IntelGenx Technologies Corp. (TSX:IGX) (OTCQB:IGXT) (the

"Company" or "IntelGenx") today reported financial results for the

third quarter ended September 30, 2021. All dollar amounts are

expressed in U.S. currency, unless otherwise indicated, and results

are reported in accordance with United States generally

accepted accounting principles except where noted otherwise.

2021 Third Quarter Financial

Summary:

- Revenue

was $593,000, compared to $510,000 in the 2020 third

quarter.

- Net

comprehensive loss was $2.2 million, compared to $1.6 million in

Q3-2020.

- Adjusted EBITDA

loss was $1.4 million, compared to $1.2 million in

the 2020 third quarter.

Third Quarter and Recent

Developments:

- Resumed patient

screening in the ongoing ‘BUENA’ Montelukast VersaFilm® Phase 2a

clinical trial in patients with mild to moderate Alzheimer’s

Disease (“AD”) following Health Canada’s issuance of a No Objection

Letter in response to the Company’s amended Clinical Trial

Application.

- Graduated to the

Toronto Stock Exchange.

- Announced that

its co-development and commercialization partner for Tadalafil oral

films for the treatment of erectile dysfunction (ED) and benign

prostatic hyperplasia (BPH), Aquestive Therapeutics, Inc.

(NASDAQ:AQST), entered into a definitive license and supply

agreement with an undisclosed leading men’s health company.

- Announced that

atai Life Sciences AG (“atai”) committed $6.0 million in future

financial support to IntelGenx via amendments to the loan facility

between the parties.

- Announced that

Exeltis Healthcare S.L., the Company’s commercialization partner in

the European Union for RIZAPORT®, a unique treatment for acute

migraines, launched the product in Spain.

- Completed an

initial shipment of CBD Filmstrips in support of Heritage Cannabis

Holdings Corp.’s (CSE:CANN) Canadian market launch of its “CB4

Control” branded product.

- Closed a $2.1

million private placement of 8% convertible notes due July 31,

2025, which the Company intends to use to finance its BUENA trial

of Montelukast in AD.

- Increased the

size of the Board of Directors from six to eight with the

appointments of Srinivas (Srini) G. Rao, M.D., Ph.D. and Frank

Stegert.

"The past few months have been a very productive

and exciting period for IntelGenx, marked by the achievement of

five major milestones,” commented Dr. Horst G. Zerbe, CEO

of IntelGenx. “Our graduation to the TSX, Canada’s most senior

exchange, came on the heels of our successful transition from a

development-stage to a commercial-stage leader in pharmaceutical

films as well as our transformational partnership with atai. We

were also pleased to resume patient screening in our ongoing

‘BUENA’ Montelukast VersaFilm Phase 2a clinical trial in patients

with mild to moderate AD. Having executed on many elements of our

growth strategy this quarter, we look forward to continuing to

advance our portfolio of innovative film products and product

candidates.”

Financial Results:

Total revenues for the three-month period

ended September 30, 2021 amounted to $593,000, an

increase of $83,000, or 16%, compared to $510,000 for the

three-month period ended September 30, 2020. The change is

mainly attributable to increases in sales milestone revenues of

$320,000, product revenues of $70,000, partially offset by a

$308,000 decrease in revenues from licensing agreements.

Operating costs and expenses were $2.2 million

for the third quarter of 2021, versus $1.9 million for the

corresponding three-month period of 2020. The increase for the

three-month period ended September 30, 2021 is mainly attributable

to increases of $26,000 in R&D expense, $255,000 in

manufacturing expenses, $37,000 in selling, general and

administrative expenses, $17,000 in depreciation of tangible

assets.

For the third quarter of 2021, the Company had

an operating loss of $1.6 million, compared to an operating loss of

$1.4 million for the comparable period of 2020.

Net comprehensive loss for the three-month

period ended September 30, 2021 was $2.2 million, or $0.01 per

basic and diluted share, compared to net comprehensive loss of $1.6

million, or $0.01 per basic and diluted share, for the comparable

period of 2020.

As at September 30, 2021, the Company's

cash and short-term investments totalled $12.0 million.

Conference Call Details:

IntelGenx will host a conference call to

discuss these third quarter 2021 financial results today

at 4:30 p.m. ET. The dial-in number for the conference call is

(888) 506-0058 (Canada and the United States) and (973) 528-0135

(International), access code 995615. The call will also be webcast

live and archived on the Company's website at www.intelgenx.com

under "Webcasts" in the Investors section.

About IntelGenx

IntelGenx is a leading drug delivery company

focused on the development and manufacturing of pharmaceutical

films.

IntelGenx’s superior film technologies,

including VersaFilm®, DisinteQ™, VetaFilm™ and transdermal

VevaDerm™, allow for next generation pharmaceutical products that

address unmet medical needs. IntelGenx’s innovative product

pipeline offers significant benefits to patients and physicians for

many therapeutic conditions.

IntelGenx's highly skilled team provides

comprehensive pharmaceuticals services to pharmaceutical partners,

including R&D, analytical method development, clinical

monitoring, IP and regulatory services. IntelGenx's

state-of-the-art manufacturing facility offers full service by

providing lab-scale to pilot- and commercial-scale production. For

more information, visit www.intelgenx.com.

Forward-Looking Information and

StatementsThis document may contain forward-looking

information about IntelGenx's operating results and business

prospects that involve substantial risks and uncertainties.

Statements that are not purely historical are forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. These statements include, but are not

limited to, statements about IntelGenx's plans, objectives,

expectations, strategies, intentions or other characterizations of

future events or circumstances and are generally identified by the

words "may," "expects," "anticipates," "intends," "plans,"

"believes," "seeks," "estimates," "could," "would," and similar

expressions. All forward looking statements are expressly qualified

in their entirety by this cautionary statement. Because these

forward-looking statements are subject to a number of risks and

uncertainties, IntelGenx's actual results could differ materially

from those expressed or implied by these forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to, those discussed under

the heading "Risk Factors" in IntelGenx's annual report on Form

10-K, filed with the United States Securities and Exchange

Commission and available at www.sec.gov, and also filed with

Canadian securities regulatory authorities at www.sedar.com.

IntelGenx assumes no obligation to update any such forward-looking

statements.

Source: IntelGenx Technologies Corp.

For IntelGenx:

Stephen KilmerInvestor Relations(647)

872-4849stephen@kilmerlucas.com

Or

Andre Godin, CPA, CAPresident and CFOIntelGenx Corp.(514)

331-7440 ext 203andre@intelgenx.com

IntelGenx Technologies Corp.

Consolidated Balance Sheet(Expressed in

Thousands of U.S. Dollars ($000’s) Except Share and Per Share

Data)(Unaudited)

|

|

September 30, 2021 |

December 31, 2020 |

|

Assets |

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

Cash |

$ |

6,019 |

|

$ |

1,205 |

|

|

Short-term investments |

|

6,013 |

|

|

1,038 |

|

|

Accounts receivable |

|

1,162 |

|

|

260 |

|

|

Prepaid expenses |

|

116 |

|

|

162 |

|

|

Investment tax credits receivable |

|

407 |

|

|

635 |

|

|

Contract asset |

|

- |

|

|

354 |

|

|

Security deposits |

|

204 |

|

|

407 |

|

|

Inventories |

|

68 |

|

|

244 |

|

|

Total current assets |

|

13,989 |

|

|

4,305 |

|

| Leasehold improvements

and equipment, net |

|

5,348 |

|

|

5,851 |

|

| Security

deposits |

|

252 |

|

|

252 |

|

|

Operating lease right-of-use-asset |

|

1,050 |

|

|

710 |

|

|

Total assets |

$ |

20,639 |

|

$ |

11,118 |

|

|

Liabilities |

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

2,304 |

|

|

1,989 |

|

|

Current portion of long-term debt |

|

- |

|

|

561 |

|

|

Current portion of operating lease liability |

|

248 |

|

|

141 |

|

|

Current portion of finance lease liability |

|

35 |

|

|

25 |

|

|

Deferred revenue |

|

192 |

|

|

166 |

|

|

Convertible notes |

|

- |

|

|

1,486 |

|

|

Convertible debentures |

|

5,317 |

|

|

- |

|

|

Total current liabilities |

|

8,096 |

|

|

4,368 |

|

|

|

|

|

| Long-term

debt |

|

2,500 |

|

|

171 |

|

| Convertible

notes |

|

3,965 |

|

|

1,505 |

|

| Convertible

debentures |

|

- |

|

|

5,461 |

|

| Operating lease

liability |

|

691 |

|

|

482 |

|

| Finance lease

liability |

|

92 |

|

|

84 |

|

|

Deferred income tax liability |

|

82 |

|

|

- |

|

|

Total liabilities |

|

15,426 |

|

|

12,071 |

|

|

Contingencies |

|

|

|

|

|

|

| Subsequent event |

|

|

|

|

|

|

| Shareholders' equity |

|

|

|

|

|

|

| Capital stock, common shares,

$0.00001 par value; 450,000,000 shares authorized; 150,627,761

shares issued and outstanding (2020: 111,429,532 common

shares) |

|

1 |

|

|

1 |

|

| Additional paid-in

capital |

|

61,589 |

|

|

48,453 |

|

| Accumulated deficit |

|

(55,005) |

|

|

(48,551) |

|

|

Accumulated other comprehensive loss |

|

(1,372) |

|

|

(856) |

|

|

Total shareholders’ equity (deficit) |

|

5,213 |

|

|

(953) |

|

|

|

$ |

20,639 |

|

$ |

11,118 |

|

| |

|

|

|

|

|

|

IntelGenx Technologies Corp.

Consolidated Statement of Comprehensive

Loss(Expressed in Thousands of U.S. Dollars

($000’s) Except Share and Per Share

Data)(Unaudited)

|

|

For the Three-Month Period |

For the Nine-Month Period |

| |

Ended September 30, |

Ended September 30, |

|

|

2021 |

2020 |

2021 |

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

593 |

|

$ |

510 |

|

$ |

1,041 |

|

$ |

754 |

|

|

Total revenues |

|

593 |

|

|

510 |

|

|

1,041 |

|

|

754 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expense |

|

874 |

|

|

848 |

|

|

1,910 |

|

|

2,300 |

|

|

Manufacturing expenses |

|

499 |

|

|

244 |

|

|

1,598 |

|

|

1,042 |

|

|

Selling, general and administrative expense |

|

662 |

|

|

625 |

|

|

2,419 |

|

|

2,167 |

|

|

Depreciation of tangible assets |

|

199 |

|

|

182 |

|

|

589 |

|

|

536 |

|

|

Total expenses |

|

2,234 |

|

|

1,899 |

|

|

6,516 |

|

|

6,045 |

|

| Operating

loss |

|

(1,641) |

|

|

(1,389) |

|

|

(5,475) |

|

|

(5,291) |

|

| Finance and interest

income |

|

1 |

|

|

3 |

|

|

152 |

|

|

405 |

|

|

Financing and interest expense |

|

(365) |

|

|

(274) |

|

|

(1,134) |

|

|

(881) |

|

|

Net financing and interest income (expense) |

|

(364) |

|

|

(271) |

|

|

(982) |

|

|

(476) |

|

|

Loss before income taxes |

|

(2,005) |

|

|

(1,660) |

|

|

(6,457) |

|

|

(5,767) |

|

|

Deferred income tax |

|

3 |

|

|

- |

|

|

3 |

|

|

- |

|

|

Net loss |

|

(2,002) |

|

|

(1,660) |

|

|

(6,454) |

|

|

(5,767) |

|

| Other comprehensive

(loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

(175) |

|

|

40 |

|

|

(518) |

|

|

(108) |

|

|

Change in fair value |

|

4 |

|

|

51 |

|

|

2 |

|

|

79 |

|

|

|

|

(171) |

|

|

91 |

|

|

(516) |

|

|

(29) |

|

|

Comprehensive loss |

$ |

(2,173) |

|

$ |

(1,569) |

|

$ |

(6,970) |

|

$ |

(5,796) |

|

|

Basic and diluted weighted average number of shares

outstanding |

|

150,590,729 |

|

|

110,259,652 |

|

|

131,576,774 |

|

|

107,818,057 |

|

|

Basic and diluted loss per common share |

$ |

(0.01) |

|

$ |

(0.01) |

|

$ |

(0.05) |

|

$ |

(0.05) |

|

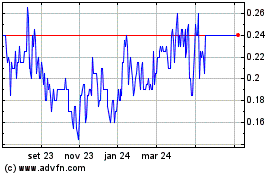

Intelgenx Technologies (TSX:IGX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

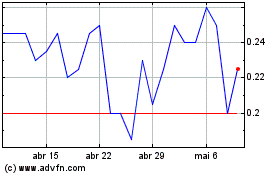

Intelgenx Technologies (TSX:IGX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024