XP Inc. (NASDAQ: XP) (“XP” or the “Company”), a leading

tech-enabled platform and a trusted pioneer in providing low-fee

financial products and services in Brazil, reported today its

financial results for the third quarter of 2021.

To our shareholders

"In adversity, some give up, while others exceed

records." Ayrton Senna.

This phrase has been inspiring us throughout our

history.

The ownership culture and our partnership,

currently with more than 800 partners and 6,000 empowered

executives acting as CEOs, coupled with our resilience and

tenacity, were the factors that made us overcome various moments of

uncertainty we have been through. It was like that in 2001, 2005,

2007, 2014 and 2019, and it will be no different today.

Whether or not we are in a crisis we cannot say,

it shall become clearer over time, but the environment is certainly

complex, and we like challenges.

In our opinion, the ability to connect dots in a

chronological order of relevance is how an entrepreneurial journey

is built. Crises force us to revisit this sequence and quickly

rebuild this chain. Our greatest quality is precisely this

pragmatism of thought and strong discipline of execution.

Our roadmap, as we've talked about since the

IPO, is to continue expanding into new verticals, to provoke

ourselves to go even further to better serve our clients and thus

increasingly address the huge revenue pool of the financial

industry and its adjacencies. Today we operate in a market of

R$120bn of annual revenue, still small in the context of an

industry pool of R$800bn.

Our efforts and investments in the allocation

and addition of employees are divided into three strategic pillars:

i) Foundations; ii) Protect and Expand the Core and iii) Build the

Future.

Foundations represent the

backbone that supports the company and allows it to grow

exponentially and sustainably. It includes, among others, the

Technology and Back Office infrastructures.

Protecting and Expanding the

Core involves the continuous focus on innovating and

reinforcing our competitive advantages in the universe of

Investments and Capital Markets, never complacent with what we have

built up to now. These pillars include, among others, the mission

of promoting the availability and liquidity of high-quality

products at the lowest possible cost, continuing to develop our

distribution channels – both advisory and self-service – and

advancing in the construction of a unique ecosystem of financial

education, digital content and entrepreneurship. In the investment

world, the concentration in the five big banks still exceeds 90%,

and our share-of-wallet of existing clients is approximately

50%.

Building the Future, in turn,

encompasses projects that are in their early stages and still

generate little or no revenue, but which will allow XP to impact an

increasing number of individuals and companies in Brazil over the

next years. These projects include the frequently mentioned

Banking, Credit, Insurance and Companies initiatives and other high

potential fronts. We could not be more confident with the prospects

of these businesses and with the return that investments made

throughout 2021 and 2022 will bring to the company in the following

years.

In the medium term, between 24-36 months,

entering these verticals will expand our operations to a potential

market of R$350bn to R$400bn of annual revenue.

In the third quarter we saw some of these lines

begin to evolve and gain relevance, such as credit and credit

cards. The growing representation of these products helped us to

expand our revenue and strengthen our business.

Today we see the company more solid and

capitalized than in any other challenging moment we have had to

face in the past. Hence, we hope to maintain a consistent growth

trajectory in the main KPIs, and we believe that the changes that

the financial sector has been going through will allow us to grow

even more intensely, benefiting consumers and literally

transforming the financial environment in our country.

Additionally, the diversification of our

business and the portfolio effect, especially in Retail, tend to

preserve the company's revenue-generating capacity in different

scenarios.

In the first days of October, we had the

important conclusion of the spin-off process of Itaú Unibanco's

stake in XP Inc. An event that brought us improvements in terms of

corporate governance and strategic flexibility, as well as a broad

base of institutional and individual investors, to which we would

like to welcome in this letter.

We will continue to fight tirelessly against

banking concentration in our country, bringing more extraordinary

products and experiences to our customers, always focusing on the

long term and strengthening our purpose: to improve people's

lives.

We are sure that our story has just begun, that

XP is our life project and that the next few years will be even

more exponential.

Thiago Maffra, CEO

Key Business Metrics

| |

|

|

|

|

|

|

|

3Q21 |

3Q20 |

YoY |

2Q21 |

QoQ |

|

Operating and Financial Metrics (unaudited) |

|

|

|

|

|

|

Total AUC (in R$ bn) |

789 |

563 |

40% |

817 |

-3% |

| Active

clients (in '000s) |

3,296 |

2,645 |

25% |

3,140 |

5% |

| Retail –

gross total revenues (in R$ mn) |

2,599 |

1,698 |

53% |

2,452 |

6% |

|

Institutional – gross total revenues (in R$ mn) |

281 |

239 |

17% |

375 |

-25% |

| Issuer

Services – gross total revenues (in R$ mn) |

284 |

169 |

68% |

255 |

11% |

| Digital

Content – gross total revenues (in R$ mn) |

31 |

32 |

-2% |

29 |

6% |

| Other –

gross total revenues (in R$ mn) |

172 |

107 |

61% |

88 |

95% |

| |

|

|

|

|

|

|

Company Financial Metrics |

|

|

|

|

|

| Gross

revenue (in R$ mn) |

3,368 |

2,245 |

50% |

3,200 |

5% |

| Net Revenue

(in R$ mn) |

3,171 |

2,101 |

51% |

3,018 |

5% |

| Gross Profit

(in R$ mn) |

2,277 |

1,395 |

63% |

2,127 |

7% |

| Gross

Margin |

71.8% |

66.4% |

541

bps |

70.5% |

133

bps |

| Adjusted

EBITDA1 (in R$ mn) |

1,170 |

728 |

61% |

1,245 |

-6% |

| Adjusted

EBITDA margin |

36.9% |

34.6% |

225

bps |

41.3% |

-438

bps |

| Adjusted Net

Income1 (in R$ mn) |

1,039 |

570 |

82% |

1,034 |

1% |

|

Adjusted Net Margin |

32.8% |

27.1% |

561 bps |

34.2% |

-149 bps |

|

(1) See appendix for a reconciliation of Adjusted Net Income and

Adjusted EBITDA |

|

|

|

| |

|

|

|

|

|

Operational Performance

Investments

Assets Under Custody (in R$

bn)

Total AUC was R$789 billion as of September 30,

up 40% year-over-year and down 3% quarter-over-quarter.

Year-over-year growth was driven by R$219 billion of net inflows

and R$7 billion of market appreciation. Relevant market

depreciation over 3Q21 offset most of the appreciation seen in

recent quarters.

*Concentrated custodies are custodies greater

than R$ 5 billion per client/economic group. These custodies are

more volatile by nature.

Net Inflows¹ (in R$ bn)

Total net inflows were R$37 billion on 3Q21 vs

R$75 billion on 2Q21. Adjusted by concentrated custodies, net

inflows reached R$47 billion, R$16bn per month, up from R$45

billion on 2Q21 and reflecting the strong performance of both IFA

and Direct channels at the XP brand.

¹Adjusted by concentrated inflows/outflows.

Concentrated inflows/outflows are the ones greater than R$ 5

billion per client/economic group. These custodies are more

volatile by nature.

Banking

Credit

Portfolio1 (in R$

bn)

Our Credit portfolio reached R$8.6 billion as of

September 30, 2021, increasing six times year over year. The

duration of our credit book was 3.3 years, with a 90-day

Non-Performing Loan (NPL) ratio of 0%.

¹This portfolio does not include Intercompany

and Credit Card related loans and receivables

Credit Card TPV (in R$ bn)

On 3Q21, XP Visa Infinite credit cards generated

R$3.3 billion in TPV (Total Purchased Value), a growth of 55%

quarter-over-quarter.

“Despite being at a very early stage in our

banking initiatives, mainly collateralized credit and credit card,

our data indicates a strong potential for cross selling in our

platform. Our focus is to increase engagement within our client

base, providing a complete and integrated experience, enhancing our

long-term relationship with our clients” commented Thiago Maffra,

XP Inc.’s CEO.

Active Clients (in ‘000s)

Active clients grew 25% and 5% in 3Q21 vs 3Q20

and 2Q21, respectively, reaching 3.3 million. Average monthly

client additions grew 6% sequentially from 49,000 in 2Q21 to 52,000

in 3Q21.

“Despite the more challenging environment, with

interest rates in an upward trend, we expect to continue to see a

healthy growth pace in our mains KPIs, due to a diversified

business model and a still highly concentrated financial industry

in Brazil”, commented Bruno Constantino, XP Inc.’s CFO.

IFA Network Gross Adds

IFA Network gross additions totaled 1,188 in

3Q21, up 30% year-over-year and remaining stable

quarter-over-quarter.

Retail DATs¹ (mn trades)

Retail DATs totaled 2.6 million in 3Q21,

remaining relatively stable quarter-over-quarter and

year-over-year.

¹Daily Average Trades, including Stocks, REITs,

Options and Futures

Net Promoter Score (NPS)

Our NPS, a widely known survey methodology used

to measure customer satisfaction, was 77 in

September 2021, reflecting our ongoing efforts to provide superior

customer service at a lower cost. Maintaining a high NPS score

remains a priority for XP since our business model is built around

client experience. The NPS calculation as of a given date reflects

the average scores in the prior six months.

3Q21 Revenue Breakdown

Total Gross Revenue (in R$

mn)

Total Gross Revenue grew 50% from R$2.2 billion

in 3Q20 to R$3.4 billion in 3Q21.The increase was mainly driven by

the Retail business, which contributed with 80% of the growth

year-over-year, while Issuer Services contributed with 10%. In

addition to the growing contribution from Banking revenues, mainly

net interest income and interchange fees, our resilient revenue

growth also shows how our business has been able to adapt to

distinct economic cycles. The reduction in DATs and the consequent

impact on revenues from Equities and Futures seen since 1Q21 has

been more than offset by the positive performance of interest rate

linked lines such as Fixed Income, Floating and Interest on Gross

Cash over the past two quarters. Our strong distribution channel

coupled with a comprehensive product offering and focus on client

experience are key factors that allow for such adaptability.

Retail

Retail Revenue (in R$ mn)

3Q20 vs 3Q21

Retail revenue grew 53% from R$1.7 billion in

3Q20 to R$2.6 billion in 3Q21, attributable mostly to (i) fixed

income and structured products growth and (ii) floating revenues

driven by higher interest rates. Revenue profile was on par with

2Q21, when there was an increase in the demand for fixed income

products and stable trading volumes in equities and futures.

In 3Q21, Retail-related revenues represented 83%

of consolidated Net Income from Financial Instruments, as per the

Accounting Income Statement, and were composed of Derivatives,

Fixed Income secondary transactions and Floating, among others.

LTM Take Rate (LTM Retail Revenue /

Average AUC)

The take rate for the last twelve months ended

September 30, 2021 remained stable compared to the same period of

2020. Our ability to add new products and services to the platform

– such as credit cards and credit – coupled with a diversified

revenue profile, kept our take rate stable.

Note: LTM Take Rate (LTM Retail Revenue /

Average AUC). Average AUC = (Sum of AUC from the beginning of

period and each quarter-end in a given year, being 5 data points in

one year)/5

Institutional

Institutional Revenue (in R$

mn)

3Q20 vs 3Q21

Institutional gross revenue totaled R$281

million in the 3Q21, up 17% from R$239 million in 3Q20. The result

was largely driven by a strong fixed income activity – also

benefiting from recent increases in interest rates in Brazil.

In 3Q21, Institutional revenue accounted for 6%

of consolidated Net Income from Financial Instruments, as per the

Accounting Income Statement, and was composed mostly of Fixed

Income secondary transactions and Derivatives, among others.

Issuer Services

Issuer Services Revenue (in R$

mn)

3Q20 vs 3Q21

Issuer Services revenue expanded 68%

year-over-year from R$169 million in 3Q20 to R$284 million in 3Q21.

This increase was driven by (i) Equity Capital Markets (ECM), with

15 executed deals vs 14 in 3Q20, and (ii) our Debt Capital Markets

(DCM) division, with participation in 48 deals vs 34 in 3Q20.

Our Issuer Services business is key to foster

our product offering and contribute to the development of Capital

Markets in Brazil. Although market conditions may affect our ECM

results in the short-term, the DCM division is expected to benefit

from the demand of corporate clients for alternative funding

sources. Furthermore, we see our recent M&A initiative starting

to flourish, reaping the benefits from being inserted in a complete

ecosystem with several opportunities for deal origination.

Digital Content and Other

Digital Content Revenue

Gross revenue totaled R$31 million in 3Q21, down

2% from R$32 million in 3Q20. Our digital content plays an

important role in educating Brazilians and making them more

proficient in financial products and services. It also enhances

client’s relationships and attracts new clients that grow our

retail platform. 3Q21 trends remained pressured by the absence of

in-person events and courses.

Other Revenue

3Q20 vs 3Q21

Other revenue increased 61% in 3Q21 vs 3Q20,

from R$107 million to R$172 million. Interest on gross cash was

higher due to both increases in interest rates and higher adjusted

gross financial asset balance in the period, along with better

results coming from asset and liability management.

In 3Q21, other revenue accounted for 10% of

consolidated Net Income from Financial Instruments, as per the

Accounting Income Statement, composed mostly of interest on

adjusted gross cash and results related to our asset and liability

management.

COGS

COGS (in R$ mn) and Gross

Margin

3Q20 vs 3Q21

COGS rose 27% from R$706 million in 3Q20 to

R$894 million in 3Q21, following the expansion in overall Retail

Revenues. There were two main drivers for this quarter’s margin

expansion: (i) our continued investments in new product deployments

– such as credit cards and credit – and (ii) rebalancing of our

product mix towards products that tend to benefit from the current

macroeconomic scenario, which has led to an increase in Gross

Margin to 71.8% in the 3Q21, the highest since our IPO.

SG&A Expenses

SG&A Expenses (ex-Share-Based

Compensation) (in R$ mn)

3Q20 vs 3Q21

SG&A expenses (excluding share-based

compensation) totaled R$1,116 million in 3Q21, up 67% from R$669

million in 3Q20. Despite the fact that the marketplace is

increasingly competitive concerning talent attraction and

retention, especially for technology professionals, we have been

able to hire people destined to carry out all the new initiatives

and products, including the abovementioned pillars of (i)

technology and operational foundations, (ii) core business and

(iii) building the future. The increase in headcount was the main

driver behind SG&A growth, as our headcount has increased by

64% in last twelve months, from 3,364 in 3Q20 to 5,527 in 3Q21.

This led to a temporary increase in SG&A as a percentage of Net

Revenue to higher levels, which should be transitory for the next

12 to 15 months, while the new initiatives and products are still

in rollout phase.

Share-Based Compensation (in R$

mn)

Through 3Q21, we have granted approximately half

of the current approved program authorizing dilution of up to 5%.

Expenses related to the program remained steady compared to 2Q21.

We expect to use the approved dilution as originally planned:

within five years from the IPO. A portion of Share-Based

Compensation is related to IFAs and allocated in COGS.

Adjusted EBITDA

Adjusted EBITDA¹ (in R$ mn) and

Margin

3Q20 vs 3Q21

Adjusted EBITDA grew 61% year over year, from

R$728 million to R$1,170 million. Adjusted EBITDA margin expanded

225 bps to 36.9%, driven by gross margin expansion, which was

partially offset by higher SG&A expenses, mainly attributable

to headcount growth. Excluding our considerable investments in

technology and new initiatives, which we expect to continue for the

next quarters and peak in 4Q22, we estimate that our Adjusted

EBITDA Margin would be above 40%.

¹ See appendix for a reconciliation of Adjusted

EBITDA.

Adjusted Net Income

Adjusted Net Income¹ (in R$ mn) and

Margin

3Q20 vs 3Q21

Adjusted Net Income grew 82%, from R$570 million

in 3Q20 to R$1,039 million in 3Q21, in connection with the factors

explained in the Adjusted EBITDA and a lower normalized effective

tax rate. The effective tax rate, normalized by withholding taxes

that are recorded in our revenue was 13.8% in 3Q21, from 23.4% in

3Q20, mainly due to a more favorable revenue and expense mix across

subsidiaries. Our Adjusted Net Margin expanded by 561 bps to 32.8%

in 3Q21. Despite investments in technology and new businesses, our

medium-term guidance range for Adjusted Net Margin remains

unchanged.

¹ See appendix for a reconciliation of Adjusted

Net Income.

Adjusted Cash Flow

(in R$ mn)

|

|

|

3Q21 |

2Q21 |

3Q20 |

|

Cash Flow Data |

|

|

|

|

|

Income before income tax |

|

908 |

1,002 |

632 |

| Adjustments

to reconcile income before income tax |

|

693 |

178 |

128 |

| Income tax

paid |

|

(174) |

(69) |

(126) |

|

Contingencies paid |

|

(0) |

(1) |

(0) |

| Interest

paid |

|

(8) |

(4) |

(44) |

| Changes in

working capital assets and liabilities |

|

(797) |

824 |

155 |

|

Adjusted net cash flow (used in) from operating

activities |

|

622 |

1,931 |

746 |

|

Net cash flow (used in) from securities, repos, derivatives and

banking activities (i) |

|

(3,393) |

(2,189) |

623 |

|

Net cash flows (used in) from operating

activities |

|

(2,771) |

(258) |

931 |

|

Adjusted Net cash flows from investing activities

(ii) |

|

(764) |

(1,248) |

(1,224) |

|

Adjusted Net cash flows from financing activities

(iii) |

|

4,570 |

1,715 |

(916) |

The management classifies (i) financial bills,

foreign exchange, foreign exchange portfolio and credit card

operations as net cash (used in) from banking activities. (ii) the

commissions and incentives to our IFA network as adjusted net cash

flow from investing activities. (iii) financing instruments payable

as adjusted net cash flows from financing activities.

Net Cash Flow Used in Operating

Activities

Our net cash flow used in Operating activities

represented by Adjusted net cash flow (used in) from operating

activities (which in management views as represents a more useful

metric to track the intrinsic cash flow generation of the business)

decreased to R$622 million in 3Q21 from R$1,931 million in 2Q21,

and increased from R$746 million in 3Q20 to R$622 million in 3Q21

driven by:

- Higher balance

of securities and derivatives that we hold in the ordinary course

of our business as a Retail investment distribution platform and as

an Institutional broker dealer (with respect to the sale of fixed

income securities and structured notes);

- Our strategy to

allocate excess cash and cash equivalents from treasury funds, from

Floating Balances and from private pension balances to securities

and other financial assets. These balances may fluctuate

substantially from quarter-to-quarter and were the key drivers to

the net cash flow from operating activities figures;

- Increases in our

banking activities from loans operations, market funding operations

mainly derived from deposits (time deposits), structured operations

certificates (COEs) and other financial liabilities which include

financial bills as a result of our expected growth in new

financials services verticals;

- Our income

before tax combined with non-cash expenses consisting primarily of

(i) Net foreign exchange differences of R$433 million in 3Q21 and

R$1 million in 3Q20, (ii) share based plan of R$124 million in 3Q21

and R$38 million in 3Q20 and (iii) depreciation and amortization of

R$51 million in 3Q21 and R$36 million in 3Q20. The total amount of

adjustments to reconcile income before income taxes was R$693

million in 3Q21 and R$128 million in 3Q20.

Net Cash Flow Used in Investing

Activities

Our net cash used in investing activities

decreased from R$1,248 million in 2Q21 to R$764 million in 3Q21 and

from R$1,224 million in 3Q20 to R$764 million, primarily affected

by:

- Investments

related our IFA Network, which decreased from R$1,102 million in

2Q21 to R$448 million in 3Q21 and from negative R$916 in

3Q20.

- the investment

in intangible assets, mostly IT infrastructure and capitalization

software development and property and equipment which decreased

from R$108 million in 2Q21 to R$68 million in 3Q21 and increased

from R$42 million in 2Q20;

- Our investments

in associates and joint ventures, mostly related to our asset

management of R$246 million in 3Q21 and R$37 million in 2Q21.

Net Cash Provided by Financing

Activities

Our net cash flows from financing activities

increased from R$1,715 million in 2Q21 to R$4,570 million in 3Q21

and from use of R$916 million in 3Q20, primarily due to:

- R$ 4,334 million

in 3Q21 related to issuance of our debt securities Bond.

- R$ 1,124 million

in 2Q21 correspondent to the IPO of XPAC Acquisition Corp. The

proceeds of IPO are restricted and only to use for the purpose of

XPAC transactions.

- R$1,570 million

in 2Q21 related to acquisitions of Borrowings mostly derived by our

loan agreement with Banco Nacional do México.

- R$500 million in

2Q21 related to issuance of non-convertible debentures with the

objective of funding the Group’s working capital for the

construction of our new headquarters “Vila XP” at São Roque, State

of São Paulo.

Floating Balance and Adjusted Gross

Financial Assets (in R$ mn)

| |

|

|

|

|

Floating Balance (=net uninvested clients'

deposits) |

|

3Q21 |

2Q21 |

|

Assets |

|

(1,065) |

(2,776) |

|

(-) Securities trading and intermediation |

|

(1,065) |

(2,776) |

|

Liabilities |

|

19,635 |

20,814 |

|

(+) Securities trading and intermediation |

|

19,635 |

20,814 |

|

(=) Floating Balance |

|

18,570 |

18,038 |

|

|

|

|

|

|

Adjusted Gross Financial Assets |

|

3Q21 |

2Q21 |

|

Assets |

|

120,595 |

105,113 |

|

(+) Cash |

|

2,823 |

1,237 |

|

(+) Securities - Fair value through profit or loss |

|

53,432 |

45,360 |

|

(+) Securities - Fair value through other comprehensive income |

|

28,566 |

23,701 |

|

(+) Securities - Evaluated at amortized cost |

|

858 |

988 |

|

(+) Derivative financial instruments |

|

15,471 |

15,485 |

|

(+) Securities purchased under agreements to resell |

|

7,871 |

8,174 |

|

(+) Loans and credit card operations |

|

10,535 |

7,964 |

|

(+) Foreign exchange portfolio |

|

1,039 |

2,204 |

|

Liabilities |

|

(85,459) |

(73,704) |

|

(-) Securities |

|

(2,082) |

(2,790) |

|

(-) Derivative financial instruments |

|

(14,506) |

(16,373) |

|

(-) Securities sold under repurchase agreements |

|

(24,234) |

(16,062) |

|

(-) Private Pension Liabilities |

|

(26,711) |

(22,046) |

|

(-) Deposits |

|

(6,867) |

(6,628) |

|

(-) Structured Operations |

|

(5,699) |

(4,198) |

|

(-) Financial Bills |

|

(2,343) |

(2,160) |

|

(-) Foreign exchange portfolio |

|

(1,150) |

(2,324) |

|

(-) Credit card operations |

|

(1,867) |

(1,124) |

| (-)

Floating Balance |

|

(18,570) |

(18,038) |

|

(=) Adjusted Gross Financial Assets |

|

16,566 |

13,372 |

We present Adjusted Gross Financial Assets

because we believe this metric captures the liquidity that is, in

fact, available to us, net of the portion of liquidity that is

related to our Floating Balance (and therefore attributable to

clients). We calculate Adjusted Gross Financial Assets as the sum

of (1) Cash and Financial Assets (comprised of Cash plus Securities

– Fair value through profit or loss, plus Securities – Fair value

through other comprehensive income, plus Securities – Evaluated at

amortized cost, plus Derivative financial instruments, plus

Securities (purchased under agreements to resell), plus Loans and

Credit Card Operations and Foreign exchange portfolio (assets) less

(2) Financial Liabilities (comprised of the sum of Securities

loaned, Derivative financial instruments, Securities sold under

repurchase agreements and Private pension liabilities), Deposits,

Structured Operation Certificates (COE), Financial Bills, Foreign

exchange portfolio (liabilities), Credit cards operations and (3)

less Floating Balance.

It is a measure that we track internally daily,

and it more intuitively reflects the effect of the operational

profits we generate and the variations between working capital

assets and liabilities (cash flows from operating activities),

investments in fixed and intangible assets and investments in the

IFA Network (cash flows from investing activities) and inflows and

outflows related to equity and debt securities in our capital

structure (cash flows from financing activities).Our management

treats all securities and financial instrument assets, net of

financial instrument liabilities, as balances that compose our

total liquidity, with subline items (such as, for example,

“securities at fair value through profit and loss” and “securities

at fair value through other comprehensive income”) expected to

fluctuate substantially from quarter to quarter as our treasury

manages and allocates our total liquidity to the most suitable

financial instruments.

Other Information

Web Meeting

The Company will host a webcast to discuss its

3Q21 financial results on Wednesday, November 03, 2021, at 5:00 pm

ET (6:00 pm BRT). To participate in the earnings webcast please

subscribe at 3Q21 Earnings Web Meeting. The replay will be

available on XP’s investor relations website at

https://investors.xpinc.com/

Investor Relations Team

André MartinsAntonio

GuimarãesMarina Montemorir@xpi.com.br

Important Disclosure

IN REVIEWING THE INFORMATION CONTAINED IN THIS

RELEASE, YOU ARE AGREEING TO ABIDE BY THE TERMS OF THIS DISCLAIMER.

THIS INFORMATION IS BEING MADE AVAILABLE TO EACH RECIPIENT SOLELY

FOR ITS INFORMATION AND IS SUBJECT TO AMENDMENT.

This release is prepared by XP Inc. (the

“Company,” “we” or “our”), is solely for informational purposes.

This release does not constitute a prospectus and does not

constitute an offer to sell or the solicitation of an offer to buy

any securities. In addition, this document and any materials

distributed in connection with this release are not directed to, or

intended for distribution to or use by, any person or entity that

is a citizen or resident or located in any locality, state, country

or other jurisdiction where such distribution, publication,

availability or use would be contrary to law or regulation or which

would require any registration or licensing within such

jurisdiction.

This release was prepared by the Company.

Neither the Company nor any of its affiliates, officers, employees

or agents, make any representation or warranty, express or implied,

in relation to the fairness, reasonableness, adequacy, accuracy or

completeness of the information, statements or opinions, whichever

their source, contained in this release or any oral information

provided in connection herewith, or any data it generates and

accept no responsibility, obligation or liability (whether direct

or indirect, in contract, tort or otherwise) in relation to any of

such information. The information and opinions contained in this

release are provided as at the date of this release, are subject to

change without notice and do not purport to contain all information

that may be required to evaluate the Company. The information in

this release is in draft form and has not been independently

verified. The Company and its affiliates, officers, employees and

agents expressly disclaim any and all liability which may be based

on this release and any errors therein or omissions therefrom.

Neither the Company nor any of its affiliates, officers, employees

or agents makes any representation or warranty, express or implied,

as to the achievement or reasonableness of future projections,

management targets, estimates, prospects or returns, if any.

The information contained in this release does

not purport to be comprehensive and has not been subject to any

independent audit or review. Certain of the financial information

as of and for the periods ended of September 30, 2021 and December

31, 2020, 2019, 2018 and 2017 has been derived from audited

financial statements and all other financial information has been

derived from unaudited interim financial statements. A significant

portion of the information contained in this release is based on

estimates or expectations of the Company, and there can be no

assurance that these estimates or expectations are or will prove to

be accurate. The Company’s internal estimates have not been

verified by an external expert, and the Company cannot guarantee

that a third party using different methods to assemble, analyze or

compute market information and data would obtain or generate the

same results.

Statements in the release, including those

regarding the possible or assumed future or other performance of

the Company or its industry or other trend projections, constitute

forward-looking statements. These statements are generally

identified by the use of words such as “anticipate,” “believe,”

“could,” “expect,” “should,” “plan,” “intend,” “estimate” and

“potential,” among others. By their nature, forward-looking

statements are necessarily subject to a high degree of uncertainty

and involve known and unknown risks, uncertainties, assumptions and

other factors because they relate to events and depend on

circumstances that will occur in the future whether or not outside

the control of the Company. Such factors may cause actual results,

performance or developments to differ materially from those

expressed or implied by such forward-looking statements and there

can be no assurance that such forward-looking statements will prove

to be correct. These risks and uncertainties include factors

relating to: (1) general economic, financial, political,

demographic and business conditions in Brazil, as well as any other

countries we may serve in the future and their impact on our

business; (2) fluctuations in interest, inflation and exchange

rates in Brazil and any other countries we may serve in the future;

(3) competition in the financial services industry; (4) our ability

to implement our business strategy; (5) our ability to adapt to the

rapid pace of technological changes in the financial services

industry; (6) the reliability, performance, functionality and

quality of our products and services and the investment performance

of investment funds managed by third parties or by our asset

managers; (7) the availability of government authorizations on

terms and conditions and within periods acceptable to us; (8) our

ability to continue attracting and retaining new

appropriately-skilled employees; (9) our capitalization and level

of indebtedness; (10) the interests of our controlling

shareholders; (11) changes in government regulations applicable to

the financial services industry in Brazil and elsewhere; (12) our

ability to compete and conduct our business in the future; (13) the

success of operating initiatives, including advertising and

promotional efforts and new product, service and concept

development by us and our competitors; (14) changes in consumer

demands regarding financial products, customer experience related

to investments and technological advances, and our ability to

innovate to respond to such changes; (15) changes in labor,

distribution and other operating costs; (16) our compliance with,

and changes to, government laws, regulations and tax matters that

currently apply to us; (17) other factors that may affect our

financial condition, liquidity and results of operations.

Accordingly, you should not place undue reliance on forward-looking

statements. The forward-looking statements included herein speak

only as at the date of this release and the Company does not

undertake any obligation to update these forward-looking

statements. Past performance does not guarantee or predict future

performance. Moreover, the Company and its affiliates, officers,

employees and agents do not undertake any obligation to review,

update or confirm expectations or estimates or to release any

revisions to any forward-looking statements to reflect events that

occur or circumstances that arise in relation to the content of the

release. You are cautioned not to unduly rely on such

forward-looking statements when evaluating the information

presented and we do not intend to update any of these

forward-looking statements.

Market data and industry information used

throughout this release are based on management’s knowledge of the

industry and the good faith estimates of management. The Company

also relied, to the extent available, upon management’s review of

industry surveys and publications and other publicly available

information prepared by a number of third-party sources. All of the

market data and industry information used in this release involves

a number of assumptions and limitations, and you are cautioned not

to give undue weight to such estimates. Although the Company

believes that these sources are reliable, there can be no assurance

as to the accuracy or completeness of this information, and the

Company has not independently verified this information.

The contents hereof should not be construed as

investment, legal, tax or other advice and you should consult your

own advisers as to legal, business, tax and other related matters

concerning an investment in the Company. The Company is not acting

on your behalf and does not regard you as a customer or a client.

It will not be responsible to you for providing protections

afforded to clients or for advising you on the relevant

transaction.

This release includes our Floating Balance,

Adjusted Gross Financial Assets, Adjusted EBITDA and Adjustments to

Reported Net Income, which are non-GAAP financial information. We

believe that such information is meaningful and useful in

understanding the activities and business metrics of the Company’s

operations. We also believe that these non-GAAP financial measures

reflect an additional way of viewing aspects of the Company’s

business that, when viewed with our International Financial

Reporting Standards (“IFRS”) results, as issued by the

International Accounting Standards Board, provide a more complete

understanding of factors and trends affecting the Company’s

business. Further, investors regularly rely on non-GAAP financial

measures to assess operating performance and such measures may

highlight trends in the Company’s business that may not otherwise

be apparent when relying on financial measures calculated in

accordance with IFRS. We also believe that certain non-GAAP

financial measures are frequently used by securities analysts,

investors and other interested parties in the evaluation of public

companies in the Company’s industry, many of which present these

measures when reporting their results. The non-GAAP financial

information is presented for informational purposes and to enhance

understanding of the IFRS financial statements. The non-GAAP

measures should be considered in addition to results prepared in

accordance with IFRS, but not as a substitute for, or superior to,

IFRS results. As other companies may determine or calculate this

non-GAAP financial information differently, the usefulness of these

measures for comparative purposes is limited. A reconciliation of

such non-GAAP financial measures to the nearest GAAP measure is

included in this release.

For purposes of this release:

“Active Clients” means the total number of

retail clients served through our XP Investimentos, Rico, Clear, XP

Investments and XP Private (Europe) brands, with an AUC above

R$100.00 or that have transacted at least once in the last thirty

days. For purposes of calculating this metric, if a client holds an

account in more than one of the aforementioned entities, such

client will be counted as one “active client” for each such

account. For example, if a client holds an account in each of XP

Investimentos and Rico, such client will count as two “active

clients” for purposes of this metric.

“Assets Under Custody (AUC)” means the market

value of all client assets invested through XP’s platform and that

is related to reported Retail Revenue, including equities, fixed

income securities, mutual funds (including those managed by XP

Gestão de Recursos Ltda., XP Advisory Gestão de Recursos Ltda. and

XP Vista Asset Management Ltda., as well as by third-party asset

managers), pension funds (including those from XP Vida e

Previdência S.A., as well as by third-party insurance companies),

exchange traded funds, COEs (Structured Notes), REITs, and

uninvested cash balances (Floating Balances), among others.

Although AUC includes custody from Corporate Clients that generate

Retail Revenue, it does not include custody from institutional

clients (asset managers, pension funds and insurance

companies).

Rounding

We have made rounding adjustments to some of the

figures included in this annual report. Accordingly, numerical

figures shown as totals in some tables may not be an arithmetic

aggregation of the figures that preceded them.

Unaudited Managerial Income Statement (in

R$ mn)

|

|

|

|

|

|

|

| |

3Q21 |

3Q20 |

YoY |

2Q21 |

QoQ |

|

Managerial Income Statement |

|

|

|

|

|

|

Total Gross Revenue |

3,368 |

2,245 |

50% |

3,200 |

5% |

|

Retail |

2,599 |

1,698 |

53% |

2,452 |

6% |

|

Institutional |

281 |

239 |

17% |

375 |

-25% |

|

Issuer Services |

284 |

169 |

68% |

255 |

11% |

|

Digital Content |

31 |

32 |

-2% |

29 |

6% |

|

Other |

172 |

107 |

61% |

88 |

95% |

|

Net Revenue |

3,171 |

2,101 |

51% |

3,018 |

5% |

|

COGS |

(894) |

(706) |

27% |

(891) |

0% |

|

As a % of Net Revenue |

(28.2%) |

(33.6%) |

5.4 p.p |

(29.5%) |

1.3 p.p |

|

Gross Profit |

2,277 |

1,395 |

63% |

2,127 |

7% |

|

Gross Margin |

71.8% |

66.4% |

5.4

p.p |

70.5% |

1.3

p.p |

|

SG&A |

(1,116) |

(669) |

67% |

(900) |

24% |

|

Share Based Compensation1 |

(156) |

(44) |

252% |

(147) |

6% |

|

EBITDA |

1,005 |

681 |

48% |

1,080 |

-7% |

|

EBITDA Margin |

31.7% |

32.4% |

-0.7

p.p |

35.8% |

-4.1

p.p |

|

Adjusted EBITDA |

1,170 |

728 |

61% |

1,245 |

-6% |

|

Adjusted EBITDA Margin |

36.9% |

34.6% |

2.2 p.p |

41.3% |

-4.4 p.p |

|

D&A |

(51) |

(36) |

41% |

(58) |

-12% |

|

EBIT |

953 |

645 |

48% |

1,022 |

-7% |

| Interest

expense on debt |

(49) |

(12) |

324% |

(20) |

146% |

| Share of

profit or (loss) in joint ventures and associates |

4 |

(1) |

-763% |

1 |

-1119% |

|

Taxable equivalent adjustments2 |

179 |

74 |

142% |

126 |

42% |

|

Taxable equivalent EBT |

1,087 |

706 |

54% |

1,128 |

-4% |

|

Normalized tax expense |

(150) |

(165) |

-9% |

(197) |

-24% |

|

Normalized effective tax rate2 |

(13.8%) |

(23.4%) |

9.5

p.p |

(17.5%) |

3.6

p.p |

| Net

Income |

936 |

541 |

73% |

931 |

1% |

|

Net Margin |

29.5% |

25.8% |

3.8 p.p |

30.9% |

-1.3 p.p |

|

Adjustments |

102 |

29 |

255% |

102 |

0% |

|

Adjusted Net Income |

1,039 |

570 |

82% |

1,034 |

1% |

|

Adjusted Net Margin |

32.8% |

27.1% |

5.6 p.p |

34.2% |

-1.5 p.p |

¹ A portion of total Share-Based Compensation is

related to IFAs and allocated in COGS. 2 Tax adjustments are

related to tax withholding expenses that are recognized net in our

gross revenue.

Accounting Income Statement

(in R$ mn)

| |

|

|

|

|

|

|

|

3Q21 |

3Q20 |

YoY |

2Q21 |

QoQ |

|

Accounting Income Statement |

|

|

|

|

|

|

Net revenue from services rendered |

1,589 |

1,278 |

24% |

1,601 |

-1% |

|

Brokerage commission |

633 |

548 |

16% |

650 |

-3% |

|

Securities placement |

442 |

388 |

14% |

513 |

-14% |

|

Management fees |

415 |

274 |

51% |

384 |

8% |

|

Insurance brokerage fee |

33 |

18 |

89% |

35 |

-4% |

|

Educational services |

15 |

25 |

-43% |

27 |

-46% |

|

Banking Fees |

57 |

33 |

73% |

42 |

38% |

|

Other services |

154 |

122 |

26% |

111 |

39% |

|

Taxes and contributions on services |

(160) |

(131) |

22% |

(160) |

0% |

|

Net income from financial instruments at amortized cost and

at fair value through other comprehensive income |

(717) |

190 |

-478% |

(331) |

117% |

|

Net income from financial instruments at fair value through

profit or loss |

2,300 |

633 |

263% |

1,748 |

32% |

|

Total revenue and income |

3,171 |

2,101 |

51% |

3,018 |

5% |

| Operating

costs |

(889) |

(696) |

28% |

(838) |

6% |

| Selling

expenses |

(58) |

(38) |

50% |

(62) |

-7% |

|

Administrative expenses |

(1,267) |

(810) |

57% |

(1,115) |

14% |

| Other

operating revenues (expenses), net |

1 |

98 |

-99% |

72 |

-99% |

| Expected

credit losses |

(5) |

(10) |

-45% |

(54) |

-90% |

| Interest

expense on debt |

(49) |

(12) |

324% |

(20) |

146% |

|

Share of profit or (loss) in joint ventures and associates |

4 |

(1) |

-763% |

1 |

-1119% |

|

Income before income tax |

908 |

632 |

44% |

1,002 |

-9% |

|

Income tax expense |

28 |

(91) |

-131% |

(71) |

-140% |

|

Effective tax rate |

3.1% |

(14.4%) |

17.5 p.p |

(7.1%) |

10.2 p.p |

| Net

income for the period |

936 |

541 |

73% |

931 |

1% |

Balance Sheet (in R$ mn)

| |

|

|

|

|

|

|

3Q21 |

2Q21 |

|

Assets |

|

|

|

|

Cash |

|

2,823 |

1,237 |

|

Financial assets |

|

119,626 |

107,174 |

|

Fair value through profit or loss |

|

68,904 |

60,845 |

|

Securities |

|

53,432 |

45,360 |

|

Derivative financial instruments |

|

15,471 |

15,485 |

|

Fair value through other comprehensive income |

|

28,566 |

23,701 |

|

Securities |

|

28,566 |

23,701 |

|

Evaluated at amortized cost |

|

22,157 |

22,628 |

|

Securities |

|

858 |

988 |

|

Securities purchased under agreements to resell |

|

7,871 |

8,174 |

|

Securities trading and intermediation |

|

1,065 |

2,776 |

|

Accounts receivable |

|

356 |

396 |

|

Loan Operations |

|

10,535 |

7,964 |

|

Other financial assets |

|

1,473 |

2,330 |

|

Other assets |

|

3,991 |

3,293 |

|

Recoverable taxes |

|

127 |

118 |

|

Rights-of-use assets |

|

260 |

194 |

|

Prepaid expenses |

|

3,413 |

2,887 |

|

Other |

|

191 |

94 |

|

Deferred tax assets |

|

1,042 |

795 |

|

Investments in associates and joint ventures |

|

1,185 |

772 |

|

Property and equipment |

|

293 |

243 |

|

Goodwill & Intangible assets |

|

775 |

807 |

|

Total Assets |

|

129,735 |

114,321 |

| |

|

|

|

|

|

|

3Q21 |

2Q21 |

|

Liabilities |

|

|

|

|

Financial liabilities |

|

88,560 |

78,314 |

|

Fair value through profit or loss |

|

16,588 |

19,163 |

|

Securities |

|

2,082 |

2,790 |

|

Derivative financial instruments |

|

14,506 |

16,373 |

|

Evaluated at amortized cost |

|

71,972 |

59,151 |

|

Securities sold under repurchase agreements |

|

24,234 |

16,062 |

|

Securities trading and intermediation |

|

19,635 |

20,814 |

|

Financing instruments payable |

|

19,213 |

13,154 |

|

Accounts payables |

|

929 |

1,186 |

|

Borrowings |

|

1,885 |

1,775 |

|

Other financial liabilities |

|

6,076 |

6,161 |

|

Other liabilities |

|

27,744 |

23,416 |

|

Social and statutory obligations |

|

584 |

852 |

|

Taxes and social security obligations |

|

412 |

481 |

|

Private pension liabilities |

|

26,711 |

22,046 |

|

Provisions and contingent liabilities |

|

28 |

26 |

|

Other |

|

10 |

11 |

|

Deferred tax liabilities |

|

- |

- |

|

Total Liabilities |

|

116,304 |

101,730 |

|

Equity attributable to owners of the Parent

company |

|

13,427 |

12,588 |

|

Issued capital |

|

0 |

0 |

|

Capital reserve |

|

11,051 |

10,926 |

|

Other comprehensive income |

|

(223 |

(3 |

|

Retained earnings |

|

2,600 |

1,664 |

|

Non-controlling interest |

|

3 |

3 |

|

Total equity |

|

13,431 |

12,591 |

|

Total liabilities and equity |

|

129,735 |

114,321 |

Adjusted EBITDA (in R$ mn)

|

|

|

|

|

|

|

|

|

3Q21 |

3Q20 |

YoY |

2Q21 |

QoQ |

|

EBITDA |

1,005 |

681 |

48% |

1,080 |

-7% |

| (+) Share

Based Compensation |

165 |

45 |

269% |

165 |

-0% |

| (+) Offering

expenses |

- |

2 |

-100% |

- |

n.a. |

| Adj.

EBITDA |

1,170 |

728 |

61% |

1,245 |

-6% |

| |

|

|

|

|

|

Adjusted Net Income (in R$ mn)

|

|

|

|

|

|

|

|

|

3Q21 |

3Q20 |

YoY |

2Q21 |

QoQ |

|

Net Income |

936 |

541 |

73% |

931 |

1% |

|

(+) Share Based Compensation |

165 |

45 |

269% |

165 |

-0% |

|

(+) Offering expenses |

- |

2 |

-100% |

- |

n.a. |

|

(+/-) Taxes |

(62) |

(18) |

254% |

(63) |

-1% |

| Adj.

Net Income |

1,039 |

570 |

82% |

1,034 |

1% |

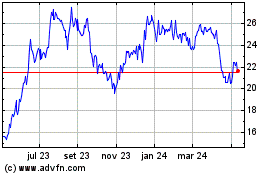

XP (NASDAQ:XP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

XP (NASDAQ:XP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024