The Board of Directors of Retail Opportunity Investments Corp.

(NASDAQ:ROIC) announced today that it has concluded the Board

refreshment and governance review it launched after its 2021 Annual

Meeting and has appointed Zabrina Jenkins and Adrienne Banks Pitts

as independent directors, effective December 15, 2021, and has

adopted a Bylaw amendment to enhance stockholder rights. In

addition, director Charles Persico has advised the Board that he

will not stand for re-election to the Board at ROIC’s next annual

meeting.

“In response to stockholder feedback at and

after our Annual Meeting, the Board conducted a thorough search for

directors with the help of a third-party search firm,” commented

Eric S. Zorn, Chairman of the Company’s Nomination and Governance

Committee. “I am pleased that we identified, and were able to

recruit, Ms. Jenkins and Ms. Pitts, both of whom are outstanding

professionals who complement the skills and experience of our

Board.”

Ms. Jenkins is Senior Vice President and Deputy

General Counsel of Starbucks Corporation. Ms. Pitts is Managing

Director, General Counsel and Corporate Secretary of Loop Capital,

LLC, the largest minority-owned investment bank and broker dealer

in the United States, including its investment management joint

venture with Magic Johnson Enterprises, known as JLC

Infrastructure.

Richard A. Baker, Chairman of the Board of ROIC,

stated, “We are delighted to welcome Ms. Jenkins and Ms. Pitts to

the Board. Both are highly respected and accomplished leaders who

will bring unique and valued expertise to the Board.”

ROIC also announced today that director Charles

Persico has advised the Board that he will not stand for

re-election to the Board at ROIC’s 2022 annual meeting. After that

annual meeting, the ROIC Board will consist of nine directors,

seven of whom will be independent.

Mr. Baker commented, “On behalf of the Board, we

would like to express our sincere gratitude to Mr. Persico for his

years of dedicated service, dating back to ROIC’s inception. His

invaluable contributions over the years have been instrumental in

the company’s growth and success. For this and many other reasons,

our company shall always be grateful to Mr. Persico.”

ROIC also announced today that the Board has

enhanced the rights of stockholders by providing that stockholders

may amend the company’s Bylaws.

“We heard the feedback from our stockholders on

this point and implemented this change as a result of our

governance review,” said Mr. Zorn. “We thank our stockholders for

their input.”

ABOUT ZABRINA JENKINS

Ms. Jenkins, 51, has served as Senior Vice

President and Deputy General Counsel of Starbucks Corporation since

February 2020 (NASDAQ: SBUX). In this role she leads a diverse

cross-functional team responsible for legal strategy, real estate,

intellectual property, employment, commercial transactions, and

litigation. From January 2019 to February 2020, Ms. Jenkins served

as Vice President and Interim Chief Ethics and Compliance Officer

and from April 2016 to January 2019 she served as Managing Director

at Starbucks Corporation. Ms. Jenkins joined Starbucks Corporation

in 2005 and prior to that was an attorney in private practice.

Additionally, Ms. Jenkins serves as an Executive Champion of the

Starbucks Black Partner Network, advises the Inclusion and

Diversity Committee for the Law & Corporate Affairs department,

and provides legal counsel to the Audit Committee of the Starbucks

Corporation Board of Directors. Ms. Jenkins also currently

serves as a member of the Board of Trustees for Central Washington

University and as a member of the Advisory Board of Washington

Leadership Institute and the Board of Directors of the Loren Miller

Bar Foundation. Ms. Jenkins was selected as a 2019-2020 fellow

of the International Women’s Forum. Ms. Jenkins received a B.S. in

Business Administration, Finance from Central Washington

University, an M.S. in Higher Education Administration from

Syracuse University School of Education, and a J.D. from Syracuse

University College of Law. We believe Ms. Jenkins' extensive legal

and corporate experience makes her qualified to serve as a

director.

ABOUT ADRIENNE BANKS PITTS

Ms. Pitts, 53, has served as Managing Director

and General Counsel for Loop Capital, LLC since July 2016, and was

recently appointed Corporate Secretary. In this role, she manages

all legal concerns for the firm’s multiple financial services

units, including real estate investments, corporate and public

finance, its infrastructure fund, its growing real estate platform,

as well as other asset and investment management matters. She works

with these business units to assess risks related to M&A,

capital and debt raising, and the firm’s other financial offerings

and investments. Prior to that, from 1995 to 2015, Ms. Pitts was an

attorney in private practice, elected to partner or principal at

three international law firms where she served as both a litigator

and transactional lawyer and represented large public and private

companies in the areas of antitrust, banking, corporate governance,

M&A, securities regulatory compliance, as well as white-collar

criminal defense. Ms. Pitts also currently serves on the Finance

and Audit Committees of the Francis W. Parker School in Chicago, as

well as on World Business Chicago’s Legal Advisory Board. Ms. Pitts

received a B.A. in Economics from the University of Pennsylvania,

and a J.D. from Boston University School of Law. We believe Ms.

Pitts’ extensive legal and corporate experience makes her qualified

to serve as a director.

ABOUT RETAIL

OPPORTUNITY INVESTMENTS

CORP.

Retail Opportunity Investments Corp. (NASDAQ:

ROIC), is a fully-integrated, self-managed real estate investment

trust (REIT) that specializes in the acquisition, ownership and

management of grocery-anchored shopping centers located in

densely-populated, metropolitan markets across the West Coast. As

of September 30, 2021, ROIC owned 86 shopping centers encompassing

approximately 9.8 million square feet. ROIC is the largest

publicly- traded, grocery-anchored shopping center REIT focused

exclusively on the West Coast. ROIC is a member of the S&P

SmallCap 600 Index and has investment-grade corporate debt ratings

from Moody's Investor Services, Standard & Poor’s, and Fitch

Ratings, Inc. Additional information is available at:

www.roireit.net.

When used herein, the words "believes,"

"anticipates," "projects," "should," "estimates," "expects,"

“guidance” and similar expressions are intended to identify

forward-looking statements with the meaning of that term in Section

27A of the Securities Act of 1933, as amended, and in Section 21F

of the Securities and Exchange Act of 1934, as amended. Certain

statements contained herein may constitute “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors which may cause

the actual results of ROIC to differ materially from future results

expressed or implied by such forward-looking statements.

Information regarding such risks and factors is described in ROIC's

filings with the SEC, including its most recent Annual Report on

Form 10-K, which is available at: www.roireit.net.

ADDITIONAL INFORMATION

This document may be deemed to be proxy

solicitation material in connection with ROIC’s 2022 Annual Meeting

of Stockholders (the “2022 Annual Meeting”). Stockholders

are urged to read ROIC’s definitive proxy statement and any other

documents filed by ROIC with the Securities and Exchange Commission

(the “SEC”) in connection with the 2022 Annual Meeting when they

become available because they will contain important

information.

Investors will be able to obtain, for free,

copies of documents filed by ROIC with the SEC at the SEC’s website

at http://www.sec.gov or at ROIC’s website at

http://www.roireit.net.

ROIC and its directors, executive officers and

certain other members of management and employees may be deemed to

be “participants” in the solicitation of proxies from ROIC’s

stockholders in connection with the 2022 Annual Meeting.

Information regarding the persons who are, under the rules of the

SEC, deemed to be participants in the solicitation of ROIC’s

stockholders, will be set forth in the definitive proxy statement.

Information relating to the foregoing can also be found in ROIC’s

definitive proxy statement for its 2021 annual meeting of

shareholders (the “2021 Proxy Statement”), filed with the SEC on

March 26, 2021. To the extent holdings of ROIC’s securities by such

potential participants (or the identity of such participants) have

changed since the information printed in the 2021 Proxy Statement,

such information has been or will be reflected on Statements of

Change in Ownership on Forms 3 and 4 filed with the SEC. Investors

may obtain, for free, copies of these documents at the SEC’s

website at http://www.sec.gov or at ROIC’s website at

http://www.roireit.net.

Contact:Ashley Rubino, Investor

Relations858-677-0900arubino@roireit.net

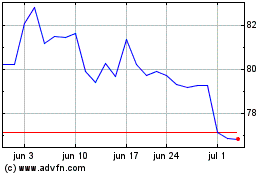

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024