DENTSPLY SIRONA Inc. (“Dentsply Sirona” or the "Company") (Nasdaq:

XRAY) today announced its financial results for the fourth quarter

and full year 2022.

Full year 2022 net sales of $3,922 million

decreased (7.3%), compared to $4,231 million for the full year of

2021. Net loss was ($950) million, or ($4.41) per diluted share,

compared to income of $411 million, or $1.87 per diluted share for

the full year of 2021. Full year 2022 net loss includes a non-cash

charges for the impairment of goodwill and intangible assets of

$1.1 billion net of tax, which were recorded in the second half of

2022. These charges impacted earnings per diluted share by $5.10.

Adjusted earnings per diluted share decreased to $2.09 compared to

$2.82 in 2021. Excluding the impact of foreign currency

translation, adjusted earnings per share was $2.44. Adjusted EBITDA

for the full year of 2022 was $761 million, compared to $978

million in 2021. A reconciliation of Non-GAAP measures (including

organic sales, adjusted operating income and margin, adjusted EPS,

adjusted EBITDA, and adjusted free cash flow conversion) to GAAP

measures is provided below.

Fourth quarter 2022 net sales of $983 million

decreased (10.9%), compared to $1,103 million in the fourth quarter

of 2021. Net loss was ($15) million, or ($0.07) per diluted share,

compared to net income of $119 million, or $0.54 per diluted share

in the fourth quarter of 2021. Adjusted earnings per diluted share

decreased to $0.46 compared to $0.83 in the fourth quarter of

2021.

“2022 was a challenging year due to both internal

and external factors. Despite these challenges, we were pleased to

deliver fourth quarter financial results that exceeded the high end

of our prior sales and EPS outlook ranges. This represents an

important milestone as the Company works to improve performance and

rebuild investor and employee confidence,” said Simon Campion,

Chief Executive Officer. “As we enter a new year, we are intently

focused on the changes we are making to our organization, operating

model, and cadence, highlighted by the plan we recently announced.

Dentsply Sirona is well-positioned in an attractive industry, and

we are confident that the combination of industry trends, our

robust portfolio, and the actions we are taking now will produce

significant long-term value for our stakeholders."

Q4 22 and FY 22 Summary Results

(GAAP)

|

(in millions, except per share amount and

percentages) |

|

Q4 22 |

|

Q4 21 |

|

YoY |

|

FY 22 |

|

FY 21 |

|

YoY |

|

Net Sales |

|

983 |

|

1,103 |

|

(10.9%) |

|

3,922 |

|

4,231 |

|

(7.3%) |

|

Operating Income/(Loss) |

|

65 |

|

172 |

|

(62.0%) |

|

(937) |

|

608 |

|

NM |

|

Operating Income/(Loss) % |

|

6.6% |

|

15.6% |

|

|

|

(23.9%) |

|

14.4% |

|

|

|

Diluted Earnings/(Loss) Per Share |

|

(0.07) |

|

0.54 |

|

NM |

|

(4.41) |

|

1.87 |

|

NM |

NM - not meaningful Percentages are based on

actual values and may not recalculate due to rounding.

Q4 22 and FY 22 Summary Results

(Non-GAAP)[1]

|

(in millions, except per share amount and

percentages) |

|

Q4 22 |

|

Q4 21 |

|

YoY |

|

FY 22 |

|

FY 21 |

|

YoY |

|

Net Sales |

|

983 |

|

1,103 |

|

(10.9%) |

|

3,922 |

|

4,231 |

|

(7.3%) |

|

Organic Sales Growth % |

|

|

|

|

|

(2.6%) |

|

|

|

|

|

(0.5%) |

|

Adj. Operating income |

|

154 |

|

235 |

|

(34.4%) |

|

657 |

|

858 |

|

(23.4%) |

|

Adj. Operating income % |

|

15.7% |

|

21.3% |

|

|

|

16.8% |

|

20.3% |

|

|

|

Adj. EPS |

|

0.46 |

|

0.83 |

|

(44.4%) |

|

2.09 |

|

2.82 |

|

(25.7%) |

[1] Organic sales growth, adjusted operating

income, and adjusted EPS are Non-GAAP financial measures which

exclude certain items. Please refer to "Non-GAAP Financial

Measures" below for a description of these measures and to the

tables at the end of this release for a reconciliation between GAAP

and Non-GAAP measures.Percentages are based on actual values and

may not recalculate due to rounding.

Segment Results

Technologies &

EquipmentFull year 2022 net sales were $2,318 million,

down (7.4%) versus prior year. Foreign currency negatively impacted

sales by (7.9%), acquisitions increased sales by 0.1%, while

organic sales increased by 0.4% as compared to prior year.

Fourth quarter 2022 net sales were $602 million,

down (11.6%) versus prior year. Foreign currency negatively

impacted sales by (9.4%), while organic sales decreased by (2.2%)

as compared to prior year. The decrease in organic sales was

primarily driven by softer implants volume, particularly in China,

partially offset by strong aligners growth.

ConsumablesFull year 2022 net

sales were $1,604 million, down (7.1%) versus prior year. Foreign

currency negatively impacted sales by (5.2%), divestitures and

discontinued products negatively impacted sales by (0.2%), while

organic sales decreased by (1.7%) as compared to prior year.

Fourth quarter 2022 net sales were $381 million,

down (9.9%) versus prior year. Foreign currency negatively impacted

sales by (6.5%), while organic sales decreased by (3.4%) as

compared to prior year. The decrease in organic sales was primarily

driven by COVID lockdowns in China, partially offset by pricing and

contributions from new products.

Cash Flow and Liquidity

Operating cash flow in the fourth quarter of 2022

was $142 million, as compared to $222 million in the prior year.

Adjusted free cash flow conversion in the quarter was 110%, up from

100% conversion in the prior year fourth quarter. Full year 2022

operating cash flow was $517 million, as compared to $657 million

in the prior year. In the fourth quarter, the Company paid $26

million in dividends resulting in a total of $254 million returned

to shareholders in 2022. As of December 31, 2022, the Company

had $365 million of cash and cash equivalents on its balance

sheet.

2023 Outlook

Going forward, the Company will use adjusted EBITDA

margin as its primary profitability metric. Management believes

that EBITDA margin is a useful profitability metric because it

provides an objective measure of operational performance and

excludes certain non-cash charges. The outlook for full year 2023

includes net sales in the range of $3.85 billion to $3.95 billion,

down (1%) to up 2% on an organic basis. The outlook assumes foreign

currency will be a (100) bps headwind to net sales on a full year

basis. Adjusted EBITDA margin is expected to be greater than 18%

with adjusted EPS in the range of $1.80 to $2.00.

The Company expects first quarter 2023 organic

sales growth of approximately 1% and adjusted EBITDA margin to be

greater than 15%.

Further 2023 outlook assumptions are included in

the Q4 2022 Earnings Presentation posted on the Investors section

of the Dentsply Sirona website at

https://investor.dentsplysirona.com. The Company does not provide

forward-looking estimates on a GAAP basis as certain information is

not available and cannot be reasonably estimated.

Recent Announcements & Additional

Highlights

- New Executive Team

Member - On February 27, 2023, Dentsply Sirona announced

that Richard Rosenzweig has been appointed Senior Vice President,

Corporate Development, General Counsel and Secretary. With a

25-year history advising global health care companies, Mr.

Rosenzweig joins most recently from AngioDynamics where he led the

legal department, including compliance, and served as Secretary to

the Board as Senior Vice President, General Counsel &

Secretary.

- Quarterly Cash Dividend

Increased - On February 21, 2023, Dentsply Sirona's Board

of Directors approved a 12% increase in the Company's quarterly

dividend rate, from the previous rate of $0.125 per share of common

stock to $0.14 per share. The dividend is payable on April 14, 2023

to holders of record as of March 31, 2023. This represents the

third consecutive annual double-digit increase, highlighting the

Company’s commitment to return cash to shareholders.

- Restructuring Plan -

On February 16, 2023, Dentsply Sirona announced that its Board of

Directors has approved an organizational restructuring plan

intended to improve operational performance and drive shareholder

value creation. The restructuring plan anticipates a reduction in

the Company’s global workforce of approximately 8% to 10%. The

proposed changes are subject to co-determination processes with

employee representative groups in countries where required.

- Dentsply Sirona to attend IDS

2023 - Dentsply Sirona will participate in the 40th

International Dental Show (IDS) in Cologne, Germany, which takes

place from March 14-18, 2023. The company plans to present

interactive events, feature digital experiences, and host live

demonstrations at its exhibition space. Held every two years, IDS

is the leading trade fair for the dental industry.

- DS World Dubai - In

early February 2023, the first-ever DS World Dubai took place with

more than 800 registered attendees from 47 countries. DS World

Dubai was the fourth DS World event completed in the last six

months, emphasizing Dentsply Sirona’s commitment to clinical

education, innovation, and the power of collaboration; more than

7,000 dental professionals have engaged through these four

events.

Conference Call/Webcast

InformationDentsply Sirona’s management team will host an

investor conference call and live webcast on February 28,

2023 at 8:30 am ET. A live webcast of the investor conference call

and a presentation related to the call will be available on

the Investors section of the Company’s website

at https://investor.dentsplysirona.com.

For those planning to participate on the call,

please register at

https://register.vevent.com/register/BI56c586b6b5714a6ab9bdab080355052e.

A webcast replay of the conference call will be available on the

Investors section of the Company’s website following the call.

About Dentsply SironaDentsply

Sirona is the world’s largest manufacturer of professional dental

products and technologies, with over a century of innovation and

service to the dental industry and patients worldwide. Dentsply

Sirona develops, manufactures, and markets a comprehensive

solutions offering including dental and oral health products as

well as other consumable medical devices under a strong portfolio

of world class brands. Dentsply Sirona’s products provide

innovative, high-quality and effective solutions to advance patient

care and deliver better and safer dental care. Dentsply Sirona’s

headquarters is located in Charlotte, North Carolina. The Company’s

shares are listed in the United States on Nasdaq under the symbol

XRAY. Visit www.dentsplysirona.com for more information about

Dentsply Sirona and its products.

Contact

Information:Investors:Andrea DaleyVice President, Investor

Relations+1-704-805-1293InvestorRelations@dentsplysirona.com

Press:Marion Par-WeixlbergerVice President, Public

Relations & Corporate Communications+43 676

848414588marion.par-weixlberger@dentsplysirona.com

Forward-Looking Statements and Associated

Risks

This Press Release contains statements that do not

directly and exclusively relate to historical facts which

constitute forward-looking statements, including, statements and

projections concerning, among other things, the expected timing,

benefits and costs associated with the Company’s restructuring plan

described in this Press Release. The Company’s forward-looking

statements represent current expectations and beliefs and involve

risks and uncertainties. Actual results may differ significantly

from those projected or suggested in any forward-looking statements

and no assurance can be given that the results described in such

forward-looking statements will be achieved. Investors are

cautioned not to place undue reliance on such forward-looking

statements which speak only as of the date they are made. The

forward-looking statements are subject to numerous assumptions,

risks and uncertainties and other factors that could cause actual

results to differ materially from those described in such

statements, many of which are outside of our control. The Company

does not undertake any obligation to release publicly any revisions

to such forward-looking statements to reflect events or

circumstances occurring after the date hereof or to reflect the

occurrence of unanticipated events. Any number of factors could

cause the Company’s actual results to differ materially from those

contemplated by any forward-looking statements, including, but not

limited to, the risks associated with the following: the Company’s

ability to remain profitable in a very competitive marketplace,

which depends upon the Company’s ability to differentiate its

products and services from those of competitors; the Company’s

failure to realize assumptions and projections which may result in

the need to record additional impairment charges; the effect of

changes to the Company’s distribution channels for its products and

the failure of significant distributors of the Company to

effectively manage their inventories; the Company’s ability to

control costs and failure to realize expected benefits of cost

reduction and restructuring efforts and the Company’s failure to

anticipate and appropriately adapt to changes or trends within the

rapidly changing dental industry. Furthermore, many of these risks

and uncertainties are currently amplified by and may continue to be

amplified by or may, in the future, be amplified by, the COVID-19

pandemic and the impact of varying private and governmental

responses that affect our customers, employees, vendors and the

economies and communities where they operate. Investors should

carefully consider these and other relevant factors, including

those risk factors in Part I, Item 1A, (“Risk Factors”) in the

Company’s most recent Form 10-K, including any amendments thereto,

and any updating information which may be contained in the

Company’s other filings with the SEC, when reviewing any

forward-looking statement. The Company notes these factors for

investors as permitted under the Private Securities Litigation

Reform Act of 1995. Investors should understand it is impossible to

predict or identify all such factors or risks. As such, you should

not consider either the foregoing lists, or the risks identified in

the Company’s SEC filings, to be a complete discussion of all

potential risks or uncertainties.

|

DENTSPLY SIRONA INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In millions, except per share amounts and percentages) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

| |

|

|

|

|

|

|

|

|

Net sales |

$ |

983 |

|

|

$ |

1,103 |

|

$ |

3,922 |

|

|

$ |

4,231 |

|

Cost of products sold |

|

466 |

|

|

|

499 |

|

|

1,795 |

|

|

|

1,884 |

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

517 |

|

|

|

604 |

|

|

2,127 |

|

|

|

2,347 |

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expenses |

|

402 |

|

|

|

377 |

|

|

1,589 |

|

|

|

1,551 |

|

Research and development expenses |

|

43 |

|

|

|

49 |

|

|

174 |

|

|

|

171 |

|

Goodwill impairment |

|

— |

|

|

|

— |

|

|

1,187 |

|

|

|

— |

|

Intangible asset impairment and other costs |

|

7 |

|

|

|

6 |

|

|

114 |

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

65 |

|

|

|

172 |

|

|

(937 |

) |

|

|

608 |

|

|

|

|

|

|

|

|

|

|

Other income and expenses: |

|

|

|

|

|

|

|

|

Interest expense, net |

|

19 |

|

|

|

12 |

|

|

60 |

|

|

|

55 |

|

Other expense (income), net |

|

38 |

|

|

|

4 |

|

|

58 |

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

(Loss) income before income taxes |

|

8 |

|

|

|

156 |

|

|

(1,055 |

) |

|

|

545 |

|

(Benefit) provision for income taxes |

|

23 |

|

|

|

37 |

|

|

(105 |

) |

|

|

134 |

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

(15 |

) |

|

|

119 |

|

|

(950 |

) |

|

|

411 |

|

|

|

|

|

|

|

|

|

|

Less: Net income (loss) attributable to noncontrolling

interests |

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to Dentsply Sirona |

$ |

(15 |

) |

|

$ |

119 |

|

$ |

(950 |

) |

|

$ |

411 |

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share attributable to Dentsply

Sirona: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.07 |

) |

|

$ |

0.55 |

|

$ |

(4.41 |

) |

|

$ |

1.88 |

|

Diluted |

$ |

(0.07 |

) |

|

$ |

0.54 |

|

$ |

(4.41 |

) |

|

$ |

1.87 |

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

215.1 |

|

|

|

218.0 |

|

|

215.5 |

|

|

|

218.4 |

|

Diluted |

|

215.1 |

|

|

|

219.2 |

|

|

215.5 |

|

|

|

220.2 |

|

DENTSPLY SIRONA INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In millions) |

|

(unaudited) |

| |

|

|

|

| |

|

|

|

| |

December 31, 2022 |

|

December 31, 2021 |

| |

|

|

|

|

Assets |

|

|

|

|

Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

365 |

|

$ |

339 |

|

Accounts and notes receivable-trade, net |

|

632 |

|

|

750 |

|

Inventories, net |

|

627 |

|

|

515 |

|

Prepaid expenses and other current assets |

|

269 |

|

|

248 |

|

Total Current Assets |

|

1,893 |

|

|

1,852 |

|

|

|

|

|

|

Property, plant and equipment, net |

|

761 |

|

|

773 |

|

Operating lease right-of-use assets, net |

|

200 |

|

|

198 |

|

Identifiable intangible assets, net |

|

1,903 |

|

|

2,319 |

|

Goodwill, net |

|

2,688 |

|

|

3,976 |

|

Other noncurrent assets |

|

198 |

|

|

121 |

|

Total Assets |

$ |

7,643 |

|

$ |

9,239 |

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

279 |

|

$ |

262 |

|

Accrued liabilities |

|

727 |

|

|

760 |

|

Income taxes payable |

|

46 |

|

|

57 |

|

Notes payable and current portion of long-term debt |

|

118 |

|

|

182 |

|

Total Current Liabilities |

|

1,170 |

|

|

1,261 |

|

|

|

|

|

|

Long-term debt |

|

1,826 |

|

|

1,913 |

|

Operating lease liabilities |

|

149 |

|

|

149 |

|

Deferred income taxes |

|

287 |

|

|

391 |

|

Other noncurrent liabilities |

|

399 |

|

|

528 |

|

Total Liabilities |

|

3,831 |

|

|

4,242 |

| |

|

|

|

|

Total Equity |

|

3,812 |

|

|

4,997 |

| |

|

|

|

|

Total Liabilities and Equity |

$ |

7,643 |

|

$ |

9,239 |

DENTSPLY SIRONA INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(In millions) (unaudited)

| |

Year Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(950 |

) |

|

$ |

411 |

|

|

|

|

|

|

|

Adjustments to reconcile net (loss) income to net cash provided by

operating activities: |

|

|

|

|

Depreciation |

|

119 |

|

|

|

124 |

|

|

Amortization of intangible assets |

|

209 |

|

|

|

222 |

|

|

Goodwill impairment |

|

1,187 |

|

|

|

— |

|

|

Indefinite-lived intangible asset impairment |

|

100 |

|

|

|

— |

|

|

Deferred income taxes |

|

(228 |

) |

|

|

(25 |

) |

|

Stock based compensation expense |

|

59 |

|

|

|

48 |

|

|

Equity in earnings from unconsolidated affiliates |

|

36 |

|

|

|

10 |

|

|

Other non-cash (income) expense |

|

60 |

|

|

|

24 |

|

|

Loss (gain) on sale or disposal of non-strategic businesses and

product lines |

|

3 |

|

|

|

(14 |

) |

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

|

Accounts and notes receivable-trade, net |

|

85 |

|

|

|

(117 |

) |

|

Inventories, net |

|

(141 |

) |

|

|

(64 |

) |

|

Prepaid expenses and other current assets, net |

|

(33 |

) |

|

|

(32 |

) |

|

Other noncurrent assets |

|

1 |

|

|

|

(10 |

) |

|

Accounts payable |

|

30 |

|

|

|

(49 |

) |

|

Accrued liabilities |

|

(6 |

) |

|

|

100 |

|

|

Income taxes |

|

(15 |

) |

|

|

17 |

|

|

Other noncurrent liabilities |

|

1 |

|

|

|

12 |

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

517 |

|

|

$ |

657 |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Cash paid for acquisitions of businesses and equity investments,

net of cash acquired |

|

— |

|

|

|

(248 |

) |

|

Cash received on sale of non-strategic businesses or product

lines |

|

— |

|

|

|

28 |

|

|

Capital expenditures |

|

(149 |

) |

|

|

(142 |

) |

|

Cash received on derivative contracts |

|

13 |

|

|

|

2 |

|

|

Other investing activities, net |

|

(2 |

) |

|

|

2 |

|

|

|

|

|

|

|

Net cash used in investing activities |

$ |

(138 |

) |

|

$ |

(358 |

) |

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from long-term borrowings, net of deferred financing

costs |

|

6 |

|

|

|

16 |

|

|

Repayments on long-term borrowings |

|

(2 |

) |

|

|

(297 |

) |

|

Net borrowings (repayments) on short-term borrowings |

|

(64 |

) |

|

|

179 |

|

|

Proceeds from exercised stock options |

|

6 |

|

|

|

51 |

|

|

Cash paid for treasury stock |

|

(150 |

) |

|

|

(200 |

) |

|

Cash dividends paid |

|

(104 |

) |

|

|

(92 |

) |

|

Other financing activities, net |

|

(21 |

) |

|

|

(36 |

) |

|

|

|

|

|

|

Net cash (used in) provided by financing

activities |

$ |

(329 |

) |

|

$ |

(379 |

) |

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash

equivalents |

|

(24 |

) |

|

|

(19 |

) |

|

|

|

|

|

|

Net increase (decrease) in cash and cash

equivalents |

|

26 |

|

|

|

(99 |

) |

|

|

|

|

|

|

Cash and cash equivalents at beginning of

period |

|

339 |

|

|

|

438 |

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

$ |

365 |

|

|

$ |

339 |

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

Interest paid, net of amounts capitalized |

$ |

70 |

|

|

$ |

64 |

|

|

Income taxes paid, net of refunds |

|

122 |

|

|

|

148 |

|

|

Non-cash investing activities: |

|

|

|

|

Change in accounts payable related to capital expenditures |

$ |

(6 |

) |

|

$ |

19 |

|

Non-GAAP Financial Measures

In addition to results determined in accordance

with U.S. generally accepted accounting principles (“US GAAP”)

the Company provides certain measures in this press release,

described below, which are not calculated in accordance with

US GAAP and therefore represent Non-GAAP measures. These Non-GAAP

measures may differ from those used by other companies and should

not be considered in isolation from, or as a substitute for,

measures of financial performance prepared in accordance with US

GAAP. These Non-GAAP measures are used by the Company to measure

its performance and may differ from those used by other

companies.

Management believes that these Non-GAAP measures

are helpful as they provide another measure of the results of

operations, and are frequently used by investors and analysts to

evaluate the Company’s performance exclusive of certain items

that impact the comparability of results from period to period,

and which may not be indicative of past or future performance

of the Company.

Organic Sales

The Company defines "organic sales" as the reported

net sales adjusted for: (1) net sales from acquired businesses

recorded prior to the first anniversary of the acquisition, (2) net

sales attributable to disposed businesses or discontinued

product lines in both the current and prior year periods, and (3)

the impact of foreign currency changes, which is calculated by

translating current period net sales using the comparable prior

period's foreign currency exchange rates.

Adjusted Operating Income (Loss) and Margin

Adjusted operating income (loss) is computed by

excluding the following items from operating income:

(1) Business combination related costs and fair

value adjustments. These adjustments include costs related to

consummating and integrating acquired businesses, as well as net

gains and losses related to the disposed businesses. In

addition, this category includes the post-acquisition roll-off

of fair value adjustments recorded related to business

combinations, except for amortization expense of purchased

intangible assets noted below. Although the Company

is regularly engaged in activities to find and act on

opportunities for strategic growth and enhancement of product

offerings, the costs associated with these activities may vary

significantly between periods based on the timing, size and

complexity of acquisitions and as such may not be indicative

of past and future performance of the Company.

(2) Impairment related charges and other costs.

These adjustments include charges related to goodwill and

intangible asset impairments. Other costs include costs related to

the implementation of restructuring initiatives, including but

not limited to, severance costs, facility closure costs, lease

and contract termination costs, and related professional service

costs associated with specific restructuring initiatives. The

Company is continually seeking to take actions that could

enhance its efficiency; consequently restructuring charges may

recur but are subject to significant fluctuations from period

to period due to the varying levels of restructuring activity,

and as such may not be indicative of past and future performance of

the Company. Other costs also include legal settlements,

executive separation costs, and changes in

accounting principle recorded within the period. Beginning in

the second quarter of 2022, this category includes costs

related to the recent investigation and associated remediation

activities which primarily include legal, accounting and other

professional service fees, as well as turnover and other

employee-related costs.

(3) Amortization of purchased intangible assets.

This adjustment excludes the periodic amortization expense

related to purchased intangible assets, which are recorded at fair

value in purchase accounting. Although these costs contribute to

revenue generation and will recur in future periods, their

amounts are significantly impacted by the timing and size of

acquisitions, and as such may not be indicative of the future

performance of the Company.

(4) Fair value and credit risk adjustments. These

adjustments include the non-cash mark-to-market changes in fair

value associated with pension assets and obligations, and

equity-method investments. Although these adjustments are

recurring in nature, they are subject to

significant fluctuations from period to period due to changes

in the underlying assumptions and market conditions. The

non-service component of pension expense is a recurring item,

however it is subject to significant fluctuations from period

to period due to changes in actuarial assumptions, interest

rates, plan changes, settlements, curtailments, and other changes

in facts and circumstances. As such, these items may not be

indicative of past and future performance of the Company.

Adjusted operating margin is calculated by dividing

adjusted operating income by net sales.

Adjusted Net Income (Loss)

Adjusted net income (loss) consists of the reported

net income (loss) in accordance with US GAAP, adjusted to

exclude the items identified above, the related income tax impacts,

and discrete income tax adjustments such as: final settlement

of income tax audits, discrete tax items resulting from

the implementation of restructuring initiatives and the

vesting and exercise of employee share-based compensation, any

difference between the interim and annual effective tax rate, and

adjustments relating to prior periods.

These adjustments are irregular in timing, and the

variability in amounts may not be indicative of past

and future performance of the Company and therefore are

excluded for comparability purposes.

Adjusted Earnings (Loss) Per Diluted Share

Adjusted earnings (loss) (EPS) per diluted share is

computed by dividing adjusted earnings (losses) attributable

to Dentsply Sirona shareholders by the diluted weighted average

number of common shares outstanding.

Adjusted EBITDA

Adjusted EBITDA is computed by excluding interest,

income tax expense, depreciation and amortization, as well as the

adjustments described above for computing Adjusted Operating

Income.

Adjusted Free Cash Flow Conversion

The Company defines adjusted free cash flow as net

cash provided by operating activities minus capital expenditures

during the same period, and adjusted free cash flow conversion is

defined as that number divided by adjusted net income (loss).

Management believes that this Non-GAAP measure is important for use

in evaluating the Company’s financial performance as it measures

our ability to efficiently generate cash from our business

operations relative to earnings. It should be considered in

addition to, rather than as a substitute for, net income as a

measure of our performance or net cash provided by operating

activities as a measure of our liquidity.

DENTSPLY SIRONA INC. AND

SUBSIDIARIES(In millions, except

percentages)(unaudited)

|

|

|

Three Months Ended December 31, 2022 |

|

Q4 2022 Change |

|

Three Months Ended December 31, 2021 |

|

(in millions, except percentages) |

|

US |

Europe |

ROW |

Total |

|

US |

Europe |

ROW |

Total |

|

US |

Europe |

ROW |

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

369 |

$ |

376 |

$ |

238 |

$ |

983 |

|

(3.9 |

%) |

(14.1 |

%) |

(15.7 |

%) |

(10.9 |

%) |

|

$ |

386 |

$ |

436 |

$ |

281 |

$ |

1,103 |

|

Foreign exchange impact |

|

|

|

|

|

|

(2.2 |

%) |

(10.9 |

%) |

(12.7 |

%) |

(8.3 |

%) |

|

|

|

|

|

|

Organic sales |

|

|

|

|

|

|

(1.7 |

%) |

(3.2 |

%) |

(3.0 |

%) |

(2.6 |

%) |

|

|

|

|

|

Percentages are based on actual values and may

not recalculate due to rounding.

|

|

|

Year Ended December 31, 2022 |

|

2022 Change |

|

Year Ended December 31, 2021 |

|

(in millions, except percentages) |

|

US |

Europe |

ROW |

Total |

|

US |

Europe |

ROW |

Total |

|

US |

Europe |

ROW |

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,392 |

$ |

1,559 |

$ |

971 |

$ |

3,922 |

|

(5.9 |

%) |

(6.9 |

%) |

(9.8 |

%) |

(7.3 |

%) |

|

$ |

1,480 |

$ |

1,675 |

$ |

1,076 |

$ |

4,231 |

|

Foreign exchange impact |

|

|

|

|

|

|

(1.4 |

%) |

(9.8 |

%) |

(9.6 |

%) |

(6.8 |

%) |

|

|

|

|

|

|

Acquisitions |

|

|

|

|

|

|

0.2 |

% |

— |

% |

— |

% |

0.1 |

% |

|

|

|

|

|

|

Divestitures and discontinued products |

|

|

|

|

|

|

(0.1 |

%) |

(0.1 |

%) |

(0.1 |

%) |

(0.1 |

%) |

|

|

|

|

|

|

Organic sales |

|

|

|

|

|

|

(4.6 |

%) |

3.0 |

% |

(0.1 |

%) |

(0.5 |

%) |

|

|

|

|

|

Percentages are based on actual values and may

not recalculate due to rounding.

A reconciliation of reported net sales to organic

sales by segment is as follows:

|

|

|

Three Months Ended December 31, 2022 |

|

Q4 2022 Change |

|

Three Months Ended December 31, 2021 |

|

(in millions, except percentages) |

|

Technologies& Equipment |

Consumables |

Total |

|

Technologies& Equipment |

Consumables |

Total |

|

Technologies& Equipment |

Consumables |

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

602 |

$ |

381 |

$ |

983 |

|

(11.6 |

%) |

(9.9 |

%) |

(10.9 |

%) |

|

$ |

680 |

$ |

423 |

$ |

1,103 |

|

Foreign exchange impact |

|

|

|

|

|

(9.4 |

%) |

(6.5 |

%) |

(8.3 |

%) |

|

|

|

|

|

Organic sales |

|

|

|

|

|

(2.2 |

%) |

(3.4 |

%) |

(2.6 |

%) |

|

|

|

|

Percentages are based on actual values and may

not recalculate due to rounding.

|

|

|

Year Ended December 31, 2022 |

|

2022 Change |

|

Year Ended December 31, 2021 |

|

(in millions, except percentages) |

|

Technologies& Equipment |

Consumables |

Total |

|

Technologies& Equipment |

Consumables |

Total |

|

Technologies& Equipment |

Consumables |

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

2,318 |

$ |

1,604 |

$ |

3,922 |

|

(7.4 |

%) |

(7.1 |

%) |

(7.3 |

%) |

|

$ |

2,504 |

$ |

1,727 |

$ |

4,231 |

|

Foreign exchange impact |

|

|

|

|

|

(7.9 |

%) |

(5.2 |

%) |

(6.8 |

%) |

|

|

|

|

|

Acquisitions |

|

|

|

|

|

0.1 |

% |

— |

% |

0.1 |

% |

|

|

|

|

|

Divestitures and discontinued products |

|

|

|

|

|

— |

% |

(0.2 |

%) |

(0.1 |

%) |

|

|

|

|

|

Organic sales |

|

|

|

|

|

0.4 |

% |

(1.7 |

%) |

(0.5 |

%) |

|

|

|

|

Percentages are based on actual values and may

not recalculate due to rounding.

DENTSPLY SIRONA INC. AND

SUBSIDIARIES(In millions, except per share amounts and

percentages)(unaudited)

For the three months ended December 31, 2022,

a reconciliation of select items as reported in the Condensed

Consolidated Statements of Operations to adjusted Non-GAAP items is

as follows:

| |

GAAP |

|

|

|

|

|

|

|

ADJUSTEDNON-GAAP |

|

(in millions, except per share amounts and percentages) |

Three Months Ended December 31, 2022 |

Amortization of Purchased Intangible Assets |

Impairment Related Costs and Other Costs (a) |

Business Combination Related Costs and Fair Value

Adjustments |

Fair Value and Credit Risk Adjustments |

Tax Impact of Non-GAAP Adjustments |

Income Tax Related Adjustments |

Total Non-GAAP Adjustments |

Three Months Ended December 31, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

NET SALES |

$ |

983 |

|

— |

|

— |

|

— |

|

— |

|

|

|

$ |

— |

|

$ |

983 |

|

|

GROSS PROFIT |

|

517 |

|

29 |

|

6 |

|

— |

|

— |

|

|

|

|

35 |

|

|

552 |

|

|

% OF NET SALES |

|

52.6 |

% |

|

|

|

|

|

|

|

|

56.2 |

% |

|

SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES |

|

402 |

|

(21 |

) |

(23 |

) |

(3 |

) |

— |

|

|

|

|

(47 |

) |

|

355 |

|

|

% OF NET SALES |

|

40.9 |

% |

|

|

|

|

|

|

|

|

36.1 |

% |

|

RESEARCH AND DEVELOPMENT EXPENSES |

|

43 |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

— |

|

|

43 |

|

|

INTANGIBLE ASSET IMPAIRMENT AND OTHER COSTS |

|

7 |

|

— |

|

(7 |

) |

— |

|

— |

|

|

|

|

(7 |

) |

|

— |

|

|

OPERATING INCOME |

|

65 |

|

50 |

|

36 |

|

3 |

|

— |

|

— |

— |

|

|

89 |

|

|

154 |

|

|

% OF NET SALES |

|

6.6 |

% |

|

|

|

|

|

|

|

|

15.7 |

% |

|

OTHER INCOME AND EXPENSE |

|

57 |

|

— |

|

— |

|

(3 |

) |

(23 |

) |

|

|

|

(26 |

) |

|

31 |

|

|

INCOME BEFORE INCOME TAXES |

|

8 |

|

50 |

|

36 |

|

6 |

|

23 |

|

|

|

|

115 |

|

|

123 |

|

|

PROVISION FOR INCOME TAXES |

|

23 |

|

|

|

|

|

23 |

(22 |

) |

|

1 |

|

|

24 |

|

|

% OF PRE-TAX INCOME |

|

278.7 |

% |

|

|

|

|

|

|

|

|

19.7 |

% |

|

LESS: NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS |

|

— |

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

NET INCOME ATTRIBUTABLE TO DENTSPLY SIRONA |

$ |

(15 |

) |

|

|

|

|

|

|

$ |

114 |

|

$ |

99 |

|

|

% OF NET SALES |

|

(1.6 |

)% |

|

|

|

|

|

|

|

|

10.1 |

% |

|

EARNINGS PER SHARE - DILUTED |

$ |

(0.07 |

) |

|

|

|

|

|

|

$ |

0.53 |

|

$ |

0.46 |

|

| |

|

|

|

|

|

|

|

|

|

|

Shares used in calculating diluted US GAAP net loss per share |

|

|

|

|

|

|

$ |

215.1 |

|

|

Shares used in calculating diluted non-US GAAP net income per

share |

|

|

|

|

|

|

$ |

215.5 |

|

Percentages are based on actual values and may

not recalculate due to rounding.

(a) Other Costs includes $16 million in costs

related to the internal investigation comprised of $12 million in

professional service fees, and $4 million in turnover and other

employee related SG&A expenses.

For the three months ended December 31, 2022,

the following table presents the details of the "Impairment Related

Charges and Other Costs" column in the above table and the affected

line item in the Consolidated Statements of Operations:

|

(in millions) |

|

Impairments |

|

Costs Related toRestructuring Plans |

|

Professional Services Costs |

|

Incentive Compensation |

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

6 |

|

$ |

6 |

|

Selling, general, and administrative expenses |

|

|

— |

|

|

1 |

|

|

18 |

|

|

4 |

|

|

— |

|

|

23 |

|

Intangible asset impairment and other costs |

|

|

6 |

|

|

1 |

|

|

— |

|

|

— |

|

|

— |

|

|

7 |

|

Total |

|

$ |

6 |

|

$ |

2 |

|

$ |

18 |

|

$ |

4 |

|

$ |

6 |

|

$ |

36 |

DENTSPLY SIRONA INC. AND

SUBSIDIARIES(In millions, except per share amounts and

percentages)(unaudited)

For the three months ended December 31, 2021,

a reconciliation of select items as reported in the Condensed

Consolidated Statements of Operations to adjusted Non-GAAP items is

as follows:

| |

GAAP |

|

|

|

|

|

|

|

ADJUSTEDNON-GAAP |

|

(in millions, except per share amounts and percentages) |

Three Months Ended December 31, 2021 |

Amortization of Purchased Intangible Assets |

Impairment Related Charges and Other Costs

(a) |

Business Combination Related Costs and Fair Value

Adjustments |

Fair Value and Credit Risk Adjustments |

Tax Impact of Non-GAAP Adjustments |

Income Tax Related Adjustments |

Total Non-GAAP Adjustments |

Three Months Ended December 31, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

NET SALES |

$ |

1,103 |

|

— |

|

— |

|

— |

— |

|

|

|

$ |

— |

|

$ |

1,103 |

|

|

GROSS PROFIT |

|

604 |

|

33 |

|

— |

|

1 |

— |

|

|

|

|

34 |

|

|

638 |

|

|

% OF NET SALES |

|

54.7 |

% |

|

|

|

|

|

|

|

|

57.8 |

% |

|

SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES |

|

377 |

|

(23 |

) |

— |

|

— |

— |

|

|

|

|

(23 |

) |

|

354 |

|

|

% OF NET SALES |

|

33.3 |

% |

|

|

|

|

|

|

|

|

32.1 |

% |

|

RESEARCH AND DEVELOPMENT EXPENSES |

|

49 |

|

— |

|

— |

|

— |

— |

|

|

|

|

— |

|

|

49 |

|

|

INTANGIBLE ASSET IMPAIRMENT AND OTHER COSTS |

|

6 |

|

— |

|

(6 |

) |

— |

— |

|

|

|

|

(6 |

) |

|

— |

|

|

OPERATING INCOME |

|

172 |

|

56 |

|

6 |

|

1 |

— |

|

|

|

|

63 |

|

|

235 |

|

|

% OF NET SALES |

|

15.6 |

% |

|

|

|

|

|

|

|

|

21.3 |

% |

|

OTHER INCOME AND EXPENSE |

|

16 |

|

— |

|

— |

|

1 |

(14 |

) |

|

|

|

(13 |

) |

|

3 |

|

|

INCOME BEFORE INCOME TAXES |

|

156 |

|

56 |

|

6 |

|

— |

14 |

|

|

|

|

76 |

|

|

232 |

|

|

PROVISION FOR INCOME TAXES |

|

37 |

|

|

|

|

|

19 |

(5 |

) |

|

14 |

|

|

51 |

|

|

% OF PRE-TAX INCOME |

|

23.7 |

% |

|

|

|

|

|

|

|

|

21.8 |

% |

|

LESS: NET LOSS ATTRIBUTABLE TO NON-CONTROLLING INTERESTS |

|

— |

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

NET INCOME ATTRIBUTABLE TO DENTSPLY SIRONA |

$ |

119 |

|

|

|

|

|

|

|

$ |

62 |

|

$ |

181 |

|

|

% OF NET SALES |

|

10.8 |

% |

|

|

|

|

|

|

|

|

16.4 |

% |

|

EARNINGS PER SHARE - DILUTED |

$ |

0.54 |

|

|

|

|

|

|

|

$ |

0.29 |

|

$ |

0.83 |

|

Percentages are based on actual values and may

not recalculate due to rounding.

For the three months ended December 31, 2021,

the following table presents the details of the "Impairment Related

Charges and Other Costs" column in the above table and the affected

line item in the Consolidated Statements of Operations:

|

(in millions) |

|

Costs Related toRestructuring Plans |

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

Intangible asset impairment and other costs |

|

$ |

5 |

|

$ |

1 |

|

$ |

6 |

|

Total |

|

$ |

5 |

|

$ |

1 |

|

$ |

6 |

DENTSPLY SIRONA INC. AND

SUBSIDIARIES(In millions, except per share amounts and

percentages)(unaudited)

For the year ended December 31, 2022, a

reconciliation of select items as reported in the Condensed

Consolidated Statements of Operations to adjusted Non-GAAP items is

as follows:

| |

GAAP |

|

|

|

|

|

|

|

ADJUSTEDNON-GAAP |

|

(in millions, except per share amounts and percentages) |

Twelve Months Ended December 31, 2022 |

Amortization of Purchased Intangible Assets |

Impairment Related Charges and Other Costs

(a) |

Business Combination Related Costs and Fair Value

Adjustments |

Fair Value and Credit Risk Adjustments |

Tax Impact of Non-GAAP Adjustments |

Income Tax Related Adjustments |

Total Non-GAAP Adjustments |

Twelve Months Ended December 31, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

NET SALES |

$ |

3,922 |

|

— |

|

— |

|

— |

|

— |

|

|

|

$ |

— |

|

$ |

3,922 |

|

|

GROSS PROFIT |

|

2,127 |

|

121 |

|

7 |

|

1 |

|

— |

|

|

|

|

129 |

|

|

2,256 |

|

|

% OF NET SALES |

|

54.2 |

% |

|

|

|

|

|

|

|

|

57.5 |

% |

|

SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES |

|

1,589 |

|

(88 |

) |

(70 |

) |

(5 |

) |

— |

|

|

|

|

(163 |

) |

|

1,426 |

|

|

% OF NET SALES |

|

40.5 |

% |

|

|

|

|

|

|

|

|

36.4 |

% |

|

RESEARCH AND DEVELOPMENT EXPENSES |

|

174 |

|

— |

|

(1 |

) |

— |

|

— |

|

|

|

|

(1 |

) |

|

173 |

|

|

GOODWILL IMPAIRMENT |

|

1,187 |

|

— |

|

(1,187 |

) |

— |

|

— |

|

|

|

|

(1,187 |

) |

|

— |

|

|

INTANGIBLE ASSET IMPAIRMENT AND OTHER COSTS |

|

114 |

|

— |

|

(114 |

) |

— |

|

— |

|

|

|

|

(114 |

) |

|

— |

|

|

OPERATING (LOSS) INCOME |

|

(937 |

) |

209 |

|

1,379 |

|

6 |

|

— |

|

— |

— |

|

|

1,594 |

|

|

657 |

|

|

% OF NET SALES |

|

(23.9 |

%) |

|

|

|

|

|

|

|

|

16.8 |

% |

|

OTHER INCOME AND EXPENSE |

|

118 |

|

— |

|

— |

|

(3 |

) |

(43 |

) |

|

|

|

(46 |

) |

|

72 |

|

|

(LOSS) INCOME BEFORE INCOME TAXES |

|

(1,055 |

) |

209 |

|

1,379 |

|

9 |

|

43 |

|

— |

— |

|

|

1,640 |

|

|

585 |

|

|

(BENEFIT) PROVISION FOR INCOME TAXES |

|

(105 |

) |

|

|

|

|

271 |

(33 |

) |

|

238 |

|

|

133 |

|

|

% OF PRE-TAX INCOME |

|

9.9 |

% |

|

|

|

|

|

|

|

|

22.7 |

% |

|

LESS: NET LOSS ATTRIBUTABLE TO NON-CONTROLLING INTERESTS |

|

— |

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

NET (LOSS) INCOME ATTRIBUTABLE TO DENTSPLY SIRONA |

$ |

(950 |

) |

|

|

|

|

|

|

$ |

1,402 |

|

$ |

452 |

|

|

% OF NET SALES |

|

(24.2 |

%) |

|

|

|

|

|

|

|

|

11.5 |

% |

|

(LOSS) EARNINGS PER SHARE - DILUTED |

$ |

(4.41 |

) |

|

|

|

|

|

|

$ |

6.50 |

|

$ |

2.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

Shares used in calculating diluted US GAAP net loss per share |

|

|

215.5 |

|

|

Shares used in calculating diluted non-US GAAP net income per

share |

|

|

215.9 |

|

Percentages are based on actual values and may

not recalculate due to rounding.

(a) Other Costs includes $61 million in costs

related to the internal investigation comprised of $31 million in

professional service fees, and $30 million in turnover and other

employee related SG&A expenses.

For the year ended December 31, 2022, the

following table presents the details of the "Impairment Related

Charges and Other Costs" column in the above table and the affected

line item in the Consolidated Statements of Operations:

|

(in millions) |

|

Impairments |

|

Severance CostsRelated to Executives |

|

Costs Related toRestructuring Plans |

|

Professional Services Costs |

|

Incentive Compensation |

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

1 |

|

$ |

6 |

|

$ |

7 |

|

Selling, general, and administrative expenses |

|

|

— |

|

|

18 |

|

|

— |

|

|

39 |

|

|

11 |

|

|

2 |

|

|

70 |

|

Goodwill impairment |

|

|

1,187 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,187 |

|

Research and Development |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

1 |

|

Intangible asset impairment and other costs |

|

|

100 |

|

|

— |

|

|

13 |

|

|

— |

|

|

— |

|

|

1 |

|

|

114 |

|

Total |

|

$ |

1,287 |

|

$ |

18 |

|

$ |

13 |

|

$ |

39 |

|

$ |

12 |

|

$ |

10 |

|

$ |

1,379 |

DENTSPLY SIRONA INC. AND

SUBSIDIARIES(In millions, except per share amounts and

percentages)(unaudited)

For the year ended December 31, 2021, a

reconciliation of select items as reported in the Condensed

Consolidated Statements of Operations to adjusted Non-GAAP items is

as follows:

| |

GAAP |

|

|

|

|

|

|

|

ADJUSTEDNON-GAAP |

|

(in millions, except per share amounts and percentages) |

Twelve Months Ended December 31, 2021 |

Amortization of Purchased Intangible Assets |

Impairment Related Charges and Other Costs

(a) |

Business Combination Related Costs and Fair Value

Adjustments |

Fair Value and Credit Risk Adjustments |

Tax Impact of Non-GAAP Adjustments |

Income Tax Related Adjustments |

Total Non-GAAP Adjustments |

Twelve Months Ended December 31, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

NET SALES |

$ |

4,231 |

|

— |

|

— |

|

— |

|

— |

|

|

|

$ |

— |

|

$ |

4,231 |

|

|

GROSS PROFIT |

|

2,347 |

|

131 |

|

(6 |

) |

3 |

|

— |

|

|

|

|

128 |

|

|

2,475 |

|

|

% OF NET SALES |

|

55.5 |

% |

|

|

|

|

|

|

|

|

58.5 |

% |

|

SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES |

|

1,551 |

|

(91 |

) |

(3 |

) |

(11 |

) |

— |

|

|

|

|

(105 |

) |

|

1,446 |

|

|

% OF NET SALES |

|

36.6 |

% |

|

|

|

|

|

|

|

|

34.2 |

% |

|

RESEARCH AND DEVELOPMENT EXPENSES |

|

171 |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

— |

|

|

171 |

|

|

INTANGIBLE ASSET IMPAIRMENT AND OTHER COSTS |

|

17 |

|

— |

|

(17 |

) |

— |

|

— |

|

|

|

|

(17 |

) |

|

— |

|

|

OPERATING INCOME |

|

608 |

|

222 |

|

14 |

|

14 |

|

— |

|

|

|

|

250 |

|

|

858 |

|

|

% OF NET SALES |

|

14.4 |

% |

|

|

|

|

|

|

|

|

20.3 |

% |

|

OTHER INCOME AND EXPENSE |

|

63 |

|

— |

|

— |

|

11 |

|

(21 |

) |

|

|

|

(10 |

) |

|

53 |

|

|

INCOME BEFORE INCOME TAXES |

|

545 |

|

222 |

|

14 |

|

3 |

|

21 |

|

|

|

|

260 |

|

|

805 |

|

|

PROVISION FOR INCOME TAXES |

|

134 |

|

|

|

|

|

65 |

(15 |

) |

|

50 |

|

|

184 |

|

|

% OF PRE-TAX INCOME |

|

24.6 |

% |

|

|

|

|

|

|

|

|

22.9 |

% |

|

LESS: NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS |

|

— |

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

NET INCOME ATTRIBUTABLE TO DENTSPLY SIRONA |

$ |

411 |

|

|

|

|

|

|

|

$ |

210 |

|

$ |

621 |

|

|

% OF NET SALES |

|

9.7 |

% |

|

|

|

|

|

|

|

|

14.7 |

% |

|

EARNINGS PER SHARE - DILUTED |

$ |

1.87 |

|

|

|

|

|

|

|

$ |

0.95 |

|

$ |

2.82 |

|

Percentages are based on actual values and may

not recalculate due to rounding.

For the year ended December 31, 2021, the

following table presents the details of the "Impairment Related

Charges and Other Costs" column in the above table and the affected

line item in the Consolidated Statements of Operations:

|

(in millions) |

|

Severance CostsRelated to Executives |

|

Costs Related toRestructuring Plans |

|

Professional Services Costs |

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold |

|

$ |

— |

|

|

$ |

(3 |

) |

|

$ |

— |

|

$ |

(3 |

) |

|

$ |

(6 |

) |

|

Selling, general, and administrative expenses |

|

|

(1 |

) |

|

|

1 |

|

|

|

2 |

|

|

1 |

|

|

|

3 |

|

|

Intangible asset impairment and other costs |

|

|

— |

|

|

|

21 |

|

|

|

— |

|

|

(4 |

) |

|

|

17 |

|

|

Total |

|

$ |

(1 |

) |

|

$ |

19 |

|

|

$ |

2 |

|

$ |

(6 |

) |

|

$ |

14 |

|

A reconciliation of as reported GAAP net income to

Adjusted EBITDA for the three ended December 31, 2022 and 2021

is as follows:

|

(in millions) |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

GAAP net (loss) income |

|

$ |

(15 |

) |

|

$ |

119 |

|

Interest expense, net |

|

|

19 |

|

|

|

12 |

|

Income tax expense |

|

|

23 |

|

|

|

37 |

|

Depreciation(1) |

|

|

28 |

|

|

|

29 |

|

Amortization of purchased intangible assets |

|

|

50 |

|

|

|

56 |

|

Impairment related costs and other costs |

|

|

36 |

|

|

|

6 |

|

Business combination related costs and fair value adjustments |

|

|

6 |

|

|

|

— |

|

Fair value and credit risk adjustments |

|

|

23 |

|

|

|

14 |

|

Adjusted EBITDA |

|

$ |

170 |

|

|

$ |

273 |

(1) Excludes those depreciation related amounts

which were included as part of the business combination related

adjustments below.

A reconciliation of as reported GAAP net income to

Adjusted EBITDA for the year ended December 31, 2022 and 2021

is as follows:

|

(in millions) |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

GAAP net (loss) income |

|

$ |

(950 |

) |

|

$ |

411 |

|

Interest expense, net |

|

|

60 |

|

|

|

55 |

|

Income tax expense |

|

|

(105 |

) |

|

|

134 |

|

Depreciation(1) |

|

|

116 |

|

|

|

118 |

|

Amortization of purchased intangible assets |

|

|

209 |

|

|

|

222 |

|

Impairment related costs and other costs |

|

|

1,379 |

|

|

|

14 |

|

Business combination related costs and fair value adjustments |

|

|

9 |

|

|

|

3 |

|

Fair value and credit risk adjustments |

|

|

43 |

|

|

|

21 |

|

Adjusted EBITDA |

|

$ |

761 |

|

|

$ |

978 |

(1) Excludes those depreciation related amounts

which were included as part of the business combination related

adjustments below.

A reconciliation of adjusted free cash flow

conversion for the three months ended December 31, 2022 and

2021 is as follows:

|

(in millions, except percentages) |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

142 |

|

|

$ |

222 |

|

|

Capital Expenditures |

|

|

(32 |

) |

|

|

(41 |

) |

|

Adjusted free cash flow |

|

|

110 |

|

|

|

181 |

|

| |

|

|

|

|

|

Adjusted net income |

|

$ |

99 |

|

|

$ |

181 |

|

|

Adjusted free cash flow conversion |

|

|

110 |

% |

|

|

100 |

% |

A reconciliation of adjusted free cash flow

conversion for the year ended December 31, 2022 and 2021 is as

follows:

|

(in millions, except percentages) |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

517 |

|

|

$ |

657 |

|

|

Capital Expenditures |

|

|

(149 |

) |

|

|

(142 |

) |

|

Adjusted free cash flow |

|

|

368 |

|

|

|

515 |

|

| |

|

|

|

|

|

Adjusted net income |

|

$ |

452 |

|

|

$ |

621 |

|

|

Adjusted free cash flow conversion |

|

|

81 |

% |

|

|

83 |

% |

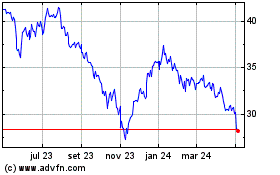

DENTSPLY SIRONA (NASDAQ:XRAY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

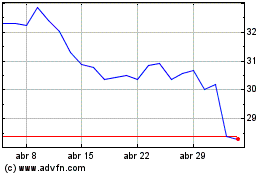

DENTSPLY SIRONA (NASDAQ:XRAY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024