Iris Energy Limited (NASDAQ: IREN) (“Iris Energy” or “the

Company”), a leading owner and operator of institutional-grade,

highly efficient proprietary Bitcoin mining data centers powered by

100% renewable energy, today published a monthly investor update

for November 2022, containing its results from operations as well

as construction and development updates.

Key Highlights1

|

Key metrics2 |

Nov-22 |

|

Average operating hashrate (PH/s) |

1,445 |

|

Bitcoin mined |

151 |

|

Mining revenue (US$’000) |

2,871 |

|

Electricity costs (US$’000) |

1,905 |

|

Revenue per Bitcoin (US$) |

18,955 |

|

Electricity costs per Bitcoin (US$) |

12,581 (10,168 adj)3 |

- Corporate:

- On December 6, the

Company provided an investor update – “Everything changes,

everything remains the same” – in respect of its positioning,

go-forward opportunities, and strategic priorities

- Risk-focused

approach positions the Company to weather the storm and capitalize

on the next bull run

- Liquidity (as of

month end)

- $47 million cash,

no debt4

- $21 million

estimated net capex spend to achieve 180MW5

- $75 million

remaining Bitmain prepayments

- $100 million

unutilized under B. Riley equity facility6

- Potential

monetization of assets through miner sales (2.4 EH/s down to 2.0

EH/s7)

- Opportunities

- Significant

optionality from 180MW real assets platform (e.g. self-mining or

hosting)

- Focus on expanding

self-mining capacity to 5.4 EH/s

- Potential

additional expansion from 20MW to 600MW at Childress

- On November 21, the Company also

provided a corporate update and announced certain preliminary

financial information and operational updates for Q1 FY23 and

October 2022

- Operations (for the

month of November 2022):

- Average operating

hashrate of 1,445 PH/s (-63% vs. October)8

- Monthly operating

revenue of $2.9 million (-67% vs. October)

- 151 Bitcoin mined

(-66% vs. October)

The reduction in operating metrics (vs.

October) primarily reflects termination of hosting arrangements

during the month in connection with certain of the Group’s limited

recourse equipment financing facilities following receipt of an

acceleration notice from the relevant lender under such

facilities9

- Construction:

- Mackenzie (80MW –

BC, Canada)

- Expansion from 50MW

to 80MW energized on December 6, 2022, three weeks ahead of

schedule

- Internal data

center fit-out complete for the additional 30MW

- Childress (20MW –

Texas, USA)

- Foundations and

earthworks for the substation and first data center building (20MW)

complete

- Structural steel

for the first data center building (20MW) erected

- Substation area

prepared for upcoming delivery and installation of the 600MW

transformer and main power transformers

Corporate update

Strategic update

On December 6, the Company provided an investor

update – “Everything changes, everything remains the same” – in

respect of its positioning, go-forward opportunities, and strategic

priorities.

Key takeaways included:

- Risk-focused

approach positions the Company to weather the storm and capitalize

on the next bull run

- Liquidity (as of

month end)

- $47 million cash,

no debt4

- $21 million

estimated net capex spend to achieve 180MW5

- $75 million

remaining Bitmain prepayments

- $100 million

unutilized under B. Riley equity facility6

- Potential

monetization of assets through miner sales (2.4 EH/s down to 2.0

EH/s7)

- Opportunities

- Significant

optionality from 180MW real assets platform (e.g. self-mining or

hosting)

- Focus on expanding

self-mining capacity to 5.4 EH/s

- Potential

additional expansion from 20MW to 600MW at Childress

The webcast and the Company’s latest investor

presentation are available on the Company’s website here:

https://investors.irisenergy.co/events-and-presentations

Corporate, financial and operational updates

On November 21, the Company provided a corporate

update and announced certain preliminary financial information and

operational updates for the three months ended September 30, 2022,

as well as certain additional preliminary financial information

with respect to the month of October 2022.

The update can be accessed via the following

link: https://investors.irisenergy.co/node/7706/html

Canal Flats update (0.8 EH/s, 30MW) –

BC, Canada

Canal Flats has been powered by 100% renewable

energy since inception10.

The project achieved average monthly operating

hashrate of 570 PH/s in November (0.8 EH/s of capacity)11.

Mackenzie update (2.5 EH/s, 80MW) – BC,

Canada

Mackenzie has been powered by 100% renewable

energy since inception10.

The project achieved average monthly operating

hashrate of 268 PH/s in November (2.5 EH/s of capacity)11.

Expansion from 50MW to 80MW was energized on

December 6, 2022, three weeks ahead of schedule, and will utilize

the remaining 10MW of the third data center building (20MW) and a

fourth data center building (20MW) with both internal fit-outs

complete.

Prince George update (1.4 EH/s, 50MW) –

BC, Canada

Prince George has been powered by 100% renewable

energy since inception10.

The project achieved average monthly operating

hashrate of 607 PH/s in November (1.4 EH/s of capacity)11.

Childress update (0.7 EH/s, 20MW) –

Texas, USA

Foundations and earthworks for the substation

were completed during the month. Structural steel for the first

data center building (20MW) was erected as earthworks, and the

substation area is prepared for the upcoming delivery and

installation of the 600MW transformer and main power

transformers.

Key civil, data center building, substation, and

electrical contractors continue to progress construction activities

and are being managed by a core group of Iris Energy employees

based in Childress.

Approximately $18 million in previous deposits

with AEP Texas are expected to be refunded following energization

at Childress.

Community engagement

In November 2022, Iris Energy sponsored the

Windermere Valley Saddle Club, a non-profit horse club that aims to

encourage and educate the youth of the Canal Flats Valley about

horsemanship. In Mackenzie, Iris Energy team members honoured those

who have served by laying a wreath in the Remembrance Day

ceremony.

Future development sites

Development works continued across additional

sites in Canada, the USA and Asia-Pacific, which have the potential

to support up to an additional >1GW of aggregate power capacity

capable of powering growth beyond the Company’s 795MW of announced

power capacity.

Operating and financial results

Daily average operating hashrate chart is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6fd0c6a-86ce-4529-b3d8-d5eaeb2b997c

Technical commentary

The Company’s average operating hashrate was 1,445 PH/s in

November 2022 (compared to 3,899 PH/s in October8), with the

decrease primarily attributable to the termination of hosting

arrangements during the month in connection with certain of the

Company’s limited recourse equipment financing facilities as

described above9. The corresponding decrease in Bitcoin mined (151

vs. 448 in October) and electricity costs ($1.9 million vs. $4.2

million in October8) were also primarily attributable to the

termination of these hosting arrangements.

The energization of the 30MW expansion at Mackenzie ahead of

schedule, increases the Company’s total available data center

capacity to 160MW, capable of powering approximately 4.7 EH/s of

miners (via self-mining and/or hosting).

The increase in the Company’s unadjusted

electricity costs per Bitcoin mined ($12.6k vs. $10.2k adj vs.

$9.3k in October8) was primarily driven by excess demand charges

attributable to average unutilized power capacity (due to

termination of relevant hosting arrangements as described above) as

well as the increase in the average difficulty-implied global

hashrate during the period.

|

Operating |

Sep-22 |

Oct-22 |

Nov-22 |

|

Renewable energy usage

(MW)12* |

84 |

123 |

46 |

|

Avg operating hashrate (PH/s)8* |

2,679 |

3,899 |

1,445 |

|

Financial (unaudited)2 |

Sep-22 |

Oct-22 |

Nov-22 |

|

Bitcoin mined |

325 |

448 |

151 |

|

Mining revenue (US$’000) |

6,224 |

8,785 |

2,871 |

|

Electricity costs (US$’000)8* |

2,737 |

4,167 |

1,905 |

|

Revenue per Bitcoin (US$) |

19,124 |

19,591 |

18,955 |

|

Electricity costs per Bitcoin (US$)8* |

8,410 |

9,293 |

12,581 (10,128 adj)3 |

* Restated – see section ‘Restatement of prior

period metrics’ for further details.

Restatement of prior period metrics

The Company has refined its methodology for calculating

electricity costs and monthly average operating hashrate to align

with the respective reported Bitcoin mined each month by one day as

a result of time zones and mining pool payout timing.

Please see below for the restated average operating

hashrate.

|

2022 |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

|

Avg operating hashrate (PH/s) – restated |

802 |

844 |

849 |

1,028 |

1,165 |

1,164 |

1,120 |

2,162 |

2,679 |

3,899 |

1,445 |

|

BTC mined – unchanged |

126 |

110 |

121 |

137 |

151 |

148 |

154 |

301 |

325 |

448 |

151* |

* Under the previous methodology, Bitcoin mined divided by

average operating hashrate (1.347 EH/s) would have been ~112 for

November (vs. ~105 under the restated methodology).

|

Miner Shipping Schedule* |

Hardware |

Units |

EH/s(incremental) |

EH/s(cumulative) |

|

Operating (as of December 12)** |

S19j Pro13 |

12,042 |

1.1 |

1.1 |

|

Inventory – in transit and/or pending deployment*** |

S19j Pro14 |

9,223 |

0.9 |

0.9 |

|

Total |

|

21,265 |

2.0 |

2.0 |

* Excludes ~3.6 EH/s of miners securing

equipment financing facilities with two of the Company’s three SPV

borrowers in respect of which the Company has received a notice of

acceleration from the relevant lender, none of which have been

operating following termination of relevant hosting arrangements

during the month as described above. Approximately $103.4m

aggregate principal amount of loans are outstanding under such

facilities as of October 31, 2022. See the Company's Report on Form

6-K filed on November 21, 2022 for further information.** Includes

~0.2 EH/s of miners securing the limited recourse equipment

financing facility with the Company’s third SPV borrower in respect

of which the Company has received a notice of acceleration from the

relevant lender. Approximately $1m aggregate principal amount of

loans are outstanding under such facility as of November 30, 2022.

See the Company's Report on Form 6-K filed on November 21, 2022 for

further information.*** Excludes ~0.4 EH/s of miners in transit

and/or pending deployment for which the Company is currently

finalizing monetization transactions. There can be no assurance as

to the timing or terms of any such transaction, or whether any such

transaction will be consummated at all.

|

Site |

Capacity (MW) |

Capacity(EH/s)15 |

Timing |

Status |

|

Canal Flats (BC, Canada) |

30 |

0.8 |

Complete |

Operating |

|

Mackenzie (BC, Canada) |

50 |

1.5 |

Complete |

Operating |

|

30 |

1.0 |

Complete |

Energized |

|

Prince George (BC, Canada) |

50 |

1.4 |

Complete |

Operating |

|

Total (BC, Canada) |

160 |

4.7 |

|

|

|

Childress (Texas, US) |

20 |

0.7 |

2023 |

Under construction16 |

|

Total (Canada & USA) |

180 |

5.4 |

|

|

About Iris Energy

Iris Energy is a sustainable Bitcoin mining

company that supports the decarbonization of energy markets and the

global Bitcoin network.

- 100% renewables:

Iris Energy targets markets with low-cost, under-utilized renewable

energy, and where the Company can support local communities

- Long-term security

over infrastructure, land and power supply: Iris Energy builds,

owns and operates its electrical infrastructure and proprietary

data centers, providing long-term security and operational control

over its assets

- Seasoned management

team: Iris Energy’s team has an impressive track record of success

across energy, infrastructure, renewables, finance, digital assets

and data centers with cumulative experience in delivering >$25bn

in energy and infrastructure projects globally

Forward-Looking Statements

This investor update includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or Iris Energy’s future financial or operating

performance. For example, forward-looking statements include but

are not limited to, the Company’s expected power capacity and

operating capacity, and the impact of an event of default and/or

acceleration of amounts due under limited recourse equipment

financing arrangements in the Company’s special purpose vehicles.

In some cases, you can identify forward-looking statements by

terminology such as “anticipate,” “believe,” “may,” “can,”

“should,” “could,” “might,” “plan,” “possible,” ”project,”

“strive,” “budget,” “forecast,” “expect,” “intend,” “target”,

“will,” “estimate,” “predict,” “potential,” “continue”, ”scheduled”

or the negatives of these terms or variations of them or similar

terminology, but the absence of these words does not mean that

statement is not forward-looking. Such forward-looking statements

are subject to risks, uncertainties, and other factors which could

cause actual results to differ materially from those expressed or

implied by such forward looking statements. In addition, any

statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking.

These forward-looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

Iris Energy’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to: Iris Energy’s limited

operating history with operating losses; electricity outage,

limitation of electricity supply or increase in electricity costs;

long term outage or limitation of the internet connection at Iris

Energy’s sites; any critical failure of key electrical or data

center equipment; serial defects or underperformance with respect

to Iris Energy’s equipment; failure of suppliers to perform under

the relevant supply contracts for equipment that has already been

procured which may delay Iris Energy’s expansion plans; supply

chain and logistics issues for Iris Energy or Iris Energy’s

suppliers; cancellation or withdrawal of required operating and

other permits and licenses; customary risks in developing

greenfield infrastructure projects; Iris Energy’s evolving business

model and strategy; Iris Energy’s ability to successfully manage

its growth; Iris Energy’s ability to raise additional financing

(whether because of the conditions of the markets, Iris Energy’s

financial condition or otherwise) on a timely basis, or at all,

which could adversely impact the Company’s ability to meet its

capital commitments (including payments due under its hardware

purchase contracts with Bitmain) and the Company’s growth plans;

Iris Energy’s failure to make certain payments due under any one of

its hardware purchase contracts with Bitmain on a timely basis

could result in liquidated damages, claims for specific performance

or other claims against Iris Energy, any of which could result in a

loss of all or a portion of any prepayments or deposits made under

the relevant contract or other liabilities in respect of the

relevant contract, and could also result in Iris Energy not

receiving certain discounts under the relevant contract or

receiving the relevant hardware at all, any of which could

adversely impact its business, operating expansion plans, financial

condition, cash flows and results of operations; the failure of

Iris Energy’s wholly-owned special purpose vehicles to make

required payments of principal and/or interest under their limited

recourse equipment financing arrangements when due or otherwise

comply with the terms thereof, as a result of which the lender

thereunder has declared the entire principal amount of each loan to

be immediately due and payable, and while no assurance can be

provided as to what actions may be taken, we expect such lender

will take steps to enforce the indebtedness and its rights in the

Bitcoin miners with respect to certain of such loans (and

potentially all such loans) and other assets securing such loans,

which would result in the loss of the relevant Bitcoin miners

securing such loans and materially reduce the Company’s operating

capacity, and could also lead to bankruptcy or liquidation of the

relevant special purpose vehicles, and materially and adversely

impact the Company’s business, operating expansion plans, financial

condition, cash flows and results of operations; the terms of any

additional financing or any refinancing, restructuring or

modification to the terms of any existing financing, which could be

less favorable or require Iris Energy to comply with more onerous

covenants or restrictions, any of which could restrict its business

operations and adversely impact its financial condition, cash flows

and results of operations; competition; Bitcoin prices, global

hashrate and the market value of Bitcoin miners, any of which could

adversely impact the Company’s financial condition, cashflows and

results of operations, as well as its ability to raise additional

financing and the ability of its wholly-owned special purpose

vehicles to make required payments of principal and/or interest on

their equipment financing facilities; risks related to health

pandemics including those of COVID-19; changes in regulation of

digital assets; and other important factors discussed under the

caption “Risk Factors” in Iris Energy’s Annual Report on Form 20-F

for the fiscal year ended June 30, 2022 filed with the SEC on

September 13, 2022, as such factors may be updated from time to

time in its other filings with the SEC, accessible on the SEC’s

website at www.sec.gov and the Investor Relations section of Iris

Energy’s website at https://investors.irisenergy.co.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this investor update. Any

forward-looking statement that Iris Energy makes in this investor

update speaks only as of the date of such statement. Except as

required by law, Iris Energy disclaims any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Preliminary Financial

Information

The preliminary financial information for the

month of November 2022 included in this investor update is not

subject to the same closing procedures as our unaudited quarterly

financial results and has not been reviewed by our independent

registered public accounting firm. The preliminary financial

information included in this investor update does not represent a

comprehensive statement of our financial results or financial

position and should not be viewed as a substitute for unaudited

financial statements prepared in accordance with International

Financial Reporting Standards. Accordingly, you should not place

undue reliance on the preliminary financial information included in

this investor update.

Contacts

MediaJon SnowballDomestique+61 477 946 068

InvestorsLincoln TanIris Energy+61 407 423

395lincoln.tan@irisenergy.co

To keep updated on Iris Energy’s news releases and SEC filings,

please subscribe to email alerts at

https://investors.irisenergy.co/ir-resources/email-alerts.

_____________________

1 All timing references in this investor update are to calendar

quarters and calendar years, in each case unless otherwise

specified.2 Bitcoin and Bitcoin mined in this investor update are

presented in accordance with our revenue recognition policy which

is determined on a Bitcoin received basis (post deduction of mining

pool fees as applicable). 3 The increase in the Company’s

unadjusted electricity costs per Bitcoin mined ($12.6k vs. $10.2k

adj vs. $9.3k in October) was primarily driven by excess demand

charges attributable to average unutilized power capacity (due to

termination of hosting arrangements in connection with certain of

the Group’s limited recourse equipment financing facilities) as

well as the increase in the average difficulty-implied global

hashrate during the period. The adjusted electricity costs per

Bitcoin mined ($10.2k) excludes such excess demand charges (i.e.

assumes unit electricity costs of ~$0.046/kWh).4 Reflects USD

equivalent, unaudited preliminary cash balance as of November 30,

2022 (excluding cash held by the two relevant SPV borrowers).

Reflects acceleration of outstanding loans under two of the Group's

three outstanding limited recourse equipment financing facilities

and assumes foreclosure by the lender thereunder against the

collateral securing such facilities held by the applicable

non-recourse SPV borrowers, and also assumes repayment by the Group

on behalf of the applicable SPV borrower of $1m of outstanding

loans under the Group's third limited recourse equipment financing

facility. See the Company's Report on Form 6-K filed on November

21, 2022 for further information. Following such acceleration and

foreclosure, and such repayment, as applicable, the Group would not

have any indebtedness for borrowed money outstanding.5 Indicative

estimated remaining net capital expenditure to build out 180MW of

infrastructure and repay $1m of outstanding loans under the Group’s

third limited recourse equipment financing facility (net of

anticipated proceeds from hardware sales and anticipated tax and

deposit refunds). Excludes impact of all other potential future

cash movements (e.g. operating cashflows and financing cashflows).6

Subject to market conditions and regulatory approvals.7 Comprises

~1.1 EH/s of miners in operation as of December 12 (including ~0.2

EH/s of miners securing the facility with the Company’s third

limited recourse equipment financing facility in respect of which

the Company has received a notice of acceleration as described in

the Company's Report on Form 6-K filed on November 21, 2022) and

~0.9 EH/s of miners in transit and/or pending deployment. The

Company is currently finalizing monetization transactions with

respect to ~0.4 EH/s of miners which are in transit and/or pending

deployment. There can be no assurance as to the timing or terms of

any such transaction, or whether any such transaction will be

consummated at all.8 Certain metrics reported for prior periods

have been restated in this investor update to reflect refined

methodology. See section ‘Restatement of prior period metrics’ for

further details.9 Refer to the Company’s announcements on November

7, 2022 and November 21, 2022.10 Currently approximately 97%

directly from renewable energy sources; approximately 3% from

purchase of RECs.11 However figures are post impact of termination

of hosting arrangements associated with certain of the Company’s

limited recourse equipment financing facilities as described

above.12 Comprises actual power usage for Canal Flats, Mackenzie

and Prince George.13 Includes mix of lower efficiency hardware,

which is estimated to represent less than 10% of the operating 1.1

EH/s.14 Includes mix of lower efficiency hardware, which is

estimated to represent less than 4% of miners in transit and/or

pending deployment.15 Reflects estimated hashrate capacity by site

assuming full utilization of available data center capacity with

additional Bitmain S19j Pro miners.16 Decisions around how much,

and when, data center capacity above an initial 20MW will be built

at Childress are being assessed.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/62b18a9d-4dbb-457e-ba5a-47d5d72f41b3

https://www.globenewswire.com/NewsRoom/AttachmentNg/2014ef4e-f053-47dc-98f8-0f53d2b9cd97

https://www.globenewswire.com/NewsRoom/AttachmentNg/0be1738e-84bf-494d-9384-9a0ac8b9f120

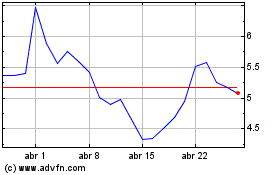

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024