Tenaris S.A. (NYSE and Mexico: TS and EXM Italy: TEN) (“Tenaris”)

today announced its results for the quarter ended September 30,

2022 in comparison with its results for the quarter ended September

30, 2021.

Summary of 2022 Third Quarter

Results

|

|

3Q 2022 |

2Q 2022 |

3Q 2021 |

|

Net sales ($ million) |

2,975 |

|

2,800 |

|

6 |

% |

1,754 |

|

70 |

% |

|

Operating income ($ million) |

803 |

|

663 |

|

21 |

% |

231 |

|

248 |

% |

|

Net income ($ million) |

608 |

|

634 |

|

(4 |

%) |

326 |

|

86 |

% |

|

Shareholders’ net income ($ million) |

606 |

|

637 |

|

(5 |

%) |

330 |

|

84 |

% |

|

Earnings per ADS ($) |

1.03 |

|

1.08 |

|

(5 |

%) |

0.56 |

|

84 |

% |

|

Earnings per share ($) |

0.51 |

|

0.54 |

|

(5 |

%) |

0.28 |

|

84 |

% |

|

EBITDA ($ million) |

946 |

|

806 |

|

17 |

% |

379 |

|

149 |

% |

|

EBITDA margin (% of net sales) |

31.8 |

% |

28.8 |

% |

|

21.6 |

% |

|

Our third quarter sales increased 6%

sequentially as further pricing gains more than compensated lower

shipments, which were affected by lower deliveries to pipeline

projects and seasonal factors. Our EBITDA increased a further 17%

sequentially with the margin rising above 30% following the

increase in average selling prices which offset the increase in

costs of raw materials and energy. Net income decreased 4%

sequentially affected by non-operating items: lower results from

our equity participation in non-consolidated companies (Ternium and

Usiminas) and higher financial expenses.

Our free cash flow for the quarter remained

positive at $113 million despite an increase in working capital of

$601 million related to a buildup of inventories in anticipation of

increased shipments and an increase in receivables. Our capital

investments for the quarter, which included $56 million for the

wind farm in Argentina, also increased. Our net cash position

increased to $700 million at September 30, 2022.

Interim Dividend Payment

Our board of directors approved the payment of an interim

dividend of $0.17 per share ($0.34 per ADS), or approximately $201

million. The payment date will be November 23, 2022 , with an

ex-dividend date on November 21, 2022 and record date on November

22, 2022.

Market Background and

Outlook

In an environment of high geopolitical and

macro-economic risk, global economic growth is slowing, and energy

prices have come off their recent highs. Conditions in the energy

industry, however, remain supportive for an increased level of

investment, with low levels of spare capacity and inventories,

uncertainty about the impact of further sanctions on Russian

exports and a renewed focus on energy security around the world.

Global energy provision is constrained and all sources of supply

will be needed to meet growing demand.

Drilling activity has increased this year and is

expected to increase further, particularly in the Middle East and

offshore. Global demand for OCTG is increasing and is expected to

surpass pre-Covid levels in 2023. Pipeline activity is also

advancing to support oil and gas developments, notably in Argentina

and the Middle East.

In the fourth quarter, we anticipate further

growth in sales boosted by higher shipments to pipeline projects

and additional pricing gains. At the same time, our EBITDA margin

should continue to benefit from higher operating leverage while our

free cash flow should continue to recover.

US Trade Case

On October 27, 2021, the U.S. Department of

Commerce (“DOC”) announced the initiation of antidumping duty

investigations of oil country tubular goods (“OCTG”) from

Argentina, Mexico, and Russia and countervailing duty

investigations of OCTG from Russia and South Korea.

On October 26, 2022, the ITC issued a final

determination that the imports under investigation caused injury to

the U.S. OCTG industry. As a result of the investigation, Tenaris

is required to pay antidumping duties (at a rate of 78.30% for

imports from Argentina and 44.93% for imports from Mexico) on its

imports of OCTG from Argentina and Mexico for five years. Tenaris

has been paying such duties since May 11, 2022, reflecting the

amount of such deposits in its production costs. The duty rates may

be reset periodically based on the results of the review

process.

Analysis of 2022 Third Quarter Results

Tubes

The following table indicates, for our Tubes business segment,

sales volumes of seamless and welded pipes for the periods

indicated below:

|

Tubes Sales volume (thousand metric tons) |

3Q 2022 |

2Q 2022 |

3Q 2021 |

|

Seamless |

750 |

815 |

(8 |

%) |

675 |

11 |

% |

|

Welded |

106 |

75 |

41 |

% |

71 |

49 |

% |

|

Total |

856 |

890 |

(4 |

%) |

746 |

15 |

% |

The following table indicates, for our Tubes business segment,

net sales by geographic region, operating income and operating

income as a percentage of net sales for the periods indicated

below:

|

Tubes |

3Q 2022 |

2Q 2022 |

3Q 2021 |

|

(Net sales - $ million) |

|

|

|

|

|

|

North America |

1,761 |

|

1,583 |

|

11 |

% |

901 |

|

95 |

% |

|

South America |

600 |

|

462 |

|

30 |

% |

314 |

|

91 |

% |

|

Europe |

190 |

|

259 |

|

(27 |

%) |

141 |

|

35 |

% |

|

Middle East & Africa |

234 |

|

260 |

|

(10 |

%) |

199 |

|

18 |

% |

|

Asia Pacific |

46 |

|

67 |

|

(31 |

%) |

52 |

|

(11 |

%) |

|

Total net sales ($ million) |

2,832 |

|

2,632 |

|

8 |

% |

1,607 |

|

76 |

% |

|

Operating income ($ million) |

780 |

|

636 |

|

23 |

% |

200 |

|

290 |

% |

|

Operating margin (% of sales) |

27.5 |

% |

24.2 |

% |

|

12.4 |

% |

|

Net sales of tubular products and services

increased 8% sequentially and 76% year on year. On a sequential

basis volumes shipped decreased 4%, affected by lower deliveries to

pipeline projects and seasonal factors, while average selling

prices increased 12% sequentially, more than offsetting the lower

volumes. In North America, sales increased thanks to higher OCTG

prices throughout the region and higher shipments of OCTG in

Canada. In South America we had higher sales of OCTG to offshore

projects in Guyana and higher sales for pipelines in Argentina. In

Europe sales declined due to lower sales for offshore line pipe

projects and lower sales of industrial products. In the Middle East

and Africa sales declined as we had lower sales in Saudi Arabia and

lower sales of high alloy products in UAE. In Asia Pacific sales

declined reflecting the discontinuation of sales from NKKTubes in

Japan and lower sales in China.

Operating results from tubular products and

services amounted to a gain of $780 million in the third quarter of

2022 compared to a gain of $636 million in the previous quarter and

$200 million in the third quarter of 2021. Our operating margin

improved as tubes price increases more than offset higher energy

and raw material costs.

Others

The following table indicates, for our Others business segment,

net sales, operating income and operating income as a percentage of

net sales for the periods indicated below:

|

Others |

3Q 2022 |

2Q 2022 |

3Q 2021 |

|

Net sales ($ million) |

143 |

|

168 |

|

(15 |

%) |

147 |

|

(2 |

%) |

|

Operating income ($ million) |

23 |

|

27 |

|

(12 |

%) |

31 |

|

(26 |

%) |

|

Operating margin (% of sales) |

16.2 |

% |

15.8 |

% |

|

21.4 |

% |

|

Net sales of other products and services

decreased 15% sequentially and 2% year on year. Sequentially, sales

declined mainly due to lower sales of excess raw materials and

lower sales of pipes for plumbing applications in Italy.

Selling, general and administrative

expenses, or SG&A, amounted to $403

million, or 13.6% of net sales, in the third quarter of 2022,

compared to $412 million, 14.7% in the previous quarter and $317

million, 18.1% in the third quarter of 2021. Sequentially, our

SG&A expenses decreased mainly due to a reduction in logistic

costs associated with lower shipments.

Financial results amounted to a

loss of $29 million in the third quarter of 2022, compared to a

loss of $11 million in the previous quarter and a loss close to

zero in the third quarter of 2021. The financial result of the

quarter includes a $30 million loss related to a dividend

distribution in kind (Argentine sovereign bonds) paid by an

Argentine subsidiary of the Company, which was impacted by the

change in value of such bonds from the local Argentine market to

the International market. This is related to foreign exchange

control measures in Argentina, please see note 18 to our

consolidated condensed interim financial statements for the

nine-month period ended September 30, 2022.

Equity in earnings of non-consolidated

companies generated a gain of $5 million in the third

quarter of 2022, compared to a gain of $103 million in the previous

quarter and a gain of $154 million in the third quarter of 2021.

The result of the quarter includes a $32 million loss from an

impairment in Usiminas ($19 million from our direct investment in

Usiminas and $13 million from our indirect investment in Usiminas

through Ternium). Excluding the impairment loss the equity in

earnings of non-consolidated companies would have amounted to $37

million.

Income tax charge amounted to

$171 million in the third quarter of 2022, compared to $120 million

in the previous quarter and $59 million in the third quarter of

2021. The increase in income tax mainly reflects better results at

several subsidiaries following the improvement in activity.

Cash Flow and Liquidity of 2022

Third Quarter

Net cash generated by operating activities

during the third quarter of 2022 was $242 million, compared to $428

million in the previous quarter and $53 million in the third

quarter of 2021. During the third quarter of 2022 cash generated by

operating activities is net of an increase in working capital of

$601 million mainly related to a buildup of inventories in

anticipation of increased shipments and higher receivables

reflecting the increase in sales.

With capital expenditures of $129 million, which

include $56 million invested in the wind farm in Argentina, our

free cash flow amounted to $113 million during the quarter and our

net cash position amounted to $700 million at September 30,

2022.

Analysis of 2022 First Nine Months

Results

|

|

9M 2022 |

9M 2021 |

Increase/(Decrease) |

|

Net sales ($ million) |

8,142 |

|

4,464 |

|

82 |

% |

|

Operating income ($ million) |

1,950 |

|

434 |

|

349 |

% |

|

Net income ($ million) |

1,746 |

|

717 |

|

143 |

% |

|

Shareholders’ net income ($ million) |

1,746 |

|

730 |

|

139 |

% |

|

Earnings per ADS ($) |

2.96 |

|

1.24 |

|

139 |

% |

|

Earnings per share ($) |

1.48 |

|

0.62 |

|

139 |

% |

|

EBITDA ($ million) |

2,379 |

|

877 |

|

171 |

% |

|

EBITDA margin (% of net sales) |

29.2 |

% |

19.6 |

% |

|

The following table shows our net sales by business segment for

the periods indicated below:

|

Net sales ($ million) |

9M 2022 |

9M 2021 |

Increase/(Decrease) |

|

Tubes |

7,667 |

94 |

% |

4,084 |

91 |

% |

88 |

% |

|

Others |

475 |

6 |

% |

380 |

9 |

% |

25 |

% |

|

Total |

8,142 |

|

4,464 |

|

82 |

% |

Tubes

The following table indicates, for our Tubes business segment,

sales volumes of seamless and welded pipes for the periods

indicated below:

|

Tubes Sales volume (thousand metric tons) |

9M 2022 |

9M 2021 |

Increase/(Decrease) |

|

Seamless |

2,337 |

1,782 |

31 |

% |

|

Welded |

231 |

221 |

5 |

% |

|

Total |

2,568 |

2,003 |

28 |

% |

The following table indicates, for our Tubes business segment,

net sales by geographic region, operating income and operating

income as a percentage of net sales for the periods indicated

below:

|

Tubes |

9M 2022 |

9M 2021 |

Increase/(Decrease) |

|

(Net sales - $ million) |

|

|

|

|

North America |

4,691 |

|

2,122 |

|

121 |

% |

|

South America |

1,411 |

|

710 |

|

99 |

% |

|

Europe |

681 |

|

454 |

|

50 |

% |

|

Middle East & Africa |

676 |

|

623 |

|

9 |

% |

|

Asia Pacific |

207 |

|

174 |

|

19 |

% |

|

Total net sales ($ million) |

7,667 |

|

4,084 |

|

88 |

% |

|

Operating income ($ million) |

1,887 |

|

368 |

|

413 |

% |

|

Operating margin (% of sales) |

24.6 |

% |

9.0 |

% |

|

Net sales of tubular products and services

increased 88% to $7,667 million in the first nine months of 2022,

compared to $4,084 million in the first nine months of 2021 due to

an increase of 28% in volumes and a 46% increase in average selling

prices. Sales increased in all regions, mainly in North America

where there was a recovery in volumes and prices throughout the

region, led by the U.S. onshore market. Average drilling activity

in the first nine months of 2022 increased 54% in the United States

& Canada and 13% internationally compared to the first nine

months of 2021.

Operating results from tubular products and

services amounted to a gain of $1,887 million in the first nine

months of 2022 compared to $368 million in the first nine months of

2021. The improvement in operating results was driven by the

recovery in sales and margins, as higher tubes prices and an

improvement in industrial performance due to the increased levels

of activity and utilization of production capacity more than offset

the increase in raw material and energy costs.

Others

The following table indicates, for our Others business segment,

net sales, operating income and operating income as a percentage of

net sales for the periods indicated below:

|

Others |

9M 2022 |

9M 2021 |

Increase/(Decrease) |

|

Net sales ($ million) |

475 |

|

380 |

|

25 |

% |

|

Operating income ($ million) |

63 |

|

66 |

|

(5 |

%) |

|

Operating margin (% of sales) |

13.2 |

% |

17.4 |

% |

|

Net sales of other products and services

increased 25% to $475 million in the first nine months of 2022,

compared to $380 million in the first nine months of 2021, mainly

due to higher sales of our oilfield services business in Argentina

which offers hydraulic fracturing and coiled tubing services,

higher sales of sucker rods and excess raw materials, partially

offset by lower sales from the discontinued industrial equipment

business in Brazil.

Selling, general and administrative

expenses, or SG&A, amounted to $1,180 million in the

first nine months of 2022, representing 14.5% of sales, and $869

million in the first nine months of 2021, representing 19.5% of

sales. SG&A expenses increased mainly due to higher selling

expenses (in particular commissions and freights) associated with

higher sales and higher labor costs. However, they decreased as a

percentage of sales due to the better absorption of fixed and

semi-fixed components of SG&A expenses on higher sales.

Other operating results

amounted to a net gain of $12 million in the first nine months of

2022, compared to a net gain of $50 million in the first nine

months of 2021. In the first nine months of 2022 other operating

results include a non-cash gain of $71 million from the

reclassification to the income statement of NKKTubes’s cumulative

foreign exchange adjustments belonging to the shareholders, an $18

million gain from the sale of land in Canada after the relocation

of the Prudential facility, partially offset by a $78 million loss

from the settlement with the U.S. SEC. The gain in 2021 was mainly

due to a $34 million recognition of fiscal credits in Brazil and

the profit from the sale of fixed assets in Saudi Arabia.

Financial results amounted to a

loss of $42 million in the first nine months of 2022, compared to a

gain of $21 million in the first nine months of 2021. The financial

result in the first nine months of 2022 includes a $30 million loss

related to a dividend distribution in kind (Argentine sovereign

bonds) performed by an Argentine subsidiary of the Company, which

was mainly impacted by the change in valuation of the bonds from

the local Argentine market to the International market, as well as

the decline in the fair value of certain financial instruments

obtained in an operation of settlement of trade receivables in the

second quarter of 2022.

Equity in earnings of non-consolidated

companies generated a gain of $196 million in the first

nine months of 2022, compared to a gain of $379 million in the

first nine months of 2021. The result of the first nine months of

2022 includes a $32 million loss from an impairment in Usiminas

($19 million from our direct investment in Usiminas and $13 million

from our indirect investment in Usiminas through Ternium) and an

impairment on the value of our joint venture in Russia, amounting

to $15 million. The remaining results are mainly derived from our

participation in Ternium (NYSE:TX).

Income tax amounted to a charge

of $359 million in the first nine months of 2022, compared to $117

million in the first nine months of 2021. The increase in income

tax reflects better results at several subsidiaries following the

improvement in activity in 2022.

Cash Flow and Liquidity of 2022

First Nine Months

Net cash provided by operating activities during

the first nine months of 2022 amounted to $643 million (net of an

increase in working capital of $1,408 million), compared to cash

provided by operations of $73 million (net of an increase in

working capital of $673 million) in the first nine months of 2021.

Working capital, mainly inventories and trade receivables, has been

increasing since 2021 following the recovery in activity from very

low levels in 2020.

Capital expenditures amounted to $271 million in

the first nine months of 2022, compared to $171 million in the

first nine months of 2021. Free cash flow amounted to $372 million

in the first nine months of 2022, compared to a negative free cash

flow of $98 million in the first nine months of 2021.

Our net cash position amounted to $700 million

at September 30, 2022, same level as at December 31, 2021.

Conference

call

Tenaris will hold a conference call to discuss

the above reported results, on November 4, 2022, at 09:00 a.m.

(Eastern Time). Following a brief summary, the conference call will

be opened to questions. To listen to the conference please join

through one of the following options:

ir.tenaris.com/events-and-presentations or

https://edge.media-server.com/mmc/p/9rkcyax4If you wish to

participate in the Q&A session please register at the following

link:

https://register.vevent.com/register/BI722f17c9bfb94b2ea67ce3682137cb5dPlease

connect 10 minutes before the scheduled start time.A replay of the

conference call will also be available on our webpage

at:ir.tenaris.com/events-and-presentations

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking

statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those

expressed or implied by those statements. These risks include but

are not limited to risks arising from uncertainties as to future

oil and gas prices and their impact on investment programs by oil

and gas companies.Consolidated Condensed Interim Income

Statement

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

Unaudited |

Unaudited |

|

Net sales |

2,974,801 |

|

1,753,743 |

|

8,142,316 |

|

4,464,043 |

|

|

Cost of sales |

(1,766,486 |

) |

(1,214,451 |

) |

(5,023,770 |

) |

(3,211,232 |

) |

|

Gross profit |

1,208,315 |

|

539,292 |

|

3,118,546 |

|

1,252,811 |

|

|

Selling, general and administrative expenses |

(403,435 |

) |

(316,708 |

) |

(1,180,097 |

) |

(868,519 |

) |

|

Other operating income (expense), net |

(1,755 |

) |

8,325 |

|

11,775 |

|

49,902 |

|

|

Operating income |

803,125 |

|

230,909 |

|

1,950,224 |

|

434,194 |

|

|

Finance Income |

26,998 |

|

4,988 |

|

42,264 |

|

32,203 |

|

|

Finance Cost |

(17,741 |

) |

(6,320 |

) |

(25,703 |

) |

(16,826 |

) |

|

Other financial results |

(38,368 |

) |

1,024 |

|

(58,247 |

) |

5,704 |

|

|

Income before equity in earnings of non-consolidated

companies and income tax |

774,014 |

|

230,601 |

|

1,908,538 |

|

455,275 |

|

|

Equity in earnings of non-consolidated companies |

5,295 |

|

154,139 |

|

196,001 |

|

379,109 |

|

|

Income before income tax |

779,309 |

|

384,740 |

|

2,104,539 |

|

834,384 |

|

|

Income tax |

(171,239 |

) |

(58,505 |

) |

(359,010 |

) |

(117,202 |

) |

|

Income for continuing operations |

608,070 |

|

326,235 |

|

1,745,529 |

|

717,182 |

|

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

Shareholders' equity |

606,470 |

|

329,871 |

|

1,745,962 |

|

730,157 |

|

|

Non-controlling interests |

1,600 |

|

(3,636 |

) |

(433 |

) |

(12,975 |

) |

|

|

608,070 |

|

326,235 |

|

1,745,529 |

|

717,182 |

|

Consolidated Condensed Interim Statement of Financial

Position

| (all amounts in thousands of

U.S. dollars) |

At September 30, 2022 |

|

At December 31, 2021 |

|

|

Unaudited |

|

|

|

ASSETS |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment, net |

5,640,329 |

|

|

5,824,801 |

|

|

Intangible assets, net |

1,347,892 |

|

|

1,372,176 |

|

|

Right-of-use assets, net |

112,342 |

|

|

108,738 |

|

|

Investments in non-consolidated companies |

1,536,439 |

|

|

1,383,774 |

|

|

Other investments |

150,489 |

|

|

320,254 |

|

|

Derivative financial instruments |

- |

|

|

7,080 |

|

|

Deferred tax assets |

264,843 |

|

|

245,547 |

|

|

Receivables, net |

220,312 |

9,272,646 |

|

205,888 |

9,468,258 |

|

Current assets |

|

|

|

|

|

|

Inventories, net |

3,679,135 |

|

|

2,672,593 |

|

|

Receivables and prepayments, net |

208,287 |

|

|

96,276 |

|

|

Current tax assets |

212,093 |

|

|

193,021 |

|

|

Trade receivables, net |

2,013,660 |

|

|

1,299,072 |

|

|

Derivative financial instruments |

46,178 |

|

|

4,235 |

|

|

Other investments |

434,566 |

|

|

397,849 |

|

|

Cash and cash equivalents |

994,854 |

7,588,773 |

|

318,127 |

4,981,173 |

|

Total assets |

|

16,861,419 |

|

|

14,449,431 |

|

EQUITY |

|

|

|

|

|

|

Shareholders' equity |

|

13,204,886 |

|

|

11,960,578 |

|

Non-controlling interests |

|

129,895 |

|

|

145,124 |

|

Total equity |

|

13,334,781 |

|

|

12,105,702 |

|

LIABILITIES |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Borrowings |

47,164 |

|

|

111,432 |

|

|

Lease liabilities |

84,922 |

|

|

82,694 |

|

|

Deferred tax liabilities |

284,549 |

|

|

274,721 |

|

|

Other liabilities |

235,309 |

|

|

231,681 |

|

|

Provisions |

91,318 |

743,262 |

|

83,556 |

784,084 |

|

Current liabilities |

|

|

|

|

|

|

Borrowings |

827,962 |

|

|

219,501 |

|

|

Lease liabilities |

31,127 |

|

|

34,591 |

|

|

Derivative financial instruments |

11,778 |

|

|

11,328 |

|

|

Current tax liabilities |

288,208 |

|

|

143,486 |

|

|

Other liabilities |

277,812 |

|

|

203,725 |

|

|

Provisions |

10,829 |

|

|

9,322 |

|

|

Customer advances |

324,623 |

|

|

92,436 |

|

|

Trade payables |

1,011,037 |

2,783,376 |

|

845,256 |

1,559,645 |

|

Total liabilities |

|

3,526,638 |

|

|

2,343,729 |

|

Total equity and liabilities |

|

16,861,419 |

|

|

14,449,431 |

Consolidated Condensed Interim Statement of Cash

Flows

| (all amounts in thousands of

U.S. dollars) |

|

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

Unaudited |

Unaudited |

|

Cash flows from operating activities |

|

|

|

|

|

|

Income for the period |

|

608,070 |

|

326,235 |

|

1,745,529 |

|

717,182 |

|

|

Adjustments for: |

|

|

|

|

|

|

Depreciation and amortization |

|

142,488 |

|

148,465 |

|

428,588 |

|

442,561 |

|

|

Income tax accruals less payments |

|

72,639 |

|

12,197 |

|

118,590 |

|

11,630 |

|

|

Equity in earnings of non-consolidated companies |

|

(5,295 |

) |

(154,139 |

) |

(196,001 |

) |

(379,109 |

) |

|

Interest accruals less payments, net |

|

6,763 |

|

(490 |

) |

5,152 |

|

(12,537 |

) |

|

Changes in provisions |

|

(1,210 |

) |

4,618 |

|

9,269 |

|

14,216 |

|

|

Reclassification of currency translation adjustment reserve |

|

- |

|

- |

|

(71,252 |

) |

- |

|

|

Changes in working capital |

|

(601,242 |

) |

(275,622 |

) |

(1,408,341 |

) |

(672,712 |

) |

|

Currency translation adjustment and others |

|

19,914 |

|

(8,360 |

) |

11,741 |

|

(48,186 |

) |

|

Net cash provided by operating activities |

|

242,127 |

|

52,904 |

|

643,275 |

|

73,045 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Capital expenditures |

|

(129,457 |

) |

(74,306 |

) |

(270,800 |

) |

(170,871 |

) |

|

Changes in advance to suppliers of property, plant and

equipment |

|

14,062 |

|

1,308 |

|

(5,793 |

) |

(4,420 |

) |

|

Acquisition of subsidiaries, net of cash acquired |

|

- |

|

- |

|

(4,082 |

) |

- |

|

|

Proceeds from disposal of property, plant and equipment and

intangible assets |

|

772 |

|

9,016 |

|

46,768 |

|

14,355 |

|

|

Investment in companies under cost method |

|

- |

|

(692 |

) |

- |

|

(692 |

) |

|

Dividends received from non-consolidated companies |

|

- |

|

- |

|

45,488 |

|

49,131 |

|

|

Changes in investments in securities |

|

128,746 |

|

35,500 |

|

85,175 |

|

278,423 |

|

|

Net cash provided by (used in) investing

activities |

|

14,123 |

|

(29,174 |

) |

(103,244 |

) |

165,926 |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Dividends paid |

|

- |

|

- |

|

(330,584 |

) |

(165,275 |

) |

| Dividends paid to

non-controlling interest in subsidiaries |

|

(10,432 |

) |

(148 |

) |

(10,432 |

) |

(3,355 |

) |

| Changes in non-controlling

interests |

|

(5,128 |

) |

- |

|

(3,506 |

) |

- |

|

| Payments of lease

liabilities |

|

(10,431 |

) |

(11,917 |

) |

(38,836 |

) |

(38,221 |

) |

| Proceeds from borrowings |

|

497,982 |

|

289,579 |

|

1,349,718 |

|

575,698 |

|

| Repayments of borrowings |

|

(352,411 |

) |

(370,438 |

) |

(793,587 |

) |

(674,325 |

) |

|

Net cash provided by (used in) financing

activities |

|

119,580 |

|

(92,924 |

) |

172,773 |

|

(305,478 |

) |

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash

equivalents |

|

375,830 |

|

(69,194 |

) |

712,804 |

|

(66,507 |

) |

|

|

|

|

|

|

|

|

Movement in cash and cash equivalents |

|

|

|

|

|

| At the beginning of the

period |

|

635,928 |

|

585,239 |

|

318,067 |

|

584,583 |

|

| Effect of exchange rate

changes |

|

(20,955 |

) |

(2,380 |

) |

(40,068 |

) |

(4,411 |

) |

| Increase (decrease) in cash

and cash equivalents |

|

375,830 |

|

(69,194 |

) |

712,804 |

|

(66,507 |

) |

|

|

|

990,803 |

|

513,665 |

|

990,803 |

|

513,665 |

|

Exhibit I – Alternative performance

measures

Alternative performance measures should be

considered in addition to, not as substitute for or superior to,

other measures of financial performance prepared in accordance with

IFRS.

EBITDA, Earnings before interest, tax,

depreciation and amortization.

EBITDA provides an analysis of the operating

results excluding depreciation and amortization and impairments, as

they are recurring non-cash variables which can vary substantially

from company to company depending on accounting policies and the

accounting value of the assets. EBITDA is an approximation to

pre-tax operating cash flow and reflects cash generation before

working capital variation. EBITDA is widely used by investors when

evaluating businesses (multiples valuation), as well as by rating

agencies and creditors to evaluate the level of debt, comparing

EBITDA with net debt.

EBITDA is calculated in the following manner:

EBITDA = Net income for the period + Income tax

charges +/- Equity in Earnings (losses) of non-consolidated

companies +/- Financial results + Depreciation and amortization +/-

Impairment charges/(reversals)

EBITDA is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

| Income for continuing

operations |

608,070 |

|

326,235 |

|

1,745,529 |

|

717,182 |

|

| Income tax |

171,239 |

|

58,505 |

|

359,010 |

|

117,202 |

|

| Equity in earnings of

non-consolidated companies |

(5,295 |

) |

(154,139 |

) |

(196,001 |

) |

(379,109 |

) |

| Financial Results |

29,111 |

|

308 |

|

41,686 |

|

(21,081 |

) |

| Depreciation and

amortization |

142,488 |

|

148,465 |

|

428,588 |

|

442,561 |

|

| EBITDA |

945,613 |

|

379,374 |

|

2,378,812 |

|

876,755 |

|

Free Cash Flow

Free cash flow is a measure of financial performance, calculated

as operating cash flow less capital expenditures. FCF represents

the cash that a company is able to generate after spending the

money required to maintain or expand its asset base.

Free cash flow is calculated in the following manner:

Free cash flow = Net cash (used in) provided by operating

activities - Capital expenditures.

Free cash flow is a non-IFRS alternative performance

measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended September 30, |

Nine-month period ended September 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

| Net cash provided by operating

activities |

242,127 |

|

52,904 |

|

643,275 |

|

73,045 |

|

| Capital expenditures |

(129,457 |

) |

(74,306 |

) |

(270,800 |

) |

(170,871 |

) |

| Free cash

flow |

112,670 |

|

(21,402 |

) |

372,475 |

|

(97,826 |

) |

Net Cash / (Debt)

This is the net balance of cash and cash

equivalents, other current investments and fixed income investments

held to maturity less total borrowings. It provides a summary of

the financial solvency and liquidity of the company. Net cash /

(debt) is widely used by investors and rating agencies and

creditors to assess the company’s leverage, financial strength,

flexibility and risks.

Net cash/ debt is calculated in the following manner:

Net cash = Cash and cash equivalents + Other investments

(Current and Non-Current)+/- Derivatives hedging borrowings and

investments - Borrowings (Current and Non-Current).

Net cash/debt is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

At September 30, |

|

|

2022 |

|

2021 |

|

| Cash and cash equivalents |

994,854 |

|

513,781 |

|

| Other current investments |

434,566 |

|

457,861 |

|

| Non-current investments |

144,222 |

|

369,079 |

|

| Derivatives hedging borrowings

and investments |

1,284 |

|

3,381 |

|

| Current borrowings |

(827,962 |

) |

(402,237 |

) |

| Non-current borrowings |

(47,164 |

) |

(111,442 |

) |

| Net cash |

699,800 |

|

830,423 |

|

Operating working capital days

Operating working capital is the difference

between the main operating components of current assets and current

liabilities. Operating working capital is a measure of a company’s

operational efficiency, and short-term financial health.

Operating working capital days is calculated in

the following manner:

Operating working capital days = [(Inventories +

Trade receivables – Trade payables – Customer advances) /

Annualized quarterly sales ] x 365

Operating working capital days is a non-IFRS alternative

performance measure.

| (all amounts in thousands of

U.S. dollars) |

At September 30, |

| |

2022 |

|

2021 |

|

| Inventories |

3,679,135 |

|

2,477,445 |

|

| Trade receivables |

2,013,660 |

|

1,111,174 |

|

| Customer advances |

(324,623 |

) |

(56,738 |

) |

| Trade payables |

(1,011,037 |

) |

(791,424 |

) |

| Operating working

capital |

4,357,135 |

|

2,740,457 |

|

| Annualized quarterly

sales |

11,899,204 |

|

7,014,972 |

|

| Operating working capital

days |

134 |

|

143 |

|

Giovanni

Sardagna Tenaris

1-888-300-5432www.tenaris.com

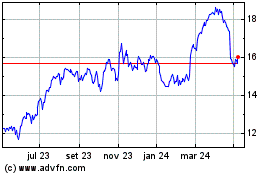

Tenaris (BIT:TEN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

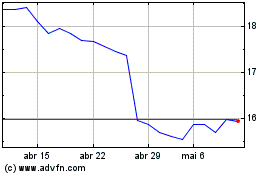

Tenaris (BIT:TEN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024