NuVista Energy Ltd. (“NuVista” or the “Company”) (TSX:NVA) is

pleased to announce financial and operating results for the three

and six months ended June 30, 2021, and provide a number of updates

which demonstrate continued successful advancement of our Pipestone

and Wapiti Montney play development. This was a

successful quarter for NuVista, with results that included the

continued ramp-up of production in the new Pipestone North

compressor station facility, the completion and startup of 6 new

wells, and the delivery of production and cash flow results which

were ahead of expectations.

All of the aforementioned actions have placed

NuVista in the solid position of moving forward to 2022 with

strength and increasing momentum in the significantly improved

commodity price environment.

During the quarter ended June 30, 2021, NuVista:

- Produced 51,485 Boe/d, near the top

of guidance range of 50,000 – 52,000 Boe/d. This figure represented

an increase of 12% as compared to the prior quarter. The average

production included the effect of approximately 2,000 Boe/d of

planned midstream maintenance downtime, and approximately 1,000

Boe/d of unplanned downtime which included midstream repairs and

temporary company and midstream production curtailment due to the

unusually hot weather in June;

- Achieved $55.5 million of cash flow

in the quarter ($0.25/share), above expectations due to increased

production and commodity pricing, partially offset by the

associated increase in realized hedging losses;

- Executed a successful capital

program of $44.3 million, including 6 new wells completed and

brought online early in the quarter at an overall cost which was

20% below the 2020 average on a length and tonnage normalized

basis;

- Continued our focus upon reducing

net debt, ending the quarter with reduced credit facility drawings

of $286 million against our successfully redetermined credit

facility capacity of $440 million;

- Continued to significantly advance

our progress and plans in environmental, social and governance

items (“ESG”); and

- In July, successfully refinanced

and redeemed our $220 million of senior unsecured notes which were

due 2023, with the issuance of $230 million 5 year senior unsecured

notes due July 2026, at a coupon rate of 7.875%.

Excellence in Operations and Cost

Reductions

Activity levels are high and a number of

production milestones have been reached on our recent wells.

Drilling is complete on the first of three 6-well pads in

Pipestone; drilling costs averaged $2.1 million or $830 per Hz

meter. On the second 6-well pad we achieved a new NuVista record,

reaching total depth in 9 days (2,960 Hz meters) at a cost of $620

per Hz meter. Completion activities have already commenced at

Pipestone North and we expect cycle time on the next pad from spud

to first sales to be approximately 90 days, which is a 45%

improvement over our prior best. Two 6-well pads at Pipestone North

and a 4-well Pad at Elmworth are all expected to be onstream over

the next 3-4 months.

IP365 milestones have been achieved on our first

three pads drilled on the Pipestone South block. All four benches

in the Montney have been tested. First year average production per

well was 750 Boe/d including 200 Bbls/d of condensate with a

Condensate Gas Ratio (“CGR”) of 55 Bbls/MMcf. This compares well to

management expectations and the IP30 which was 1,615 Boe/d with 630

Bbls/d of condensate and a CGR of 88 Bbls/Mmcf. All-in well costs

averaged $6.4 MM per well. In a flat $65 WTI and $3 NYMEX

environment these wells provide an average of one-year payout. In

addition, our most recent 6-well pad achieved all-in well costs of

$6.0 MM per well which is over 20% lower than our 2020 average on a

length and per tonne normalized basis. These wells have reached the

IP60 milestone averaging 1,460 Boe/d including 600 Bbls/d of

condensate (CGR of 99 Bbls/MMcf), which is 25% above the historic

average in Pipestone South due to well spacing, CGR, and zonal

optimization implemented upon learnings from earlier pads.

In addition, the IP90 milestone was reached at

our first 12-well pad at Pipestone North which tested each of the

four horizons and delineated the Northwest corner of the block.

IP90 volumes per well averaged 1,100 Boe/d including 450 Bbls/d of

condensate (initial CGR >200 Bbls/MMcf). As expected, there was

a range of average IP90 CGR’s encountered on this pad; from 75 to

165 Bbls/MMcf, and we have seen pad average CGR stabilize at ~100

Bbls/MMcf, in-line with our expectations. With well-established

decline rates to date, similar to the three pads at Pipestone

South, this pad is expected to reach payout within its first year.

Payout periods are expected to be improved further with the benefit

of continued well cost reductions which have already been realized

on new wells as noted above. With data now in hand for all four

zones, further optimization of economics through well spacing, CGR,

and zonal highgrading is being implemented similar to Pipestone

South.

Significant Commodity Price

Diversification and Risk Management

Global oil prices continued to strengthen

through the second quarter as advances in vaccine delivery have

spurred increased demand expectations. The supply outlook looks

tight as a consequence of reduced global capital spending and OPEC

production discipline. With natural gas storage levels

reducing partially due to a significant increase in LNG shipments,

improved and sustained strength in NYMEX gas pricing has been

occurring and is expected to continue through 2021. Propane and

butane are also experiencing improved pricing levels. As commodity

prices have now returned to levels in excess of what we require to

drive our near term strategic priorities, we have re-engaged our

rolling hedge program to ensure attenuation of future price

volatility.

We have primarily been using a combination of

collars, swaps and three-way collars in order to provide downside

protection while maintaining upside for price growth. We currently

possess hedges which, in aggregate, cover approximately 68% of

third quarter projected liquids production and 50% of fourth

quarter projected liquids production at an average WTI floor price

of C$66.05/Bbl and an average ceiling of C$76.99/Bbl. We have

hedged approximately 38% of projected remaining 2021 gas production

at an average floor and ceiling price of C$2.12/Mcf and C$2.44/Mcf,

respectively (hedged and exported volumes converted to an AECO

equivalent price) using a combination of swaps and collars.

For the first half of 2022, we have hedged

approximately 38% of projected liquids production at an average

floor price of C$67.32/Bbl using three-way collars, with hedged

volumes declining thereafter. The average ceiling price is

C$80.22/Bbl. We have hedged approximately 12% of projected natural

gas production for 2022 with floor and ceiling prices of $2.60/Mcf

and $2.93/Mcf. All of the preceding percentage figures relate to

production net of royalty volumes.

ESG Progress Continues

We continue to execute upon our stated GHG and

methane emission reduction projects, and we look forward to

providing a significant update on these and other items in our

2019-2020 ESG report which will be published within the next few

weeks.

2021 Guidance Re-affirmed

As discussed above, NuVista is pleased to note

that both condensate and natural gas future strip prices have

increased significantly, resulting in a material increase to

projected cash flows and decreasing debt levels. Our continuing

efforts will be to focus on a disciplined capital program to

maximize economic returns from our existing facilities, and rapid

debt repayment.

NuVista’s capital spending guidance for 2021

remains at $230 – $250 million. Keeping the schedule smooth and

full for existing rigs is increasingly fundamental to retaining

high quality rigs and crews in this tightening and inflationary

environment. This leads to the maximization of efficiency, cost,

and safety performance. Full year 2021 production guidance is

re-affirmed at 50,000 - 52,000 Boe/d, and third quarter production

guidance is 50,000 – 52,000 Boe/d prior to the fourth quarter

ramp-up in production as our post spring breakup wells begin to

come online.

We continue to forecast significant ongoing

reduction of net debt as well as dramatic reduction in net debt to

cash flow ratio. At strip prices*, we anticipate exiting 2021 with

a net debt to annualized fourth quarter cash flow ratio of less

than 1.2x. Net debt at year end 2021 is anticipated to be below

$520 million, a reduction of almost $140 million from the peak

during the 2020 pandemic, with free cash flow driving a further

reduction to approximately $400 million by the end of 2022.

* 2021 full year pricing projection

incorporating actual year to date pricing and July 30th strip

pricing: WTI US$67.00/Bbl, NYMEX US$3.65/MMBtu, AECO $3.20/GJ,

CAD:USD FX 1.25

We intend to continue our track record of

carefully directing additional available cash flow towards a

prudent balance of net debt reduction and production growth until

our existing facilities are filled to maximum efficiency, and net

debt to cash flow levels reach 1.0x or less. Capital spending will

continue to be weighted heavily towards Pipestone, as our highest

return area, with expected well payouts well below a year. NuVista

retains the flexibility to adjust capital spending should commodity

prices increase or retreat significantly from the current positive

trend.

NuVista has a solid business plan that maximizes

free cash flow and the return of capital to shareholders when our

existing facilities are filled to capacity and maximum efficiency

at flattened production levels of approximately 80,000 – 90,000

Boe/d. We are confident that the actions described above accelerate

the Company towards that goal by as early as 2023, while still

providing free cash flow and net debt reduction while growing

through 2021-2023. With facilities filled, returns and netbacks are

enhanced significantly due to efficiencies of scale, with overall

cash costs which are expected to reduce by over 25%, or

approximately $6/Boe by 2023 as compared to the first quarter of

2021.

NuVista has top quality assets and a management

team focused on value and relentless improvement. We have the

necessary foundation and liquidity to add significant value as

commodity prices continue to recover. We have set the table for

returns-focused profitable growth to between 80,000 – 90,000 Boe/d

with only half-cycle spending, since the required facility

infrastructure is now in place. We will continue to adjust to this

environment in order to maximize the value of our asset base and

ensure the long term sustainability of our business. We would like

to thank our staff, contractors, and suppliers for their continued

dedication and delivery, and we thank our board of directors and

our shareholders for their continued guidance and support. Please

note that our corporate presentation, including our outlook for

2022 and beyond, is being updated and will be available at

www.nuvistaenergy.com on August 4, 2021. NuVista’s financial

statements, notes to the financial statements and management’s

discussion and analysis ("MD&A") for the quarter ended June 30,

2021, will be filed on SEDAR (www.sedar.com) under NuVista Energy

Ltd. on August 4, 2021 and can also be accessed on NuVista’s

website.

| Financial and

Operating Highlights |

|

|

|

|

| |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

| (Cdn

$000s, except otherwise indicated) |

2021 |

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

2020 |

|

|

% Change |

|

|

|

FINANCIAL |

|

|

|

|

|

|

|

Petroleum and natural gas revenues |

187,925 |

|

|

67,399 |

|

|

179 |

|

|

339,334 |

|

|

194,552 |

|

|

74 |

|

|

| Adjusted funds flow (1)

(2) |

55,452 |

|

|

15,115 |

|

|

267 |

|

|

88,709 |

|

|

65,983 |

|

|

34 |

|

|

|

Per share - basic |

0.25 |

|

|

0.07 |

|

|

257 |

|

|

0.39 |

|

|

0.29 |

|

|

34 |

|

|

|

Per share - diluted |

0.25 |

|

|

0.07 |

|

|

257 |

|

|

0.38 |

|

|

0.29 |

|

|

31 |

|

|

| Net income (loss) |

(10,941 |

) |

|

(80,422 |

) |

|

(86 |

) |

|

4,447 |

|

|

(869,169 |

) |

|

101 |

|

|

|

Per share - basic |

(0.05 |

) |

|

(0.36 |

) |

|

(86 |

) |

|

0.02 |

|

|

(3.85 |

) |

|

101 |

|

|

|

Per share - diluted |

(0.05 |

) |

|

(0.36 |

) |

|

(86 |

) |

|

0.02 |

|

|

(3.85 |

) |

|

101 |

|

|

| Total assets |

|

|

|

2,140,473 |

|

|

1,503,825 |

|

|

42 |

|

|

| Capital expenditures (2) |

44,344 |

|

|

20,765 |

|

|

114 |

|

|

125,292 |

|

|

149,497 |

|

|

(16 |

) |

|

| Proceeds on property

dispositions |

— |

|

|

— |

|

|

— |

|

|

93,578 |

|

|

— |

|

|

— |

|

|

| Net debt (1) (2) |

|

|

|

547,314 |

|

|

656,889 |

|

|

(17 |

) |

|

|

OPERATING |

|

|

|

|

|

|

| Daily Production |

|

|

|

|

|

|

| Natural gas (MMcf/d) |

178.3 |

|

|

187.1 |

|

|

(5 |

) |

|

173.4 |

|

|

188.0 |

|

|

(8 |

) |

|

| Condensate & oil

(Bbls/d) |

16,296 |

|

|

14,231 |

|

|

15 |

|

|

14,472 |

|

|

14,783 |

|

|

(2 |

) |

|

| NGLs (Bbls/d) |

5,473 |

|

|

5,504 |

|

|

(1 |

) |

|

5,315 |

|

|

5,391 |

|

|

(1 |

) |

|

| Total (Boe/d) |

51,485 |

|

|

50,922 |

|

|

1 |

|

|

48,685 |

|

|

51,501 |

|

|

(5 |

) |

|

| Condensate, oil & NGLs

weighting |

42% |

|

|

39% |

|

|

|

41% |

|

|

39% |

|

|

|

| Condensate & oil

weighting |

32% |

|

|

28% |

|

|

|

30% |

|

|

29% |

|

|

|

| Average realized selling

prices (4) |

|

|

|

|

|

|

| Natural gas ($/Mcf) |

3.48 |

|

|

1.98 |

|

|

76 |

|

|

3.63 |

|

|

2.21 |

|

|

64 |

|

|

| Condensate & oil

($/Bbl) |

79.00 |

|

|

22.46 |

|

|

252 |

|

|

75.47 |

|

|

40.67 |

|

|

86 |

|

|

| NGLs ($/Bbl) (3) |

28.73 |

|

|

9.31 |

|

|

209 |

|

|

28.76 |

|

|

9.68 |

|

|

197 |

|

|

| Netbacks ($/Boe) |

|

|

|

|

|

|

| Petroleum and natural gas

revenues |

40.11 |

|

|

14.54 |

|

|

176 |

|

|

38.50 |

|

|

20.76 |

|

|

85 |

|

|

| Realized gain (loss) on

financial derivatives |

(6.13 |

) |

|

5.84 |

|

|

(205 |

) |

|

(5.65 |

) |

|

4.32 |

|

|

(231 |

) |

|

| Royalties |

(2.24 |

) |

|

(0.11 |

) |

|

1,936 |

|

|

(2.41 |

) |

|

(1.07 |

) |

|

125 |

|

|

| Transportation expenses |

(5.44 |

) |

|

(4.35 |

) |

|

25 |

|

|

(5.27 |

) |

|

(4.25 |

) |

|

24 |

|

|

| Operating expenses |

(10.54 |

) |

|

(9.66 |

) |

|

9 |

|

|

(10.81 |

) |

|

(9.92 |

) |

|

9 |

|

|

| Operating netback (2) |

15.76 |

|

|

6.26 |

|

|

152 |

|

|

14.36 |

|

|

9.84 |

|

|

46 |

|

|

|

Corporate netback (2) |

11.84 |

|

|

3.27 |

|

|

262 |

|

|

10.06 |

|

|

7.04 |

|

|

43 |

|

|

|

SHARE TRADING STATISTICS |

|

|

|

|

|

|

| High ($/share) |

4.01 |

|

|

1.25 |

|

|

221 |

|

|

4.01 |

|

|

3.36 |

|

|

19 |

|

|

| Low ($/share) |

2.00 |

|

|

0.42 |

|

|

376 |

|

|

0.89 |

|

|

0.24 |

|

|

271 |

|

|

| Close ($/share) |

3.98 |

|

|

0.76 |

|

|

424 |

|

|

3.98 |

|

|

0.76 |

|

|

424 |

|

|

| Average daily volume

('000s) |

1,350 |

|

|

3,401 |

|

|

(60 |

) |

|

1,413 |

|

|

2,490 |

|

|

(43 |

) |

|

| Common

shares outstanding ('000s) |

|

|

|

226,256 |

|

|

225,716 |

|

|

— |

|

|

(1) Refer to Note 15 “Capital

management” in NuVista's financial statements and to the sections

entitled “Adjusted funds flow” and “Liquidity and capital

resources” contained in NuVista's MD&A.

(2) Non-GAAP measure that does not have any

standardized meaning under IFRS and therefore may not be comparable

to similar measures presented by other companies where similar

terminology is used. Reference should be made to the “Non-GAAP

measurements”. (3) Natural gas liquids (“NGLs”)

include butane, propane and ethane and an immaterial amount of

sulphur revenue. (4) Product prices exclude

realized gains/losses on financial derivatives.

Advisories Regarding Oil And Gas

Information

BOEs may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 Mcf: 1 Bbl is based on an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Any references in this news release to initial

production rates are useful in confirming the presence of

hydrocarbons, however, such rates are not determinative of the

rates at which such wells will continue production and decline

thereafter. While encouraging, readers are cautioned not to place

reliance on such rates in calculating the aggregate production for

NuVista.

Payout means the anticipated years of production

from a well required to fully pay for the drilling, completion,

equipping and tie-in of such well.

Basis of presentation

Unless otherwise noted, the financial data

presented in this press release has been prepared in accordance

with Canadian generally accepted accounting principles (“GAAP”)

also known as International Financial Reporting Standards (“IFRS”).

The reporting and measurement currency is the Canadian dollar.

National Instrument 51-101 - "Standards of Disclosure for Oil and

Gas Activities" includes condensate within the product type of

natural gas liquids. NuVista has disclosed condensate values

separate from natural gas liquids herein as NuVista believes it

provides a more accurate description of NuVista's operations and

results therefrom.

Advisory regarding forward-looking

information and statements

This press release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. The use of any of the words “will”, “expects”,

“believe”, “plans”, “potential” and similar expressions are

intended to identify forward-looking statements. More particularly

and without limitation, this press release contains forward looking

statements, including management's assessment of: NuVista’s future

focus, strategy, plans, opportunities and operations; that NuVista

will move forward through to 2022 with strength and increasing

momentum; expected cycle time on the next pad at Pipestone North;

expectations with respect to when certain well pads at Pipestone

North, Pipestone South and at Elmworth will be onstream; well

economics and payouts; expectations with respect to future well

cost reductions; anticipated decline rates; expectations with

respect to further optimization of economics at Pipestone North and

that the results of such activities will be similar to Pipestone

South; drilling and completion plans at Elmworth; industry

conditions and commodity prices; the effect of our financial,

commodity, and natural gas risk management strategy and market

diversification; ESG plans and initiatives; that NuVista will

experience a material increase to projected cash flows and

decreased debt levels at current commodity prices; NuVista's plans

to focus on a disciplined capital program to maximize economic

returns from existing facilities and rapid debt repayment; guidance

with respect to 2021 capital spending amounts and spending plans;

that NuVista's capital spending plans will maximize efficiency,

costs, and safety performance; 2021 full year and third quarter

production guidance; expected 2021 exit net debt to annualized

fourth quarter cash flow ratio; 2021 and 2022 year end net debt;

plans to carefully direct available cash flow towards a prudent

balance of net debt reduction and production growth until existing

facilities are filled to maximum efficiency and net debt to cash

flow levels reach 1.0x or less; that capital spending will continue

to be weighted heavily towards Pipestone; expectations that

Pipestone will continue to be NuVista's highest return area;

expected well payouts at Pipestone; that NuVista has the

flexibility to adjust capital spending if commodity prices change;

that NuVista's business plan will maximize free cash flow and will

enable NuVista to return capital to shareholders by as early as

2023; that existing facilities will be filled to capacity by 2023;

that NuVista will experience maximum efficiency at production

levels of approximately 80,000 – 90,000 Boe/d; that NuVista could

achieve its production goal of 80,000 – 90,000 Boe/d by as early as

2023; that NuVIsta will generate free cash flow and will reduce net

debt while growing through 2021-2023; that once existing facilities

are filled returns will be enhanced; that returns and netbacks will

be enhanced significantly due to efficiencies of scale; that

overall cash costs will be reduced by over 25%, or approximately

$6/Boe by 2023; the quality of NuVista's asset base; NuVista's

focus on value and relentless improvement; that NuVista has the

necessary foundation and liquidity to add significant value if

commodity prices continue to recover; that NuVista will experience

returns-focused profitable growth to between 80,000 – 90,000 Boe/d

with only half-cycle spending; that NuVista has the required

facility infrastructure in place to support its growth plans and

that NuVista will continue to adjust to industry conditions in

order to maximize the value of its asset base and ensure the long

term sustainability of its business.

By their nature, forward-looking statements are

based upon certain assumptions and are subject to numerous risks

and uncertainties, some of which are beyond NuVista’s control,

including the impact of general economic conditions, industry

conditions, current and future commodity prices, currency and

interest rates, anticipated production rates, borrowing, operating

and other costs and adjusted funds flow, the timing, allocation and

amount of capital expenditures and the results therefrom,

anticipated reserves and the imprecision of reserve estimates, the

performance of existing wells, the success obtained in drilling new

wells, the sufficiency of budgeted capital expenditures in carrying

out planned activities, access to infrastructure and markets,

competition from other industry participants, availability of

qualified personnel or services and drilling and related equipment,

stock market volatility, effects of regulation by governmental

agencies including changes in environmental regulations, tax laws

and royalties, the ability to access sufficient capital from

internal sources and bank and equity markets; and including,

without limitation, those risks considered under “Risk Factors” in

our Annual Information Form. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

forward-looking statements. NuVista’s actual results, performance

or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements, or if any of them do

so, what benefits NuVista will derive therefrom.

This press release also contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about our prospective

results of operations, all of which are subject to the same

assumptions, risk factors, limitations, and qualifications as set

forth in above. Readers are cautioned that the assumptions used in

the preparation of such information, although considered reasonable

at the time of preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on FOFI and forward-looking

statements. Our actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

FOFI and forward-looking statements, or if any of them do so, what

benefits we will derive therefrom.

We have included the FOFI and forward-looking

statements in this press release in order to provide readers with a

more complete perspective on our prospective results of operations

and such information may not be appropriate for other purposes. The

FOFI and forward-looking statements and information contained in

this press release are made as of the date hereof and we undertake

no obligation to update publicly or revise any FOFI or

forward-looking statements, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

Non-GAAP measurements

Within the press release, references are made to

terms commonly used in the oil and natural gas industry, but do not

have any standardized meaning as prescribed by IFRS and therefore

may not be comparable with the calculations of similar measures for

other entities. Management believes that the presentation of these

non-GAAP measures provide useful information to investors and

shareholders as the measures provide increased transparency and the

ability to better analyze performance against prior periods on a

comparable basis. Management uses "cash flow", "cash flow per

share", "operating netback", "corporate netback", "capital

expenditures", "free cash flow", "net debt", "net debt to cash flow

ratio" and "net debt to annualized cash flow ratio" to analyze

performance and leverage. For further information refer to the

section "Non-GAAP measures" in our MD&A.

For ease of readability, in this press release,

we have used the term "cash flow" instead of "adjusted funds flow"

as defined in our MD&A. Free cash flow is forecast cash flow

less capital expenditures required to maintain production. Cash

costs are defined as the total of operating expenses,

transportation expenses, general and administrative expenses and

financing costs.

The following list identifies certain non-GAAP

measures included in this press release, a description of how the

measure has been calculated, a discussion of why management has

deemed the measure to be useful and a reconciliation to the most

comparable GAAP measure.

Adjusted funds flow

NuVista has calculated adjusted funds flow based

on cash flow provided by operating activities, excluding changes in

non-cash working capital, asset retirement expenditures and

environmental remediation recovery, as management believes the

timing of collection, payment, and occurrence is variable and by

excluding them from the calculation, management is able to provide

a more meaningful measure of NuVista's operations on a continuing

basis. More specifically, expenditures on asset retirement

obligations may vary from period to period depending on the

Company's capital programs and the maturity of its operating areas.

The settlement of asset retirement obligations is managed through

NuVista's capital budgeting process which considers its available

adjusted funds flow.

Adjusted funds flow as presented is not intended

to represent operating cash flow or operating profits for the

period nor should it be viewed as an alternative to cash flow from

operating activities, per the statement of cash flows, net earnings

(loss) or other measures of financial performance calculated in

accordance with GAAP. Adjusted funds flow per share is calculated

based on the weighted average number of common shares outstanding

consistent with the calculation of net earnings (loss) per share.

Refer to Note 15 “Capital Management” in NuVista's financial

statements.

NuVista considers adjusted funds flow to be a

key measure that provides a more complete understanding of the

Company's ability to generate cash flow necessary to finance

capital expenditures, expenditures on asset retirement obligations,

and meet its financial obligations.

The following table provides a reconciliation

between the non-GAAP measure of adjusted funds flow to the more

directly comparable GAAP measure of cash flow from operating

activities:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

|

($ thousands) |

2021 |

|

|

2020 |

|

2021 |

|

|

2020 |

|

|

|

Cash provided by operating activities |

58,357 |

|

|

8,555 |

|

104,508 |

|

|

65,900 |

|

|

|

Add back: |

|

|

|

|

|

Asset retirement expenditures |

265 |

|

|

240 |

|

4,098 |

|

|

9,974 |

|

|

|

Change in non-cash working capital (1) |

(3,170 |

) |

|

6,320 |

|

(19,897 |

) |

|

(9,891 |

) |

|

|

Adjusted funds flow |

55,452 |

|

|

15,115 |

|

88,709 |

|

|

65,983 |

|

|

|

Adjusted funds flow, $/Boe |

11.84 |

|

|

3.27 |

|

10.06 |

|

|

7.04 |

|

|

|

Adjusted funds flow per share, basic |

0.25 |

|

|

0.07 |

|

0.39 |

|

|

0.29 |

|

|

|

Adjusted funds flow per share, diluted |

0.25 |

|

|

0.07 |

|

0.38 |

|

|

0.29 |

|

|

(1) Refer to Note 19 “Supplemental cash flow

information” in the financial statements.

Operating netback and corporate netback

(“netbacks”)

NuVista reports netbacks on a total dollar and

per Boe basis. Operating netback is calculated as petroleum and

natural gas revenues including realized financial derivative

gains/losses, less royalties, transportation and operating

expenses. Corporate netback is operating netback less general and

administrative, deferred share units, interest and lease finance

expense. Netbacks per Boe are calculated by dividing the netbacks

by total production volumes sold in the period.

Management feels both operating and corporate

netbacks are key industry benchmarks and measures of operating

performance for NuVista that assists management and investors in

assessing NuVista's profitability, and are commonly used by other

petroleum and natural gas producers. The measurement on a Boe basis

assists management and investors with evaluating NuVista's

operating performance on a comparable basis.

The following table provides a reconciliation

between the non-GAAP measures of operating and corporate netback to

the most directly comparable GAAP measure of net earnings (loss)

for the period:

|

|

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

|

($ thousands) |

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

|

Net earnings (loss) and comprehensive income (loss) |

(10,941 |

) |

|

(80,422 |

) |

|

4,447 |

|

|

(869,169 |

) |

|

|

Add back: |

|

|

|

|

|

Other Income |

(27 |

) |

|

— |

|

|

(886 |

) |

|

— |

|

|

|

Depletion, depreciation, amortization and impairment |

44,414 |

|

|

45,026 |

|

|

73,585 |

|

|

1,005,105 |

|

|

|

Loss (gain) on property dispositions |

— |

|

|

(578 |

) |

|

(35,375 |

) |

|

2,759 |

|

|

|

Share-based compensation |

3,180 |

|

|

1,702 |

|

|

6,586 |

|

|

1,588 |

|

|

|

Unrealized loss (gain) on financial derivatives |

25,284 |

|

|

49,362 |

|

|

43,417 |

|

|

(7,138 |

) |

|

|

Deferred income tax expense (recovery) |

(4,910 |

) |

|

— |

|

|

(18 |

) |

|

(69,174 |

) |

|

|

General and administrative expenses |

5,223 |

|

|

3,173 |

|

|

10,227 |

|

|

7,318 |

|

|

|

Financing costs |

11,641 |

|

|

10,743 |

|

|

24,645 |

|

|

20,981 |

|

|

|

Operating netback |

73,864 |

|

|

29,006 |

|

|

126,628 |

|

|

92,270 |

|

|

|

Deduct: |

|

|

|

|

|

General and administrative expenses |

(5,223 |

) |

|

(3,173 |

) |

|

(10,227 |

) |

|

(7,318 |

) |

|

|

Share-based compensation expense (recovery) |

(2,034 |

) |

|

(274 |

) |

|

(4,222 |

) |

|

1,302 |

|

|

|

Interest and lease finance expense |

(11,155 |

) |

|

(10,444 |

) |

|

(23,470 |

) |

|

(20,271 |

) |

|

|

Corporate netback |

55,452 |

|

|

15,115 |

|

|

88,709 |

|

|

65,983 |

|

|

Capital expenditures

Capital expenditures are equal to cash flow used

in investing activities, excluding changes in non-cash working

capital, other receivable and property dispositions. Any

expenditures on the other receivable are being refunded to NuVista

and are therefore included under current assets. NuVista considers

capital expenditures to be a useful measure of cash flow used for

capital reinvestment.

The following table provides a reconciliation

between the non-GAAP measure of capital expenditures to the most

directly comparable GAAP measure of cash flow used in investing

activities for the period:

|

|

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

|

($ thousands) |

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

|

Cash flow used in investing activities |

(43,504 |

) |

|

(41,126 |

) |

|

(26,483 |

) |

|

(186,975 |

) |

|

|

Changes in non-cash working capital |

276 |

|

|

22,961 |

|

|

(2,155 |

) |

|

25,200 |

|

|

|

Other receivable |

(1,116 |

) |

|

(2,600 |

) |

|

(3,076 |

) |

|

12,278 |

|

|

|

Property dispositions |

— |

|

|

— |

|

|

(93,578 |

) |

|

— |

|

|

|

Capital expenditures |

(44,344 |

) |

|

(20,765 |

) |

|

(125,292 |

) |

|

(149,497 |

) |

|

Net debt

NuVista has calculated net debt based on cash

and cash equivalents, accounts receivable and prepaid expenses,

accounts payable and accrued liabilities, other receivable,

long-term debt (credit facility) and senior unsecured notes.

Net debt is used by management to provide a more

complete understanding of the Company's capital structure and

provides a key measure to assess the Company's liquidity.

Management has excluded the current and long term financial

instrument commodity contracts as they are subject to a high degree

of volatility prior to ultimate settlement. Similarly, management

has excluded the current and long term portion of asset retirement

obligations as these are estimates based on management's

assumptions and subject to volatility based on changes in cost and

timing estimates, the risk-free rate and inflation rate.

The following table shows the composition of the

non-GAAP measure of net debt with GAAP components from the balance

sheet:

|

($ thousands) |

June 30, 2021 |

|

|

December 31, 2020 |

|

|

|

Cash and cash equivalents, accounts receivable and prepaid

expenses |

(67,985 |

) |

|

(53,093 |

) |

|

|

Other receivable |

(2,395 |

) |

|

(5,471 |

) |

|

|

Accounts payable and accrued liabilities |

107,493 |

|

|

75,142 |

|

|

|

Long-term debt (credit facility) |

286,024 |

|

|

362,673 |

|

|

|

Senior unsecured notes |

218,170 |

|

|

217,724 |

|

|

|

Other liabilities |

6,007 |

|

|

1,860 |

|

|

|

Net debt |

547,314 |

|

|

598,835 |

|

|

|

FOR FURTHER INFORMATION

CONTACT: |

| |

|

|

|

|

|

Jonathan A. Wright |

|

Ross L. Andreachuk |

|

Mike J. Lawford |

|

President and CEO |

|

VP, Finance and CFO |

|

Chief Operating Officer |

|

(403) 538-8501 |

|

(403) 538-8539 |

|

(403) 538-1936 |

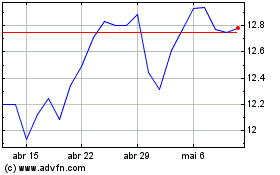

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024