Kanen Wealth Management LLC delivers letter to Board of Build-A-Bear Workshop, Inc.

08 Julho 2022 - 9:00AM

The following is a statement issued by Dave Kanen, who serves as

Managing Director at Kanen Wealth Management:

To the Members of the Build-A-Bear Board of

Directors,

Kanen Wealth Management and its affiliates are one

of the largest shareholders of Build-A-Bear with a 6.5% stake. We

believe the company has an extraordinary opportunity to allocate

capital in a way that would create significant value for long term

shareholders.

We have obtained a professional valuation of the

company’s owned distribution center which suggests a valuation in a

sale lease back of at least $31M and an associated lease expense of

~$1.8M. BBW has the opportunity to sell (and lease back) this asset

at ~17.2x earnings and repurchase stock at ~3.2x EBITDA, this would

be accretive to earnings per share by ~11%.

Furthermore, BBW has significant net cash today and

is likely to improve to ~$75M in net cash within the next 6 months.

Meaning at a 15% premium to today’s price, BBW could retire 6.2M

shares just by monetizing its distribution center and returning its

year end net cash to shareholders via share repurchases. This 6.2M

share repurchase would allow shareholders to own 67% more of the

BBW business (shares outstanding reduced by 40%) and be enormously

accretive. Importantly, this would leave BBW with a very strong

balance sheet, continued ability to invest all future FCF back into

the business, and in our opinion is unequivocally the best way the

company can allocate its capital to create value.

The below demonstrates the value creation this move

would create, along with the ensuing probable fair value range of

BBW.

| Share

Repurchase Scenario - Sale lease back plus YE net cash used for

share buybacks |

| |

|

EV/EBITDA multiple |

|

|

| |

|

6x |

6.5x |

7x |

|

|

| |

55 |

$ |

35.5 |

|

$ |

38.4 |

|

$ |

41.4 |

|

|

|

|

Normalized EBITDA |

62.5 |

$ |

40.3 |

|

$ |

43.7 |

|

$ |

47.0 |

|

|

|

| |

70 |

$ |

45.2 |

|

$ |

48.9 |

|

$ |

52.7 |

|

|

|

| |

|

|

|

|

|

|

| |

% Change Vs. Current

Stock Price |

|

|

| |

|

|

|

|

|

|

| |

|

EV/EBITDA multiple |

|

|

| |

|

6x |

6.5x |

7x |

|

|

| |

55 |

|

137 |

% |

|

156 |

% |

|

176 |

% |

|

|

|

Normalized EBITDA |

62.5 |

|

169 |

% |

|

191 |

% |

|

214 |

% |

|

|

| |

70 |

|

201 |

% |

|

226 |

% |

|

251 |

% |

|

|

This board owes shareholders an explanation as to why the

company is not acting on this opportunity, if there is a capital

allocation path (for the $75M YE net cash plus $31M RE asset) that

creates more value with less risk, then the management and the

board should enlighten shareholders – the owners of the business.

Regarding M&A, we likely cannot buy a business as good as our

own for less than 3.2x EBITDA and one that carries no integration

risk like that of share repurchases. Does it make sense to hoard

$75-100M+ in net cash on the balance sheet while ignoring the value

creation highlighted above?

The majority of the members of the BBW board own a

minimal number of shares and we estimate that 95%+ of the shares

owned by the board have been granted (i.e. shares that this board

has handed to themselves) as opposed to putting real skin in the

game.

We find it disturbing that directors with very

little skin in the game Lord their “ill-advised authority” over

shareholders who are the TRUE OWNERS of the company. Both

management and the board are saying “GOOD ENOUGH FOR THEE BUT NOT

ME” by your continued dumping of shares. It’s grotesque and

abusive! If an investor looks at a chart of the stock over the last

8 years under Sharon John’s tenure, there is little to show. I

would call it mediocrity. In our opinion, the CEO SHARON JOHN IS

NOT NUMBERED amongst the winners when it comes to shareholder

returns which is the ultimate scorecard and mandate. As a result,

in our opinion, she’s a 5 on a scale of 1-10. We have made numerous

recommendations over the past 3 years, both while I was a director

and investor. Some of them are: 1) a meaningful entry into the Pet

toy market (a multibillion-dollar opportunity) 2) a 3rd party

retailer relationship with a partner that has 100’s of locations

for a “store within a store” such as Chuck E. Cheese 3) Sale lease

back with a large stock tender and 4) partnerships with elementary

education providers.

In my opinion, it seems as though our CEO cannot

execute an idea that’s not her own. Rather, exhibiting signs of

egotism at the expense of results and to the detriment of

shareholders. We are calling for an end to this seemingly childish

behavior, or if this is a mere coincidence, to “get after it”! Thus

far, your growth initiatives are “incrementalist” at best and not

transformative.

In summary, our message for management and the

board is to take transformative action immediately as we have laid

out above. We welcome other shareholders along with us, to express

their views, and equally hold BBW management and the board

accountable.

Sincerely,

David Kanen

Kanen Wealth Management, LLC.

dkanen@kanenadvisory.com

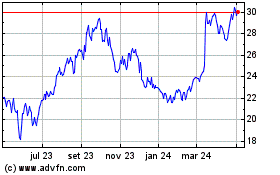

Build A Bear Workshop (NYSE:BBW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

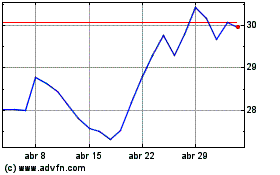

Build A Bear Workshop (NYSE:BBW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024