Agfa-Gevaert Half Year 2022 Results - Regulated information

Regulated information – August

24,

2022 -

7:45 a.m.

CET The

Agfa-Gevaert Group in Q2 2022:

- Top line growth driven by Digital Print & Chemicals

and Offset Solutions

- Order book HealthCare IT at very

healthy level – strong

growth in order intake

- Gross profit decreased due to inflationary pressure and

volume losses in medical film related to COVID lockdowns in

China

- Adjusted EBITDA amounted to 32 million

Euro

- Seasonal increase in working

capital, amplified by supply

chain issues, cost

inflation and inclusion of Inca

Digital Printers acquisition

- Positive effect of 142 million Euro on net pension

liability for the material countries versus year-end

2021

- Acquisition of Inca Digital Printers yields first

integration results: Agfa’s inks being

certified to be used on Onset

print engines

Mortsel (Belgium), August

24,

2022

– Agfa-Gevaert today

commented on its results in

the second quarter

of

2022.

“In these turbulent economic and geopolitical times, we continue

to focus on the future. We have launched engineering studies to

prepare an investment in a new production facility for our Zirfon

membranes for hydrogen production at our Mortsel site, which will

allow us to meet the strong increase in demand. We acquired and

integrated Inca Digital Printers, a leading developer and

manufacturer of advanced high speed printing and production

technologies. Our inks are being certified to be used on the Onset

printer range. Increased investments in R&D and commercial

resources should enable the HealthCare IT division to generate

profitable growth. Furthermore, the partnership with Atos for our

internal IT activities and the actions to re-organize our internal

financial services are expected to bring agility and simplification

to Agfa’s operating model. These major steps in our transformation

journey will enable us to increase our focus on our growth

businesses, which is crucial to our future success in our

markets. Operationally, the second quarter reflects the

current inflationary environment as well as the impact of China

lockdowns. The Group’s top line growth was driven by volume growth

in the Digital Print & Chemicals division and pricing actions

in the Offset Solutions division. We experienced the full impact of

cost inflation and supply chain issues on our profitability and

working capital in the second quarter,” said Pascal Juéry,

President and CEO of the Agfa-Gevaert Group.

Share buyback program

completedMarch 10, 2021, the Agfa-Gevaert Group

announced a share buyback program with a volume of up to 50 million

Euro. The program was launched April 1, 2021. Since the beginning

of the share buyback program until the completion on June 9th,

2022, the Agfa-Gevaert Group cancelled 12,930,662 own shares (7.71%

of total shares).

Agfa-Gevaert Group –

Q2 2022

|

in million Euro |

Q2

2022 |

Q2

2021 |

% change(excl. FX

effects) |

| Revenue |

469 |

441 |

6.4% (2.3%) |

| Gross profit

(*) |

137 |

135 |

1.0% |

|

% of revenue |

29.2% |

30.7% |

|

| Adjusted EBITDA

(*) |

32 |

40 |

-20.9% |

|

% of revenue |

6.8% |

9.1% |

|

| Adjusted EBIT

(*) |

16 |

25 |

-34.0% |

|

% of revenue |

3.5% |

5.6% |

|

(*) before

restructuring and non-recurring items

The Group’s top line increased by 6.4% versus the second quarter

of 2021. Continuing the evolution of the first months of the year,

the growth was mainly driven by volume increases and pricing

actions in the Digital Print & Chemicals division and pricing

actions in the Offset Solutions division.

The Agfa-Gevaert Group was strongly impacted by cost inflation

and supply chain issues in Q2 2022. Although price actions allowed

the Group to partly mitigate this impact, its gross profit margin

decreased to 29.2% of revenue.

Selling and General Administration expenses remained stable as a

% of sales, but were 6.6% above the level of the second quarter of

2021, mainly due to increased business activity impacting the

selling expenses, as well as broader cost inflation and currency

effects.

R&D expenses remained stable at 24 million Euro.

Due to inflationary pressure and supply chain issues, adjusted

EBITDA decreased from 40 million Euro (9.1% of revenue) in the

second quarter of 2021 to 32 million Euro (6.8% of revenue).

Adjusted EBIT reached 16 million Euro, versus 25 million Euro in

the second quarter of 2021.

Restructuring and non-recurring items resulted in an expense of

14 million Euro, versus an expense of 3 million Euro in the second

quarter of 2021. This increase reflects investments in various

transformation projects, including the organization of the Offset

Solutions activities into a stand-alone legal entity structure, the

re-organization of the Group’s internal financial services and the

partnership with Atos for the internal IT activities.

The net finance costs amounted to minus 11 million Euro.

Income tax expenses amounted to 4 million Euro versus 9 million

Euro in the second quarter of 2021.

As a result of the elements mentioned above, the Agfa-Gevaert

Group posted a net loss of 13 million Euro.

Financial position and cash

flow

- Net financial debt (including IFRS 16) evolved from a net cash

position of 325 million Euro at the end of 2021 to a net cash

position of 120 million Euro. In the second quarter, net financial

debt was influenced by the seasonal increase in working capital,

the acquisition of Inca Digital Printers and the finalization of

the share buyback program.

- Due to seasonal working capital build-up amplified by supply

chain issues, cost inflation and the consolidation of Inca Digital

Printers, trade working capital increased from 26% at the end of

2021 to 31% at the end of June 2022. In absolute numbers, trade

working capital evolved from 449 million Euro at the end of 2021 to

563 million Euro.

- The Group generated a free cash flow of minus 59 million

Euro.

- The half year actuarial calculation of the pensions shows a

reduction of 142 million Euro in the net liability for the material

countries versus year end 2021, principally due to the increase in

the discount rate.

OutlookThe Agfa-Gevaert Group

expects a continuing impact of cost inflation, supply chain issues

and the uncertain geopolitical and economic situation in the coming

quarters. Potential COVID-related lockdowns in China and other

COVID-related effects might also have an impact. The Group is

taking all necessary actions to operate in an increasingly complex

business environment.

Additional price actions are being taken to tackle cost

inflation. Assuming that the uncertainty in most markets will not

deteriorate, the second half of the year is expected to be better

thanks to additional pricing actions coming into effect.

Overall, the Agfa-Gevaert Group continues to focus on working

capital improvements and cost management. The ongoing

transformation actions are well on track and are expected to bring

more agility and to further simplify the operations of the Group.

They will also allow the Group to further reduce its costs from

2023 onwards.

HealthCare IT

– Q2

2022

|

in million Euro |

Q2

2022 |

Q2

2021 |

% change(excl. FX

effects) |

| Revenue |

57 |

56 |

2.8%(-4.8%) |

| Adjusted EBITDA

(*) |

5.6 |

7.9 |

-29.9% |

|

% of revenue |

9.7% |

14.2% |

|

| Adjusted EBIT

(*) |

3.7 |

5.8 |

-36.8% |

|

% of revenue |

6.4% |

10.5% |

|

(*) before

restructuring and non-recurring items

The HealthCare IT division’s top line reached 57 million Euro,

following a slower Q1 2022, with increasing sales in North America.

Fluctuations between quarters are normal, as a significant portion

of revenues and margins are realized when projects reach key

milestones. In spite of supply chain issues for hardware

components, the division expects sales to pick up in the second

half of the year.

Although the gross profit margin improved to 45.8% of revenue

driven by favorable mix effects (more own IP), adjusted EBITDA

decreased to 5.6 million Euro (9.7% of revenue) due to increased

investments in R&D and commercial resources to grow the

business. Adjusted EBIT amounted to 3.7 million Euro (6.4% of

revenue) in the second quarter of 2022.

HealthCare IT’s order book remains at a very healthy level and

the division recorded strong growth in order intake. The division

continues to attract new customers and expand the scope of its

solutions at existing customer sites. In North America, Agfa

HealthCare landed several strategic wins with its Enterprise

Imaging solution (Sunnybrook, Santa Clara County Health),

Cardiology solution (Florida Heart) and Vendor Neutral Archive

(Mirada Medical). In the Netherlands, Agfa HealthCare and Northwest

Clinics extended their strategic cooperation. The health

organization further expanded its consolidated Enterprise Imaging

platform with Agfa’s RUBEE™ for AI Augmented Intelligence

portfolio. This enhanced collaboration supports Northwest Clinics

in its strive to further optimize care delivery and to curb growing

healthcare cost.

In Estonia, Pildipank and Agfa HealthCare are strengthening and

extending their relationship, by moving the national shared Picture

Archiving and Communication System to the Enterprise Imaging

platform. Pildipank enables all healthcare institutions in Estonia

to share a single environment for exchanging, archiving and

accessing medical images.

The recently published Middle East & Africa PACS 2022 report

by KLAS Research highlights Agfa HealthCare as one of the most

frequently considered vendors in the Middle East and Africa.

For the HealthCare IT division, 2022 is a year of consolidation,

as the focus is turning towards profitable growth. As shown by the

positive development of the order intake, the division’s strategy

to target customer segments and geographies for which its

Enterprise Imaging solution is best fit and to prioritize higher

value revenue streams is working. This strategy will ultimately

allow the division to reach the targeted growth of EBITDA: starting

from a mid-single-digit percentage in 2019 to percentages in the

high-teens over the next years.

Radiology Solutions –

Q2

2022

|

in million Euro |

Q2

2022 |

Q2

2021 |

% change(excl. FX

effects) |

| Revenue |

114 |

121 |

-5.9% (-11.5%) |

| Adjusted EBITDA

(*) |

12.1 |

21.0 |

-42.1% |

|

% of revenue |

10.7% |

17.3% |

|

| Adjusted EBIT

(*) |

5.9 |

15.3 |

-61.2% |

|

% of revenue |

5.2% |

12.6% |

|

(*) before

restructuring and non-recurring items

The Radiology Solutions division’s top line decreased by 5.9%

compared to the second quarter of 2021.

In Direct Radiography, the post-COVID market context continues

to be volatile as healthcare providers continue to face operational

challenges affecting short term spend decisions, while having to

review investment priorities for the short and medium term. The

order book for this business remains strong, with continuously

longer conversion lead times affected by the supply chain

environments. Agfa is taking actions (costs control actions, price

increases, net working capital actions) to increase its agility and

better adapt to these market conditions. Denmark’s Aleris-Hamlet

hospital services group became first to implement Agfa’s VALORY™

digital radiography room in Europe. Aleris-Hamlet is the largest

supplier of private healthcare in Denmark. VALORY delivers a simple

design, bringing reliability, productivity and “first-time-right”

imaging into reach for any hospital.

Mainly in China, the COVID situation still weighed heavily on

the medical film business, with shipments and invoicing being

disrupted by lockdowns. Furthermore, the current geopolitical

situation and slower than normal volumes in some export markets

also had an impact. These volume effects were not fully offset by

the price increases for all types of medical film to tackle cost

inflation.

The market driven top line decline for the Computed Radiography

business was further amplified by component shortages and transport

issues. Agfa continued to manage the CR business to maintain

healthy profit margins.

As strict cost management and price actions for medical film

products did not suffice to tackle volume decreases, mix effects

and cost inflation, the gross profit margin of the division

decreased from 37.5% of revenue to 32.6%. The division’s adjusted

EBITDA margin amounted to 10.7% of revenue, versus 17.1% in the

second quarter of 2021. In absolute figures, adjusted EBITDA

reached 12.1 million Euro (21.0 million Euro in the second quarter

of 2021). Adjusted EBIT amounted to 5.9 million Euro (5.2% of

revenue), versus 15.3 million Euro (12.6% of revenue) in the

previous year.

Radiology Solutions received the new European Medical Device

Regulation (MDR) certification, which was issued by Intertek on

June 21, 2022. This certification allows Agfa to continue expanding

its radiology solutions and release innovations in due course. This

includes making significant changes to the solutions and adding new

functionalities to meet the evolving needs of customers and the

market, as well as allowing them to benefit from state-of-the-art

X-ray technologies.

Digital Print & Chemicals –

Q2

2022

|

in million Euro |

Q2

2022 |

Q2

2021 |

% change(excl. FX

effects) |

| Revenue |

98 |

81 |

20.9% (18.2%) |

| Adjusted EBITDA

(*) |

4.2 |

6.8 |

-38.0% |

|

% of revenue |

4.3% |

8.4% |

|

| Adjusted EBIT

(*) |

1.3 |

3.9 |

-67.6% |

|

% of revenue |

1.3% |

4.7% |

|

(*) before

restructuring and non-recurring items

In spite of supply chain issues, the Digital Print &

Chemicals division’s top line grew substantially versus the second

quarter of 2021. Price increases have been implemented in almost

all business areas to tackle the increasing raw material,

packaging, energy and freight costs. The full impact of these price

increases will become visible towards the end of the year.

Mainly impacted by strong cost inflation, COVID lockdowns in

China, logistic challenges, exchange rate effects and mix effects,

the division’s gross profit margin decreased to 26.1% of revenue

(28.7% in the second quarter of 2021). The adjusted EBITDA margin

evolved from 8.4% of revenue (6.8 million Euro in absolute figures)

in the second quarter of 2021 to 4.3% (4.2 million Euro in absolute

figures). Adjusted EBIT reached 1.3 million Euro (1.3% of revenue)

in the second quarter of 2022 versus 3.9 million Euro (4.7% of

revenue) in the second quarter of 2021.

In the field of digital print, the top line of the sign &

display business continued to grow. The ink product ranges for sign

& display applications continued to perform well, clearly

exceeding pre-COVID levels. In spite of industry-wide logistic

challenges for the high-end equipment, the top line of the

wide-format printing equipment business continued to recover from

the strong COVID-19 impact. Especially for the larger printers, the

order book has grown with a double digit percentage since the start

of the year.

At the Fespa trade show on June 1, Agfa announced the closing of

the acquisition of Inca Digital Printers, a UK based leading

developer and manufacturer of advanced high speed printing and

production technologies for sign and display applications as well

as for the rapidly growing digital printing market for packaging.

The integration of the activities is evolving as planned and Agfa’s

inks are being certified for use on the Onset printer range. At the

Printing United Expo (Las Vegas –October, 19-21), Inca’s Onset

printing engine will be shown printing with Agfa’s inks for the

first time.

Agfa recently received orders for two units of the newly

released InterioJet 2250i system for printing on décor paper used

for interior decoration, such as laminate floors and furniture.

These orders confirm Agfa’s technological leadership in this field.

The systems will be installed in the coming quarters. A further

ramp up of the order intake for InterioJet is expected over the

next quarters.

The specialty chemicals range of the division is well-positioned

for future growth with products and solutions that target specific

promising markets. Agfa’s Orgacon conductive materials, for

instance, are used in hybrid and electric car technology. In spite

of the COVID impact (mainly in China), this business continued to

grow.

Sales figures for the Zirfon membranes for advanced alkaline

electrolysis are growing according to plan. In March, Agfa

announced that it will supply a significant volume of its Zirfon

separator membranes to Thyssenkrupp Nucera within the framework of

a number of large-scale hydrogen projects. This confirms Agfa’s

position as technology leader in this field. In recent quarters,

the number of active customers for Zirfon has increased to over 50.

Agfa started engineering studies for a new industrial unit for the

Zirfon membranes at its Mortsel site in Belgium (investment

decision to be made in Q1 2023). This will allow the Group to be

ready for the expected further increase in customer demand.

Agfa’s range of products for the production of printed circuit

boards was hit by cost inflation and by the COVID-related lockdowns

in China. Cost inflation was only partially offset by price

increase actions.

Agfa’s specialty film and foil products benefited from the

post-COVID pick-up in sectors including aviation, the oil and gas

industry and the printing industry. Sales figures for the Synaps

range of synthetic papers grew strongly, based on the recovery of

the relevant printing markets and on the success of certain new

applications.

Offset Solutions –

Q2

2022

|

in million Euro |

Q2

2022 |

Q2

2021 |

% change(excl. FX

effects) |

| Revenue |

199 |

183 |

9.2% (4.3%) |

| Adjusted EBITDA

(*) |

14.2 |

8.0 |

77.3% |

|

% of revenue |

7.1% |

4.4% |

|

| Adjusted EBIT

(*) |

9.8 |

3.3 |

192.9% |

|

% of revenue |

4.9% |

1.8% |

|

(*) before

restructuring and non-recurring items

The Offset Solutions division’s top line improved by 9.2%

compared to the second quarter of 2021. The revenue increase is

fueled by successful price increases that have been implemented to

tackle the raw material, packaging and freight cost inflation.

Furthermore, the division is increasing its focus on high-value

regions.

Although affected by cost inflation, the Offset Solutions

division’s gross profit margin improved from 22.7% of revenue in

the second quarter of 2021 to 23.8% due to the implemented price

adjustments. Targeted actions to improve the division’s

profitability resulted in lower selling, general and administration

expenses as a percentage of revenue. Adjusted EBITDA improved

strongly to 14.2 million Euro (7.1% of revenue) versus 8.0 million

Euro (4.4% of revenue) in the second quarter of 2021. Adjusted EBIT

amounted to 9.8 million Euro (4.9% of revenue), compared to 3.3

million Euro (1.8% of revenue) in the second quarter of 2021.

In the second quarter, Agfa has announced the release of

SolidTune, a breakthrough prepress software solution for offset

packaging printing that excels by reducing ink consumption and

allowing faster turnaround time for greater production efficiency,

improved image quality and less waste.

Agfa is organizing the Offset Solutions activities into a

stand-alone legal entity structure and organization within the

Agfa-Gevaert Group. The implementation of this project is

proceeding according to plan.

Results after six

monthsAgfa-Gevaert Group – year to

date

|

in million Euro |

H1 2022 |

H1 2021 |

% change(excl. FX

effects |

| Revenue |

893 |

836 |

6.7% (2.3%) |

| Gross profit

(*) |

260 |

252 |

3.1% |

|

% of revenue |

29.1% |

30.1% |

|

| Adjusted EBITDA

(*) |

51 |

56 |

-9.1% |

|

% of revenue |

5.7% |

6.6% |

|

| Adjusted EBIT

(*) |

20 |

24 |

-17.9% |

|

% of revenue |

2.2% |

2.9% |

|

(*) before

restructuring and non-recurring items

HealthCare IT – year to date

|

in million Euro |

H1 2022 |

H1 2021 |

% change(excl. FX

effects) |

| Revenue |

112 |

111 |

1.2%(-4.8%) |

| Adjusted EBITDA

(*) |

9.9 |

14.4 |

-31.0% |

|

% of revenue |

8.9% |

13.0% |

|

| Adjusted EBIT

(*) |

6.2 |

9.9 |

-37.3% |

|

% of revenue |

5.5% |

8.9% |

|

(*) before

restructuring and non-recurring items

Radiology Solutions – year to date

|

in million Euro |

H1 2022 |

H1 2021 |

% change(excl. FX

effects) |

| Revenue |

215 |

220 |

-2.0% (-6.8%) |

| Adjusted EBITDA

(*) |

19.1 |

28.2 |

-32.1% |

|

% of revenue |

8.9% |

12.8% |

|

| Adjusted EBIT

(*) |

6.9 |

16.8 |

-58.8% |

|

% of revenue |

3.2% |

7.6% |

|

(*) before

restructuring and non-recurring items

Digital Print & Chemicals – year to

date

|

in million Euro |

H1 2022 |

H1 2021 |

% change(excl. FX

effects) |

| Revenue |

178 |

154 |

15.3% (12.8%) |

| Adjusted EBITDA

(*) |

8.3 |

12.1 |

-31.0% |

|

% of revenue |

4.7% |

7.8% |

|

| Adjusted EBIT

(*) |

2.7 |

6.2 |

-55.8% |

|

% of revenue |

1.5% |

4.0% |

|

(*) before

restructuring and non-recurring items

Offset Solutions – year to date

|

in million Euro |

H1

2022 |

H1

2021 |

% change(excl. FX

effects) |

| Revenue |

388 |

352 |

10.3% (5.8%) |

| Adjusted EBITDA

(*) |

22.2 |

9.6 |

129.9% |

|

% of revenue |

5.7% |

2.7% |

|

| Adjusted EBIT

(*) |

13.2 |

0.2 |

|

|

% of revenue |

3.4% |

0.1% |

|

(*) before

restructuring and non-recurring items

End of message

Management Certification of Financial Statements and

Quarterly ReportThis statement is made in order to comply

with new European transparency regulation enforced by the Belgian

Royal Decree of November 14, 2007 and in effect as of 2008."The

Board of Directors and the Executive Committee of Agfa-Gevaert NV,

represented by Mr. Frank Aranzana, Chairman of the Board of

Directors, Mr. Pascal Juéry, President and CEO, and Mr. Dirk De

Man, CFO, jointly certify that, to the best of their knowledge, the

consolidated financial statements included in the report and based

on the relevant accounting standards, fairly present in all

material respects the financial condition and results of

Agfa-Gevaert NV, including its consolidated subsidiaries. Based on

our knowledge, the report includes all information that is required

to be included in such document and does not omit to state all

necessary material facts.”Statement of riskThis

statement is made in order to comply with new European transparency

regulation enforced by the Belgian Royal Decree of November 14,

2007 and in effect as of 2008."As with any company, Agfa is

continually confronted with – but not exclusively – a number of

market and competition risks or more specific risks related to the

cost of raw materials, product liability, environmental matters,

proprietary technology or litigation." Key risk management data is

provided in the annual report available on www.agfa.com.

Contact:Viviane DictusDirector

Corporate CommunicationSeptestraat 272640 Mortsel - BelgiumT +32

(0) 3 444 71 24E viviane.dictus@agfa.com

Johan JacobsCorporate Press

Relations ManagerT +32 (0) 3 444 80 15 E johan.jacobs@agfa.com

The full press release and financial information is also

available on the company's website:

www.agfa.com.Consolidated

Statement of Profit or Loss

(in million Euro)

Unaudited, consolidated figures following IFRS

accounting policies.

|

|

Q2 2022 |

Q2 2021 |

H1 2022 |

H1 2021 |

|

Revenue |

469 |

441 |

893 |

836 |

|

Cost of sales |

(332) |

(305) |

(633) |

(584) |

|

Gross profit |

137 |

135 |

260 |

252 |

|

Selling expenses |

(62) |

(58) |

(122) |

(113) |

|

Administrative expenses |

(42) |

(40) |

(84) |

(79) |

|

R&D expenses |

(24) |

(24) |

(48) |

(49) |

|

Net impairment loss on trade and other receivables, including

contract assets |

- |

- |

- |

- |

|

Other & sundry operating income |

7 |

12 |

- |

- |

|

Other & sundry operating expenses |

(13) |

2 |

14 |

26 |

|

Results from operating activities |

2 |

28 |

(3) |

27 |

|

Interest income (expense) - net |

- |

- |

(1) |

(1) |

|

Interest income |

1 |

- |

1 |

1 |

|

Interest expense |

(1) |

(1) |

(1) |

(2) |

|

Other finance income (expense) - net |

(11) |

(3) |

(9) |

(3) |

|

Other finance income |

(2) |

2 |

5 |

6 |

|

Other finance expense |

(9) |

(4) |

(14) |

(9) |

|

Net finance costs |

(11) |

(3) |

(9) |

(4) |

|

Share of profit of associates, net of tax |

- |

- |

- |

- |

|

Profit (loss) before income taxes |

(9) |

25 |

(13) |

23 |

|

Income tax expenses |

(4) |

(9) |

(7) |

(14) |

|

Profit (loss) for the period |

(13) |

15 |

(20) |

9 |

|

Profit (loss) attributable to: |

|

|

|

|

|

Owners of the Company |

(17) |

15 |

(21) |

10 |

|

Non-controlling interests |

4 |

- |

1 |

(1) |

|

|

|

|

|

|

|

Results from operating activities |

2 |

28 |

(3) |

27 |

|

Restructuring and non-recurring items |

(14) |

3 |

(23) |

2 |

|

Adjusted EBIT |

16 |

25 |

20 |

24 |

|

|

|

|

|

|

|

Earnings per Share Group (Euro) |

(0.11) |

0.09 |

(0.13) |

0.06 |

Consolidated Statements of Comprehensive Income for

the period ending

June 2021

/ June

2022 (in million

Euro) Unaudited, consolidated figures

following IFRS accounting policies.

|

|

H1 2022 |

H1 2021 |

|

Profit / (loss) for the period |

(20) |

9 |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

32 |

15 |

|

Exchange differences on translation of foreign operations |

32 |

15 |

|

Cash flow hedges: |

(2) |

(3) |

|

Effective portion of changes in fair value of cash flow hedges |

(4) |

3 |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

2 |

(2) |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

(4) |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

117 |

81 |

|

Equity investments at fair value through OCI – change in fair

value |

(2) |

2 |

|

Remeasurements of the net defined benefit liability |

130 |

82 |

|

Income tax on remeasurements of the net defined benefit

liability |

(11) |

(3) |

|

Total Other Comprehensive

Income for the period, net of tax |

147 |

92 |

|

|

|

|

|

Total Comprehensive

Income for the period,

net of tax |

127 |

102 |

|

Attributable to |

|

|

|

Owners of the Company |

125 |

101 |

|

Non-controlling interests |

2 |

1 |

Consolidated Statements of Comprehensive Income for

the quarter ending

June

2021

/ June

2022 (in million

Euro) Unaudited, consolidated figures

following IFRS accounting policies.

|

|

Q2

2022 |

Q2

2021 |

|

Profit / (loss) for the period |

(13) |

15 |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

24 |

2 |

|

Exchange differences on translation of foreign operations |

24 |

2 |

|

Cash flow hedges: |

(2) |

- |

|

Effective portion of changes in fair value of cash flow hedges |

(3) |

3 |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

1 |

(1) |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

(2) |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

117 |

80 |

|

Equity investments at fair value through OCI – change in fair

value |

(2) |

1 |

|

Remeasurements of the net defined benefit liability |

130 |

82 |

|

Income tax on remeasurements of the net defined benefit

liability |

(11) |

(3) |

|

Total Other Comprehensive

Income for the period, net of tax |

138 |

81 |

|

|

|

|

|

Total Comprehensive

Income for the period,

net of tax |

125 |

97 |

|

Attributable to |

|

|

|

Owners of the Company |

120 |

96 |

|

Non-controlling interests |

5 |

- |

Consolidated Statement of Financial

Position (in million Euro)

Unaudited, consolidated figures following IFRS

accounting policies.

| |

30/06/2022 |

31/12/2021 |

|

Non-current assets |

808 |

756 |

| Goodwill |

302 |

280 |

| Intangible

assets |

38 |

13 |

| Property, plant

and equipment |

130 |

129 |

| Right-of-use

assets |

66 |

68 |

| Investments in

associates |

1 |

1 |

| Other financial

assets |

6 |

8 |

| Assets related to

post-employment benefits |

56 |

40 |

| Trade

receivables |

10 |

12 |

| Receivables under

finance leases |

73 |

70 |

| Other assets |

10 |

11 |

| Deferred tax

assets |

117 |

124 |

| Current

assets |

1,284 |

1,339 |

| Inventories |

537 |

418 |

| Trade

receivables |

323 |

307 |

| Contract

assets |

96 |

76 |

| Current income

tax assets |

60 |

63 |

| Other tax

receivables |

25 |

19 |

| Other financial

assets |

1 |

2 |

| Receivables under

finance lease |

20 |

30 |

| Other

receivables |

7 |

4 |

| Other assets |

17 |

18 |

| Derivative

financial instruments |

4 |

1 |

| Cash and cash

equivalents |

191 |

398 |

| Non-current

assets held for sale |

2 |

3 |

|

TOTAL ASSETS |

2,092 |

2,095 |

|

|

30/06/2022 |

31/12/2021 |

| Total

equity |

787 |

685 |

| Equity

attributable to owners of the company |

736 |

632 |

| Share

capital |

187 |

187 |

| Share

premium |

210 |

210 |

| Retained

earnings |

1,242 |

1,284 |

| Reserves |

(4) |

(1) |

| Translation

reserve |

15 |

(15) |

| Post-employment

benefits: remeasurements of the net defined benefit liability |

(914) |

(1,033) |

| Non-controlling

interests |

51 |

54 |

|

Non-current liabilities |

685 |

812 |

| Liabilities for

post-employment and long-term termination benefit plans |

608 |

735 |

| Other employee

benefits |

12 |

11 |

| Loans and

borrowings |

45 |

46 |

| Provisions |

12 |

12 |

| Deferred tax

liabilities |

8 |

6 |

| Contract

liabilities |

- |

1 |

| Other non-current

liabilities |

2 |

- |

| Current

liabilities |

620 |

597 |

| Loans and

borrowings |

26 |

27 |

| Provisions |

36 |

42 |

| Trade

payables |

271 |

252 |

| Contract

liabilities |

132 |

111 |

| Current income

tax liabilities |

25 |

28 |

| Other tax

liabilities |

23 |

28 |

| Other

payables |

11 |

9 |

| Employee

benefits |

84 |

99 |

| Other current

liabilities |

1 |

- |

| Derivative

financial instruments |

10 |

2 |

| TOTAL

EQUITY AND LIABILITIES |

2,092 |

2,095 |

Consolidated Statement of Cash Flows (in million

Euro) Unaudited, consolidated figures following IFRS

accounting policies.

|

|

H1 2022 |

H1 2021 |

Q2 2022 |

Q2 2021 |

|

Profit (loss) for the period |

(20) |

9 |

(13) |

15 |

|

Income taxes |

7 |

14 |

4 |

9 |

|

Share of (profit)/loss of associates, net of tax |

- |

- |

- |

- |

|

Net finance costs |

9 |

4 |

11 |

3 |

|

Operating result |

(3) |

27 |

2 |

28 |

|

|

|

|

|

|

|

Depreciation & amortization |

17 |

17 |

8 |

9 |

|

Depreciation & amortization on right-of-use assets |

14 |

14 |

7 |

7 |

|

Impairment losses on goodwill, intangibles and PP&E |

- |

- |

- |

- |

|

Impairment losses on right-of-use assets |

- |

- |

- |

- |

|

|

|

|

|

|

|

Exchange results and changes in fair value of derivates |

8 |

2 |

4 |

(1) |

|

Recycling of hedge reserve |

2 |

(2) |

1 |

(1) |

|

Government grants and subsidies |

(2) |

(5) |

(1) |

(3) |

|

(Gains)/losses on the sale of intangible assets and PP&E and

remeasurement of leases |

- |

(7) |

- |

- |

|

Result on the disposal of discontinued operations |

- |

- |

- |

- |

|

Expenses for defined benefit plans & long-term termination

benefits |

22 |

13 |

15 |

6 |

|

Accrued expenses for personnel commitments |

30 |

35 |

9 |

15 |

|

Write-downs/reversal of write-downs on inventories |

7 |

5 |

2 |

2 |

|

Impairments/reversal of impairments on receivables |

- |

- |

- |

- |

|

Additions/reversals of provisions |

4 |

(5) |

4 |

(7) |

|

|

|

|

|

|

|

Operating cash flow before changes in working

capital |

97 |

95 |

53 |

54 |

|

|

|

|

|

|

|

Change in inventories |

(102) |

(64) |

(43) |

(29) |

|

Change in trade receivables |

14 |

14 |

22 |

4 |

|

Change in contract assets |

(13) |

(3) |

(10) |

5 |

|

Change in trade working capital assets |

(101) |

(52) |

(30) |

(20) |

|

Change in trade payables |

(5) |

33 |

(7) |

1 |

|

Change in contract liabilities |

14 |

14 |

3 |

5 |

|

Changes in trade working capital liabilities |

9 |

47 |

(4) |

6 |

|

Changes in trade working capital |

(92) |

(5) |

(34) |

(14) |

|

|

H1 2022 |

H1 2021 |

Q2 2022 |

Q2 2021 |

|

Cash out for employee benefits |

(87) |

(206) |

(63) |

(162) |

|

Cash out for provisions |

(11) |

(25) |

(8) |

(13) |

|

Changes in lease portfolio |

9 |

4 |

4 |

4 |

|

Changes in other working capital |

(7) |

3 |

1 |

2 |

|

Cash settled operating derivatives |

(3) |

5 |

(3) |

3 |

|

|

|

|

|

|

|

Cash generated from operating activities |

(95) |

(128) |

(49) |

(127) |

|

|

|

|

|

|

|

Income taxes paid |

(6) |

(1) |

(4) |

1 |

|

Net cash from / (used in) operating

activities |

(101) |

(130) |

(53) |

(126) |

|

|

|

|

|

|

|

Capital expenditure |

(13) |

(14) |

(6) |

(8) |

|

Proceeds from sale of intangible assets and PP&E |

1 |

11 |

- |

1 |

|

Acquisition of associates and subsidiaries, net of cash

acquired |

(48) |

- |

(48) |

- |

|

Disposal of discontinued operations, net of cash disposed of |

(2) |

- |

(2) |

- |

|

Repayment of loans granted to 3rd parties |

- |

1 |

- |

1 |

|

Interests received |

2 |

1 |

1 |

1 |

|

Dividends received |

- |

- |

- |

- |

|

|

|

|

|

|

|

Net cash from / (used in) investing

activities |

(59) |

(1) |

(54) |

(5) |

|

|

|

|

|

|

|

Interests paid |

(2) |

(2) |

(1) |

(1) |

|

Dividends paid to non-controlling interests |

(5) |

- |

(5) |

- |

|

Interests and dividends paid |

(7) |

- |

(6) |

- |

|

Purchase of treasury shares |

(21) |

(9) |

(13) |

(9) |

|

Proceeds from borrowings |

- |

- |

- |

- |

|

Repayment of borrowings |

(1) |

(2) |

- |

- |

|

Payment of finance leases |

(15) |

(15) |

(8) |

(7) |

|

Changes in borrowings |

(16) |

(18) |

(8) |

(7) |

|

Proceeds / (payment) of derivatives |

(6) |

1 |

(4) |

- |

|

Other financing income / (costs) received/paid |

4 |

1 |

(3) |

(2) |

|

|

|

|

|

|

|

Net cash from / used in financing

activities |

(46) |

(26) |

(33) |

(19) |

|

|

|

|

|

|

|

Net increase / (decrease) in cash & cash

equivalents |

(206) |

(157) |

(140) |

(150) |

|

|

|

|

|

|

|

Cash & cash equivalents at the start of the

period |

398 |

585 |

330 |

578 |

|

Net increase / (decrease) in cash & cash equivalents |

(206) |

(157) |

(140) |

(150) |

|

Effect of exchange rate fluctuations on cash held |

(1) |

(1) |

1 |

- |

|

Gains/(losses) on marketable securities |

- |

(1) |

- |

- |

|

Cash & cash equivalents at the end of the

period |

191 |

427 |

191 |

427 |

Consolidated Statement of changes in Equity (in million

Euro) Unaudited, consolidated figures following IFRS

accounting policies.

|

in million Euro |

Share capital |

Share premium |

Retained earnings |

Reserve for own shares |

Revaluation reserve |

Hedging reserve |

Remeasurement of the net defined benefit

liability |

Translation reserve |

Total |

NON-CONTROLLING INTERESTS |

TOTAL EQUITY |

|

Balance at January 1,

2021 |

187 |

210 |

1,412 |

(82) |

- |

7 |

(1,122) |

(42) |

570 |

51 |

620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

10 |

- |

- |

- |

- |

- |

10 |

(1) |

9 |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

2 |

(3) |

79 |

14 |

91 |

2 |

92 |

|

Total comprehensive income for the period |

- |

- |

10 |

- |

2 |

(3) |

79 |

14 |

101 |

1 |

102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase of own shares |

- |

- |

- |

(9) |

- |

- |

- |

- |

(9) |

- |

(9) |

|

Cancellation of own shares |

- |

- |

(90) |

90 |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(90) |

81 |

- |

- |

- |

- |

(9) |

- |

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June

30,

2021 |

187 |

210 |

1,332 |

(1) |

2 |

3 |

(1,043) |

(28) |

662 |

52 |

713 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2022 |

187 |

210 |

1,284 |

- |

2 |

(2) |

(1,033) |

(15) |

632 |

54 |

685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(21) |

- |

- |

- |

- |

- |

(21) |

1 |

(20) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

(2) |

(2) |

119 |

31 |

146 |

2 |

147 |

|

Total comprehensive income for the period |

- |

- |

(21) |

- |

(2) |

(2) |

119 |

31 |

125 |

2 |

127 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(5) |

(5) |

|

Purchase of own shares |

- |

- |

- |

(21) |

- |

- |

- |

- |

(21) |

- |

(21) |

|

Cancellation of own shares |

- |

- |

(21) |

21 |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(21) |

- |

- |

- |

- |

- |

(21) |

(5) |

(26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June

30,

2022 |

187 |

210 |

1,242 |

- |

- |

(4) |

(914) |

15 |

736 |

51 |

787 |

- CO_20220824_Q2_UK statements

- CO_20220824_Q2_UK final

- HY report 2022 ENG

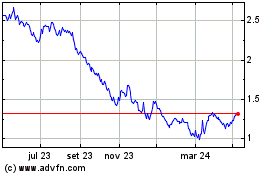

AGFA Gevaert NV (EU:AGFB)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

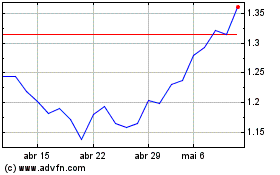

AGFA Gevaert NV (EU:AGFB)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024