Abaxx Technologies Inc., (NEO:ABXX)(OTCQX:ABXXF)

(“Abaxx” or the “Company”), a financial software company, majority

shareholder of

Abaxx Singapore Pte. Ltd., the

Abaxx Commodity Exchange (ACX), and producer of the

SmarterMarkets™ Podcast, summarizes activities

from Q1 2022 and the progress of the Company’s business plans for

the remainder of Q2 2022.

Highlights:

- Pandemic

and sanctions on Russia put LNG at center of global energy security

strategy

- Volatile LNG prices drive

recognition of the need for physically-delivered LNG futures

contracts to enable transparent pricing and central counterparty

(CCP) credit risk mitigation

- Opportunities for Abaxx

infrastructure and risk management applications have

increased

- Abaxx Exchange adds

supplemental technology developers Exberry and

Baymarkets

- SmarterMarkets™ Podcast

concludes its “Demystifying the Carbon Markets” series and begins

its commodity risk series: “Systems at Risk”

- Abaxx

to hold investor update call on Tuesday, May 17th, 2022 at 10:00am

EST (Eastern Standard Time)

Dear Shareholders,

LNG supply and security dynamics have moved to

the forefront of the geopolitical economic agenda. The need has

never been as acute, and opportunity has never been so large for

the infrastructure and tools Abaxx is developing for the LNG

marketplace specifically, and commodities generally. Abaxx

Exchange’s structure of a trade order book and central clearing

house has been positioned from the formation of the company for

these market trends.

Abaxx participation in Q1 at the Futures

Industry Association (FIA), Financial Times Global Commodities

Summit, and IHS CERA Energy Trading Week confirmed the importance

of solutions related to the commercial consequences of recent price

volatility including:

- the critical need for a

physically-delivered, centrally-cleared LNG benchmark futures

contracts for reliable hedging and counterparty risk management,

and seller of last resort market coordination

- the traders’ need for solutions for

liquidity pressures created by inefficient margin and collateral

usage

Both the FIA and Commodity Futures Trading

Commission (CFTC) have recently reported volumes and customer fund

balances in futures accounts hit all-time records. The steep change

in margin requirements as a result of volatility are a persistent

challenge. In addition, the growth in hedging in Asia and new asset

classes are demand drivers for our clearing services.

Our commercial team is in constant engagement

with a core group of FCMs and clearing members preparing to launch

the Exchange. The objective of this development work will be

reflected in the capability for Abaxx Exchange to assist in the

further reduction of the risks in credit extension by providing

more effective hedging instruments and quicker clearing.

There are concurrent development streams ongoing

in preparation for the commercial roll out: 1. The Abaxx Technology

Suite and 2. The Abaxx Exchange trade order system and central

clearing house. The systems are mutually beneficial but not

interdependent. Several of the console applications currently in

testing will be available to Exchange users in advance of the full

commercial launch of the futures products.

Abaxx Technology Suite

Successful testing of the core features of the

technology modules include: user testing of proprietary

self-sovereign identity, credentialed-user login built on ID++,

secure upload/management of test agreements, and testing of

two-party bilateral trades linked to the Abaxx GreenHouse Gas (GHG)

Protocol.

The rollout and beta launch of the console

modules that are core to the Exchange are preceding the futures

products and are being introduced to LNG and Carbon trading clients

for use in their bi-lateral trading activities. Testing is ongoing

and anticipated to be scaled up in Q3-Q4 of 2022.

Abaxx Exchange Product

Developments

ACX, through its subsidiaries in Singapore have

entered into software agreements with OM2 Ventures Ltd. (dba

Exberry) and Baymarkets AS to augment trading, post trade and risk

management capabilities. The features and functionality made

available through these agreements are intended to enhance the

firm's ability to more seamlessly introduce, integrate and deploy

future features, marketplace capabilities and proprietary software

upgrades consistent with the Company’s long term objectives. The

company will continue to develop its exchange and post trade

services technology capabilities by combining proprietary

middleware and third-party software. We closed Q1 2022 with a

decision to expand our technology development build which was

initially planned as a Phase 2 future functionality set.

These features are supplemental for market

acceptance, competitive strength, and risk reduction. Timing for

the finalization of Exchange and Clearing member contractual

onboarding will still require proof of efficacy and technical

integration with FCMs. Specific dates for member and clearing

member onboarding can only be approximated based upon the

completion of the additional software and will be updated via the

continuous disclosure mandate and as confirmed by the regulatory

process and FCM partners.

The launch of the Abaxx Exchange remains in

process pending the satisfaction of the regulatory conditions

listed in the Approval In Principle (AIP) letters. Abaxx Exchange

has received regulatory AIP, as a Recognized Market Operator

(“RMO”) and Approved Clearing House (“ACH”) with the Monetary

Authority of Singapore (“MAS”), on September 7, 2020, and August

25, 2021, respectively. The Company is continuing its engagement

with regulators regarding timelines for obtaining the final

licenses in coordination with clearinghouse finalization and

technical integration with launch members.

SmarterMarkets™ Podcast Series:

Demystifying Carbon Markets and

Commodities Systems at Risk

SmarterMarkets™ Media concludes a fourteen part series delving deep

into everything from Article 6 of the Paris Agreement to solutions

for channeling financial capital to scale Voluntary Carbon Markets.

Industry experts included David Antonioli, CEO of Verra, and David

Shukman, former BBC Climate Journalist, Barbara Barsma, CEO of Rabo

Carbon Bank and several others.

The next planned series, Commodities Systems at

Risk, covers ways pandemic and war, supply-chain disruptions and

economic sanctions, are testing our markets and risk management

systems, revealing weaknesses and potential points of failure. We

invite industry experts in market risk management who ensure the

security and circulation of the food, energy, and materials we

need. Guests will include Walt Lukken, President and CEO of the

FIA, Bob Anderson, Head of the CCRO, and Craig Pirrong, Professor

of Finance at the University of Houston

Q2 2022 Business Update Investor

Call

The Company plans to host a quarterly business

update investor presentation, to provide a business update and

respond to investor questions.

The Company will hold the investor presentation

via Zoom Meetings on Tuesday May 17, 2022 at 10:00a.m. Eastern

Standard Time Zone (EST). The Company invites current and

prospective shareholders to attend this quarterly business update

and Q&A session with the Abaxx executive team. Attendees may

email their questions in advance to

ir@abaxx.tech.

Registration will be required to access the

meeting. Following the presentation, a recording of the session

will be made available on the Abaxx Investor Relations website at

investors.abaxx.tech.

PRESENTATION DETAILS

|

DATE |

Tuesday, May 17nd, 2022 |

|

TIME |

10:00 AM Eastern Standard Time (EST) |

|

LOCATION |

Zoom MeetingTo receive the meeting link and

passcode, please register here. |

|

QUESTIONS |

Please submit questions ahead of the presentation to:

ir@abaxx.tech. |

About Abaxx Technologies

Abaxx is a development stage financial software

company creating proprietary technological infrastructure for both

global commodity exchanges and digital marketplaces. The company’s

formative technology increases transaction velocity, data security

and facilitates improved risk management in the majority owned

Abaxx Singapore Pte. Ltd. (“ACX”, or “Abaxx.Exchange”) - a

commodity futures exchange seeking final regulatory approvals as a

Recognized Market Operator (“RMO”) and Approved Clearing House

(“ACH”) with the Monetary Authority of Singapore (“MAS”). Abaxx is

a founding shareholder in Base Carbon Corp. and the creator and

producer of the SmarterMarkets™ podcast.For more information please

visit abaxx.tech, abaxx.exchange and

SmarterMarkets.media

About Exberry

Exberry delivers a purpose-built exchange

infrastructure regardless of the asset class or opportunity. The

core technology is deployed to enhance existing exchanges' limited

capabilities or to serve as the base for trading new digital

assets.

Exberry's technology and software engineering

heritage, combined with strategic business counsel, can quickly

scale with business growth and is easy to integrate into new and

existing ecosystems through well-documented APIs and easy-to-access

sandboxes. Exberry also launched Nebula, a unique turnkey solution

that provides its clients & partners a full exchange and

marketplace solution.

About Baymarkets

Baymarkets AS is an independent vendor of

clearing systems for the financial markets and has been operating

since 2007.

Baymarkets AS, is a provider of FinTech

solutions to the financial services industry. Baymarkets experience

has been gained building and operating multi-asset exchange and OTC

trading and clearing solutions for some of the largest firms in the

industry. These include banks, brokers, exchanges, CCPs and

technology providers.

Media and investor

inquiries:

Abaxx Technologies Inc.Paris Golab, Head of

Investor RelationsTel: +1 246 271 0082E-mail: ir@abaxx.tech

Forward-Looking Statements

This News Release includes certain

"forward-looking statements" which do not consist of historical

facts. Forward-looking statements include estimates and statements

that describe Abaxx or the Company’s future plans, objectives or

goals, including words to the effect that Abaxx expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as “seeking”, “believes”, “anticipates”,

“expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”.

Since forward-looking statements are based on assumptions and

address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Although these statements

are based on information currently available to Abaxx, Abaxx does

not provide any assurance that actual results will meet

management’s expectations. Risks, uncertainties and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Forward looking information in this news release

includes, but is not limited to, Abaxx’ objectives, goals or future

plans, statements, timing of the commencement of operations and

estimates of market conditions. Such factors include, among others:

risks relating to the global economic climate; dilution; the

Company’s limited operating history; future capital needs and

uncertainty of additional financing; the competitive nature of the

industry; currency exchange risks; the need for Abaxx to manage its

planned growth and expansion; the effects of product development

and need for continued technology change; protection of proprietary

rights; the effect of government regulation and compliance on Abaxx

and the industry; network security risks; the ability of Abaxx to

maintain properly working systems; reliance on key personnel;

global economic and financial market deterioration impeding access

to capital or increasing the cost of capital; and volatile

securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors which could

impact future results of the business of Abaxx include but are not

limited to: operations in foreign jurisdictions, protection of

intellectual property rights, contractual risk, third party risk;

clearinghouse risk, malicious actor risks, third-party software

license risk, system failure risk, risk of technological change;

dependence of technical infrastructure, an inability to predict and

counteract the effects of COVID-19 on the business of the Company,

including but not limited to the effects of COVID-19 on the price

of commodities, capital market conditions, restriction on labour

and international travel and supply chains. Abaxx has also assumed

that no significant events occur outside of Abaxx’ normal course of

business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated or intended. When

relying on Abaxx forward-looking statements and information to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Abaxx has assumed that the material factors referred to in the

previous paragraph will not cause such forward-looking statements

and information to differ materially from actual results or events.

However, the list of these factors is not exhaustive and is subject

to change and there can be no assurance that such assumptions will

reflect the actual outcome of such items or factors. The

forward-looking information contained in this press release

represents the expectations of Abaxx as of the date of this press

release and, accordingly, is subject to change after such date.

Readers should not place undue importance on forward-looking

information and should not rely upon this information as of any

other date. Abaxx does not undertake to update this information at

any particular time except as required in accordance with

applicable laws. The NEO Exchange does not accept responsibility

for the adequacy or accuracy of this press release.

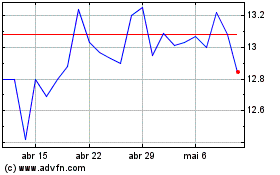

Abaxx Technologies (NEO:ABXX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

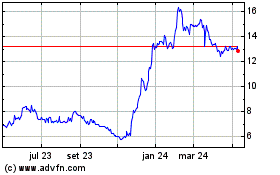

Abaxx Technologies (NEO:ABXX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024