Gaming and Leisure Properties Completes Previously Announced Sale of Tropicana Las Vegas and Simultaneously Enters into Ground Lease with Bally’s Corporation

27 Setembro 2022 - 8:00AM

Gaming and Leisure Properties, Inc. (NASDAQ: GLPI) (the “Company”),

announced today the completion of the previously announced sale of

GLPI’s non-land real estate assets and PENN Entertainment, Inc.'s

(NASDAQ: PENN) outstanding equity interests in Tropicana Las Vegas

Hotel and Casino, Inc. to Bally’s Corporation (NYSE: BALY)

(“Bally’s”). GLPI will receive net proceeds of approximately $145

million in cash after fees and expenses.

Pursuant to the terms of the original agreement,

GLPI retained its ownership of the land and concurrent with the

closing, entered into a 50-year ground lease with Bally's, subject

to extension upon Bally’s achieving a capital investment threshold,

for an initial annual rent of $10.5 million. The ground lease will

be supported by a Bally’s corporate guarantee and cross-defaulted

with the Bally’s Master Lease with GLPI.

The Tropicana Las Vegas Hotel and Casino is

located in Las Vegas, Nevada on a 35-acre parcel on the corner of

Tropicana Boulevard and Las Vegas Boulevard. It includes 1,470

guest rooms, 50,000 square feet of casino space with 1,000 gaming

positions, a 1,200-seat performance theater and 100,000 square feet

of convention and meeting space.

CBRE served as financial advisor to GLPI in the

transaction.

About Gaming

and Leisure

PropertiesGLPI is engaged in the business of

acquiring, financing, and owning real estate property to be leased

to gaming operators in triple-net lease arrangements, pursuant to

which the tenant is responsible for all facility maintenance,

insurance required in connection with the leased properties and the

business conducted on the leased properties, taxes levied on or

with respect to the leased properties and all utilities and other

services necessary or appropriate for the leased properties and the

business conducted on the leased properties.

Forward-Looking StatementsThis

press release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including Bally’s making future capital investment in the Tropicana

Las Vegas Hotel and Casino. Forward-looking statements can be

identified by the use of forward-looking terminology such as

“expects,” “believes,” “estimates,” “intends,” “may,” “will,”

“should” or “anticipates” or the negative or other variation of

these or similar words, or by discussions of future events,

strategies or risks and uncertainties. Such forward looking

statements are inherently subject to risks, uncertainties and

assumptions about GLPI and its subsidiaries, including risks

related to the following: the effect of pandemics, such as

COVID-19, on GLPI as a result of the impact such pandemics may have

on the business operations of GLPI’s tenants and their continued

ability to pay rent in a timely manner or make investments in

GLPI’s properties; the potential negative impact of recent high

levels of inflation (which have been exacerbated by the armed

conflict between Russia and Ukraine) on our tenants operations;

GLPI's ability to maintain its status as a REIT; our ability to

access capital through debt and equity markets in amounts and at

rates and costs acceptable to GLPI; the impact of our substantial

indebtedness on our future operations; changes in the U.S. tax law

and other state, federal or local laws, whether or not specific to

REITs or to the gaming or lodging industries; and other factors

described in GLPI’s Annual Report on Form 10-K for the year ended

December 31, 2021, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K, each as filed with the Securities and Exchange

Commission. All subsequent written and oral forward-looking

statements attributable to GLPI or persons acting on GLPI’s behalf

are expressly qualified in their entirety by the cautionary

statements included in this press release. GLPI undertakes no

obligation to publicly update or revise any forward-looking

statements contained or incorporated by reference herein, whether

as a result of new information, future events or otherwise, except

as required by law. In light of these risks, uncertainties and

assumptions, the forward-looking events discussed in this press

release may not occur as presented or at all.

|

Contact |

|

| Gaming and

Leisure Properties,

Inc. |

Investor Relations |

| Matthew Demchyk, Chief Investment Officer |

Joseph Jaffoni, Richard Land, James Leahy at JCIR |

| 610/401-2900 |

212/835-8500 |

| investorinquiries@glpropinc.com |

glpi@jcir.com |

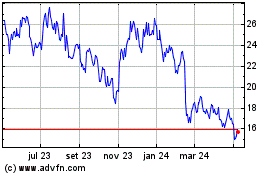

PENN Entertainment (NASDAQ:PENN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

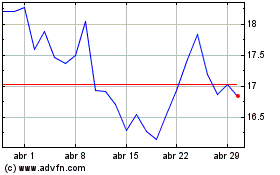

PENN Entertainment (NASDAQ:PENN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024