Today, RBC iShares expands its exchange traded fund (“ETF”) lineup

with the launch of four iShares Megatrends ETFs.

The four ETFs (collectively the “iShares ETFs”)

are listed in the table below and are expected to begin trading on

the Toronto Stock Exchange (the “TSX”) today; the new iShares ETFs

will be managed by BlackRock Asset Management Canada Limited

(“BlackRock Canada”), an indirect wholly-owned subsidiary of

BlackRock, Inc.

|

Fund Name |

Ticker |

AnnualManagementFee |

|

iShares Exponential Technologies Index ETF |

XEXP |

0.39% |

|

iShares Global Clean Energy Index ETF |

XCLN |

0.35%1 |

|

iShares Genomics Immunology and Healthcare Index ETF |

XDNA |

0.39% |

|

iShares Cybersecurity and Tech Index ETF |

XHAK |

0.39% |

Steven Leong, Head of iShares Product,

BlackRock Canada:

“With the launch of these new ETFs, RBC iShares

continues to deliver high quality, growth focused strategies to

support portfolio construction, helping advisors and investors meet

their long-term investment objectives. These new ETFs give

investors additional tools to diversify their portfolios, enabling

easy access to megatrends which we believe are powerful,

transformative forces that can change the trajectory of the global

economy by shifting the priorities of societies, driving innovation

and redefining business models.”

Mark Neill, Head of RBC ETFs, RBC Global

Asset Management

Inc.:

“Since the launch of RBC iShares three years

ago, we have been committed to providing Canadian investors and

advisors with an unparalleled suite of ETFs to help them meet their

evolving needs, by leveraging the expertise of two leading global

asset managers. The addition of Megatrends ETFs is another

milestone that reflects this commitment, and further demonstrates

the strength of the RBC iShares strategic alliance.”

________________________1 If

applicable, BlackRock Canada or an affiliate is entitled to receive

a fee for acting as manager of each ETF managed by BlackRock Canada

or an affiliate (“iShares ETF”) in which this ETF may invest (an

“underlying product fee” and together with the management fee

payable to BlackRock Canada, the “total annual fee”). As the

underlying product fees are embedded in the market value of the

iShares ETFs in which this ETF may invest, any underlying product

fees are borne indirectly by this ETF. BlackRock Canada will adjust

the management fee payable to it by this ETF to ensure that the

total annual fees paid directly or indirectly to BlackRock Canada

and its affiliates by this ETF will not exceed the percentage of

the net asset value set out in this table. The total annual fee is

exclusive of HST. Any underlying product fees borne indirectly by

this ETF are calculated and accrued daily and are paid not less

than annually.

Capturing long-term forces shaping our

future

The launch of RBC iShares Megatrends ETFs

provides Canadian investors access to the long-term,

transformational forces influencing the future of our global

economy and society. These exposures seek to capture

transformational trends that have not yet reached their full

potential.

The iShares Exponential Technologies Index ETF

(XEXP) provides exposure to securities of issuers that create or

use exponential technologies, as determined by the index provider,

driving progress in the tech sector and beyond.

The iShares Global Clean Energy Index ETF (XCLN)

provides exposure to securities of issuers that are involved in the

clean energy sector or generate clean power, as determined by the

index provider.

The iShares Genomics Immunology and Healthcare

Index ETF (XDNA) provides exposure to securities of issuers that

could benefit from the long-term growth and innovation in genomics,

immunology and bioengineering, as determined by the index

provider.

The iShares Cybersecurity and Tech Index ETF

(XHAK) provides exposure to securities of issuers that are involved

in cyber security and technology, as determined by the index

provider.

RBC iShares aims to help clients achieve their

investment objectives by empowering them to build efficient

portfolios and take control of their financial futures. RBC iShares

is committed to delivering a truly differentiated ETF experience

and positive outcomes for clients.

For more information about RBC iShares, please

visit https://www.rbcishares.com.

About

BlackRock

BlackRock’s purpose is to help more and more

people experience financial well-being. As a fiduciary to investors

and a leading provider of financial technology, we help millions of

people build savings that serve them throughout their lives by

making investing easier and more affordable. For additional

information on BlackRock, please visit www.blackrock.com/corporate

| Twitter: @BlackRockCA.

About iShares

iShares unlocks opportunity across markets to

meet the evolving needs of investors. With more than twenty years

of experience, a global line-up of 900+ exchange traded funds

(ETFs) and US$3.15 trillion in assets under management as of March

31, 2022, iShares continues to drive progress for the financial

industry. iShares funds are powered by the expert portfolio and

risk management of BlackRock.

iShares ETFs are managed by BlackRock Asset

Management Canada Limited. About RBC Global

Asset Management

RBC Global Asset Management (RBC GAM) is the

asset management division of Royal Bank of Canada (RBC) and

includes money managers BlueBay Asset Management and Phillips,

Hager & North Investment Management. RBC GAM is a provider of

global investment management services and solutions to

institutional, high-net-worth and individual investors through

separate accounts, pooled funds, mutual funds, hedge funds,

exchange-traded funds and specialty investment strategies. The RBC

GAM group of companies manage approximately $580 billion in assets

and have approximately 1,500 employees located across Canada, the

United States, Europe and Asia.

RBC iShares ETFs are comprised of RBC ETFs

managed by RBC Global Asset Management Inc. and iShares ETFs

managed by BlackRock Asset Management Canada Limited. Commissions,

trailing commissions, management fees and expenses all may be

associated with investing in ETFs. Please read the relevant

prospectus before investing. ETFs are not guaranteed, their values

change frequently and past performance may not be repeated. Tax,

investment and all other decisions should be made, as appropriate,

only with guidance from a qualified professional.

® / TM Trademark(s) of Royal Bank of Canada.

Used under license. iSHARES is a registered trademark of BlackRock,

Inc., or its subsidiaries in the United States and elsewhere. Used

under license. © 2022 BlackRock Asset Management Canada Limited and

RBC Global Asset Management Inc. All rights reserved.

For more information, please

contact:

Reem Jazar, BlackRock Communications, 1

416 919 9347

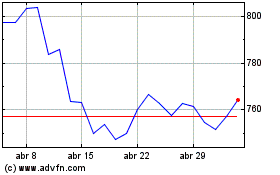

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024