Iris Energy Limited (NASDAQ: IREN) (“Iris Energy” or “the

Company”), a leading owner and operator of institutional-grade,

highly efficient proprietary Bitcoin mining data centers powered by

100% renewable energy, today published a monthly investor update

for July 2022, containing its results from operations as well as

construction and development updates.

Key Highlights1

|

Key metrics2 |

Jul-22 |

|

Average operating hashrate (PH/s) |

1,117 |

|

Bitcoin mined3 |

154 |

|

Mining revenue (US$'000) |

3,358 |

|

Electricity costs (US$'000) |

1,360 |

|

Revenue per Bitcoin (US$) |

21,823 |

|

Electricity costs per Bitcoin (US$) |

8,836 |

- Updates post month

end:

- Commissioned

remainder of the first 1.5 EH/s (50MW) at Mackenzie ahead of

schedule, approximately doubling operating capacity to exceed 2.3

EH/s

- Reached agreement

with Bitmain Technologies Limited to ship an additional 1.7 EH/s of

S19j Pro miners in August 2022, increasing expected operating

capacity from 4.3 EH/s to 6.0 EH/s

- Corporate:

- Welcomed Heather

Miller as Vice President – People, Culture and Community and Javier

Garcia as General Manager – Engineering

- Iris Energy to

present at the Canaccord Genuity 42nd Annual Growth Conference in

Boston

- Operations:

- Average operating

hashrate of 1,117 PH/s

- Monthly operating

revenue of US$3.4 million

- 154 Bitcoin

mined

- Construction:

- Mackenzie (2.1

EH/s, 80MW – BC, Canada)

- Construction

activities continue to progress for the expansion from 50MW to 80MW

and remains on track to be completed by the end of Q4 2022

- Prince George (1.4

EH/s, 50MW – BC, Canada)

- Construction

substantially complete for the first and second data center

buildings (20MW and 10MW), with the third data center building

(20MW) well advanced

- Internal fit out of

all three data center buildings underway

- Installation of

major equipment in the substation has commenced

- Childress

(preparatory construction activities – Texas, USA)

- Preparatory

construction and procurement activities remain ongoing at the 600MW

site

- Potential

development options under consideration, including with respect to

the recently announced additional 1.7 EH/s of contracted

miners

Corporate update

Miner deliveries during 2022 increased from 4.3

EH/s to 6.0 EH/s

On August 1, 2022, the Company announced that it

had reached agreement with Bitmain Technologies Limited (“Bitmain”)

to ship an additional 1.7 EH/s of S19j Pro miners in August 2022.

This increases the Company’s expected operating capacity from 4.3

EH/s to 6.0 EH/s. The Company is currently working through

deployment options across its sites, including Childress, for the

additional capacity.

$46.7 million of the previous $130 million of

payments made to Bitmain have been applied to secure the additional

1.7 EH/s, and utilization of the remaining $83.3 million of

payments in respect of additional contracted miners above the 6.0

EH/s continue to be subject to ongoing discussions with

Bitmain.4

Heather Miller, Vice President – People, Culture

and Community

The Company welcomed Heather Miller as Vice

President – People, Culture and Community. Heather has over 15

years’ senior People and Culture professional experience across all

aspects of HR and joins Iris Energy from Nutrien, a ~US$45bn5

multinational agribusiness, where she was Senior Director, Digital

HR & HR Business Relations.

Javier Garcia, General Manager – Engineering

The Company welcomed Javier Garcia as General

Manager – Engineering. Javier is a professional Engineer with over

15 years’ experience in Electrical Engineering and Power

operations, and joins us from Rio Tinto, a ~US$101bn5 multinational

mining group, where he was the Power Operations and Nechako

Reservoir Superintendent for the Kitimat alumina smelter and hydro

power generation.

Canaccord Genuity 42nd Annual Growth

Conference

Iris Energy will be participating at the

upcoming Canaccord Genuity 42nd Annual Growth Conference in Boston,

Massachusetts between August 8-11, 2022.

In attendance will be Daniel Roberts (Co-Founder

and Co-CEO). Daniel will be presenting an overview of the Company

on Tuesday, August 9 at 1.00 p.m. Eastern Time. Interested parties

can register to view a webcast of the presentation using this

link:

https://wsw.com/webcast/canaccord76/register.aspx?conf=canaccord76&page=iren&url=https://wsw.com/webcast/canaccord76/iren/2457306

Daniel will also be available for one-on-one

meetings with investors during the conference. For more

information, please contact a Canaccord Genuity sales

representative.

Canal Flats update (0.8 EH/s, 30MW) –

BC, Canada

Canal Flats has been powered by 100% renewable

energy since inception.6

The project achieved average monthly operating

hashrate of 836 PH/s in July compared to 872 PH/s in June. The

slight reduction from June was due to the impact of summer

temperatures on our first generation pilot R&D facilities.

Canal Flats continued to exceed previously announced site capacity

of 0.7 EH/s.

In line with our focus on sustainability across

all aspects of our operations, the Canal Flats logistics team

recently installed a new green initiative with an expanded

polyethylene (EPE) foam densifier, which has the capacity to

recycle over two tonnes of EPE per month, derived from miner

packaging. The machine reduces the volume of EPE by 90:1, which

allows densified EPE ingots to be sold and recycled into a number

of new polyethylene products.

Mackenzie update (2.1 EH/s, 50MW initial

/ 80MW total) – BC, Canada

Mackenzie has been powered by 100% renewable

energy since inception.6

On August 8, 2022, the Company announced it had

energized the remainder of the first 1.5 EH/s (50MW) at Mackenzie,

marking delivery of phase two of the project. Both initial phases

have been commissioned ahead of schedule:

- Phase one: 0.3 EH/s

(9MW) – April 13, 2022 (original target end of Q2 2022)

- Phase two: 1.2 EH/s

(41MW) – August 5, 2022 (original target end of Q3 2022)

Construction activities at Mackenzie continue to

progress for phase three, with the expansion from 50MW to 80MW

still on track to be completed by the end of Q4 2022.

The initial 9MW at Mackenzie achieved average

monthly operating hashrate of 282 PH/s in July compared to 292 PH/s

in June. The slight reduction was in line with expectations and due

to the temporary power draw cap of 9MW and increased exhaust fan

utilization during the warmer weather, along with scheduled outages

associated with the site transitioning to the high voltage

transmission network in early August as part of energization of the

full 1.5 EH/s (50MW).

Upon completion of all three phases at

Mackenzie, 80MW of proprietary data centers are expected to power

~22,000 Bitmain S19j Pro and S19j miners (already under contract),

generating 2.1 EH/s of incremental hashrate.

Prince George update (1.4 EH/s, 50MW) –

BC, Canada

Building construction is substantially complete

on the first and second data center buildings (20MW and 10MW)

including all exhaust fans installed, and is close to complete for

the third data center building (20MW). Internal fit out of all

three data center buildings is underway.

Major equipment installation in the substation

has commenced and the underground portions of the on-site

distribution network are complete.

Prince George remains on track to be energized

by the end of next month and, upon completion, 50MW of proprietary

data centers are expected to power ~15,000 Bitmain S19j Pro and

S19j miners (already under contract), generating 1.4 EH/s of

incremental hashrate.

See Prince George construction progress video

here: https://www.youtube.com/watch?v=Xgh1kiyiws8

Childress update – Texas,

USA

As previously announced, the Company continues

to progress preparatory construction and procurement activities at

the 600MW Childress site to preserve the opportunity to scale once

market conditions improve.

All required construction permits are in place,

construction of the access road to the main development area and

site civil works are ongoing, and purchase orders have been placed

on key long-lead items, including the 345kV step-down transformer,

138kV step-down transformer and associated circuit breakers.

Potential development options are under

consideration, including with respect to the recently announced

additional 1.7 EH/s of contracted miners.

Community engagement

Applications for the Community Grants Program at

Mackenzie and Childress are now closed. Applications are currently

being reviewed, with grants to be made available in due course.

Other notable local community initiatives during

the month included sponsoring the 4th of July kids parade in

Childress and renewing our support for the Columbia Valley Rockies

Hockey Club for the 2022/2023 season.

Future development sites

Development works continued across additional

sites in Canada, the USA and Asia-Pacific, which have the potential

to support up to an additional >1GW of aggregate power capacity

capable of powering growth beyond the Company’s 795MW of announced

power capacity.

Operating and financial

results

Daily average operating hashrate chart is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7a205561-9c59-46ea-b59c-ef683bbaac4f

Technical commentary

The Company’s average operating hashrate was

1,117 PH/s in July compared to 1,164 PH/s in June, with the

Company’s operating capacity increasing to over 2.3 EH/s following

the transition to the high voltage transmission network in early

August as part of energization of the remainder of the first 50MW

at Mackenzie. Power prices at Mackenzie are also expected to reduce

by approximately 19% as a result of moving from the distribution

feed to the transmission network.

The Company mined 154 Bitcoin during the month,

a 4% increase from 148 Bitcoin mined during June 2022, which was

primarily attributable to a decline in the average

difficulty-implied global hashrate during the period plus one extra

operating day in the month. The fall in the global hashrate

suggests higher cost miners may have dropped out of the global

Bitcoin network during the period, thereby allowing lower cost

miners (such as Iris Energy) to increase their share of the network

and Bitcoin mined.

The increase in electricity costs in July

compared to June was primarily due to one extra operating day in

the month.

|

Operating* |

May-22 |

Jun-22 |

Jul-22 |

|

Renewable energy usage (MW)7 |

37 |

36 |

36 |

|

Avg operating hashrate (PH/s) |

1,165 |

1,164 |

1,117 |

* Reflects actual recorded operating power usage and hashrate

(not nameplate). Note: nameplate capacity is higher than actual

operating power usage due to features of the Company’s proprietary

data center design which utilizes variable speed fans to reduce

power consumption during cooler months, as well as the Company

maintaining a buffer within its infrastructure capacity that can be

also directed to other site uses (e.g. in-house fabrication shop at

Canal Flats is currently operating as Iris Energy has the advantage

of saving time and costs by internally constructing certain

components for its expansion sites).

|

Financial (unaudited) |

May-22 |

Jun-22 |

Jul-22 |

|

Bitcoin mined* |

151 |

148 |

154 |

|

Mining revenue (US$’000) |

4,868 |

3,546 |

3,358 |

|

Electricity costs (US$’000) |

1,411 |

1,315 |

1,360** |

|

Revenue per Bitcoin (US$) |

32,264 |

23,925 |

21,823 |

|

Electricity costs per Bitcoin (US$) |

9,352 |

8,875 |

8,836 |

* Reflects Bitcoin mined post deduction of

mining pool fees (currently 0.5% x total Bitcoin mined).** The

increase in electricity costs (vs. June) was primarily due to one

extra operating day in the month.

|

Miner Shipping Schedule |

Hardware |

Units |

EH/s(incremental) |

EH/s(cumulative) |

|

Operating (July 2022) |

S19j Pro8 |

10,529 |

1.1 |

1.1 |

|

Inventory – pending deployment |

S19j Pro / S19j9 |

27,031 |

2.4 |

3.5 |

|

Inventory – in transit |

S19j |

1,119 |

0.1 |

3.7 |

|

Q3 2022 |

S19j Pro / S19j |

23,012 |

2.2 |

5.9 |

|

Q4 2022 |

S19j |

1,500 |

0.1 |

6.0 |

|

Total |

|

63,191 |

6.010 |

6.0 |

|

Site |

Capacity(MW) |

Capacity(EH/s) |

Timing |

Status |

|

Canal Flats (BC, Canada) |

30 |

0.8 |

Complete |

Operating |

|

Mackenzie (BC, Canada) |

50 |

1.5 |

Complete |

Operating |

|

30 |

0.6 |

Q4 2022 |

Under construction |

|

Prince George (BC, Canada) |

50 |

1.4 |

Q3 2022 |

Under construction |

|

Total (end of Q4 2022) |

160 |

4.3 |

|

|

About Iris Energy

Iris Energy is a sustainable Bitcoin mining

company that supports the decarbonization of energy markets and the

global Bitcoin network.

- Focus on low-cost

renewables: Iris Energy targets markets with low-cost, excess

and/or under-utilized renewable energy, and where the Company can

support local communities

- Long-term security

over infrastructure, land and power supply: Iris Energy builds,

owns and operates its electrical infrastructure and proprietary

data centers, providing long-term security and operational control

over its assets

- Seasoned management

team: Iris Energy’s team has an impressive track record of success

across energy, infrastructure, renewables, finance, digital assets

and data centers with cumulative experience in delivering >$25bn

in energy and infrastructure projects globally

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or Iris Energy’s future financial or operating

performance. For example, forward-looking statements include but

are not limited to the expected increase in the Company’s power

capacity and operating capacity, the Company’s business plan, the

Company’s capital raising plans, the Company’s anticipated capital

expenditures and additional borrowings, the impact of discussions

with Bitmain regarding the Company’s hardware purchase contract for

additional miners, and the expected schedule for hardware

deliveries and for commencing and/or expanding operations at the

Company’s sites. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,” “believe,” “may,”

“can,” “should,” “could,” “might,” “plan,” “possible,” “project,”

“strive,” “budget,” “forecast,” “expect,” “intend,” “target”,

“will,” “estimate,” “predict,” “potential,” “continue,” “scheduled”

or the negatives of these terms or variations of them or similar

terminology, but the absence of these words does not mean that

statement is not forward-looking. Such forward-looking statements

are subject to risks, uncertainties, and other factors which could

cause actual results to differ materially from those expressed or

implied by such forward looking statements. In addition, any

statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking.

These forward-looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

Iris Energy’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to: Iris Energy’s limited

operating history with operating losses; electricity outage,

limitation of electricity supply or increase in electricity costs;

long term outage or limitation of the internet connection at Iris

Energy’s sites; any critical failure of key electrical or data

center equipment; serial defects or underperformance with respect

to Iris Energy’s equipment; failure of suppliers to perform under

the relevant supply contracts for equipment that has already been

procured which may delay Iris Energy’s expansion plans; supply

chain and logistics issues for Iris Energy or Iris Energy’s

suppliers; cancellation or withdrawal of required operating and

other permits and licenses; customary risks in developing

greenfield infrastructure projects; Iris Energy’s evolving business

model and strategy; Iris Energy’s ability to successfully manage

its growth; Iris Energy’s ability to raise additional financing

(whether because of the conditions of the markets, Iris Energy’s

financial condition or otherwise) on a timely basis, or at all,

which could adversely impact the Company’s ability to meet its

capital commitments (including payments due under its hardware

purchase contracts with Bitmain) and the Company’s growth plans;

Iris Energy’s failure to make certain payments due under any one of

its hardware purchase contracts with Bitmain on a timely basis

could result in liquidated damages, claims for specific performance

or other claims against Iris Energy, any of which could result in a

loss of all or a portion of any prepayments or deposits made under

the relevant contract or other liabilities in respect of the

relevant contract, and could also result in Iris Energy not

receiving certain discounts under the relevant contract or

receiving the relevant hardware at all, any of which could

adversely impact its business, operating expansion plans, financial

condition, cash flows and results of operations; the terms of any

additional financing, which could be less favorable or require Iris

Energy to comply with more onerous covenants or restrictions, any

of which could restrict its business operations and adversely

impact its financial condition, cash flows and results of

operations; competition; Bitcoin prices, which could adversely

impact its financial condition, cash flows and results of

operations, as well as its ability to raise additional financing;

risks related to health pandemics including those of COVID-19;

changes in regulation of digital assets; and other important

factors discussed under the caption “Risk Factors” in Iris Energy’s

final prospectus filed pursuant to Rule 424(b)(4) with the SEC on

November 18, 2021, as such factors may be updated from time to time

in its other filings with the SEC, accessible on the SEC’s website

at www.sec.gov and the Investor Relations section of Iris Energy’s

website at https://investors.irisenergy.co.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any

forward-looking statement that Iris Energy makes in this press

release speaks only as of the date of such statement. Except as

required by law, Iris Energy disclaims any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Contacts

MediaJon SnowballDomestique+61 477 946 068

InvestorsBom ShinIris Energy+61 411 376

332bom.shin@irisenergy.co

To keep updated on Iris Energy’s news releases and SEC filings,

please subscribe to email alerts at

https://investors.irisenergy.co/ir-resources/email-alerts.

________________________________1 All timing references in this

investor update are to calendar quarters and calendar years, unless

otherwise specified.2 The preliminary financial information for the

month of July 2022 included in this investor update is not subject

to the same closing procedures as our unaudited quarterly financial

results and has not been reviewed by our independent registered

public accounting firm. The preliminary financial information

included in this investor update does not represent a comprehensive

statement of our financial results or financial position, and

should not be viewed as a substitute for unaudited financial

statements prepared in accordance with International Financial

Reporting Standards. Accordingly, you should not place undue

reliance on the preliminary financial information included in this

investor update.3 Reflects Bitcoin mined post deduction of mining

pool fees (currently 0.5% x total Bitcoin mined).4 The timing and

volume of any additional future deliveries (i.e. beyond the 1.7

EH/s scheduled for shipment in August 2022) under the separate

$400m hardware purchase contract for miners are subject to ongoing

discussions with Bitmain. The Company has not made all recent

payments under that contract and does not currently expect to make

upcoming payments in respect of any such additional future

deliveries under that contract. The Company can make no assurances

as to the outcome of these discussions (including any impact on the

Company’s expansion plans or payments made under that contract).5

Approximate market capitalizations as at August 5, 2022. Source:

Bloomberg.6 Currently 98% directly from renewable energy sources;

2% from purchase of RECs.7 Comprises actual power usage for Canal

Flats and estimated power usage for Mackenzie.8 Includes mix of

lower efficiency hardware, which is estimated to represent less

than 1% of the operating 1.1 EH/s.9 Includes mix of lower

efficiency hardware, which is estimated to represent less than 6%

of miners pending deployment.10 The Company has made $83m of

payments in respect of contracted miners above the initial 6.0

EH/s, which are subject to ongoing discussions with Bitmain. Please

see footnote 4 for more details.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f2c942ee-ad6b-4aaf-b194-246830dc4585

https://www.globenewswire.com/NewsRoom/AttachmentNg/abc79b1c-4e9c-4bcd-8186-b506c00e8185

https://www.globenewswire.com/NewsRoom/AttachmentNg/3647ba2c-6bd3-48d9-9683-3fdbbd0544e4

https://www.globenewswire.com/NewsRoom/AttachmentNg/fa0a3a4b-b83c-4a56-b973-17ea7e4fb2fe

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d299fde-5643-4e1b-bedc-67abb7c53b68

https://www.globenewswire.com/NewsRoom/AttachmentNg/1dd2625c-ee69-42a6-9454-411d9391fcf7

https://www.globenewswire.com/NewsRoom/AttachmentNg/d501da45-a289-4c06-a140-6bcf66e2b8b6

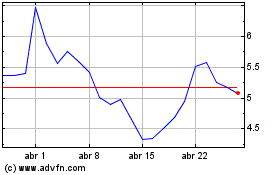

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024