High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its first quarter results today.

Mike Maguire, Chief Executive Officer

commented:

“High Arctic built on its strong 2021 closing

position this quarter, continuing the trend of increasing revenue

and earnings, and coupled this with raises to contract pricing. The

increased activity in PNG and growing contribution from the ongoing

deployment of our refurbished and enhanced automated hydraulic

catwalks in Canada were notable highlights.

We were pleased with the successful return to

operation of Rig-115 in Papua New Guinea. The legacy exploration

well was professionally capped and abandoned fulfilling a key ESG

commitment and added to High Arctic’s record of 5+ years of

recordable safety incident free work in PNG. We look forward to

increasing activity in PNG, where we anticipate activity levels in

the coming years have potential to exceed our past peaks. We expect

further announcements about advancement of the Papua LNG project,

and the development of P’nyang and other PNG-LNG fields, among

other projects to increase oil and gas production.

Also noteworthy was the three-year contract

renewal we recently announced with one of our largest and longest

standing customers for the provision of well servicing rigs in Cold

Lake, Alberta, on substantially improved terms and pricing. The

strong demand for our services and current labour driven

constraints are positive for the continuation of pricing increases

and margin growth in our Canadian production services.

Macro market conditions and business

fundamentals support a very positive outlook for High Arctic into

the second half of 2022 and beyond, and we are pleased to make the

first payment under our reinstated monthly dividend this week.”

HighlightsThe following

highlights the Corporation’s results for Q1-2022:

- First quarter

revenue of $28.7 million, EBITDA of $2.9 million, compared to $17.8

million and $1.2 million respectively in Q1-2021 and an improvement

over Q4-2021 with $23.6 million and $1.2 million respectively.

- High Arctic recommenced drilling

services activity in PNG during Q1-2022. PNG activity was the

primary driver for growth in the Quarter as consolidated revenues

rose by $10.9 million and 62% over Q1-2021.

- Oilfield operating services margin

as a percent of revenue was modestly lower in Q1-2022 at 18.5%

(Q1-2021 – 18.9%). Drilling and Ancillary services segments

experienced improved margins, however, profitability decreased in

High Arctic’s Canadian Production Services segment primarily due to

cost inflation, elimination of Canadian Emergency Wage Subsidy

(CEWS), and non-capital cost of preparing equipment for

service.

- In April 2022 High Arctic announced

a 3-year renewal of a key Production Services contract which

includes a 20% increase to the base hours rig rate, increases to

ancillary equipment and service pricing, provisions for fuel

adjustments, and alignment of parameters to current market

conditions.

- High Arctic announced

recommencement of a monthly dividend payment of $0.005 per share

commencing in May 2022.

- Strong liquidity with a working

capital balance of $30.6 million, cash of $11.4 million, increasing

access to funds under the revolving credit facility covenants and

long-term debt of $7.7 million.

StrategyOur 2022 strategic

priorities build on the platform we created in 2021 and

include:

- Safety excellence and quality

service,

- Actions aimed at generating free

cash flow including:

- Increased utilization of

Corporation’s world-class fleet of equipment,

- Improved efficiency and work force

productivity, and

- Operating cost control

- Development of new and existing

employees to grow our workforce to meet demand,

- Pursuit of opportunities that

secure the Corporation’s future as a lower emissions energy

services provider,

- Pursuit of opportunities for growth

and corporate transactions in well understood markets that enhance

shareholder value, and

- Disciplined capital stewardship to

improve returns including, divestitures, dividends and common share

buybacks.

The unaudited interim consolidated financial

statements (“Financial Statements”) and management discussion &

analysis (“MD&A”) for the quarter ended March 31, 2022 will be

available on SEDAR at www.sedar.com, and on High Arctic’s website

at www.haes.ca. Non-IFRS measures, such as EBITDA, Adjusted EBITDA,

EBITDA for purposes of long-term debt covenants, Adjusted net

earnings (loss), Oilfield services operating margin, Operating

margin %, Percent of revenue, Funds provided from operations,

Working capital and Net cash are included in this News Release. See

Non-IFRS Measures section, below. All amounts are denominated in

Canadian dollars (“CAD”), unless otherwise indicated.

Within this News Release, the three-months ended

March 31, 2022 may be referred to as the “Quarter” or “Q1-2022”.

The comparative three-months ended March 31, 2021 may be referred

to as “Q1-2021”. References to other quarters may be presented as

“QX-20XX” with X being the quarter/year to which the commentary

relates. All amounts are expressed in thousands of Canadian

dollars, unless otherwise noted.

RESULTS OVERVIEWThe following is a summary of

select financial information of the Corporation:

|

|

For the three-months ended March 31 |

|

($ thousands, except per share amounts) |

2022 |

|

|

2021 |

|

|

Revenue |

28,696 |

|

|

17,767 |

|

| Net

loss |

(2,671) |

|

|

(5,197) |

|

|

Per share (basic and diluted) |

(0.05) |

|

|

(0.11) |

|

| Oilfield

services operating margin |

5,310 |

|

|

3,362 |

|

| Oilfield

services operating margin as a % of revenue |

18.5% |

|

|

18.9% |

|

|

EBITDA |

2,944 |

|

|

1,208 |

|

| Adjusted

EBITDA |

2,884 |

|

|

874 |

|

| Adjusted

EBITDA as % of revenue |

10.1% |

|

|

4.9% |

|

|

Operating loss |

(2,818) |

|

|

(6,145) |

|

| Cash

provided by (used in) operating activities |

300 |

|

|

(1,085) |

|

|

Per share (basic and diluted) |

0.01 |

|

|

(0.02) |

|

| Funds

provided by operations |

2,243 |

|

|

590 |

|

|

Per share (basic and diluted) |

0.05 |

|

|

0.01 |

|

|

Capital expenditures |

1,582 |

|

|

765 |

|

|

|

As at |

| ($

thousands, except share amounts) |

March 31, 2022 |

|

|

December 31, 2021 |

|

|

Working capital |

30,649 |

|

|

29,724 |

|

| Cash, end of period |

11,442 |

|

|

12,037 |

|

| Total assets |

182,042 |

|

|

185,452 |

|

| Long-term debt |

7,697 |

|

|

7,779 |

|

| Total long-term financial

liabilities, excluding long-term debt |

12,602 |

|

|

13,414 |

|

| Shareholders’ equity |

145,400 |

|

|

148,851 |

|

|

Per share (basic and diluted) |

2.98 |

|

|

3.05 |

|

| Common

shares outstanding, thousands |

48,733 |

|

|

48,733 |

|

First Quarter 2022 Summary:

- For the three-months period ended

March 31, 2022, High Arctic’s consolidated revenues increased by

$10,929 or 62% to $28,696, primarily due to higher Drilling and

Ancillary revenues. Revenues in High Arctic’s Canadian Production

Services segment were flat as a result of lower activity offset by

higher revenue per hour.

- Net loss of $2,671 in Q1-2022 was

lower by 49% as compared to net loss of $5,197 in Q1-2021, mainly

due to increased activity in PNG and lower depreciation expense of

$1,360 in Q1-2022.

- Oilfield services operating margin

as a percent of revenue of 18.5% (2021 – 18.9%) was lower in

Q1-2022 due to lower profitability in High Arctic’s Production

Services segment in Canada. The Production Services segment

collected $812 lower CEWS and experienced operational constraints

relating to tight labour supply, rigs shutdown due to Covid-19

outbreaks, isolated poor weather conditions, high fuel costs, and

higher equipment repair & maintenance expenditure to return

equipment to service.

- In Q1-2022 High Arctic’s net cash

generated from operating activities was $300, with funds provided

from operation of $2,243.

Drilling Services Segment

|

|

Three-months ended March 31 |

|

($ thousands, unless otherwise noted) |

2022 |

|

|

2021 |

|

| Revenue |

9,574 |

|

|

752 |

|

|

Oilfield services expense |

7,477 |

|

|

832 |

|

|

Oilfield services operating margin |

2,097 |

|

|

(80) |

|

|

Operating margin (%) |

21.9% |

|

|

(10.6%) |

|

Production Services Segment

|

|

Three-months ended March 31 |

|

($ thousands, unless otherwise noted) |

2022 |

|

|

2021 |

|

Revenue |

15,059 |

|

|

15,375 |

|

|

Oilfield services expense |

14,815 |

|

|

12,957 |

|

|

Oilfield services operating margin |

244 |

|

|

2,418 |

|

|

Operating margin (%) |

1.6% |

|

|

15.7% |

|

|

|

Three-months ended March 31 |

|

Operating Statistics – Canada |

2022 |

|

|

2021 |

|

| Service rigs: |

|

|

|

Average fleet |

51 |

|

|

49 |

|

|

Utilization |

45% |

|

|

48% |

|

|

Operating hours |

20,448 |

|

|

21,120 |

|

|

Revenue per hour ($) |

658 |

|

|

600 |

|

| |

|

|

| Snubbing rigs: |

|

|

|

Average fleet |

7 |

|

|

8 |

|

|

Utilization |

17% |

|

|

28% |

|

|

Operating hours |

1,062 |

|

|

2,009 |

|

Ancillary Services Segment

|

|

Three-months ended March 31 |

|

($ thousands, unless otherwise noted) |

2022 |

|

|

2021 |

|

| Revenue |

4,725 |

|

|

2,196 |

|

|

Oilfield services expense |

1,756 |

|

|

1,171 |

|

|

Oilfield services operating margin |

2,969 |

|

|

1,025 |

|

|

Operating margin (%) |

62.8% |

|

|

46.7% |

|

Liquidity and Capital

Resources

|

|

Three-months ended March 31 |

|

($ thousands) |

2022 |

|

|

2021 |

|

|

Cash provided by (used in): |

|

|

|

Operating activities |

300 |

|

|

(1,085) |

|

|

Investing activities |

(418) |

|

|

93 |

|

|

Financing activities |

(521) |

|

|

(10,408) |

|

|

Effect of exchange rate changes on cash |

44 |

|

|

(181) |

|

|

Decrease in cash |

(595) |

|

|

(11,581) |

|

The Bank of PNG continues to encourage the use

of the local market currency, Kina or PGK. Due to High Arctic’s

requirement to transact with international suppliers and customers,

High Arctic has received approval from the Bank of PNG to maintain

its USD account within the conditions of the Bank of PNG currency

regulations. The Corporation continues to use PGK for local

transactions when practical. Included in the Bank of PNG’s

conditions is for PNG drilling contracts to be settled in PGK,

unless otherwise approved by the Bank of PNG for the contracts to

be settled in USD. The Corporation has historically received

such approval for its contracts with its key customers in PNG. The

Corporation will continue to seek Bank of PNG approval for future

customer contracts to be settled in USD on a contract-by-contract

basis, however, there is no assurance the Bank of PNG will continue

to grant these approvals.

If such approvals are not received in future,

the Corporation’s PNG drilling contracts will be settled in PGK

which would expose the Corporation to exchange rate fluctuations

related to the PGK. In addition, this may delay the Corporation’s

ability to receive USD which may impact the Corporation’s ability

to settle USD denominated liabilities and repatriate funds from PNG

on a timely basis. The Corporation also requires the approval

from the PNG Internal Revenue Commission (“IRC”)

to repatriate funds from PNG and make payments to non-resident PNG

suppliers and service providers. While delays can be experienced

for the IRC approvals, such approvals have been received in the

past.

Operating ActivitiesIn Q1-2022,

cash generated from operating activities was $300 (Q1-2021: $1,085

cash used in operating activities), of which $2,243 are funds

provided by operations (Q1-2021: $590), and $1,943 cash outflow

from working capital changes (Q1-2021: $1,675) mainly due to

increase in accounts receivable during the Quarter.

Investing ActivitiesDuring

Q1-2022, the Corporation’s cash used in investing activities was

$418 (Q1-2021: $93 cash from investing activities). Capital

expenditures were $1,582 (Q1-2021: $765) partially offset by $1,037

proceeds on disposal of property and equipment (Q1-2021: $571), and

$127 cash inflow relating to working capital balance changes for

capital items (Q1-2021: $287).

Financing ActivitiesIn Q1-2022,

the Corporation’s cash used in financing activities was $521

(Q1-2021: $10,408). During the quarter the Corporation paid $54

towards principal payments on its mortgage financing, see “Mortgage

Financing” below (Q1-2021: $10,000 loan payment Credit Facility),

and $467 lease liability payments (Q1-2021: $408) in the

Quarter.

Credit FacilityIn December

2021, the Corporation amended its revolving credit facility from a

borrowing limit of $45,000 to $37,000 and site-specific assets held

as mortgage security for separate mortgage financing have been

carved out. In addition, up to $5,000 of the revolving loan shall

be available by way of account overdraft outside of covenant

requirements described below.

The Corporation’s revolving credit facility has

a maturity date of August 31, 2023, is renewable with the lender’s

consent, and is secured by a general security agreement over the

Corporation’s assets.

Interest on the facility, which is independent

of standby fees, is charged monthly at prime plus an applicable

margin which fluctuates based on the Funded Debt to Covenant EBITDA

ratio (defined below). The applicable margin can range between

0.75% – 1.75% depending on the level of principal outstanding; the

higher the ratio the higher the margin. Standby fees also fluctuate

based on the Funded Debt to Covenant EBITDA ratio and range between

0.40% and 0.60% of the undrawn balance; the higher the ratio the

higher the standby fee percentage.

The facility is subject to two financial

covenants which are reported to the lender on a quarterly basis.

The first covenant requires the Funded Debt to Covenant EBITDA

ratio to be less than 3.0 to 1 and the second covenant requires

Covenant EBITDA to Interest Expense ratio to be a minimum of 3.0 to

1. Both are calculated on the last day of each fiscal quarter on a

rolling four quarter basis. As at March 31, 2022, the Corporation

was in compliance with these two financial covenants.

The financial covenant calculations at March 31,

2022 are:

|

Covenant |

|

|

As at |

|

Covenant |

|

March 31, 2022 |

|

Funded debt to Covenant EBITDA (1) |

< 3.0x |

|

- |

|

Covenant EBITDA to Interest expense (1) |

>3.0x |

|

16.4 |

(1) As at March 31, 2022 the

Corporation had access to $16.7 million of the revolving

facility.Funded Debt to Covenant EBITDA is defined as the ratio of

consolidated Funded Debt to the aggregate Covenant EBITDA for the

trailing four quarters. Funded Debt is the amount of debt provided

and outstanding at the date of the covenant calculation. Interest

Expense excludes any impact related to lease liabilities. Covenant

EBITDA for the purposes of calculating the covenants is defined as

a trailing 12-month net income (loss) plus interest expense,

current tax expense, deferred income tax expense (recovery),

depreciation and amortization, share-based compensation expense,

and non-cash inventory write-downs, less gains from foreign

exchange and sale or purchase of assets and lease payments.

Mortgage Financing

|

($ thousands) |

As at |

|

As at |

|

March 31, 2022 |

|

December 31, 2021 |

|

Current |

324 |

|

296 |

|

Non-current |

7,697 |

|

7,779 |

|

Total |

8,021 |

|

8,075 |

In December 2021, the Corporation entered into a

mortgage arrangement with the Business Development Bank of Canada

(BDC) for $8,100, secured by lands and buildings owned and occupied

by High Arctic within Alberta. The mortgage financing provides the

Corporation with long term liquidity and adds to existing cash

balances. The mortgage has an initial term of 5 years with a fixed

interest rate of 4.30% and an amortization period of 25 years with

payments occurring monthly. The mortgage liability and associated

financing costs are carved out of all revolving credit facility

financial covenant calculations.

The Corporation capitalized $25 in financing

fees incurred to set up the loan in 2021 and applied this to the

long-term debt liability. Financing fees will be amortized over the

expected life of the mortgage financing.

OutlookHigh Arctic is focused

on expanding its underlying quality service capacity within each of

its existing core operations to deploy idle equipment in

coordination with surging customer demand and prices. In Canada,

demand exceeds our current crewing capacity and measures are in

place to respond to this positive opportunity but will take time as

sustained utilization and better compensation are necessary to

attract personnel to our industry. In PNG, as previously updated,

the short-term project that reactivated drilling operations was

safely and successfully completed in Q2-2022. High Arctic remains

active with its PNG Ancillary Services segment assets and is

providing the services of its drilling personnel to key customers

while planning for a rig resumption of its PNG based Drilling

Services segment during the second half of 2022.

Oil and gas commodity prices have reached

ten-year highs in the early months of 2022 driven by the easing of

government-imposed restrictions related to the Covid-19 pandemic,

and the crisis in Ukraine. The resulting economic and trade

sanctions imposed on Russia by certain nations party to NATO and

other OECD countries, has created a major re-organization of the

global energy supply paths. Europe, who are already experiencing an

underperformance of renewable energy supply, has been moving

quickly to source new suppliers of gas, oil and even coal to enable

the further sanctioning of Russia.

Overall, macro trade and economic conditions and

the resulting high commodity prices have been beneficial to

customers in High Arctic’s two major markets and the Corporation

appears well placed geographically and through its top-tier

customers to benefit from increased activity through the second

half of 2022 and beyond. Though the impact of Covid-19 cases

amongst crews remains unpredictable, and market volatility from

evolving global events lingers, High Arctic anticipates improvement

in annual revenue and profit margins over the near to medium

term.

Papua New Guinea continues to be key to High

Arctic’s long-term business strategy due to the significant LNG

investments made by large oil and gas companies in the country and

high barriers to entry due to the technical expertise required to

operate the heli-portable drilling rigs in remote locations. High

Arctic anticipates further investments in LNG infrastructure in PNG

in the coming years and other projects to increase oil and gas

production. High Arctic anticipates future drilling rig activity

levels have potential to exceed our past peaks. This view is

supported by the growing LNG supply deficit through 2040 as

highlighted by the Shell LNG market update published in February

2022, the advancement of geothermal interest in PNG, and the

expansion of our customer base to include all the active E&P

companies in the country. We anticipate further announcements

firming the development of the Elk-Antelope field for the Papua LNG

project, and the development of P’nyang and other PNG-LNG fields to

support an expansion of the PNG-LNG export facility, later this

year.

In Canada, certain large infrastructure pipeline

projects are positive for the oil and gas industry. Following the

Enbridge Line 3 Replacement Project to the U.S. which entered

service October 1, 2021, there is the LNG Canada pipeline project

and the Trans Mountain Expansion under construction and upon

completion will provide long awaited tidewater access to Asian

markets. Additionally, in the near future, political focus on

imports from countries outside North America may turn back towards

the security of increased domestic supply. High Arctic’s Production

Services segment stands to benefit from the stimulus to drilling

activity that will follow through resulting well completion work,

ongoing well maintenance and end of life abandonment works. The

corporation expects to use the anticipated demand growth to push

further margin increases as the labor constrained services market

is already driving prices upwards.

The Corporation expects efforts to realize the

COP-26 declaration signed at the summit by 30 countries, to remain

of global importance and focus. We expect efforts to decarbonize

oil and gas production to remain, and that this current period in

the market provides a significant opportunity for the hydrocarbon

industry to secure its long-term position in a carbon abated world.

We will continue to focus on appropriate efforts to reduce the

climate impact of our operations.

NON - IFRS MEASURESThis News

Release contains references to certain financial measures that do

not have a standardized meaning prescribed by International

Financial Reporting Standards (“IFRS”) and may not be comparable to

the same or similar measures used by other companies. High Arctic

uses these financial measures to assess performance and believes

these measures provide useful supplemental information to

shareholders and investors. These financial measures are computed

on a consistent basis for each reporting period and include EBITDA,

Adjusted EBITDA, EBITDA for purposes of long-term debt covenants,

Oilfield services operating margin, Percent of revenue, Funds

provided from operations, Working capital, Total long-term

financial liabilities, excluding long-term debt, and Net cash, none

of which have standardized meanings prescribed under IFRS.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at www.sedar.com

and through High Arctic’s website at www.haes.ca.

FORWARD-LOOKING STATEMENTSThis news release

contains forward-looking statements. When used in this document,

the words “may”, “would”, “could”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”,

and similar expressions are intended to identify forward-looking

statements. Such statements reflect the Corporation’s current views

with respect to future events and are subject to certain risks,

uncertainties and assumptions. Many factors could cause the

Corporation’s actual results, performance or achievements to vary

from those described in this news release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this news release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this news release include, among

others, statements pertaining to the following: general economic

and business conditions which will include, among other things,

long-term improvement in Canadian oil and gas pricing, impact of

high commodity prices on demand for and market prices for the

Corporation’s services; continued impact of Covid-19; impact of the

crisis in Ukraine; ability to prioritize a strong balance sheet and

liquidity position; improved activity in PNG through 2022 and

beyond; modest improvement in the Corporation’s activity in Canada;

opportunities to invest and enhance shareholder value; improving

economic environment; climate and weather predictions and their

effect on energy demand; the Corporation’s ability to maintain a

USD bank account and conduct its business in USD in PNG; market

fluctuations in interest rates, commodity prices, and foreign

currency exchange rates; restrictions to repatriate funds held in

PGK; customer activity to boost production; expectations regarding

the Corporation’s ability to raise capital and manage its debt

obligations; estimated capital expenditure programs; projections of

market prices and costs; continued tightening of supply of services

in Canada; slowly improving Canadian snubbing market; factors upon

which the Corporation will decide whether or not to undertake a

specific course of operational action or expansion; the

Corporation’s ongoing relationship with key customers; treatment

under governmental regulatory regimes and political uncertainty and

civil unrest; a final Papua LNG investment decision; development of

the P’nyang gas field; developments in Ukraine; effect of economic

and trade sanctions on Russia; OPEC’s ability and desire to

increase future production; development of additional pathways to

market in Canada, and a shift in political focus from energy

transition to energy security; and estimated credit risks and tax

losses.

With respect to forward-looking statements

contained in this news release, the Corporation has made

assumptions regarding, among other things, its ability to: obtain

equity and debt financing on satisfactory terms; market

successfully to current and new customers; the general continuance

of current or, where applicable, assumed industry conditions;

activity and pricing; assumptions regarding commodity prices, in

particular oil and gas; the Corporation’s primary objectives, and

the methods of achieving those objectives; obtain equipment from

suppliers; construct property and equipment according to

anticipated schedules and budgets; remain competitive in all of its

operations; and attract and retain skilled employees.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this news release, along with the risk factors set out

in the most recent Annual Information Form filed on SEDAR at

www.sedar.com.

The forward-looking statements contained in this

news release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this news release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

ServicesHigh Arctic’s principal focus is to provide

drilling and specialized well completion services, equipment

rentals and other services to the oil and gas industry. High Arctic

is a market leader providing drilling and specialized well

completion services and supplies rig matting, camps and drilling

support equipment on a rental basis in Papua New Guinea. The

Western Canadian operation provides well servicing, well

abandonment, snubbing and nitrogen services and equipment on a

rental basis to a large number of oil and natural gas exploration

and production companies.

For further information contact:

Lance

Mierendorf Chief

Financial

Officer P:

+1 (587) 318 2218P: +1 (800) 688

7143 High

Arctic Energy Services Inc.Suite 2350, 330 – 5th Ave SWCalgary,

Alberta, Canada T2P 0L4website: www.haes.caEmail: info@haes.ca

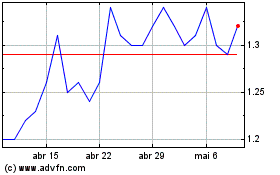

High Artic Energy Services (TSX:HWO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

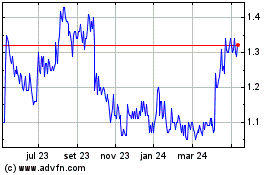

High Artic Energy Services (TSX:HWO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024