Today, at the beginning of tax-season, Robinhood Markets, Inc.

(NASDAQ: HOOD) announced that Robinhood Retirement is now available

to all eligible customers. Robinhood Retirement, which launched via

waitlist in December, is the first and only IRA to offer a 1% match

for every eligible dollar contributed.

Since it was first announced, Robinhood has granted access to

more than 1 million people on the retirement waitlist. Many of

these customers are gig economy workers from the likes of DoorDash

and Uber, identify as self-employed, or are looking to save beyond

what’s provided by their employers including Amazon, FedEx,

Walmart, UPS, among others.

“A quiet crisis is brewing – one that faces

this and the next generation,” writes Baiju Bhatt, Robinhood

co-founder and chief creative officer. “Systems are failing to

catch up to the needs of how many people live and save (or don’t)…

We see an opportunity to be a part of the solution, to build

products that adapt to the way work and savings will evolve, and

ensure people have the tools to control their financial future –

just like the way we started.”

With Robinhood Retirement, customers are now able to open

multiple Robinhood brokerage accounts for the first time, and can

immediately start earning a 1% match from Robinhood on every

eligible contribution dollar.* Earnings can grow either tax-free or

tax-deferred, which means customers will save on taxes while saving

for their future – an added tax benefit even if they already have a

401k elsewhere. Customers can also:

- Select their IRA.

Choose to invest in stocks and ETFs through either a traditional

IRA or Roth IRA. To date nearly three quarters of customers have

opted for a Roth IRA over a traditional IRA.

- Invest on their own terms. Build a custom

portfolio through a tailored in-app recommendations experience,

choose their own investments, or both. Since launch, nearly half of

all funded accounts used the recommendations tool to get a custom

portfolio suggestion.

- IRA Instant Deposit

- Once a customer contributes, they will have instant

access to their funds to start investing, up to $1,000.

Customers can learn more by visiting robinhood.com/retirement,

or can get started by simply downloading or opening the Robinhood

app, navigating to the retirement tab on the home screen, and

signing-up.

Read more from Co-Founder Baiju Bhatt about the evolving savings

crisis and how it inspired the thinking behind Robinhood Retirement

HERE or BELOW.

One job to pay the bills, one to get ahead

A quiet crisis is brewing – one that faces this and the next

generation. Systems are failing to catch up to the needs of how

many people live and save (or don’t). While it’s most acute in

retirement, planning for the future feels increasingly out of reach

for the modern worker – we believe many are simply being left

behind.

For us, it’s a familiar feeling. During the height of Occupy

Wall Street and in the wake of the Great Financial Crisis, we saw

our friends – a younger generation of Americans – feel forgotten by

the financial system. And many Americans, in general, made tough

trade-offs while a financial system healed.

Inherent to our business is listening to customers. This past

summer, we traveled to Cincinnati, Ohio, amongst other places, to

ask people how they were doing. We met nurses, grocery store

workers, construction workers and even a geologist. They talked

about inflation at a 40-year high, and how it costs more to get by.

Many spoke openly about working more than one job to help overcome

the effects of inflation. Some picked up an extra job to earn a

little spending money. And some families needed multiple ways to

work and save to feel they had some control over their future. Life

changes, like divorce or assuming responsibility for aging loved

ones, were also reflected in conversations with people referencing

trying multiple tactics to earn additional income. Others just flat

out preferred working with independence to have the time to pursue

their passions. In short, a common thread is a shift from a single,

long-term job, with salary and benefits, to multiple jobs – be it

side hustles, gig jobs, or contract work.

While talking directly to people is foundational, history can

also teach a lot. The last bout of high inflation came in the

1970’s. It led to labor movements, and with it, the development and

adoption of retirement plans like the IRA and 401(k). They became a

way for companies to provide retirement savings for employees as

the world was shifting, much like it is today – and for those

without an employer-provided pension to save for retirement. It

worked for our parents' generation. The proliferation of 401(k)

plans and IRAs provided an opportunity for millions to save while

defined benefit plans (employer-provided pensions) declined. From

their first introduction, 401(k)s and similar plans grew from $200

billion in 1980 to $9 trillion today, while IRA assets grew from

$25 billion to $11 trillion over the same period.

The move towards multiple jobs, multiple careers, side hustles

and gig work is not just a fad. Rather, it’s a shift of proportions

much larger than people realize, and the reasons are both economic

and human. In a study by MBO Partners, 73% of those working

independently on a part time basis are doing it to supplement

income, particularly in light of inflation. In addition, 63% of the

workers surveyed said it was their choice to work independently. By

choice or by circumstance, the way people are earning a living is

changing.

Taking this further, the shift also means the way people are

employed won’t match up to the way they usually access benefits –

through a traditional employment structure. What happens then, if

important benefits are tied to a less prevalent single employer

lifestyle? Those benefits should follow you to any employer or

source of income, not be tied to a company.

We decided to do something about it.

Four weeks ago, we announced Robinhood Retirement - the first

and only IRA with a 1% match for every eligible dollar contributed

(terms and conditions apply). To date, more than 1 Million people

(and counting) are taking steps to fight for their futures. Many

are gig economy workers – Dashers, Uber drivers – or consider

themselves self-employed. Others are looking to save beyond what’s

already provided by employers such as Amazon, FedEx, Walmart, and

UPS.

In 2023, Robinhood remains a company fundamentally focused on

the unmet needs of the next generations. No matter how income is

earned, we believe the impact of providing long term savings

incentives are just as powerful today as they were for our parents'

generation. With elevated inflation, like in the late 1970’s, and

now historically high government debt, it’s clear that saving for

the future has become more important than ever. We see an

opportunity to be a part of the solution, to build products that

adapt to the way work and savings will evolve, and ensure people

have the tools to control their financial future – just like the

way we started.

Robinhood was founded by Baiju Bhatt and Vlad Tenev in 2013.

Robinhood's mission is to democratize finance for all. All

investments involve risk. IRA offered through Robinhood Financial

LLC (member sipc.org).

Disclosures *Other fees may apply. Match

limitations apply.

*Contributions must come from an external source and the match

is capped at the annual IRS limits for contributions. The customer

must keep the funds that earned the match in the account for at

least five years to avoid the possibility of a fee when withdrawn.

For more information, see the IRA Match FAQs.

Robinhood does not provide tax advice.

All investments involve risk and loss of principal is

possible.

Robinhood Financial LLC (member SIPC), is a registered broker

dealer. Robinhood Securities, LLC (member SIPC), is a registered

broker dealer and provides brokerage clearing services. All are

subsidiaries of Robinhood Markets, Inc. (‘Robinhood’).

© 2022 Robinhood Markets, Inc.

About RobinhoodRobinhood Markets is on a

mission to democratize finance for all. With Robinhood, people can

invest with no account minimums through Robinhood Financial LLC,

buy and sell crypto through Robinhood Crypto, LLC, spend, save, and

earn rewards through Robinhood Money, LLC, and learn about

investing through easy-to-understand educational content. Robinhood

uses the “Overview” tab of its Investor Relations website

(accessible at investors.robinhood.com/overview) and its blog,

Under the Hood (accessible at blog.robinhood.com), as means of

disclosing information to the public for purposes of the SEC’s

Regulation Fair Disclosure (Reg. FD). Investors should routinely

monitor those web pages, in addition to Robinhood’s press releases,

SEC filings, and public conference calls and webcasts, as

information posted on them could be deemed to be material

information. "Robinhood" and the Robinhood feather logo are

registered trademarks of Robinhood Markets, Inc.

ContactsMediapress@robinhood.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/aad342b7-82d9-43a4-b93c-080e55366280

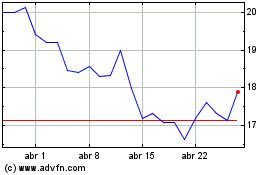

Robinhood Markets (NASDAQ:HOOD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Robinhood Markets (NASDAQ:HOOD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024