Sunrun (Nasdaq: RUN), the nation’s leading provider of residential

solar, storage and energy services, today announced financial

results for the fourth quarter and full-year ended December 31,

2021.

“The Sunrun team delivered record volumes in 2021, having added

over 110,000 customers in the year representing 31% growth in new

installations while bringing two large companies together and

navigating a dynamic operating environment during COVID,” said Mary

Powell, Sunrun’s Chief Executive Officer. “As a combined team, we

are leading the transformation of our energy system and delivering

rapid growth.”

“We expect to see continued strong growth in 2022 and to gain

significant market share,” said Tom vonReichbauer, Sunrun’s Chief

Financial Officer. “Additionally, the inflationary pressures seen

across the economy are increasing traditional power rates in many

areas, providing us more headroom to increase our prices as well,

while still delivering a strong customer value proposition. We are

entering 2022 with a record backlog of orders and are working hard

to install systems for our customers as quickly as possible.”

Growth & Market Leadership

The growth opportunity for the solar industry is massive. Today,

only 4% of the 77 million addressable homes in the U.S. have solar.

The U.S. residential electricity market is over $187 billion per

year and ongoing utility spending has resulted in escalating retail

rates, increasing our value proposition and expanding our

addressable market. Households that adopt electric vehicles consume

approximately double the amount of electricity, increasing our

market opportunity and value proposition even further. In addition

to delivering a superior electricity service, we are increasingly

working to network our dispatchable solar and battery systems to

provide resources to the grid, such as virtual power plants, to

also serve the $120 billion annual market for utility capex. These

virtual power plants offer greater potential for resiliency and

precision than bulky centralized infrastructure.

Owing to network effects and density advantages, increasing

operating scale efficiencies, growing brand strength, capital

raising capabilities, and advanced product and service offerings,

we believe Sunrun will continue to expand our leadership position.

Here are a few highlights from the last quarter:

- Sunrun announced in January that the

company has retired its $250 million recourse lending facility and

arranged a larger $425 million facility at enhanced terms and

longer tenor than the company’s prior term extensions. The new

recourse lending facility reflects improved terms, including a

higher valuation for operating assets (now using a 5% discount

rate), in conjunction with an increased advance rate against

Sunrun’s project backlog. In addition, the new facility expands the

borrowing base to support more efficient inventory financing, also

at a higher advance rate, while maintaining the same borrowing

costs.

- Severe weather caused by climate change continues to uncover

vulnerabilities with the electric grid’s aging infrastructure,

leaving millions of people without power. Severe droughts are

increasing the risk of devastating wildfires, further jeopardizing

safety and centralized power supplies. A study released this week

by the journal Nature Climate Change concluded the last 22 year

drought in the southwest is the most extreme in 1,200 years.

- Sunrun has now installed over 32,000 solar and battery systems

nationwide, which offer homeowners the ability to power through

multi-day outages with clean and reliable home energy. Solar and

battery systems also optimize when power is purchased or supplied

to the grid, helping manage constraints on the grid during peak

times. Sunrun’s battery installations increased by more than 100%

in 2021 compared to the prior year despite battery supply and

logistical constraints which lowered our battery volumes relative

to our initial outlook.

- Channel partners are selecting Sunrun and deriving significant

value from our platform. This year we continued partner onboarding

in tandem with exclusivity agreements which resulted in strong

growth in Q4 and all-time record growth in 2021. With the

exclusivity agreements in place and continued selective new partner

onboarding, we feel confident that channel partner growth will

continue to accelerate in 2022.

- Sunrun’s new homes business continues to gain momentum and

scale, with additional home builders selecting Sunrun as their

preferred partner during the fourth quarter. Our pipeline of new

homes expanded in 2021 as we added new builders to our portfolio

providing us with a high level of confidence that our positive

growth trend will continue throughout 2022. Installations grew at a

record pace of more than 100% growth in the fourth quarter of 2021

compared to the prior year. Sunrun currently works with over 80 top

home builders throughout multiple regions.

Innovation & Differentiation

The world has the technologies to move to a decentralized energy

architecture today. Home solar and batteries can operate

economically at small scale and can therefore be located where

energy is consumed, leveraging the built environment instead of

relying on expensive, centralized infrastructure whose design

specifications do not meet today’s weather reality. Sunrun is

effectuating this transition through continued business model

innovation and a superior customer experience. We provide

fixed-rate solar-as-a-service subscriptions, whole-home backup

power capabilities, and participation in virtual power plants. We

are investing in efforts to further electrify the home, including

electric vehicle charging infrastructure and converting gas

appliances to electric. We expect these efforts will increase

Sunrun’s share of the home energy wallet and enhance our value to

customers. The following recent developments highlight our

innovation and increasing differentiation:

- Sunrun’s partnership with Ford to serve as the preferred

installer of Ford Intelligent Backup Power continues to accelerate.

Ford recently announced plans to nearly double production of the

all-electric F-150 Lightning to 150,000 units annually due to high

customer demand. Sunrun stands ready to assist Ford in meeting its

ambitious new goals and is currently ramping its efforts to train

qualified installers for seamless installation of specific charging

hardware that will enable the truck to provide backup power to

homes during grid outages. Customers will need to equip their home

with the 80-amp Ford Charge Station Pro and Home Integration System

to unlock bidirectional power flow and future energy management

solutions. The Home Integration System—designed and developed

together with Ford—can be purchased exclusively through Sunrun this

spring. Customers interested in combining Ford Charge Station Pro

installation with clean solar power may be eligible to do so for as

little as zero dollars down and reduced installation pricing.

- Streamlining permitting and interconnection processes presents

an opportunity to accelerate the adoption of solar and storage by

reducing 'soft costs' and improving a homeowner's experience.

Sunrun was a founding member of a coalition to develop an

industry-wide web-based solar permitting tool called SolarAPP+,

which seeks to reduce these costs and deliver a better customer

experience. The National Renewable Energy Laboratory (NREL)

recently published the results of a comprehensive control trial

pilot of SolarAPP+, which demonstrated quantifiable reductions to

both soft costs and permitting delays. NREL found that SolarAPP+

reduced the nationwide average permitting review time from seven

days to less than one day. The pilot collectively saved an

estimated 236 hours on permit revisions with comparable inspection

passage rates. On average, projects submitted through SolarAPP+

were installed and inspected 12 days faster than projects using the

traditional process. Sunrun is encouraged by these early pilot

results and the fact that many local governments in our largest

markets are interested in adopting SolarAPP+. SolarAPP+ is fully

active in several counties and cities across California and in

Arizona, and NREL plans to engage 300 jurisdictions by the end of

March and 600 jurisdictions by 2023. In January, the California

State Senate voted 31-1 to enact legislation (SB 379) that will

require all counties with more than 150,000 residents, and all

cities within those counties, to offer automated online permits for

rooftop solar and batteries (such as via SolarAPP+) by September

30, 2023. The California State Assembly is now considering the

legislation.

- In October, Sunrun expanded its pilot program with SPAN, the

leading intelligent home electrical panel developer, to accelerate

the transition away from fossil fuels and remove integration

barriers for customers to electrify their homes. Many U.S.

households are built with obsolete combination electrical panels,

which often present significant challenges for consumers interested

in installing rooftop solar, home batteries, and electric vehicle

chargers. Through the pilot, Sunrun is including SPAN home

electrical panels as part of its home solar and battery offerings

in select markets to drastically reduce installation hurdles when

adopting on-site generation and other all-electric appliances.

Combined with Sunrun's offering, SPAN smart home electrical panels

enable customers to improve the energy resiliency of their home

with solar energy, create fully customizable backup power switches,

better manage home electrification upgrades, gain circuit-level

visibility, and benefit the grid. The pilot includes select markets

initially, with the goal of expanding the pilot over time.

- On December 13, 2021, the California Public Utilities

Commission (CPUC) announced proposed changes to California’s

electric rate structures that would, if enacted, materially and

adversely impact the value of grid-connected rooftop solar in the

state and incent solar customers to not interconnect their systems

to the grid, and instead, store and self-consume the solar energy

generated. Amid objections from national and international electric

rate design experts, national and state politicians, community

groups, environmental justice groups, environmental groups, and at

least 125,000 individual petition signers, Governor Newsom said

there is “work to do” on the proposal and, on February 3rd, the

CPUC said it was pausing the proceeding “until further notice” to

“consider revisions.” On February 6th, the Los Angeles Times

published an editorial summing up the concerns of many, noting that

the proposal “threatens to exacerbate inequality just as solar is

starting to be adopted by increasing numbers of low-income

Californians, who are all too often excluded from the benefits of

clean energy” and that Commissioners must “significantly dial [the

proposal] back and abandon the idea of a new monthly fee.”

Californians demand and deserve resiliency, control over their

energy costs and future, and faster progress against global

warming, and Sunrun will work to innovate as required to meet this

overwhelming customer desire.

- Our business development and policy teams are actively

educating more utilities and grid operators on the valuable

services that networked distributed energy resources can provide.

Sunrun has already forged 12 virtual power plant opportunities and

has continued growing our pipeline. We have over $75 million in

expected revenue from grid service opportunities that have been

awarded or are in late-stage discussions. These opportunities

provide incremental recurring revenue and offer an enhanced

customer value proposition while also further differentiating

Sunrun’s offering from companies that lack the scale, network

density, and technical capabilities to serve this market. We

estimate that over 10% of geographies we serve today have beachhead

virtual power plant opportunities in place, which is expected to

expand to over 50% of our geographies in the coming years.

Increasingly, utilities and their regulators are seeing the value

in fast-to-market solar and battery systems to solve peak energy

needs and to replace the void from retiring fossil fuel power

plants. For instance, earlier this month Hawaiian Electric has

asked the state regulator to approve a program to compensate

households upfront and on an ongoing basis for adding a battery to

their rooftop solar systems if the systems export energy to the

grid during peak times.

ESG Efforts: Embracing Sustainability & Investing in

Communities

Sunrun’s mission is to create a planet run by the sun and build

an affordable energy system that combats climate change and

provides energy access for all. We proactively serve all

stakeholders: our customers, our employees, the communities in

which we operate, and our business and financial partners.

Investing in our people and providing meaningful career

opportunities is critical to our success. As the country embarks on

upgrading infrastructure and rewiring our buildings, the demand for

skilled workers will increase substantially. We are focused on

developing a differentiated talent brand and providing

opportunities to train workers to be part of the clean energy

economy. The following recent developments highlight our commitment

to sustainability, investing in people, and investing in our

communities:

- In January 2022, Sunrun announced that it has received a

perfect score of 100 on the Human Rights Campaign Foundation’s 2022

Corporate Equality Index (CEI), the nation’s foremost benchmarking

survey and report measuring corporate policies and practices

related to LGBTQ+ workplace equality. The CEI rates companies under

four central pillars, including non-discrimination policies across

business entities, equitable benefits for LGBTQ+ workers and their

families, supporting an inclusive culture and corporate social

responsibility. The 2022 CEI showcases 1,271 U.S.-based companies

promoting LGBTQ+-friendly workplace policies in the U.S.

Approximately 56% of the CEI-rated companies have global operations

and are helping advance the cause of LGBTQ+ inclusion in workplaces

abroad. Sunrun satisfied all of the CEI’s criteria to score a

perfect 100, earning the designation as one of the Best Places to

Work for LGBTQ+ Equality.

- Sunrun expanded its Board of Directors in January, welcoming

Manjula Talreja. Ms. Talreja is currently the Senior Vice President

and Chief Customer Officer of PagerDuty, previously served as

Senior Vice President of the Customer Success Group at

Salesforce.com and had a 22-year tenure at Cisco Systems. Ms.

Talreja has been recognized as an industry leader, including being

named one of the “2020 Top 50 Women in Technology” by the National

Diversity Council.

- We remain committed to building a differentiated talent brand.

We continue to invest in our people. In Q4, our efforts in the

growth and development of Sunrunners accelerated, with 33% of our

employees now enrolled for PowerU, a continuing education program.

We also noticed employees enrolled in PowerU have significantly

higher retention, driving higher productivity, lower hiring costs,

and higher overall engagement. We continue to build our electrician

talent pipeline and at the end of Q4 we launched an electrical

apprenticeship program in multiple states which now includes

approximately 200 Sunrunners who are enrolled in the certificate

programs to become an electrician. Additionally, to accelerate our

hiring of transitioning veterans, in February 2022, Sunrun will be

featured on Lifetime TV's Military Makeover: Operation Career. In

2021, we hired ~500 transitioning veterans through the Skillbridge

and Military Spouse Program.

- The solar systems we deployed in Q4

are expected to prevent the emission of 4.6 million metric tons of

CO2 over the next thirty years. Over the last twelve months,

Sunrun’s systems are estimated to have offset more than 2.8 million

metric tons of CO2.

Key Operating Metrics

In the fourth quarter of 2021, Customer Additions were 29,870,

including 22,017 Subscriber Additions. As of December 31, 2021,

Sunrun had 660,311 Customers, including 567,744 Subscribers.

Customers grew 20% in 2021 compared to 2020, pro-forma of Vivint

Solar.

Annual Recurring Revenue from Subscribers was $851 million as of

December 31, 2021. The Average Contract Life Remaining of

Subscribers was 17.4 years as of December 31, 2021.

Subscriber Value was $36,962 in the fourth quarter of 2021 while

Creation Cost was $29,898. Net Subscriber Value was $7,064 in the

fourth quarter of 2021. Total Value Generated was $155.5 million in

the fourth quarter of 2021.

Gross Earning Assets as of December 31, 2021 were $9.7 billion.

Net Earning Assets were $4.6 billion, which includes $850 million

in total cash, as of December 31, 2021.

Solar Energy Capacity Installed was 220 Megawatts in the fourth

quarter of 2021. Solar Energy Capacity Installed for Subscribers

was 163 Megawatts in the fourth quarter of 2021.

Networked Solar Energy Capacity was 4,677 Megawatts as of

December 31, 2021. Networked Solar Energy Capacity for Subscribers

was 4,050 Megawatts as of December 31, 2021.

Outlook

Management expects Solar Energy Capacity Installed growth to be

20% or greater for the full-year 2022.

Total Value Generated is expected to grow faster than Solar

Energy Capacity Installed for the full-year 2022.

For the first quarter, management expects Solar Energy Capacity

Installed to be in a range between 195 and 200 megawatts.

Fourth Quarter 2021 GAAP Results

Total revenue was $435.2 million in the fourth quarter of 2021,

up $114.8 million, or 36%, from the fourth quarter of 2020.

Customer agreements and incentives revenue was $200.6 million, an

increase of $36.2 million, or 22%, compared to the fourth quarter

of 2020. Solar energy systems and product sales revenue was $234.6

million, an increase of $78.7 million, or 50%, compared to the

fourth quarter of 2020.

Total cost of revenue was $395.2 million, an increase of 45%

year-over-year. Total operating expenses were $643.2 million, an

increase of 12% year-over-year.

Included in operating costs for the fourth quarter of 2021 were

$16.5 million of non-recurring restructuring expenses related to

the acquisition of Vivint Solar. Operating costs include

stock-based compensation expenses of $50.2 million in the fourth

quarter of 2021.

Consistent with purchase accounting standards under GAAP, the

fair value of outstanding equity awards for Vivint Solar employees

was reevaluated upon the closing of the acquisition, which resulted

in a step-up of the value of such awards, which will result in an

increase to non-cash stock-based compensation expense until such

awards have fully vested. Additionally, the value of Solar Energy

Systems was recorded based on a fair value assessment, which was

approximately $1.1 billion higher than the book value at the date

of the acquisition, and will result in additional non-cash

depreciation expense over the estimated useful life of the assets,

partially offset by a write-off of Vivint Solar’s Cost to Obtain

Customer Agreements.

Net loss attributable to common stockholders was $38.5 million,

or $0.19 per share, in the fourth quarter of 2021.

Full Year 2021 GAAP Results

Total revenue grew to $1,610.0 million in the full year 2021, up

$687.8 million, or 75%, from 2020. Customer agreements and

incentives revenue was $826.6 million, an increase of $342.4

million, or 71%, compared to 2020. Solar energy systems and product

sales revenue was $783.4 million, an increase of $345.4 million, or

79%, compared to 2020.

Total cost of revenue was $1,365.5 million, an increase of 84%

year-over-year. Total operating expenses were $2,276.1 million, an

increase of 64% year-over-year.

One-time acquisition and deal related expenses and restructuring

costs were $31.6 million for the full-year 2021.

Net loss attributable to common stockholders was $79.4 million,

or $0.39 per share, for the full year 2021.

Financing Activities

As of February 17, 2022, closed transactions and executed term

sheets provide us expected tax equity and project debt capacity to

fund over 375 megawatts of Solar Energy Capacity Installed for

Subscribers beyond what was deployed through the end of the fourth

quarter of 2021.

Conference Call Information

Sunrun is hosting a conference call for analysts and investors

to discuss its fourth quarter and full-year 2021 results and

business outlook at 2:00 p.m. Pacific Time today, February 17,

2022. A live audio webcast of the conference call along with

supplemental financial information will be accessible via the

“Investor Relations” section of Sunrun’s website at

https://investors.sunrun.com. The conference call can also be

accessed live over the phone by dialing (877) 407-5989 (toll free)

or (201) 689-8434 (toll). An audio replay will be available

following the call on the Sunrun Investor Relations website for

approximately one month.

About Sunrun

Sunrun Inc. (Nasdaq: RUN) is the nation’s leading home solar,

battery storage, and energy services company. Founded in 2007,

Sunrun pioneered home solar service plans to make local clean

energy more accessible to everyone for little to no upfront cost.

Sunrun’s innovative home battery solution brings families

affordable, resilient, and reliable energy. The company can also

manage and share stored solar energy from the batteries to provide

benefits to households, utilities, and the electric grid while

reducing our reliance on polluting energy sources. For more

information, please visit www.sunrun.com.

Forward Looking Statements

This communication contains forward-looking statements related

to Sunrun (the “Company”) within the meaning of Section 27A of the

Securities Act of 1933, and Section 21E of the Securities Exchange

Act of 1934 and the Private Securities Litigation Reform Act of

1995. Such forward-looking statements include, but are not limited

to, statements related to: the Company’s leadership team and talent

development; the Company’s financial and operating guidance and

expectations; the Company’s business plan, trajectory and

expectations in 2022 and beyond, market leadership, competitive

advantages, operational and financial results and metrics (and the

assumptions related to the calculation of such metrics); the

ongoing, anticipated, or potential impacts of the COVID-19 pandemic

and its variants; the Company’s momentum in the company’s business

strategies, expectations regarding market share, total addressable

market, customer value proposition, market penetration, financing

activities, financing capacity, product mix, and ability to manage

cash flow and liquidity; the growth of the solar industry; the

Company’s ability to manage suppliers, inventory, and workforce;

supply chains and regulatory impacts affecting supply chains;

factors outside of the Company’s control such as macroeconomic

trends, public health emergencies, natural disasters, and the

impacts of climate change; the legislative and regulatory

environment of the solar industry and the potential impacts of

proposed, amended, and newly adopted legislation and regulation on

the solar industry and our business; expectations regarding the

Company’s storage and energy services businesses, the Company’s

acquisition of Vivint Solar (including cost synergies), anticipated

emissions reductions due to utilization of the Company’s solar

systems; the Company’s ability to derive value from the anticipated

benefits of partnerships, new technologies, and pilot programs;

expectations regarding the growth of home electrification, electric

vehicles, virtual power plants, and distributed energy resources.

These statements are not guarantees of future performance; they

reflect the Company’s current views with respect to future events

and are based on assumptions and estimates and are subject to known

and unknown risks, uncertainties and other factors that may cause

actual results, performance or achievements to be materially

different from expectations or results projected or implied by

forward-looking statements. The risks and uncertainties that could

cause the Company’s results to differ materially from those

expressed or implied by such forward-looking statements include:

the impact of COVID-19 and its variants on the Company’s

operations; the Company’s continued ability to manage costs and

compete effectively; the availability of additional financing on

acceptable terms; worldwide economic conditions, including slow or

negative growth rates; rising interest rates; changes in policies

and regulations, including net metering and interconnection limits

or caps and licensing restrictions; the Company’s ability to

attract and retain the Company’s solar partners; supply chain risks

and associated costs; the successful integration of Vivint Solar;

realizing the anticipated benefits of past or future investments,

strategic transactions, or acquisitions, and integrating those

acquisitions; the Company’s leadership team and ability to retract

and retain key employees; changes in the retail prices of

traditional utility generated electricity; the availability of

rebates, tax credits and other incentives; the availability of

solar panels, batteries, and other components and raw materials;

the Company’s business plan and the Company’s ability to

effectively manage the Company’s growth and labor constraints; the

Company’s ability to meet the covenants in the Company’s investment

funds and debt facilities; factors impacting the solar industry

generally, and such other risks and uncertainties identified in the

reports that we file with the U.S. Securities and Exchange

Commission from time to time. All forward-looking statements used

herein are based on information available to us as of the date

hereof, and we assume no obligation to update publicly these

forward-looking statements for any reason, except as required by

law.

Citations to industry and market statistics used herein may be

found in our Investor Presentation, available via the “Investor

Relations” section of Sunrun’s website at

https://investors.sunrun.com.

Consolidated Balance

Sheets(In Thousands)

| |

|

As of December 31, |

|

|

|

|

2021 |

|

|

2020 |

| Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash |

|

$ |

617,634 |

|

$ |

519,965 |

|

Restricted cash |

|

|

232,649 |

|

|

188,095 |

|

Accounts receivable, net |

|

|

146,037 |

|

|

95,141 |

|

Inventories |

|

|

506,819 |

|

|

283,045 |

|

Prepaid expenses and other current assets |

|

|

44,580 |

|

|

51,483 |

|

Total current assets |

|

|

1,547,719 |

|

|

1,137,729 |

|

Restricted cash |

|

|

148 |

|

|

148 |

|

Solar energy systems, net |

|

|

9,459,696 |

|

|

8,202,788 |

|

Property and equipment, net |

|

|

56,886 |

|

|

62,182 |

|

Intangible assets, net |

|

|

12,891 |

|

|

18,262 |

|

Goodwill |

|

|

4,280,169 |

|

|

4,280,169 |

|

Other assets |

|

|

1,125,743 |

|

|

681,665 |

|

Total assets |

|

$ |

16,483,252 |

|

$ |

14,382,943 |

| Liabilities and total

equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

288,108 |

|

$ |

207,441 |

|

Distributions payable to noncontrolling interests and redeemable

noncontrolling interests |

|

|

31,582 |

|

|

28,627 |

|

Accrued expenses and other liabilities |

|

|

364,136 |

|

|

325,614 |

|

Deferred revenue, current portion |

|

|

111,739 |

|

|

108,452 |

|

Deferred grants, current portion |

|

|

8,302 |

|

|

8,251 |

|

Finance lease obligations, current portion |

|

|

10,901 |

|

|

11,037 |

|

Non-recourse debt, current portion |

|

|

190,186 |

|

|

195,036 |

|

Pass-through financing obligation, current portion |

|

|

7,166 |

|

|

16,898 |

|

Total current liabilities |

|

|

1,012,120 |

|

|

901,356 |

|

Deferred revenue, net of current portion |

|

|

761,872 |

|

|

690,824 |

|

Deferred grants, net of current portion |

|

|

206,615 |

|

|

213,269 |

|

Finance lease obligations, net of current portion |

|

|

11,314 |

|

|

12,929 |

|

Line of credit |

|

|

211,066 |

|

|

230,660 |

|

Non-recourse debt, net of current portion |

|

|

5,711,020 |

|

|

4,370,449 |

|

Convertible senior notes |

|

|

390,618 |

|

|

— |

|

Pass-through financing obligation, net of current portion |

|

|

314,231 |

|

|

323,496 |

|

Other liabilities |

|

|

190,056 |

|

|

268,684 |

|

Deferred tax liabilities |

|

|

101,753 |

|

|

81,905 |

|

Total liabilities |

|

|

8,910,665 |

|

|

7,093,572 |

| Redeemable noncontrolling

interests |

|

|

594,973 |

|

|

560,461 |

|

Total stockholders’ equity |

|

|

6,254,736 |

|

|

6,077,911 |

|

Noncontrolling interests |

|

|

722,878 |

|

|

650,999 |

|

Total equity |

|

|

6,977,614 |

|

|

6,728,910 |

|

Total liabilities, redeemable noncontrolling interests and

total equity |

|

$ |

16,483,252 |

|

$ |

14,382,943 |

Consolidated Statements of

Operations(In Thousands, Except Per Share

Amounts)

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

Customer agreements and incentives |

|

$ |

200,625 |

|

|

$ |

164,456 |

|

|

$ |

826,564 |

|

|

$ |

484,160 |

|

|

Solar energy systems and product sales |

|

|

234,604 |

|

|

|

155,950 |

|

|

|

783,390 |

|

|

|

438,031 |

|

|

Total revenue |

|

|

435,229 |

|

|

|

320,406 |

|

|

|

1,609,954 |

|

|

|

922,191 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of customer agreements and incentives |

|

|

187,029 |

|

|

|

146,601 |

|

|

|

699,102 |

|

|

|

385,650 |

|

|

Cost of solar energy systems and product sales |

|

|

208,162 |

|

|

|

126,853 |

|

|

|

666,370 |

|

|

|

357,876 |

|

|

Sales and marketing |

|

|

180,787 |

|

|

|

141,608 |

|

|

|

622,961 |

|

|

|

352,299 |

|

|

Research and development |

|

|

6,541 |

|

|

|

5,326 |

|

|

|

23,165 |

|

|

|

19,548 |

|

|

General and administrative |

|

|

59,337 |

|

|

|

155,087 |

|

|

|

259,173 |

|

|

|

266,746 |

|

|

Amortization of intangible assets |

|

|

1,341 |

|

|

|

1,363 |

|

|

|

5,370 |

|

|

|

5,180 |

|

|

Total operating expenses |

|

|

643,197 |

|

|

|

576,838 |

|

|

|

2,276,141 |

|

|

|

1,387,299 |

|

| Loss from operations |

|

|

(207,968 |

) |

|

|

(256,432 |

) |

|

|

(666,187 |

) |

|

|

(465,108 |

) |

| Interest expense, net |

|

|

(89,335 |

) |

|

|

(78,588 |

) |

|

|

(327,700 |

) |

|

|

(230,601 |

) |

| Other income, net |

|

|

4,166 |

|

|

|

7,422 |

|

|

|

22,628 |

|

|

|

8,188 |

|

| Loss before income taxes |

|

|

(293,137 |

) |

|

|

(327,598 |

) |

|

|

(971,259 |

) |

|

|

(687,521 |

) |

| Income tax expense

(benefit) |

|

|

28,329 |

|

|

|

(30,149 |

) |

|

|

9,271 |

|

|

|

(60,573 |

) |

| Net loss |

|

|

(321,466 |

) |

|

|

(297,449 |

) |

|

|

(980,530 |

) |

|

|

(626,948 |

) |

| Net loss attributable to

noncontrolling interests and redeemable noncontrolling

interests |

|

|

(282,947 |

) |

|

|

(128,129 |

) |

|

|

(901,107 |

) |

|

|

(453,554 |

) |

| Net loss attributable to

common stockholders |

|

$ |

(38,519 |

) |

|

$ |

(169,320 |

) |

|

$ |

(79,423 |

) |

|

$ |

(173,394 |

) |

| Net loss per share

attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.19 |

) |

|

$ |

(0.88 |

) |

|

$ |

(0.39 |

) |

|

$ |

(1.24 |

) |

|

Diluted |

|

$ |

(0.19 |

) |

|

$ |

(0.88 |

) |

|

$ |

(0.39 |

) |

|

$ |

(1.24 |

) |

| Weighted average shares used

to compute net loss per share attributable to common

stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

|

207,418 |

|

|

|

192,597 |

|

|

|

205,132 |

|

|

|

139,606 |

|

|

Diluted |

|

|

207,418 |

|

|

|

192,597 |

|

|

|

205,132 |

|

|

|

139,606 |

|

Consolidated Statements of Cash

Flows(In Thousands)

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Operating

activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(321,466 |

) |

|

$ |

(297,449 |

) |

|

$ |

(980,530 |

) |

|

$ |

(626,948 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization, net of amortization of deferred

grants |

|

|

102,095 |

|

|

|

86,685 |

|

|

|

388,096 |

|

|

|

242,942 |

|

|

Deferred income taxes |

|

|

28,316 |

|

|

|

(30,149 |

) |

|

|

9,607 |

|

|

|

(60,573 |

) |

|

Stock-based compensation expense |

|

|

50,246 |

|

|

|

133,043 |

|

|

|

211,000 |

|

|

|

170,587 |

|

|

Interest on pass-through financing obligations |

|

|

5,143 |

|

|

|

5,686 |

|

|

|

21,431 |

|

|

|

23,166 |

|

|

Reduction in pass-through financing obligations |

|

|

(10,149 |

) |

|

|

(10,281 |

) |

|

|

(42,309 |

) |

|

|

(39,188 |

) |

|

Other noncash items |

|

|

21,944 |

|

|

|

19,793 |

|

|

|

60,600 |

|

|

|

51,040 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

28,046 |

|

|

|

2,261 |

|

|

|

(62,124 |

) |

|

|

4,988 |

|

|

Inventories |

|

|

(62,300 |

) |

|

|

(35,050 |

) |

|

|

(223,774 |

) |

|

|

47,554 |

|

|

Prepaid and other assets |

|

|

(103,557 |

) |

|

|

(79,075 |

) |

|

|

(377,505 |

) |

|

|

(117,033 |

) |

|

Accounts payable |

|

|

(53,480 |

) |

|

|

11,795 |

|

|

|

66,932 |

|

|

|

(45,718 |

) |

|

Accrued expenses and other liabilities |

|

|

5,242 |

|

|

|

15,658 |

|

|

|

33,195 |

|

|

|

(10,306 |

) |

|

Deferred revenue |

|

|

28,563 |

|

|

|

25,870 |

|

|

|

78,195 |

|

|

|

41,517 |

|

|

Net cash used in operating activities |

|

|

(281,357 |

) |

|

|

(151,213 |

) |

|

|

(817,186 |

) |

|

|

(317,972 |

) |

| Investing

activities: |

|

|

|

|

|

|

|

|

| Payments for the costs of

solar energy systems |

|

|

(491,279 |

) |

|

|

(347,568 |

) |

|

|

(1,677,609 |

) |

|

|

(966,580 |

) |

| Business combination, net of

cash acquired |

|

|

— |

|

|

|

537,242 |

|

|

|

— |

|

|

|

537,242 |

|

| Purchase of equity method

investment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(65,356 |

) |

| Purchases of property and

equipment, net |

|

|

3,064 |

|

|

|

(711 |

) |

|

|

(8,576 |

) |

|

|

(3,095 |

) |

|

Net cash provided by (used in) investing activities |

|

|

(488,215 |

) |

|

|

188,963 |

|

|

|

(1,686,185 |

) |

|

|

(497,789 |

) |

| Financing

activities: |

|

|

|

|

|

|

|

|

| Proceeds from state tax

credits, net of recapture |

|

|

— |

|

|

|

(344 |

) |

|

|

— |

|

|

|

5,683 |

|

| Proceeds from line of

credit |

|

|

211,066 |

|

|

|

55,750 |

|

|

|

738,046 |

|

|

|

182,700 |

|

| Repayment of line of

credit |

|

|

(209,284 |

) |

|

|

(50,000 |

) |

|

|

(757,640 |

) |

|

|

(191,525 |

) |

| Proceeds from issuance of

convertible senior notes, net of capped call transaction |

|

|

2 |

|

|

|

— |

|

|

|

372,000 |

|

|

|

— |

|

| Proceeds from issuance of

non-recourse debt |

|

|

495,735 |

|

|

|

308,543 |

|

|

|

2,186,990 |

|

|

|

751,493 |

|

| Repayment of non-recourse

debt |

|

|

(103,045 |

) |

|

|

(191,088 |

) |

|

|

(856,091 |

) |

|

|

(399,459 |

) |

| Payment of debt fees |

|

|

(11,036 |

) |

|

|

(5,730 |

) |

|

|

(53,793 |

) |

|

|

(14,083 |

) |

| Proceeds from pass-through

financing and other obligations |

|

|

2,175 |

|

|

|

2,973 |

|

|

|

10,032 |

|

|

|

8,701 |

|

| Early repayment of

pass-through financing obligations |

|

|

— |

|

|

|

— |

|

|

|

(18,050 |

) |

|

|

— |

|

|

Payment of finance lease obligations |

|

|

(3,109 |

) |

|

|

(2,815 |

) |

|

|

(12,352 |

) |

|

|

(10,578 |

) |

|

Contributions received from noncontrolling interests and redeemable

noncontrolling interests |

|

|

338,400 |

|

|

|

206,206 |

|

|

|

1,238,732 |

|

|

|

818,061 |

|

|

Distributions paid to noncontrolling interests and redeemable

noncontrolling interests |

|

|

(54,430 |

) |

|

|

(48,682 |

) |

|

|

(196,466 |

) |

|

|

(111,223 |

) |

|

Acquisition of noncontrolling interests |

|

|

(383 |

) |

|

|

(2,694 |

) |

|

|

(41,955 |

) |

|

|

(2,694 |

) |

|

Net proceeds related to stock-based award activities |

|

|

12,791 |

|

|

|

16,825 |

|

|

|

36,141 |

|

|

|

48,664 |

|

|

Proceeds from shares issued in connection with a subscription

agreement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

75,000 |

|

|

Repurchase of common stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net cash provided by financing activities |

|

|

678,882 |

|

|

|

288,944 |

|

|

|

2,645,594 |

|

|

|

1,160,740 |

|

| Net change in cash and

restricted cash |

|

|

(90,690 |

) |

|

|

326,694 |

|

|

|

142,223 |

|

|

|

344,979 |

|

| Cash and restricted cash,

beginning of period |

|

|

941,121 |

|

|

|

381,514 |

|

|

|

708,208 |

|

|

|

363,229 |

|

| Cash and restricted cash, end

of period |

|

$ |

850,431 |

|

|

$ |

708,208 |

|

|

$ |

850,431 |

|

|

$ |

708,208 |

|

Key Operating and Financial

Metrics

| In-period volume

metrics: |

Three Months EndedDecember 31, 2021 |

|

Full Year Ended December 31, 2021 |

|

Customer Additions |

|

29,870 |

|

|

110,234 |

|

Subscriber Additions |

|

22,017 |

|

|

88,834 |

|

Solar Energy Capacity Installed (in Megawatts) |

|

219.7 |

|

|

791.7 |

|

Solar Energy Capacity Installed for Subscribers (in Megawatts) |

|

163.2 |

|

|

642.7 |

| |

|

| In-period value

creation metrics: |

Three Months Ended December 31, 2021 |

|

Full Year Ended December 31, 2021 |

|

Subscriber Value Contracted Period |

$33,734 |

|

$32,559 |

|

Subscriber Value Renewal Period |

$3,228 |

|

$3,166 |

|

Subscriber Value |

$36,962 |

|

$35,725 |

|

Creation Cost |

$29,898 |

|

$28,635 |

|

Net Subscriber Value |

$7,064 |

|

$7,104 |

|

Total Value Generated (in millions) |

$155.5 |

|

$631.1 |

| |

|

|

|

| In-period

environmental impact metrics: |

Three Months EndedDecember 31, 2021 |

|

Full Year Ended December 31, 2021 |

|

Positive Environmental Impact from Customers (over trailing twelve

months, in millions of metric tons of CO2 avoidance) |

|

2.8 |

|

|

2.8 |

|

Positive Expected Lifetime Environmental Impact from Customer

Additions (in millions of metric tons of CO2 avoidance) |

|

4.6 |

|

|

17.2 |

| |

|

|

|

| Period-end

metrics: |

December 31, 2021 |

|

December 31, 2020 |

|

Customers |

|

660,311 |

|

|

550,078 |

|

Subscribers |

|

567,744 |

|

|

478,910 |

|

Networked Solar Energy Capacity (in megawatts) |

|

4,677 |

|

|

3,885 |

|

Networked Solar Energy Capacity for Subscribers (in megawatts) |

|

4,050 |

|

|

3,407 |

|

Annual Recurring Revenue (in millions) |

$851 |

|

$668 |

|

Average Contract Life Remaining (in years) |

|

17.4 |

|

|

17.2 |

|

Gross Earning Assets Contracted Period (in millions) |

$6,639 |

|

$5,234 |

|

Gross Earning Assets Renewal Period (in millions) |

$3,033 |

|

$2,539 |

|

Gross Earning Assets (in millions) |

$9,672 |

|

$7,773 |

|

Net Earning Assets (in millions) |

$4,602 |

|

$4,168 |

|

|

|

|

|

|

|

Note that figures presented above may not sum due to rounding.

For adjustments related to Subscriber Value and Creation Cost,

please see the supplemental Creation Cost Methodology memo for each

applicable period, which is available on investors.sunrun.com.

Definitions

Deployments represent solar energy systems,

whether sold directly to customers or subject to executed Customer

Agreements (i) for which we have confirmation that the systems are

installed on the roof, subject to final inspection, (ii) in the

case of certain system installations by our partners, for which we

have accrued at least 80% of the expected project cost (inclusive

of acquisitions of installed systems), or (iii) for multi-family

and any other systems that have reached our internal milestone

signaling construction can commence following design completion,

measured on the percentage of the system that has been completed

based on expected system cost.

Customer Agreements refer to, collectively,

solar power purchase agreements and solar leases.

Subscriber Additions represent the number of

Deployments in the period that are subject to executed Customer

Agreements.

Customer Additions represent the number of

Deployments in the period.

Solar Energy Capacity Installed represents the

aggregate megawatt production capacity of our solar energy systems

that were recognized as Deployments in the period.

Solar Energy Capacity Installed for Subscribers

represents the aggregate megawatt production capacity of our solar

energy systems that were recognized as Deployments in the period

that are subject to executed Customer Agreements.

Creation Cost represents the sum of certain

operating expenses and capital expenditures incurred divided by

applicable Customer Additions and Subscriber Additions in the

period. Creation Cost is comprised of (i) installation costs, which

includes the increase in gross solar energy system assets and the

cost of customer agreement revenue, excluding depreciation expense

of fixed solar assets, and operating and maintenance expenses

associated with existing Subscribers, plus (ii) sales and marketing

costs, including increases to the gross capitalized costs to obtain

contracts, net of the amortization expense of the costs to obtain

contracts, plus (iii) general and administrative costs, and less

(iv) the gross profit derived from selling systems to customers

under sale agreements and Sunrun’s product distribution and lead

generation businesses. Creation Cost excludes stock based

compensation, amortization of intangibles, and research and

development expenses, along with other items the company deems to

be non-recurring or extraordinary in nature.

Subscriber Value represents the per subscriber

value of upfront and future cash flows (discounted at 5%) from

Subscriber Additions in the period, including expected payments

from customers as set forth in Customer Agreements, net proceeds

from tax equity finance partners, payments from utility incentive

and state rebate programs, contracted net grid service program cash

flows, projected future cash flows from solar energy renewable

energy credit sales, less estimated operating and maintenance costs

to service the systems and replace equipment, consistent with

estimates by independent engineers, over the initial term of the

Customer Agreements and estimated renewal period. For Customer

Agreements with 25 year initial contract terms, a 5 year renewal

period is assumed. For a 20 year initial contract term, a 10 year

renewal period is assumed. In all instances, we assume a 30-year

customer relationship, although the customer may renew for

additional years, or purchase the system.

Net Subscriber Value represents Subscriber

Value less Creation Cost.

Total Value Generated represents Net Subscriber

Value multiplied by Subscriber Additions.

Customers represent the cumulative number of

Deployments, from the company’s inception through the measurement

date.

Subscribers represent the cumulative number of

Customer Agreements for systems that have been recognized as

Deployments through the measurement date.

Networked Solar Energy Capacity represents the

aggregate megawatt production capacity of our solar energy systems

that have been recognized as Deployments, from the company’s

inception through the measurement date.

Networked Solar Energy Capacity for Subscribers

represents the aggregate megawatt production capacity of our solar

energy systems that have been recognized as Deployments, from the

company’s inception through the measurement date, that have been

subject to executed Customer Agreements.

Gross Earning Assets is calculated as Gross

Earning Assets Contracted Period plus Gross Earning Assets Renewal

Period.

Gross Earning Assets Contracted Period

represents the present value of the remaining net cash flows

(discounted at 5%) during the initial term of our Customer

Agreements as of the measurement date. It is calculated as the

present value of cash flows (discounted at 5%) that we would

receive from Subscribers in future periods as set forth in Customer

Agreements, after deducting expected operating and maintenance

costs, equipment replacements costs, distributions to tax equity

partners in consolidated joint venture partnership flip structures,

and distributions to project equity investors. We include cash

flows we expect to receive in future periods from state incentive

and rebate programs, contracted sales of solar renewable energy

credits, and awarded net cash flows from grid service programs with

utilities or grid operators.

Gross Earning Assets Renewal Period is the

forecasted net present value we would receive upon or following the

expiration of the initial Customer Agreement term but before the

30th anniversary of the system’s activation (either in the form of

cash payments during any applicable renewal period or a system

purchase at the end of the initial term), for Subscribers as of the

measurement date. We calculate the Gross Earning Assets Renewal

Period amount at the expiration of the initial contract term

assuming either a system purchase or a renewal, forecasting only a

30-year customer relationship (although the customer may renew for

additional years, or purchase the system), at a contract rate equal

to 90% of the customer’s contractual rate in effect at the end of

the initial contract term. After the initial contract term, our

Customer Agreements typically automatically renew on an annual

basis and the rate is initially set at up to a 10% discount to

then-prevailing utility power prices.

Net Earning Assets represents Gross Earning

Assets, plus total cash, less adjusted debt and less pass-through

financing obligations, as of the same measurement date. Debt is

adjusted to exclude a pro-rata share of non-recourse debt

associated with funds with project equity structures along with

debt associated with the company’s ITC safe harboring facility.

Because estimated cash distributions to our project equity partners

are deducted from Gross Earning Assets, a proportional share of the

corresponding project level non-recourse debt is deducted from Net

Earning Assets, as such debt would be serviced from cash flows

already excluded from Gross Earning Assets.

Annual Recurring Revenue represents revenue

arising from Customer Agreements over the following twelve months

for Subscribers that have met initial revenue recognition criteria

as of the measurement date.

Average Contract Life Remaining represents the

average number of years remaining in the initial term of Customer

Agreements for Subscribers that have met revenue recognition

criteria as of the measurement date.

Positive Environmental Impact from Customers

represents the estimated reduction in carbon emissions as a result

of energy produced from our Networked Solar Energy Capacity over

the trailing twelve months. The figure is presented in millions of

metric tons of avoided carbon emissions and is calculated using the

Environmental Protection Agency’s AVERT tool.

Positive Expected Lifetime Environmental Impact from

Customer Additions represents the estimated reduction in

carbon emissions over thirty years as a result of energy produced

from solar energy systems that were recognized as Deployments in

the period. The figure is presented in millions of metric tons of

avoided carbon emissions and is calculated using the Environmental

Protection Agency’s AVERT tool.

Investor & Analyst Contact:

Patrick JobinSenior Vice President, Finance &

IRinvestors@sunrun.com

Media Contact:

Wyatt SemanekPublic Relations Managerpress@sunrun.com

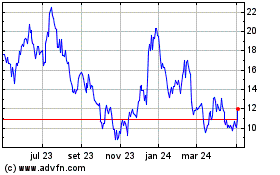

Sunrun (NASDAQ:RUN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

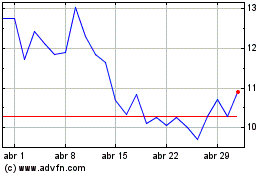

Sunrun (NASDAQ:RUN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024