Orosur Mining Inc. - Full Year 2021 Results

30 Agosto 2021 - 1:58PM

Orosur Mining Inc. (“Orosur” or “the Company”) (TSX: OMI) (AIM:

OMI) announces its audited results for the fiscal year ended May

31, 2021. All dollar figures are stated in US$ unless otherwise

noted. The audited financial statements of the Company for the year

ended May 31, 2021; the related management’s discussion and

analysis (“MD&A”); the annual information form (“AIF”) and the

Forms 52-109F1 have all been filed and are available for review on

the SEDAR website at www.sedar.com. The financial statements, the

MD&A and the AIF are also available on the Company’s website at

www.orosur.ca.

HIGHLIGHTS

Colombia

- On 30th September 2020, Newmont

Corporation, entered into a joint venture with Agnico Eagle Mines

Limited (“Agnico”) whereby the two companies jointly assumed and

will advance Newmont’s prior rights and obligations with respect to

the Anzá Project in Colombia on a 50:50 basis, with Agnico as

operator of the joint venture. Agnico’s and Newmont’s JV vehicle

has been renamed Minera Monte Águila.

- Following receipt of exploration

funds from Minera Monte Águila, Minera Anzá began the process of

re-establishing its field camp at the Anzá Project in readiness for

commencement of field operations. A substantial team of

geoscientists and support staff were recruited to manage the

work.

- Drilling operations commenced on

the 15th of November 2020 and a total of some 10,000m have been

drilled to date.

- Four announcements have been made

related to assay results from the ongoing drilling campaign – on

25th January 2021; 22nd February 2021; 4th May 2021; and, 6th July

2021. Key intersections include:

| MAP-072 |

4.1m @ 6.52g/t Au, 29.73g/t Ag and 0.28% Zn from

108m |

| |

5.90m @ 4.55g/t Au, 2.74g/t Ag and 0.30% Zn from

171.1m, and |

| |

70.50m @ 3.53g/t Au, 9.33g/t Ag and 1.62% Zn from

184.80m |

| |

|

| MAP-073 |

21.60m @ 6.02g/t Au, 6.02g/t Ag and 3.23 %Zn from

271.75m |

| |

|

| MAP-074 |

5.20m @ 1.17g/t Au 4.97g/t Ag and 3.02% Zn from

195.40m |

| |

|

| MAP-075 |

19.85m @ 0.90g/t Au 2.17 g/t Ag and 6.46% Zn from

226.15m |

| |

|

| MAP-076 |

12.25m @ 5.39g/t Au, 1.65 g/t Ag and 0.18 % Zn from

228.65m |

| |

|

| MAP-079 |

23.75m @17.40g/t Au, 1.89g/t Ag, 0.19% Zn |

| |

|

| MAP-082 |

29.45m @2.50g/t Au, 1.95g/t Ag, 1.08% Zn |

| |

|

| MAP-089 |

59.55m @9.61g/t Au, 6.23g/t Ag, 3.75% Zn |

| |

|

| MAP-091 |

61.75m @ 2.05g/t Au, 3.3g/t Ag, 0.82% Zn |

- A number of samples remain at the

laboratory of ALS in Peru, which has experienced substantial delays

in turnaround times due to Covid related staff shortages. These

issues are slowly being resolved and it is anticipated that assay

delays will be reduced going forwards

- Apart from drilling at the APTA

prospect, work commenced on regional mapping and sampling across

the wider lease holding. A large program of BLEG sampling was

commenced, which once analyzed should provide vectors to more

targeted programs in following quarters. Initial results have been

promising, with two new prospect areas identified and named for

future reference, Pupino and Pepas.

- The Company has commenced work on

converting the last of its secure license applications to granted

status so that they can be accessed for exploration work later in

the year.

Uruguay

- In Uruguay, the Company has focused

its activities on the implementation of the Creditors Agreement,

which was approved by the Court in September 2019, and on the sale

of the assets of its Uruguayan subsidiary Loryser. As part of that

Agreement, Orosur issued in December 2019, 10,000,000 Orosur common

shares to a trust for the benefit of Loryser’s creditors as

contemplated in the court-approved Creditors Agreement.

- At the same time, and in line with

Company’s expectations, during Q3 2020, Loryser signed a Settlement

Agreement with DINAMA (Uruguay environmental agency) in order to

recover the $1,326,000 from an environmental guarantee it had

executed previously. Pursuant to the Settlement Agreement, Loryser

is continuing with the reclamation of the tailings dam and Dinama

will pay in instalments upon completion of a nine-phased closure

plan. The agreement has been in effect all year after getting final

approval from the Audit Tribunal, who oversees all Governmental

accounts. The reclamation is progressing well. To date, four

payments totalling $957,000 have been received from DINAMA.

- Good progress is being made on the

sale of Loryser’s other assets including plant and equipment. The

proceeds from all of these sales and the sales of the shares by the

Trust will be used to pay liabilities in Uruguay in connection with

the aforementioned Creditors Agreement.

Financial and Corporate

- The consolidated

financial statements have been prepared on a going concern basis

under the historical cost method except for certain financial

assets and liabilities, which are accounted for as Assets and

Liabilities held for sale (at the lower of book value or fair

value) and Profit and Loss from discontinuing operations. This

accounting treatment has been applied to the activities in Uruguay

and Chile.

- On May 31, 2021, the Company had a

cash balance of $6,958,000 (May 31, 2020: $782,000). As at the date

of this announcement the Company had a cash balance of $6,270,000,

which includes the proceeds from the private placement and from the

exercise of stock options, both detailed below.

- On July 17, 2020, Brad George was

appointed Chief Executive Officer and Thomas Masney was appointed

as a non-executive director, replacing Ignacio Salazar and HD Lee

respectively.

- On August 14, 2020, 8,370,000

warrants expired unexercised.

- On October 30, 2020, 2,876,670

stock options were exercised by a number of employees and former

employees resulting in proceeds of CDN$455,000 for the

Company.

- On December 7, 2020, the Company

completed a private placement financing consisting of the sale of

23,529,412 units (the “Units”) at 17 pence per Unit for aggregate

gross proceeds of £4 million ($5,372,000). Each Unit consisted of

one (1) common share in the capital stock of the Company (“Common

Share”) and one-half (1/2) of one Common Share purchase warrant

(each whole warrant, a “Warrant”). Each Warrant entitles the holder

thereof to acquire an additional Common Share at a price of 25.5

pence for a period of 12 months from the date of issuance.

- On December 10, 2020, the Company

granted an aggregate of 5,600,000 stock options of which 4,300,000

were granted to certain directors and officers of the Company, at

an exercise price of CAD$0.325 with an expiration date of December

10, 2030. These options vested 50% immediately and then 50% on

December 10, 2021.

- On January 12, 2021, the Company

appointed Nicholas (Nick) von Schirnding to the Company’s Board as

an Independent Non-Executive Director. The Company also appointed

Louis Castro, then Non-Executive Chairman of the Company, to the

role of Executive Chairman.

Outlook and Strategy

During the period, the Company continued its

focus on developing the potential at Anza and continuing the

orderly closure of its historical operations in Uruguay in

accordance with the court agreed settlement process. Work on both

facets of the corporate strategy is progressing well and the

capital raising in November 2020 has provided sufficient balance

sheet strength to continue progress. The Company has also been

examining new business opportunities in South America and, on July

7th, 2021, it announced that it had entered into a non-binding

Letter of Intent in order to establish a joint venture on a tin

project in Rhondonia state in Brazil.The Company will continue to

build its project portfolio with other high quality assets, subject

to current travel restrictions caused by Covid.

Brad George, CEO of Orosur

said:“Operationally and financially it has been a good

year, albeit a somewhat challenging one in light of the Covid-19

pandemic that has impacted every facet of our business. Uruguay

continues to be wound down in an orderly fashion as per our plans

and is near the end; Colombia has been a major success story with

tremendous results from our drilling and sampling programs, all

undertaken while the pandemic raged around us; and our balance

sheet was brought back to life with a well-supported capital

raising. With work accelerating at Anza and with potential new

projects coming on line, this coming year looks to be even

better.”

|

Orosur Mining Inc.Consolidated Statements

of Financial Position(Expressed in thousands of

United States dollars) |

|

|

|

|

As at |

As at |

|

|

May 31,2021 |

May 31,2020 |

|

|

|

(Revised Note 1) |

|

ASSETS |

|

|

|

Current assetsCash and cash equivalents |

$ |

6,958 |

|

$ |

782 |

|

|

Restricted cash |

|

1,367 |

|

|

- |

|

|

Accounts receivable and other assets |

|

201 |

|

|

130 |

|

|

Assets held for sale in Uruguay |

|

2,314 |

|

|

3,081 |

|

|

Total current assets |

|

10,840 |

|

|

3,993 |

|

|

Non-current assetsProperty, plant and

equipment |

|

124 |

|

|

72 |

|

|

Exploration and evaluation assets Colombia |

|

5,148 |

|

|

6,479 |

|

|

Total assets |

$ |

16,112 |

|

$ |

10,544 |

|

|

LIABILITIES AND (DEFICIT) |

|

|

|

Current liabilitiesAccounts payable and accrued

liabilities |

$ |

486 |

|

$ |

313 |

|

|

Liabilities of Chile discontinued operation |

|

2,047 |

|

|

2,010 |

|

|

Warrant liability |

|

1,734 |

|

|

- |

|

|

Liabilities held for sale in Uruguay |

|

16,830 |

|

|

17,995 |

|

|

Total current liabilities |

|

21,097 |

|

|

20,318 |

|

|

DeficitShare capital |

|

69,333 |

|

|

65,670 |

|

|

Shares held by Trust |

|

(165 |

) |

|

(380 |

) |

|

Contributed surplus |

|

8,591 |

|

|

5,987 |

|

|

Currency translation reserve |

|

(1,826 |

) |

|

(2,016 |

) |

|

Deficit |

|

(80,918 |

) |

|

(79,035 |

) |

|

Total deficit |

|

(4,985 |

) |

|

(9,774 |

) |

|

Total liabilities and deficit |

$ |

16,112 |

|

$ |

10,544 |

|

|

Orosur Mining Inc.Consolidated Statements

of Loss and Comprehensive Loss(Expressed in

thousands of United States dollars) |

|

|

|

|

|

|

Year Ended |

Year Ended |

|

|

May 31, 2021 |

May 31, 2020 |

|

|

|

(Revised Note 1) |

|

Operating expensesCorporate and administrative

expenses |

$ |

(1,206 |

) |

$ |

(1,453 |

) |

|

Exploration expenses |

|

(29 |

) |

|

(44 |

) |

|

Share-based payments |

|

(1,048 |

) |

|

(40 |

) |

|

Other income |

|

21 |

|

|

6 |

|

|

Net finance cost |

|

(187 |

) |

|

(6 |

) |

|

Gain on fair value of warrants |

|

627 |

|

|

11 |

|

|

Net foreign exchange gain (loss) |

|

110 |

|

|

(1 |

) |

|

Net (loss) for the year for continued

operations |

$ |

(1,712 |

) |

$ |

(1,527 |

) |

|

Other comprehensive income (loss):Cumulative

translation adjustment |

$ |

190 |

|

$ |

(510 |

) |

|

Total comprehensive (loss) for the year from continued

operations |

|

(1,522 |

) |

|

(2,037 |

) |

|

(Loss) income from discontinued operations |

|

(171 |

) |

|

1,891 |

|

|

Total comprehensive (loss) for the year |

|

(1,693 |

) |

|

(146 |

) |

|

Basic and diluted net (loss) per share for continued

operations |

$ |

(0.01 |

) |

$ |

(0.01 |

) |

|

Basic and diluted net (loss) income per share for

discontinued operations |

$ |

(0.00 |

) |

$ |

0.01 |

|

|

Weighted average number of common shares

outstanding |

|

173,825 |

|

|

153,380 |

|

|

Orosur Mining Inc.Consolidated Statements

of Cash Flows(Expressed in thousands of United

States dollars) |

|

|

|

|

Year Ended |

Year Ended |

|

|

May 31, |

May 31, |

|

|

2021 |

2020 |

|

|

|

(Revised Note 1) |

|

Operating activities |

|

|

|

Net (loss) income for the year |

$ |

(1,883 |

) |

$ |

364 |

|

|

Adjustments for: |

|

|

|

Depreciation / Write downs |

|

356 |

|

|

66 |

|

|

Share-based payments |

|

1,048 |

|

|

40 |

|

|

Labor provision adjustments |

|

(1,472 |

) |

|

- |

|

|

Obsolescence provision |

|

443 |

|

|

(83 |

) |

|

Fair value of warrants |

|

(627 |

) |

|

(11 |

) |

|

Accretion of asset retirement obligation |

|

4 |

|

|

(130 |

) |

|

Gain on sale of property, plant and equipment |

|

(379 |

) |

|

(830 |

) |

|

Foreign exchange and other |

|

440 |

|

|

(1,032 |

) |

| Changes

in non-cash working capital items: |

|

|

|

Accounts receivable and other assets |

|

73 |

|

|

464 |

|

|

Inventories |

|

247 |

|

|

915 |

|

|

Accounts payable and accrued liabilities |

|

481 |

|

|

(1,748 |

) |

|

Net cash used in operating activities |

|

(1,270 |

) |

|

(1,985 |

) |

|

|

|

|

|

Investing activities |

|

|

|

Increase in the restricted cash |

|

(1,367 |

) |

|

- |

|

|

Proceeds received for sale of property, plant and equipment |

|

758 |

|

|

1,120 |

|

|

Purchase of property, plant and equipment |

|

(59 |

) |

|

- |

|

|

Environmental tasks |

|

(708 |

) |

|

(215 |

) |

|

Proceeds received from exploration and option agreement |

|

4,660 |

|

|

2,019 |

|

|

Exploration and evaluation expenditures |

|

(3,087 |

) |

|

(554 |

) |

|

Net cash provided by investing activities |

|

196 |

|

|

2,370 |

|

|

|

|

|

|

Financing activities |

|

|

|

Issue of common shares |

|

5,154 |

|

|

- |

|

|

Proceeds from the sale of treasury shares |

|

1,879 |

|

|

- |

|

|

Proceeds from exercise of options |

|

455 |

|

|

- |

|

|

Proceeds from exercise of warrants |

|

308 |

|

|

- |

|

|

Net cash provided by financing activities |

|

7,796 |

|

|

- |

|

|

Net Change in cash and cash equivalents |

|

6,722 |

|

|

385 |

|

|

Net change in cash classified within assets held for

sale |

|

(546 |

) |

|

(129 |

) |

|

Cash and cash equivalents, beginning of year |

|

782 |

|

|

526 |

|

|

Cash and cash equivalents, end of year |

$ |

6,958 |

|

$ |

782 |

|

|

Operating activities |

|

|

|

- continued operations |

|

(1,766 |

) |

|

(1,209 |

) |

|

- discontinued operations |

|

496 |

|

|

(776 |

) |

|

Investing activities |

|

|

|

- continued operations |

|

146 |

|

|

1,465 |

|

|

- discontinued operations |

|

50 |

|

|

905 |

|

|

Financing activities |

|

|

|

- continued operations |

|

7,796 |

|

|

- |

|

Note 1. Revision

of 2020 reported financial statements

Subsequent to the issuance of the previously

reported financial statements for the year ended May 31, 2020, a

review of foreign exchange movements in its Uruguayan discontinued

operations have caused the Company to revise the prior period

comparative figures, increasing creditors in its discontinued

operation by $606,000 which results in a change in the

comprehensive profit (loss) from a profit of $460,000 to a loss of

$(146,000).

Whilst the comparative figures have been

revised, the Company has concluded that the adjustment is not

material to any of the previously issued consolidated financial

statements. In reaching this conclusion the Company has had regards

to the following: the adjustment is non-cash in nature; it is an

adjustment solely to the discontinued activities of the Company and

increases the liabilities of the discontinued activities from

$17,389 to $17,995 (an immaterial increase of 3%). Furthermore,

there is no impact on the Company’s assessment of going concern nor

on the liquidity of the Company.

For further information, please

contact:

Orosur Mining IncLouis Castro,

Chairman, Brad George, CEO info@orosur.ca Tel: +1 (778)

373-0100

SP Angel Corporate Finance LLP – Nomad

& BrokerJeff Keating / Caroline RoweTel: +44 (0) 20 3

470 0470

Turner Pope Investments (TPI)

Ltd – Joint

BrokerAndy Thacker/James PopeTel: +44 (0)20 3657

0050

Flagstaff Communications Tim

ThompsonMark EdwardsFergus

Mellonorosur@flagstaffcomms.com

Tel: +44 (0)207 129 1474

About Orosur Mining Inc.

Orosur Mining Inc. (TSX: OMI; AIM: OMI) is a

South American focused minerals exploration and development

company. The Company operates in Colombia and Uruguay.

Forward Looking Statements

All statements, other than statements of

historical fact, contained in this news release constitute “forward

looking statements” within the meaning of applicable securities

laws, including but not limited to the “safe harbour” provisions of

the United States Private Securities Litigation Reform Act of 1995

and are based on expectations estimates and projections as of the

date of this news release.

Forward-looking statements include, without

limitation, the exploration plans in Colombia and the funding from

Minera Monte Águila of those plans, Minera Monte Águila’s decision

to continue with the Exploration and Option agreement, the ability

for Loryser to continue and finalize with the remediation in

Uruguay, the ability to implement the Creditors’ Agreement

successfully as well as continuation of the business of the Company

as a going concern and other events or conditions that may occur in

the future. The Company’s continuance as a going concern is

dependent upon its ability to obtain adequate financing and to

reach a satisfactory implementation of the Creditor’s Agreement in

Uruguay. These material uncertainties may cast significant doubt

upon the Company’s ability to realize its assets and discharge its

liabilities in the normal course of business and accordingly the

appropriateness of the use of accounting principles applicable to a

going concern. There can be no assurance that such statements will

prove to be accurate. Actual results and future events could differ

materially from those anticipated in such forward-looking

statements. Such statements are subject to significant risks and

uncertainties including, but not limited, those as described in

Section “Risks Factors” of the MD&A and the Annual Information

Form. The Company disclaims any intention or obligation to update

or revise any forward-looking statements whether as a result of new

information, future events and such forward-looking statements,

except to the extent required by applicable law.

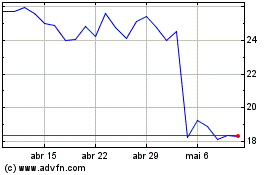

Owens and Minor (NYSE:OMI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

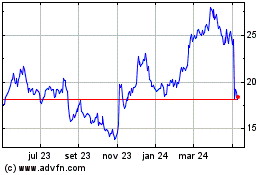

Owens and Minor (NYSE:OMI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024