Unisync Corp. (“Unisync") (TSX:"UNI")

(OTCQX:“USYNF”) announces its audited financial results for the

fourth quarter and fiscal year ended September 30, 2022. Unisync

operates through two business units: Unisync Group Limited (“UGL”)

with operations throughout Canada and the USA and 90% owned

Peerless Garments LP (“Peerless”), a domestic manufacturing

operation based in Winnipeg, Manitoba. UGL is a leading

customer-focused provider of corporate apparel, serving many

leading Canadian and American iconic brands. Peerless specializes

in the production and distribution of highly technical protective

garments, military operational clothing and accessories for a broad

spectrum of Federal, Provincial and Municipal government

departments and agencies.

Results for Fiscal 2022 versus Fiscal

2021

Revenue for the year ended September 30, 2022 of

$96.3 million increased by $10.0 million or 12% from the prior year

due on a $12.5 million revenue improvement in the UGL segment less

a $3.0 million revenue decrease in the Peerless segment plus a $0.5

million decrease in intersegment sales eliminations. UGL segment

revenue of $81.4 million accelerated by 18% over the prior year on

a $17.0 million or 118% improvement in sales to the segment’s

airline accounts, expanded product line sales to a leading Canadian

quick service restaurant chain, less a $7.1 million decline in

personal protective equipment (“PPE”) sales to a Canadian

government entity. The dramatic increase in sales to the Company’s

airline accounts was caused by the post pandemic rebound in the

airline industry where staffing levels have surged above

pre-pandemic levels to compensate for flight delays and employee

absences and also included the impact of a new uniform rollout for

WestJet employees which was shipped from June to September 2022.

Sales volumes during new uniform rollouts are typically three times

that of normal steady state replenishment levels of uniform

sales.

Although Fiscal 2022 consolidated revenues were

$10 million higher than Fiscal 2021, the top line was plagued by an

unexpected additional wave of COVID followed by major delays in the

receipt of offshore containers that saw some product order lead

times increase from four months to six or more months. At the same

time, airline demand soared back during the latter half of Fiscal

2022 requiring a massive hiring program that produced a rapid

increase in demand for uniforms coupled with reduced allocation

quantities to ensure they could dress new hires. These reduced

allocations per employee didn’t get re-instated until recently. As

a result, our number of orders shipped almost doubled but the per

order dollar values dropped significantly. In turn, more inventory

had to be ordered and maintained to accommodate the longer order

lead times. This combination of events plus the onboarding of new

accounts, created a bottleneck in our distribution facility in

Guelph which further slowed our stocking, picking and shipping

efforts.

The net affect was a massive build-up in the

backlog of open orders which amounted to $14.7 million by the end

of October, which is 4x our normal pre-pandemic levels, and an

unprecedented increase in inventory on hand and in transit to $56.2

million at year end – up from $36.2 million at the same time last

year and $49.3 million on June 30, 2022. The inventory in-transit

amounted to $5.4 million as of September 30, 2022 and had increased

by $4.3 million from $1 million as at the previous month

end. We expect that inventory will remain at higher than

normal levels for another 3-4 months.

The revenue decrease in the Peerless segment to

$15.4 million was caused by the non-reoccurrence of PPE sales to

the Department of National Defence (“DND”) and to the Government of

Manitoba in 2022.

Gross profit of $19.5 million climbed by $3.7

million or 23% year over year and to 20.3% of revenue from 18.3% of

revenue in the prior year on the change in customer and product mix

as well as greater absorption of fixed costs on the increase in

revenue. As a result of the higher margin mix of sales and fixed

cost leverage on the higher volume of sales experienced in the UGL

segment, a gross profit of $16.6 million or 20% of segment revenue

was achieved compared to $12.2 million or 18% of segment revenue in

the prior fiscal year. The Peerless segment recorded gross profit

of $3.4 million in fiscal 2022, down $0.6 million or 15% from the

previous year on the reduced level of revenue but the segment’s

gross profit margin improved to 22% of segment revenue from 20% in

the prior fiscal year on account of the higher margin product mix

of sales in the current year.

At $18.6 million or 19.2% of revenue, general

and administrative expenses increased by $2.1 million or by 13% for

the year ended September 30, 2022 against $16.4 million or 19.1% of

revenue in the year before. The absolute increase in expenses

occurred in the UGL segment where the rebound in airline sales and

the addition of new accounts necessitated additional customer

service personnel with a $1.0 million rise in wages. Employee

benefits and recruitment costs rose $0.5 million with the increase

in warehouse and customer service staff during tight labour market

conditions for such personnel while data services, system

maintenance, telecommunications and software licenses rose $0.4

million due to a greater number of users on the fully deployed ERP

system and due to IT security improvements.

Total interest expense of $1.7 million for the

year ended September 30, 2022 decreased by $0.5 million from the

prior year on account of the repayment of $4.5 million in bank

postponed shareholder advances and accrued interest and fees in

late fiscal 2021 with funds received from mortgage loan advances

totalling $10.0 million. In fiscal 2022, the Company incurred

interest of $0.4 million on the mortgage loans at a lower fixed

interest rate of 4.1% compared to $0.8 million in fiscal 2021 on

the high interest bank postponed shareholder advances.

On a consolidated basis the Company reported a

net loss of $1.3 million for the year ended September 30, 2022

against a loss of $2.6 million in the year before. Cash flow from

operations, before non-cash working capital items and distributions

to minority partner, was $4.8 million compared to $3.0 million for

the year ended September 30, 2021.

Following the corporate restructure to a more

focused leadership team announced on Feb 25, 2022 and the

subsequent decision to withdraw our bid for the large DND

operational clothing project, the Company terminated a number of

redundant management positions. These positions represent a $1.46

million reduction in ongoing annual base compensation expense in

the Canadian operations of UGL. The above net loss for fiscal 2022

was after expensing $1.43 million in non-recurring salary, bonus

and severance expense related to this restructuring.

Results for Q4 2022 versus Q4

2021

Revenue for the three months ended September 30,

2022 of $25.3 million increased by $5.9 million or 27% over the

three months ended September 30, 2021 as revenue jumped $6.6

million or 41% in the UGL segment, while revenue fell $0.5 million

or 15% in the Peerless segment and intersegment sales were up $0.2

million. The rise in fourth quarter 2022 UGL segment revenue to

$22.6 million was attributed to airline customer sector revenue

growth of $5.5 million or 118% over the 4th quarter a year ago,

expanded product line sales to a leading Canadian quick service

restaurant chain and an uptick in sales volumes from hospitality

industry customers in the United States, while PPE sales were down

by $1.7 million from the same quarter last year. The decrease in

the Peerless segment revenue to $2.9 million in the current quarter

was due to a reduction in PPE product sales.

Gross profit for the three months ended

September 30, 2022 of $5.6 million or 22% of revenue grew by $2.9

million and increased from 14% of revenue in the same period last

year on account of the higher margin mix of sales and fixed cost

leverage on the greater volume of sales. The UGL segment recorded

gross profit of $4.9 million or 22% of segment revenue compared to

$2.0 million or 12% of segment revenue in the same quarter of the

prior fiscal year. The Peerless segment recorded gross profit of

$0.7 million or 25% of segment revenue in the fourth quarter of

fiscal 2022 against $0.8 million or 22% of segment revenue in the

same quarter of the prior fiscal year.

At $5.2 million, total general and

administrative expenses for the three months ended September 30,

2022 were up $1.4 million or 36% from the three months ended

September 30, 2021 primarily because of increases in the UGL

segment of $0.4 million in cost of living related employee pay

adjustments, of $0.3 million in customer service staff additions,

$0.2 million in employee severance accruals and $0.1 million in

employee benefits and recruitment costs.

The Company’s reported a net loss of $0.5

million in the quarter ended September 30, 2022 compared to a net

loss of $1.5 million in the same quarter last year for the reasons

cited above. Cash flow from operations, before non-cash working

capital items and distributions to minority partner, was $1.1

million for the three months ended September 30, 2022 versus

negative $0.4 million for the three-month period ended September

30, 2021

More detailed information is contained in the

Company’s Consolidated Financial Statements for the fiscal year

ended September 30, 2022 and Management Discussion and Analysis

dated December 28, 2022 which may be accessed at www.sedar.com.

Business Outlook

The Company’s North American airline accounts

are experiencing increased demand and have returned to pre-pandemic

passenger volumes in 2022. The Company expects that this will

continue to cause a strong increase in uniform sales to its airline

accounts and when complimented by recent new account additions,

will result in an improving revenue and profitability picture.

Recently the flow of offshore ocean shipments has begun to improve,

and the costs of container shipments has declined from the inflated

levels experienced during the pandemic. The Company believes that

these trends will allow it to reduce its order backlog and to right

size the quantity of uniform products held in its distribution

centres over the coming months.

In addition to the reduction in ongoing

administrative costs, the above referenced strategic restructuring

has allowed our key executives to concentrate on our core business

and more actively pursue larger managed workwear opportunities. As

part of this restructuring, Unisync concluded the sale of our New

Jersey based business unit in December for US$1.5 million. This

business sector operated fairly independently as Red The Uniform

Taylor which specialized in the design and sub-contracted domestic

production of one-off custom specialty garments.

Unisync remains committed and focused on its

expansion and growth into the US market. After efforts initiated

this past year, UGL has been shortlisted and entered into advanced

discussions with a number of upcoming major corporate image wear

programs totalling close to US$100 million annually. Additionally,

UGL has been added as an approved supplier to an extensive list of

major customers that are also scheduled to come to market during

the 2023 calendar year. With the previously announced hiring of a

seasoned VP Strategy and Business Development leading the US

expansion and UGL’s strong reputation and customer references, the

Company is expecting that these new opportunities will have a

significant impact on future revenue growth and profitability.

On Behalf of the Board of Directors

Douglas GoodExecutive Chairman

Investor relations

contact:Douglas F Good, Executive Chairman at 778-370-1725

Email: dgood@unisyncgroup.com

Forward Looking StatementsThis news release may

contain forward-looking statements that involve known and unknown

risk and uncertainties that may cause the Company’s actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied in

these forward-looking statements. Any forward-looking statements

contained herein are made as of the date of this news release and

are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company undertakes no

obligation to publicly update or revise any such forward-looking

statements to reflect any change in its expectations or in events,

conditions or circumstances on which any such forward-looking

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the

forward-looking statements. Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

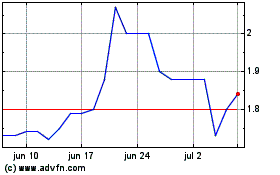

Unisync (TSX:UNI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Unisync (TSX:UNI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024