STEP Energy Services Ltd. (the “Company” or “STEP”) is pleased to

provide an update on its approved 2023 capital spending plan

against a backdrop of continued progress on debt reduction. STEP

also announces an update to fourth quarter 2022 activity levels as

well as an outlook for a very strong first quarter of 2023.

“STEP has just completed the best year in its

corporate history as measured by revenues and Adjusted EBITDA. Our

professionals and equipment were ready for the increased demand

from our clients and I’m extremely proud of how STEP and the North

American oil and gas industry contributed to global energy

security,” said Steve Glanville, President, and CEO. “We look

forward to 2023 with a lot of confidence in our future and it shows

in our approved 2023 capital budget. We will continue to invest in

our fracturing and coiled tubing fleet to make it highly relevant

to our North American clients. We will finish the upgrade of our

first Tier 4 dual-fuel fleet, which has been backed by a unique

financial commitment from a leading E&P client; given the

excellent progress in lowering our net debt levels we also expanded

our 2023 capital program to include an additional $45 million for

optimization and refurbishment projects.”

Balance Sheet Update and Capital

Spending Program for 2023

STEP’s balance sheet continues to strengthen.

Net debt is expected to end the year in the $140-$145 million

range1 – well ahead of internal targets set earlier in the year.

The internal targets also included a Funded Debt to Adjusted Bank

EBITDA ratio of less than 1.0x, which was achieved in the third

quarter of 2022. STEP has paid down approximately $45 million in

2022, and nearly $170 million of long-term debt since 2018, while

retaining a well-maintained fracturing and deep coiled tubing fleet

throughout North America. Even through the deep activity downturn

from 2015 to 2020, STEP was one of the few in its North American

pressure pumping peer group to continue spending enough capital to

approximately equal its rate of depreciation.

STEP’s Board of Directors has approved a $45

million increase in the 2023 capital program, bringing the total

2023 capital budget to approximately $100 million. The additional

capital was approved for projects that are expected to bring

incremental margin through improved reliability and/or efficiency

to STEP’s current operations. The total sustaining and optimization

budget will be split approximately 60/40 between the U.S. and

Canada.

Looking ahead to 2023, free cash flow will be

used to continue to strengthen the balance sheet as well invest

opportunistically to add greater size and/or efficiency in both of

STEP’s major business lines.

_____________________________1 Net debt is a

non-IFRS financial measure that is not defined and has not

standardized meaning under IFRS. See Non-IFRS Measures. Estimated

December 31, 2022 results are preliminary and have not been audited

or reviewed by the Company’s auditors. See Forward-Looking

Information & Statements, Future Oriented Financial Information

and Financial Outlooks.

Fourth Quarter 2022 Activity Update and

First Quarter 2023 Update

STEP’s fourth quarter activity levels in Canada

were sequentially lower from the third quarter of 2022, affected by

year end budget exhaustion along with cold weather that resulted in

some work getting pushed into the first quarter of 2023. U.S.

fourth quarter activity levels were sequentially higher than third

quarter activity, with utilization staying steady before slowing

down towards the holidays in December.

The first quarter of 2023 is expected to see

high levels of utilization in Canada and the U.S. The Company

anticipates that its five Canadian and three U.S. fracturing fleets

will be fully booked through the quarter. STEP expects the Canadian

market to shift from an oversupplied position in the fourth quarter

of 2022 to a more balanced position in the first quarter of 2023,

demonstrating that the current complement of crewed equipment in

the basin is sufficient to meet peak demand and that additional

fracturing capacity is not needed in this market. The strong fourth

quarter coiled tubing activity is expected to continue into the

first quarter of 2023 and STEP expects to operate nine and twelve

coiled tubing units in Canada and the U.S., respectively. STEP’s 21

active units make it one of the largest deep coiled tubing

providers in North America.

High utilization in both fracturing and coiled

tubing is expected to keep strong pricing tension in the respective

markets, with a positive effect on sequential operating margins

expected in both Canada and the U.S. Cost inflation remains a

concern, particularly around proppant, wages and equipment related

items. STEP has secured the inputs needed for its upcoming work

scope in Canada and the U.S. and will continue to work with its

supply chain and clients to manage the effects of inflation,

passing on cost increases as needed.

Visibility into the second quarter and second

half is limited, but the Company is encouraged at the longer-term

opportunity that U.S. and Canadian LNG project development may

present for its full North American operations. Canada is expected

to see a step-up in field spending starting in mid to late 2023 as

the launch of trains 1 and 2 of the LNG Canada project comes into

view. On the U.S. side, a recent study by Rystad Energy forecast

that 56% of global incremental LNG capacity would originate in the

U.S. STEP’s southern U.S. footprint puts the Company in a very good

position to benefit from this multi-year spending trajectory.

Non-IFRS Measures

This press release includes terms and

performance measures commonly used in the oilfield services

industry that are not defined under IFRS. The terms presented are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These non-IFRS

measures have no standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other issuers.

The non-IFRS measure should be read in conjunction with the

Company’s quarterly financial statements and annual financial

statements and the accompanying notes thereto.

“Net debt” is equal to loans and borrowings

before deferred financing charges less cash and cash equivalents

and CCS derivatives. Net debt is presented to provide additional

information about items on the statement of financial position. The

Company’s Net debt for the year ended December 31, 2022 is

forward-looking in nature. The following table presents the

equivalent historical composition of the Company’s Net debt as at

September 30, 2022, which composition does not differ significantly

from the composition of the Company’s Net debt as at December 31,

2022 other than the change in loans and borrowings as discussed in

this press release:

|

($000s) |

|

September 30, |

|

December 31, |

|

|

|

|

|

2022 |

|

|

2021 |

|

|

Loans and borrowings |

|

$ |

153,148 |

|

$ |

189,957 |

|

|

Add back: Deferred financing costs |

|

|

2,977 |

|

|

626 |

|

|

Less: Cash and cash equivalents |

|

|

(1,756 |

) |

|

(3,698 |

) |

|

Less: CCS Derivatives Asset |

|

|

(6,831 |

) |

|

- |

|

|

Net debt |

|

$ |

147,538 |

|

$ |

186,885 |

|

Forward-Looking Information & Statements, Future

Oriented Financial Information and Financial Outlooks

Certain statements contained in this press

release constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”). These statements

relate to the expectations of management about future events,

results of operations and the Company’s future performance (both

operational and financial) and business prospects. All statements

other than statements of historical fact are forward-looking

statements. The use of any of the words “anticipates”, “expects”,

“expected”, “opportunity”, “may”, “should”, and similar expressions

are intended to identify forward-looking statements. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. While STEP believes the expectations reflected in the

forward-looking statements included in this press release are

reasonable, such statements are not guarantees of future

performance or outcomes and may prove to be incorrect and should

not be unduly relied upon.

In particular, but without limitation, this

press release contains forward-looking statements pertaining to:

planned investments in the Company’s fracturing and coiled tubing

fleet, the completion of the upgrade of STEP’s first Tier 4

dual-fuel fleet, the expansion of the Company’s capital program and

intended use of capital program funds, the company’s expectations

for its new projects, including incremental margin through improved

reliability and/or efficiency to STEP’s current operations, the

geographic split of the Company’s sustaining and optimization

budget, the use of the Company’s free cash flow to strengthen its

balance sheet as well as grow/optimize business lines, utilization

levels in Canada and the U.S., the Company’s expectations for

Canadian fracturing capacity and demand, coiled tubing activity,

the number of coiled tubing units to be operated by the Company in

Canada and the U.S., pricing and operating margins in both Canada

and the U.S., the Company’s ability to manage its supply chain to

dampen effects of cost inflation, the Company’s expectations for

sand cost inflation, and requirements for forecasted work and the

potential opportunities arising from U.S. and Canadian LNG project

development, including additional field spending as a result of the

launch of trains 1 and 2 of LNG Canada and incremental LNG capacity

levels in the U.S.

The forward-looking information and statements

contained in this press release reflect several material factors

and expectations and assumptions of STEP including, without

limitation: the general continuance of current or, where

applicable, assumed industry conditions; the effect of inflation on

the cost of goods and equipment; the ability of suppliers to

complete the Tier 4 dual-fuel fleet upgrade process; the fulfilment

of STEP’s customers obligations under its contracts with the

Company; STEP’s ability to utilize its equipment; STEP’s ability to

collect on trade and other receivables; STEP’s ability to obtain

and retain qualified staff and equipment in a timely and cost

effective manner; levels of deployable equipment in the

marketplace; future capital expenditures to be made by STEP; future

funding sources for STEP’s capital program; STEP’s future debt

levels; and the availability of unused credit capacity on STEP’s

credit lines. STEP believes the material factors, expectations and

assumptions reflected in the forward-looking information and

statements are reasonable, but no assurance can be given that these

factors, expectations and assumptions will prove correct.

This press release also contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about STEP’s expected capital budget and the

Company’s expected year-end 2022 Net debt may also constitute FOFI.

The FOFI in this press release is subject to the same assumptions,

risk factors, limitations, and qualifications as set forth in the

above paragraphs.

In addition to the assumptions, risk factors,

limitations and qualifications described above, the estimated net

debt at December 31, 2022 is based on the Company’s internally

generated monthly financial statements for the month of December

2022 and the assumption that these internally generated monthly

financial statements will not differ materially from the fourth

quarter and year end 2022 financial information inherent in the

Company’s audited annual financial statements for the year ended

December 31, 2022.

The actual results of operations of STEP and the

resulting financial results, including the Company’s year-end 2022

Net debt, may vary from the amounts set forth in this press release

and such variation may be material. STEP and its management believe

that the FOFI has been prepared on a reasonable basis, reflecting

management's best estimates and judgments as of the date hereof;

however, because this information is subjective and subject to

numerous risks, it should not be relied on as necessarily

indicative of future results. The FOFI contained in this press

release is provided for the purpose of providing an update on the

Company’s 2023 capital budget and certain expected results for the

year ended December 31, 2022 prior to the completion and approval

of STEP’s audited financial statements for the year ended December

31, 2022. Readers are cautioned that any such FOFI contained herein

should not be used for any purposes other than those for which it

is disclosed herein.

The forward-looking information and FOFI

contained in this press release speak only as of the date of the

document, and none of STEP or its subsidiaries assumes any

obligation to publicly update or revise them to reflect new events

or circumstances, except as may be required pursuant to applicable

laws. Actual results could also differ materially from those

anticipated in these forward‐looking statements and FOFI due to the

risk factors set forth under the heading “Risk Factors” in STEP’s

Annual Information Form for the year ended December 31, 2021 dated

March 16, 2022 and under the heading “Risk Factors and Risk

Management” in STEP’s Management Discussion and Analysis for the

three and nine months ended September 30, 2022 dated as of November

2, 2022.

About STEP

STEP is an energy service company providing deep

capacity coiled tubing and hydraulic fracturing services to

operators in North America. In Canada, STEP delivers coiled tubing

and fracturing services in the Western Canadian Sedimentary Basin.

In the U.S., STEP provides coiled tubing and fracturing services in

the Permian Basin and Eagle Ford Shale Play in Texas along with

coiled tubing services in the Bakken Shale Play in North Dakota and

the Uinta-Piceance and Niobrara-DJ Basin in Utah and Colorado,

respectively. STEP delivers the expertise – the people, the

equipment, and the knowledge – required to improve operational

efficiencies and productivity in extended reach wellbore designs.

At the heart of STEP’s strategy is the company’s commitment to the

execution of safe projects, its dedication to its team of field

professionals and ultimately to providing oil and gas producers an

Exceptional Client Experience.

For more information please

contact:

|

Steve GlanvillePresident & Chief Operating Officer |

Klaas DeemterChief Financial Officer |

|

Telephone: 403-457-1772 |

Telephone: 403-457-1772 |

Email:

investor_relations@step-es.comWeb: www.stepenergyservices.com

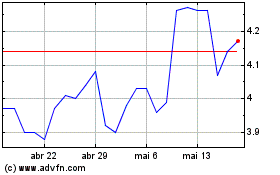

STEP Energy Services (TSX:STEP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

STEP Energy Services (TSX:STEP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024