Generation Mining Received $7.4 Million from Warrant Exercises

15 Fevereiro 2022 - 3:43PM

Generation Mining Limited (TSX: GENM) (OTCQB: GENMF) (“Gen Mining”

or the “Company”) is pleased to provide an update on the outcome of

the exercise of the Company's warrants that expired on February 13,

2022.

Gen Mining is pleased to announce that a

cumulative total of 10,123,494 warrants were exercised, generating

aggregate proceeds of approximately $7.4 million. Of this amount,

approximately $5.7 million of the warrants were exercised in 2022.

The warrants consisted of common share purchase warrants (“Purchase

Warrants”) exercisable at $0.75 per common share and broker

warrants exercisable at $0.52 per common share. After giving effect

to the warrant exercises, as at February 15, 2022 the Company has

179,917,408 common shares issued and outstanding. No common share

purchase warrants remain outstanding.

The Company is also pleased to announce that

2176423 Ontario Ltd. (a corporation beneficially owned by Mr. Eric

Sprott) exercised 4,807,693 Purchase Warrants for aggregate

consideration of approximately $3.6 million. Mr. Sprott now

beneficially owns and controls 16,423,079 shares representing

approximately 9.1% of the Company’s outstanding shares (for

additional details please refer to 2176423 Ontario Ltd.’s Early

Warning Report filed under the Company’s profile on SEDAR at

www.sedar.com).

Jamie Levy, the President and CEO commented “We

are extremely excited to have Mr. Sprott increase his equity

ownership in the Company. He has been a significant supporter of

our Company for several years."

Together with the Company's previous cash

balances Gen Mining now has approximately $9.5 million in cash.

About the Company

Gen Mining’s focus is the development of its

100% owned Marathon Project, a large undeveloped platinum group

metal mineral deposit in Northwestern Ontario. The Company released

the results of the Feasibility Study on March 3, 2021 and published

the NI43-101 Technical Report dated March 25, 2021. The Marathon

property covers a land package of approximately 22,000 hectares, or

220 square kilometres. Gen Mining owns a 100% interest in the

Marathon Project.

The Feasibility Study in respect of the Marathon

Project estimated that at US$1725/oz palladium, and US$3.20/lb

copper, Marathon’s Net Present Value (at 6% discount rate) is

approximately C$1.07 billion with a payback of 2.3 years and an

Internal Rate of Return of 30%. Up front capital costs were

estimated at C$665 million. The mine would produce an estimated

245,000 palladium equivalent ounces per year over a 13-year mine

life at an All-In Sustaining Cost of US$809 per

palladium-equivalent ounce. For more information, please review the

detailed Feasibility Study dated March 25, 2021, filed under the

Company’s profile at SEDAR.com.

For further information please contact:

Jamie LevyPresident and Chief

ExecutiveOfficer(416) 640-2934(416) 567-2440jlevy@genmining.com

Forward-Looking Information

This news release contains certain

forward-looking information and forward-looking statements, as

defined in applicable securities laws (collectively referred to

herein as "forward-looking statements"). Forward-looking statements

reflect current expectations or beliefs regarding future events or

the Company’s future performance. All statements other than

statements of historical fact are forward-looking statements.

Often, but not always, forward-looking statements can be identified

by the use of words such as "plans", "expects", "is expected",

"budget", "scheduled", "estimates", "continues", "forecasts",

"Projects", "predicts", "intends", "anticipates", "targets" or

"believes", or variations of, or the negatives of, such words and

phrases or state that certain actions, events or results "may",

"could", "would", "should", "might" or "will" be taken, occur or be

achieved, including statements relating to the Company advancing

the Marathon Project to bring it into production. All

forward-looking statements, including those herein are qualified by

this cautionary statement.

Although the Company believes that the

expectations expressed in such statements are based on reasonable

assumptions, such statements are not guarantees of future

performance and actual results or developments may differ

materially from those in the statements. There are certain factors

that could cause actual results to differ materially from those in

the forward-looking information. These include commodity price

volatility, continued availability of capital and financing,

uncertainties involved in interpreting geological data, increases

in costs, environmental compliance and changes in environmental

legislation and regulation, the Company’s relationships with First

Nations communities, exploration successes, and general economic,

market or business conditions, as well as those risk factors set

out in the Company’s annual information form for the year ended

December 31, 2020, and in the continuous disclosure documents filed

by the Company on SEDAR at www.sedar.com. Readers are cautioned

that the foregoing list of factors is not exhaustive of the factors

that may affect forward-looking statements. Accordingly, readers

should not place undue reliance on forward-looking statements. The

forward-looking statements in this news release speak only as of

the date of this news release or as of the date or dates specified

in such statements.

Forward-looking statements are based on a number

of assumptions which may prove to be incorrect, including, but not

limited to, assumptions relating to: the availability of financing

for the Company’s operations; operating and capital costs; results

of operations; the mine development and production schedule and

related costs; the supply and demand for, and the level and

volatility of commodity prices; timing of the receipt of regulatory

and governmental approvals for development Projects and other

operations; the accuracy of Mineral Reserve and Mineral Resource

Estimates, production estimates and capital and operating cost

estimates; and general business and economic conditions.

Investors are cautioned that any such statements

are not guarantees of future performance and actual results or

developments may differ materially from those projected in the

forward-looking information. For more information on the Company,

investors are encouraged to review the Company’s public filings on

SEDAR at www.sedar.com. The Company disclaims any intention or

obligation to update or revise any forward- looking information,

whether as a result of new information, future events or otherwise,

other than as required by law.

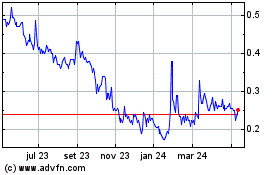

Generation Mining (TSX:GENM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

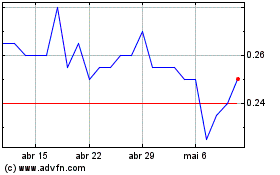

Generation Mining (TSX:GENM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024