Blink Charging Announces Proposed Public Offering of Common Stock

06 Fevereiro 2023 - 6:14PM

Blink Charging Co. (the “Company” or “Blink”)

(Nasdaq: BLNK, BLNKW), a global leading manufacturer, owner,

operator and provider of electric vehicle (EV) charging equipment

and networked EV charging services, today announced that it intends

to offer and sell up to $75 million of shares of its common stock

in an underwritten registered public offering. All shares of common

stock to be sold in the proposed offering will be offered by the

Company. In connection with the offering, the Company also intends

to grant the underwriter a 30-day option to purchase up to an

additional 15% of the shares of common stock sold in the offering.

The proposed offering is subject to market and other conditions,

and there can be no assurance as to whether or when the offering

may be completed or as to the actual size or terms of the offering.

Blink intends to use the net proceeds from the

proposed offering to fund EV charging station deployments, to

finance the costs of acquiring or investing in competitive and

complementary businesses, products and technologies as a part of

its growth strategy, and for working capital and other general

corporate purposes.

Barclays is acting as the lead book-running

manager for the proposed offering.

The proposed offering is being made pursuant to

an effective shelf registration statement on Form S-3ASR (File No.

333-251919), including a base prospectus, filed with the U.S.

Securities and Exchange Commission (the “SEC”) on January 6, 2021.

This offering will be made only by means of a prospectus supplement

and the accompanying base prospectus which forms a part of the

effective shelf registration statement.

A preliminary prospectus supplement and

accompanying prospectus relating to and describing the terms of the

proposed offering have been filed with the SEC and may be obtained

by visiting the SEC’s website at www.sec.gov or by contacting

Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717, telephone: (888) 603-5847,

or by emailing barclaysprospectus@broadridge.com. The final terms

of the proposed offering will be disclosed in a final prospectus

supplement to be filed with the SEC.

This press release does not constitute an offer

to sell or solicitation of an offer to buy any securities in the

proposed offering. Nor shall there be any sale of these securities

in any state or jurisdiction in which such offering, solicitation

or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

About Blink Charging

Blink Charging Co. (Nasdaq: BLNK, BLNKW), a

leader in electric vehicle (EV) charging equipment, has sold or

deployed over 66,000 chargers, many of which are networked EV

charging stations, enabling EV drivers to easily charge at any of

Blink’s charging locations worldwide. Blink’s principal line of

products and services is its nationwide Blink EV charging networks

(the “Blink Networks”) and Blink EV charging equipment, also known

as electric vehicle supply equipment (“EVSE”), and other EV related

services, and the products and services of recent acquisitions,

including SemaConnect, EB Charging, Blue Corner and BlueLA.

Forward-Looking Statements

This press release contains forward-looking

statements as defined within Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These forward-looking statements and terms such

as “anticipate,” “expect,” “intend,” “may,” “will,” “should” or

other comparable terms involve risks and uncertainties because they

relate to events and depend on circumstances that will occur in the

future. Those statements include statements regarding the offer and

sale of shares, the terms of the offering, the intent, belief or

current expectations of Blink Charging and members of its

management, as well as the assumptions on which such statements are

based. Prospective investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, including those described

under the caption “Risk Factors” and elsewhere in the prospectus

relating to the offering, and in Blink Charging’s periodic reports

filed with the SEC, and that actual results may differ materially

from those contemplated by such forward-looking statements.

Additionally, Blink Charging makes no assurance that any public

offering of its shares of common stock as described herein will

occur at all, or that any such transaction will occur on the

timelines, in the manner or on the terms anticipated due to

numerous factors. Except as required by U.S. federal securities

law, Blink Charging undertakes no obligation to update or revise

forward-looking statements to reflect changed conditions.

Blink Investor Relations

Contact IR@BlinkCharging.com855-313-8187

Blink Media

Contact PR@BlinkCharging.com

Blink Charging (NASDAQ:BLNK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

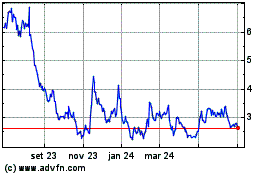

Blink Charging (NASDAQ:BLNK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024