Even though the US cannabis industry continues to make strides

toward legal acceptance, 2022 wasn’t a good year for most marijuana

stocks, primarily because cannabis companies have failed to turn

growth into profits. E-commerce solutions could dramatically impact

margins and lower customer acquisition costs.

With the increased adoption of e-commerce by dispensaries and

cannabis retailers, the legal marijuana market was valued at $17.50

billion in 2021 and is estimated to reach $80.1 billion by 2031,

growing at a CAGR of 16.9% from 2022 to 2031, according

to recent research. The main drivers for this expected growth

are growing consumer demand, increasing legalizations in various

countries and regions, and changing perceptions of cannabis use for

medicinal and recreational purposes, with adult use (recreational)

comprising 54.6% of the cannabis market.

Multichannel and omnichannel support let cannabis e-commerce

websites maintain consistency no matter how a customer interacts

with the brand. Creating a unified customer experience is

especially important given the requirement for cannabis brands to

operate across multiple channels, such as physical stores,

different branded e-commerce websites, and government-regulated

marketplaces. Privately held Leaflink is one of the leaders in

cannabis e-commerce. Leaflink has raised $479 million in funding

over eight rounds, with the latest round of $100 million having

closed on February 1, 2023.

Cannabis companies that could benefit from the future growth of

the cannabis market and e-commerce solutions include:

Tilray Brands, Inc. (NASDAQ: TLRY),

CannaPharmaRx (OTC Pink: CPMD),

Aurora Cannabis, Inc. (NASDAQ: ACB) and Canopy Growth Corporation

(NASDAQ: CGC).

Tilray Brands, Inc. (NASDAQ: TLRY) is a global

leader in cannabis research, cultivation, processing and

distribution. According to its website, Tilray is the first

GMP-certified medical cannabis producer to supply cannabis flower

and extract products to tens of thousands of patients, physicians,

pharmacies, hospitals, governments and researchers on five

continents.

For the second fiscal quarter ending November 30, 2022, Tilray's

gross profit rose to $40.1 million, a 22% increase, year over year,

while adjusted gross margin held at 29% compared to the year-ago

quarter. Tilray's gross profit on cannabis increased 37% to $18.6

million from $13.5 million in the prior year quarter, while the

gross margin percentage increased to 37% from 23%. Tilray had

adjusted EBITDA of $11.7 million, marking the 15th consecutive

quarter of positive adjusted EBITDA.

CannaPharmaRx (OTC Pink: CPMD) is focused on

acquiring and developing state-of-the-art cannabis grow facilities

in Canada. CannaPharmaRx recently announced it added to its revenue

stream by purchasing the e-commerce and financial platform LTB

Management. LTB has direct experience developing online website

applications for various customers, including medical cannabis

deliveries for pharmacies, distributors, and producers on an

international scale. According to a recent press release, this

acquisition will augment CannaPharmaRx's anticipated cannabis

sales, which the company expects to produce and deliver at an

annual run rate of nearly $30 million.

During 2023 CannaPharmaRx plans to further accelerate its

E-commerce applications. The company plans to complete its first

harvest during Q1 2023 and additional offtake agreements in

multiple countries.

Aurora Cannabis (NASDAQ: ACB) is an Edmonton,

Alberta-based cannabis company serving the medical and consumer

markets. Aurora's adult-use brand portfolio includes Aurora

Drift, San Rafael '71, Daily

Special, Whistler, Being, Greybeard, and CBD

brands, Reliva and KG7. Medical

cannabis brands include MedReleaf, CanniMed, Aurora, and

Whistler Medical Marijuana Co. Aurora also has a controlling

interest in Bevo Farms Ltd., North America's leading

supplier of propagated agricultural plants.

Aurora recently posted revenues of $50.95 million for its second

quarter that ended December 31, 2022, versus revenues of $48.07

million. The company had a quarterly loss of $0.14 per share versus

a loss of $0.42 per share a year ago. These figures are adjusted

for non-recurring items. The current consensus EPS estimate is

-$0.06 on $48.38 million in revenues for the coming quarter and

-$0.34 on $176.58 million in revenues for the current fiscal

year.

Canopy Growth Corporation (NASDAQ: CGC) is a

North American cannabis and consumer packaged goods company

focusing on premium and mainstream cannabis brands including Doja,

7ACRES, Tweed, and Deep Space. Its CPG portfolio features

sugar-free sports hydration brand BioSteel, targeted 24-hour

skincare and wellness solutions from This Works, gourmet wellness

products by Martha Stewart CBD, and category defining vaporizer

technology made in Germany by Storz & Bickel. Canopy Growth has

also established a comprehensive ecosystem to realize the

opportunities presented by the U.S. THC market through its rights

to Acreage Holdings, Wana Brands, and Jetty Extracts.

Canopy Growth recently announced net revenue of $101 million for

the third quarter of its 2023 fiscal year, a 28% decline from the

same quarter in fiscal 2022. The company posted a net loss in Q3

FY2023 of $267 million, which was a $151 million increase from Q3

FY2022. Company Growth announced a cost reduction program of

$140-$160 million over the next 12 months.

About OTC Stock Review

Since 2004, OTC Stock Review has provided a free service

introducing thousands of traders to some of the best companies in

the microcap sector. Our alerts consist of Nasdaq, NYSE, and

high-quality OTC companies with full disclosure on compensation and

ownership.

Our custom company profiles can help create volume in seemingly

unnoticed stocks. By getting new eyeballs on your company,

important company news releases could have even more impact and

bring the profiled company into the spotlight of the general

investment community. This solid foundation and raised awareness

can have a positive effect on all shareholders, as well as provide

a more liquid market for the company’s stock. If you are interested

in the lucrative microcap sector, sign up for OTC Stock Review

today!

DISCLAIMER: Atlanta Capital Partners, LLC (ATLCP), which owns

and operates Otcstockreview.com, is a third-party publisher and

news dissemination service provider, which disseminates electronic

information through multiple online media channels. ATLCP is NOT

affiliated in any manner with any company mentioned herein. ATLCP

and its affiliated companies are news dissemination solutions

providers and are not a registered broker/dealer/analyst/adviser,

holds no investment licenses and may NOT sell, offer to sell or

offer to buy any security. ATLCP’s market updates, news alerts and

corporate profiles are NOT a solicitation or recommendation to buy,

sell or hold securities. The material in this release is intended

to be strictly informational and is never to be construed or

interpreted as research material. All readers are strongly urged to

perform research and due diligence on their own and consult a

licensed financial professional before considering any level of

investing in stocks. All material included herein is republished

content and details which were previously disseminated by the

companies mentioned in this release. ATLCP is not liable for any

investment decisions by its readers or subscribers. Investors are

cautioned that they may lose all or a portion of their investment

when investing in stocks. For current services performed ATLCP was

compensated three thousand five hundred dollars for news coverage

of current press releases issued by CannaPharmaRx, Inc. ATLCP holds

no shares of any company named in this release.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and ATLCP undertakes no

obligation to update such statements.

Contact:

OTC Stock ReviewDavid Kugelman(866)

692-6847dk@otcstockreview.comhttps://otcstockreview.com

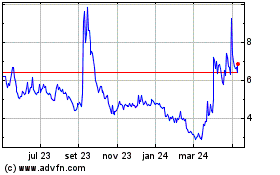

Aurora Cannabis (NASDAQ:ACB)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

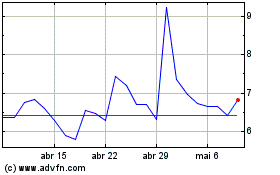

Aurora Cannabis (NASDAQ:ACB)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024