Navios Maritime Holdings Inc. (“Navios Holdings”, the “Company” or

“we”) (NYSE: NM), announced today that it is extending the

expiration date of its tender offer (the “Offer”) to purchase an

aggregate of approximately $20 million of the outstanding Series H

and Series G (as defined below) American Depositary Shares (“ADSs”)

for cash, until midnight (the end of the day), New York City time,

on October 21, 2022.

The terms of the Offer remain the same. The

Company is offering to purchase, for cash, Series H ADSs for $15.28

and Series G ADSs for $15.73, in each case less any applicable

withholding taxes.

The consideration offered is equal to:

- a $0.24 premium

to the volume weighted average price (“VWAP”) for the Series H ADSs

and a $0.03 discount to the VWAP for the Series G ADSs for the

initial period of the Offer ending on October 12, 2022;

- a 10% premium

to the last trading price of each of the Series H ADSs and the

Series G ADSs as of September 13, 2022 (the day before the offer

commenced); and

- 111.6% of the

30-day VWAP for the Series H ADSs as consolidated and reported by

Bloomberg, and 113% of the 30-day VWAP of the Series G ADSs, in

each case for the thirty consecutive calendar days immediately

preceding the date on which the Offer was commenced.

The Offer is being made exclusively to existing

holders of 1,768,102 Series H ADSs and 534,905 Series G ADSs,

offering them immediate liquidity in a relatively illiquid market.

We anticipate that upon the conclusion of this Offer that the

liquidity of the Series H ADSs and Series G ADSs likely will be

further reduced given the fewer number of Series H ADSs and Series

G ADSs outstanding. As further discussed below, approximately 31.5%

of the outstanding Series H ADSs and 7.1% of the outstanding Series

G ADSs have been tendered into the Offer.

- We do not

intend to increase the purchase price of this Offer or commence

another tender offer in the near term. While the Preferred Shares

(as defined below) underlying the Series G ADSs and Series H ADSs

are entitled to dividends in certain circumstances, since February

2016, payment of quarterly dividends has been suspended, and we

currently have no plans to pay dividends on the Preferred

Shares.

- Under the terms

of each of the Series H ADSs and Series G ADSs, dividend payments

are not compounded, although the right to unpaid dividends is

cumulative. That means that the unpaid dividends that accrue

as an arrearage do not earn any economic return so long as these

dividends remain unpaid. We believe that a rising interest

rate environment has a negative impact on any potential recovery

for such dividend arrearage, where such a recovery may be years

away, if at all.

This Offer may be appropriate for a holder

seeking liquidity and/or greater certainty that it will receive

current cash payments on its security and willing to forego the

possibility that previously accrued dividends on the Series H ADSs

and Series G ADSs may ever be paid or that the Company will elect

to redeem the Preferred Shares at their full redemption amount.

The Company will accept for tender up to $20

million consisting of (i) up to 300,000 of the outstanding American

Depositary Shares (“Series G ADSs”), each representing 1/100th of a

Share of 8.75% Series G Cumulative Redeemable Perpetual Preferred

Stock (the “Series G Preferred”), at a purchase price per Series G

ADSs of $15.73 in cash, less any applicable withholding taxes, and

(ii) up to 1,000,000 outstanding American Depositary Shares

(“Series H ADSs”), each representing 1/100th of a Share of 8.625%

Series H Cumulative Redeemable Perpetual Preferred Stock (the

“Series H Preferred” and, together with the Series G Preferred, the

“Preferred Shares”), at a purchase price per Series H ADSs of

$15.28 in cash, less any applicable withholding taxes, pursuant to

the terms and conditions set forth in the Offer to Purchase, dated

September 14, 2022, and the Amended and Restated Offer to Purchase,

dated as of September 29, 2022 (as further amended, supplemented or

otherwise modified from time to time, the “Offer to Purchase”).

Citibank, N.A., the tender offer agent for the

Offer, has advised the Company that, as of 6:00 p.m., New York City

time, on October 12, 2022, approximately 556,690 Series H ADSs and

37,810 Series G ADSs, have been validly tendered pursuant to the

Offer and not properly withdrawn, representing approximately 31.5%

of the outstanding Series H ADSs and 7.1% of the outstanding Series

G ADSs.

Conditions to the Offer

The Offer is not conditioned upon the receipt of

any financing or on any minimum number of Series H ADSs or Series G

ADSs being tendered. However, the completion of the Offer is

subject to certain other conditions as set forth in the Offer to

Purchase.

Expiration

The Offer will expire at midnight (the end of

the day), New York City Time, on October 21, 2022, unless extended.

The Depository Trust Company and its direct and indirect

participants will establish their own cutoff dates and times to

receive instructions to tender in the Offer to Purchase, which will

be earlier than the expiration date. You should contact your broker

or other securities intermediary to determine the cutoff date and

time applicable to you, in order to timely tender your ADSs and

participate in this Offer.

Complete Terms and

Conditions

Georgeson LLC is acting as the Information Agent

for the Offer. Citibank, N.A. is acting as the Tender Agent for the

Offer. The complete terms and conditions of the Offer are set forth

in the Offer to Purchase.

Copies of the Offer to Purchase may also be

obtained from the Information Agent:

Georgeson LLC

Call Toll-Free (800) 903-2897

Important Notices and Additional

Information

This press release is for informational purposes

only. This press release is not a recommendation to buy or sell any

of the Series G ADSs, Series H ADSs, the underlying Preferred

Shares or any other securities, and it is neither an offer to

purchase nor a solicitation of an offer to sell any of the Series G

ADSs, Series H ADSs, the underlying Preferred Shares or any other

securities. This press release shall not constitute an offer,

solicitation or sale in any jurisdiction in which such offer,

solicitation or sale is unlawful. In connection with the Offer, the

Company has filed with the SEC a Tender Offer Statement on Schedule

TO, including the Offer to Purchase and related documents, which

fully describe the terms and conditions of the Offer. The Company

is making the Offer only by, and pursuant to the terms of, the

Offer to Purchase. The Offer is not being made in any jurisdiction

in which the making or acceptance thereof would not be in

compliance with the securities, blue sky or other laws of such

jurisdiction. None of the Company, the Information Agent or the

Tender Agent makes any recommendation in connection with the Offer.

The Company urges holders of Series G ADSs and Series H ADSs to

read the Offer to Purchase and related disclosures (including all

amendments and supplements) and to consult with their tax,

financial, etc. advisors before making any decision with respect to

the Offer. A free copy of the Tender Offer Statement on Schedule

TO, including the Offer to Purchase and related documents, is

available at the SEC’s website at www.sec.gov or from the

Information Agent for the Offer.

About Navios Maritime Holdings

Inc.

Navios Maritime Holdings Inc. (NYSE: NM) owns a

controlling equity stake in Navios South American Logistics Inc., a

leading infrastructure and logistics company in the Hidrovia region

of South America and a passive equity interest in Navios Maritime

Partners L.P., a leading, US publicly listed shipping company which

owns and operates dry cargo and tanker vessels. For more

information about Navios Holdings, please visit our

website: www.navios.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events and expectations

including with respect to the completion of the Offer. Although

Navios Holdings believes that the expectations reflected in such

forward-looking statements are reasonable at the time made, no

assurance can be given that such expectations will prove to have

been correct. These statements involve known and unknown risks and

are based upon a number of assumptions and estimates which are

inherently subject to significant uncertainties and contingencies,

many of which are beyond the control of Navios Holdings. Actual

results may differ materially from those expressed or implied by

such forward-looking statements. Navios Holdings expressly

disclaims any obligations or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Navios Holdings’ expectations with

respect thereto or any change in events, conditions or

circumstances on which any statement is based.

Contact:

Navios Maritime Holdings Inc.

+1.345.232.3067

+1.212.906.8643

investors@navios.com

Navios Maritime (NYSE:NM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

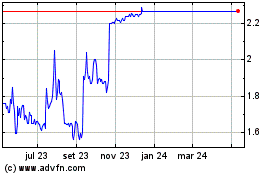

Navios Maritime (NYSE:NM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024