THIS PRESS RELEASE IS NOT FOR DISTRIBUTION IN THE

UNITED STATES OR TO U.S. NEWS AGENCIES

Goodfood Market Corp. (“Goodfood” or the

“Company”) (TSX: FOOD) is pleased to announce that it has closed

its previously announced public offering (the “Offering”) of

$30,000,000 aggregate principal amount of 5.75% convertible

unsecured subordinated debentures of the Company

(the “Debentures”) due March 31, 2027, at a price of $1,000

(the “Offering Price”) per $1,000 principal amount of Debentures,

through a syndicate of underwriters co-led by Desjardins Capital

Markets and National Bank Financial Inc. (together, the “Co-Lead

Underwriters”), and including CIBC World Markets Inc., RBC Dominion

Securities Inc., Scotia Capital Inc., Canaccord Genuity Corp.,

Raymond James Ltd., Stifel Nicolaus Canada Inc. and Acumen Capital

Finance Partners Limited (collectively with the Co-Lead

Underwriters, the “Underwriters”).

The Debentures will bear interest at a rate of

5.75% per annum, payable semi-annually on March 31 and September 30

of each year, commencing on September 30, 2022. The Debentures will

be convertible at the holder’s option into Goodfood common shares

(the “Common Shares”) at a conversion price of $4.60 per Common

Share, representing a conversion rate of 217.3913 Common Shares per

$1,000 principal amount of Debentures. The Debentures will be

direct, subordinated unsecured obligations of the Company,

subordinated to any senior indebtedness of the Company, including

the Company's revolving credit facility, and ranking equally with

one another and with all other existing and future subordinated

unsecured indebtedness of the Company to the extent subordinated on

the same terms. The Debentures will mature on March 31, 2027 and

may be redeemed by Goodfood, in certain circumstances, on or after

March 31, 2025. The Debentures will be listed and posted for

trading on the Toronto Stock Exchange under the symbol “FOOD.DB.A”

at the opening of markets today.

An over-allotment option granted by the Company

to the Underwriters for $4,500,000 aggregate principal amount of

additional Debentures at the Offering Price remains exercisable by

the Underwriters, in whole or in part, at any time until 30 days

after the date hereof.

The Company intends to use the net proceeds from

the Offering to accelerate the scaling of Goodfood’s on-demand

grocery and meal solutions network, through the signing of multiple

incremental new micro-fulfillment centers leases, fund their

required capital expenditures as well as their initial start-up and

expenses, and for general corporate purposes.

Hamnett Hill, Donald Olds, François Vimard and

Terry Yanofsky, all independent directors of the Company, have

purchased an aggregate of $415,000 principal amount of Debentures

under the Offering. Their participation is considered to be a

“related party transaction” as defined in Regulation 61-101

respecting Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). The participation of such insiders is

exempt from the formal valuation and minority shareholder approval

requirements of MI 61-101 as neither the fair market value of the

securities issued to such insiders nor the consideration for such

securities exceeds 25% of the Company’s market capitalization. The

Company did not file a material change report 21 days prior to

closing of the Offering as the details of the participation of

insiders of the Company in the Offering had not been confirmed at

that time. The Offering, including the insiders’ participation

therein, has been approved by the board of directors of the

Company.

The Debentures offered, and the Common Shares

issuable on conversion, redemption or maturity thereof, have not

and will not be registered under the U.S. Securities Act of 1933,

as amended (the “1933 Act”), and may not be offered or sold in the

United States absent registration or an applicable exemption from

the registration requirements under the 1933 Act. This press

release does not constitute an offer to sell or a solicitation of

any offer to buy Debentures or Common Shares in the United

States.

ABOUT GOODFOOD

Goodfood (TSX: FOOD) is a leading online grocery

company in Canada, delivering fresh meal solutions and grocery

items that make it easy for customers from across Canada to enjoy

delicious meals at home every day. Goodfood’s vision is to be in

every kitchen every day by enabling customers to complete their

grocery shopping and meal planning in minutes and to receive their

order in as little as 30 minutes. Goodfood customers have access to

a unique selection of online products as well as exclusive pricing

made possible by its direct-to-consumer infrastructures and

technology that eliminate food waste and costly retail overhead.

The Company’s main production facility and administrative offices

are based in Montreal, Québec, with additional production

facilities located in the provinces of Québec, Ontario, Alberta,

and British Columbia. www.makegoodfood.ca

|

FURTHER INFORMATION: |

|

|

Investors |

Media |

| Jonathan RoiterChief Financial

Officer Phone: (855) 515-5191 Email: IR@makegoodfood.ca |

Roslane AouameurVice President,

Corporate DevelopmentPhone: (855) 515-5191Email:

media@makegoodfood.ca |

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking information includes, but is not

limited to, information with respect to our objectives and the

strategies to achieve these objectives, as well as information with

respect to our beliefs, plans, expectations, anticipations,

assumptions, estimates and intentions, including, without

limitation, statements concerning the anticipated use of net

proceeds from the Offering. This forward-looking information is

identified by the use of terms and phrases such as “may”, “would”,

“should”, “could”, “expect”, “intend”, “estimate”, “anticipate”,

“plan”, “foresee”, “believe”, and “continue”, as well as the

negative of these terms and similar terminology, including

references to assumptions, although not all forward-looking

information contains these terms and phrases. Forward-looking

information is provided for the purposes of assisting the reader in

understanding the Company and its business, operations, prospects

and risks at a point in time in the context of historical trends,

current condition and possible future developments and therefore

the reader is cautioned that such information may not be

appropriate for other purposes.

Forward-looking information is based upon a

number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond our control, which could

cause actual results to differ materially from those that are

disclosed in, or implied by, such forward-looking information.

These risks and uncertainties include, but are not limited to, the

risks factors which are discussed under “Risk Factors” in the

prospectus of the Company dated February 4, 2022 available on SEDAR

at www.sedar.com and the following risk factors which are discussed

in greater detail under “Risk Factors” in the Company’s Annual

Information Form for the year ended August 31, 2021 available on

SEDAR at www.sedar.com: limited operating history, negative

operating cash flow, food industry, COVID-19 pandemic as well as

the impact of the vaccine rollout, quality control and health

concerns, regulatory compliance, regulation of the industry, public

safety issues, product recalls, damage to Goodfood’s reputation,

transportation disruptions, storage and delivery of perishable

foods, product liability, unionization activities, consolidation

trends, ownership and protection of intellectual property, evolving

industry, reliance on management, failure to attract or retain key

employees which may impact the Company’s ability to effectively

operate and meet its financial goals, factors which may prevent

realization of growth targets, inability to effectively react to

changing consumer trends, competition, availability and quality of

raw materials, environmental and employee health and safety

regulations, the inability of the Company’s IT infrastructure to

support the requirements of the Company’s business, online security

breaches, disruptions and denial of service attacks, reliance on

data centers, open source license compliance, future capital

requirements, operating risk and insurance coverage, management of

growth, limited number of products, conflicts of interest,

litigation, catastrophic events, risks associated with payments

from customers and third parties, being accused of infringing

intellectual property rights of others and, climate change and

environmental risks. This is not an exhaustive list of risks that

may affect the Company’s forward-looking statements. Other risks

not presently known to the Company or that the Company believes are

not significant could also cause actual results to differ

materially from those expressed in its forward-looking statements.

Although the forward-looking information contained herein is based

upon what we believe are reasonable assumptions, readers are

cautioned against placing undue reliance on this information since

actual results may vary from the forward-looking information.

Certain assumptions were made in preparing the forward-looking

information concerning the availability of capital resources,

business performance, market conditions, and customer demand. In

addition, information and expectations set forth herein are subject

to and could change materially in relation to developments

regarding the duration and severity of the COVID-19 pandemic as

well as the impact of the vaccine rollout and its impact on product

demand, labour mobility, supply chain continuity and other elements

beyond our control. Consequently, all of the forward-looking

information contained herein is qualified by the foregoing

cautionary statements, and there can be no guarantee that the

results or developments that we anticipate will be realized or,

even if substantially realized, that they will have the expected

consequences or effects on our business, financial condition or

results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking information contained

herein is provided as of the date hereof, and we do not undertake

to update or amend such forward-looking information whether as a

result of new information, future events or otherwise, except as

may be required by applicable law.

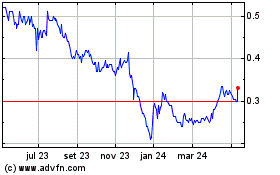

Goodfood Market (TSX:FOOD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

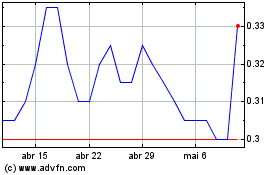

Goodfood Market (TSX:FOOD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024