Dorman Products, Inc. (the “Company” or “Dorman”) (NASDAQ:DORM), a

leading supplier in the motor vehicle aftermarket industry, today

announced its financial results for the fourth quarter and full

year ended December 31, 2022. Financial results include the

impact of an additional week in the fourth quarter.

Fourth Quarter Financial

ResultsThe Company reported fourth quarter 2022 net sales

of $501.3 million, up 25.9% compared to net sales of $398.2 million

in the fourth quarter of 2021. The sales results reflect a

continuation of favorable underlying industry dynamics across all

customer channels, successful new product development and

penetration, the addition of SuperATV, and price increases to

offset inflationary costs. The Company also benefited from having

an extra week in the fourth quarter compared to last year, which it

estimates impacted net sales by approximately $19 million. Net

sales growth excluding SuperATV, acquired October 4, 2022, was

13.4% compared to the fourth quarter of 2021.

Gross profit was $157.8 million in the fourth

quarter of 2022, or 31.5% of net sales compared to $131.4 million,

or 33.0% of net sales, for the same quarter last year. Adjusted

gross margin* was 32.8% in the fourth quarter of 2022 compared to

34.6% in the same quarter of last year. The decline in gross margin

as a percentage of net sales is primarily due to continued

broad-based inflationary cost pressures, partially offset by the

favorable gross margin percentage impact of the addition of

SuperATV. The Company has implemented many actions over the course

of 2022, and has additional actions planned for 2023, including

price increases and cost-savings initiatives to offset these

costs.

Selling, general and administrative (“SG&A”)

expenses were $125.0 million, or 24.9% of net sales, in the fourth

quarter of 2022 compared to $86.3 million, or 21.7% of net sales,

for the same quarter last year. Adjusted SG&A expenses* were

$113.4 million, or 22.6% of net sales, in the fourth quarter of

2022 compared to $82.3 million, or 20.7% of net sales, in the same

quarter last year. The increases in SG&A expenses and adjusted

SG&A expenses* as a percentage of net sales were due primarily

to the impact of higher interest rates on our customer accounts

receivable factoring programs and the addition of SuperATV in the

fourth quarter of 2022 which has higher SG&A costs than the

rest of the Company’s business.

Income tax expense was $5.1 million, or 22.2% of

income before income taxes compared to $9.8 million, or 22.4% of

income before income taxes, in the same quarter last year. The

decrease in the effective tax rate was due to favorable discrete

items in the quarter, partially offset by an increase in state tax

expense.

Net income for the fourth quarter of 2022 was

$17.8 million, or $0.57 per diluted share, compared to $34.1

million, or $1.07 per diluted share, in the prior year quarter. The

Company estimates that the additional week in fiscal 2022 added

approximately $2.5 million in net income, or $0.08 per diluted

share, during the fourth quarter of 2022. Adjusted net income* in

the fourth quarter of 2022 was $31.8 million, or $1.01 per diluted

share, compared to $42.1 million, or $1.33 per diluted share, in

the prior year quarter. In addition to the factors described above,

net income for the fourth quarter of 2022 was also impacted by an

additional $9.2 million of net interest expense primarily from a

term loan used to complete the acquisition of SuperATV in October

2022 and from higher interest rates during the quarter.

During the fourth quarter of 2022, Dorman

completed the acquisition of SuperATV, a leading supplier to the

specialty vehicle aftermarket, with a family of highly respected

brands spanning replacement parts, functional accessories and

upgrades.

Fiscal Year Financial

ResultsFiscal 2022 net sales were $1,733.7 million, up

28.9% compared to net sales of $1,345.2 million in fiscal 2021.

Year-over-year net sales growth, excluding the impact of

acquisitions, was 13.8% compared to fiscal 2021.

Net income for fiscal 2022 was $121.5 million,

or $3.85 per diluted share, compared to $131.5 million, or $4.12

per diluted share, for the prior year. Adjusted net income* in

fiscal 2022 was $150.1 million, or $4.76 per diluted share,

compared to $148.4 million, or $4.64 per diluted share, for the

prior year.

Kevin Olsen, Dorman’s President and Chief

Executive Officer, stated, “In 2022, we delivered record net sales

and adjusted earnings per share, having successfully managed

through the unprecedented challenges of global supply chain

disruptions, continued COVID-related closures experienced by many

of our global suppliers, several quarters of extraordinary

inflationary pressures, and the rise in interest rates. We also

successfully completed the acquisition of SuperATV which performed

in line with our expectations in the fourth quarter. It is

important to recognize that the hard work and dedication of our

contributors made these results possible. We continue to be

encouraged by the strength in the underlying markets we serve and

the strong fundamentals across the vehicle aftermarket. We have

been seeing an easing of global supply chain constraints and

reductions in ocean freight and commodity costs that we expect will

drive significant sequential quarterly margin expansion in the back

half of 2023.

“Innovation and new products continue to be a

strategic focus for the Company, as our expertise and market reach

in advanced technology automotive components continued to grow last

year with the introduction of all-new construction climate control

modules, electronic throttle bodies featuring Hall effect sensors

and Dorman’s Sensor Shield™ shaft seals, and pre-programmed fuel

pump driver modules. The Company’s product teams have consistently

focused on repair solutions engineered to reduce the time

technicians and vehicle owners typically spend on repairs. We

continue to deliver products that not only drive sales and profits

for our customers, but also provide the solutions that professional

technicians and do-it-yourselfers want.

“In 2022, we continued to focus on enhancing our

supply chain and operations. Our new distribution center in

Whiteland, Indiana began shipping products in the fourth quarter of

2022 and continues to ramp up to full capacity, supporting our

growth plans. The roll out of state-of-the-art automation

technology in our existing warehouses is also going well, and we

anticipate realizing productivity savings, greater flexibility, and

an enhanced customer experience from these investments. Finally, we

are making progress on a strategic initiative to further diversify

our supply chain geographically.”

2023 GuidanceThe Company is

issuing full-year 2023 guidance, detailed in the table below, which

includes the impact of the SuperATV acquisition but excludes any

potential impacts from future acquisitions, additional supply chain

disruptions, or share repurchases.

|

|

2023 Fiscal Year |

| Net

Sales |

$1.95B - $2.00B |

|

Growth vs. 2022 |

12.5% - 15.4% |

| Diluted

EPS |

$4.35 - $4.55 |

|

Growth vs. 2022 |

13.0% - 18.2% |

| Adjusted

Diluted EPS* |

$5.15 - $5.35 |

|

Growth vs. 2022 |

8.2% - 12.4% |

|

Tax Rate Estimate |

24% |

|

|

|

Mr. Olsen continued, “Demand remains robust for

our products driven by strong macro fundamentals across the vehicle

aftermarket. Vehicle miles driven continue to increase, the average

age of vehicles continue to rise, the number of cars in our 8 to

13-year-old sweet spot for the aftermarket continues to grow, and a

shortage of new vehicles benefit the aftermarket.

“We anticipate first quarter adjusted gross

margin percentage and adjusted SG&A dollars will be in line

sequentially with fourth quarter 2022. However, operating margins

and adjusted earnings per share are expected to be significantly

lower than the fourth quarter of 2022, driven by seasonally lower

sales levels. We remain encouraged by the easing of

inflationary costs we have seen over the past several months and

anticipate meaningful improvements in our gross margins throughout

2023 and expect to exit the year at a rate approaching pre-COVID

levels.

“Finally, as we reduce lead times and safety

stocks as a result of improvements in global supply chains,

combined with the impact of lower material and freight costs, we

anticipate inventory values to meaningfully decline throughout

2023. While our overall capital allocation strategy over the long

term will not change, based on current conditions we plan in the

short term to utilize excess cash from lower inventory requirements

to reduce our debt.”

About Dorman ProductsDorman

gives professionals, enthusiasts and owners greater freedom to fix

motor vehicles. For over 100 years, we have been driving new

solutions, releasing tens of thousands of aftermarket replacement

products engineered to save time and money and increase convenience

and reliability.

Founded and headquartered in the United States,

we are a pioneering global organization offering an always-evolving

catalog of products, covering cars, trucks and specialty vehicles,

from chassis to body, from underhood to undercarriage, and from

hardware to complex electronics.

*Non-GAAP MeasuresIn addition

to the financial measures prepared in accordance with generally

accepted accounting principles (GAAP), this earnings release also

contains Non-GAAP financial measures. The reasons why we believe

these measures provide useful information to investors and a

reconciliation of these measures to the most directly comparable

GAAP measures and other information relating to these Non-GAAP

measures are included in the supplemental schedules attached.

Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995,

including statements related to net sales, diluted and adjusted

diluted earnings per share, gross profit, gross margin, adjusted

gross margin, SG&A, adjusted SG&A, income tax expense,

income before income taxes, net income, cash and cash equivalents,

indebtedness, liquidity, the Company’s share repurchase program,

the Company’s outlook and distribution facility costs and

productivity initiatives. Words such as “believe,” “demonstrate,”

“expect,” “estimate,” “forecast,” “anticipate,” “plan,” “should,”

“will” and “likely” and similar expressions identify

forward-looking statements. However, the absence of these words

does not mean the statements are not forward-looking. In addition,

statements that are not historical should also be considered

forward-looking statements. Readers are cautioned not to place

undue reliance on those forward-looking statements, which speak

only as of the date such statements were made. Such forward-looking

statements are based on current expectations that involve a number

of known and unknown risks, uncertainties and other factors (many

of which are outside of our control). Such risks, uncertainties and

other factors relate to, among other things: competition in and the

evolution of the motor vehicle aftermarket industry; changes in our

relationships with, or the loss of, any customers or suppliers;

customer consolidation; our ability to grow in the specialty

vehicle category; the impacts of public health pandemics, such as

COVID-19; our ability to anticipate and meet customer demand or

adequately manage our inventory; our ability to purchase necessary

materials from our suppliers and the impacts of any related

logistics constraints; financial and economic factors, such as our

level of indebtedness, the availability and effectiveness of

customer accounts receivable financing programs, fluctuations in

interest rates and inflation; political and regulatory matters,

such as changes in trade policy, the imposition of tariffs and

climate regulation; our ability to develop, market and sell new and

existing products; our ability to protect our intellectual property

and defend against any claims of infringement; and our ability to

protect our information security systems and defend against

cyberattacks. Please refer to “Statement Regarding Forward-Looking

Statements” and “Item 1A. Risk Factors” located in Part I of our in

the Company’s Annual Report on Form 10-K for the fiscal year ended

December 25, 2021 filed with the Securities and Exchange Commission

(“SEC”), as updated by our subsequent filings with the SEC,

including the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2022 that the Company expects to file later

today, for a description of these and other risks and uncertainties

that could cause actual results to differ materially from those

projected or implied by the forward-looking statements. The Company

is under no obligation to, and expressly disclaims any such

obligation to, update any of the information in this document,

including but not limited to any situation where any

forward-looking statement later turns out to be inaccurate whether

as a result of new information, future events or otherwise.

Investor Relations

ContactMichael P. DickersonVice President, Investor

Relations and Risk Managementmdickerson@dormanproducts.com (517)

667-4003

Visit our website at www.dormanproducts.com. The

Investor Relations section of the website contains a significant

amount of information about Dorman, including financial and other

information for investors. Dorman encourages investors to visit its

website periodically to view new and updated information.

DORMAN PRODUCTS, INC. AND

SUBSIDIARIESConsolidated Statements of Operations(in

thousands, except per-share amounts)

| |

Three Months Ended |

|

Three Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.* |

|

12/25/21 |

|

Pct. * |

|

Net sales |

$ |

501,281 |

|

|

100.0 |

|

|

$ |

398,176 |

|

|

100.0 |

| Cost of goods sold |

|

343,507 |

|

|

68.5 |

|

|

|

266,759 |

|

|

67.0 |

|

Gross profit |

|

157,774 |

|

|

31.5 |

|

|

|

131,417 |

|

|

33.0 |

| Selling, general and

administrative expenses |

|

125,002 |

|

|

24.9 |

|

|

|

86,316 |

|

|

21.7 |

|

Income from operations |

|

32,772 |

|

|

6.5 |

|

|

|

45,101 |

|

|

11.3 |

| Interest expense, net |

|

10,442 |

|

|

2.1 |

|

|

|

1,244 |

|

|

0.3 |

| Other income, net |

|

(605 |

) |

|

(0.1 |

) |

|

|

(43 |

) |

|

0.0 |

|

Income before income taxes |

|

22,935 |

|

|

4.6 |

|

|

|

43,900 |

|

|

11.0 |

| Provision for income

taxes |

|

5,099 |

|

|

1.0 |

|

|

|

9,820 |

|

|

2.5 |

|

Net income |

$ |

17,836 |

|

|

3.6 |

|

|

$ |

34,080 |

|

|

8.6 |

| |

|

|

|

|

|

|

|

| Diluted earnings per

share |

$ |

0.57 |

|

|

|

|

$ |

1.07 |

|

|

|

| |

|

|

|

|

|

|

|

| Weighted average diluted

shares outstanding |

|

31,494 |

|

|

|

|

|

31,726 |

|

|

|

| |

Twelve Months Ended |

|

Twelve Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.* |

|

12/25/21 |

|

Pct. * |

|

Net sales |

$ |

1,733,749 |

|

|

100.0 |

|

$ |

1,345,249 |

|

|

100.0 |

| Cost of goods sold |

|

1,169,299 |

|

|

67.4 |

|

|

882,333 |

|

|

65.6 |

|

Gross profit |

|

564,450 |

|

|

32.6 |

|

|

462,916 |

|

|

34.4 |

| Selling, general and

administrative expenses |

|

393,402 |

|

|

22.7 |

|

|

291,365 |

|

|

21.7 |

|

Income from operations |

|

171,048 |

|

|

9.9 |

|

|

171,551 |

|

|

12.8 |

| Interest expense, net |

|

15,582 |

|

|

0.9 |

|

|

2,162 |

|

|

0.2 |

| Other income, net |

|

(735 |

) |

|

0.0 |

|

|

(377 |

) |

|

0.0 |

|

Income before income taxes |

|

156,201 |

|

|

9.0 |

|

|

169,766 |

|

|

12.6 |

| Provision for income

taxes |

|

34,652 |

|

|

2.0 |

|

|

38,234 |

|

|

2.8 |

|

Net income |

$ |

121,549 |

|

|

7.0 |

|

$ |

131,532 |

|

|

9.8 |

| |

|

|

|

|

|

|

|

| Diluted earnings per

share |

$ |

3.85 |

|

|

|

|

$ |

4.12 |

|

|

|

| |

|

|

|

|

|

|

|

| Weighted average diluted

shares outstanding |

|

31,543 |

|

|

|

|

|

31,961 |

|

|

|

* Percentage of sales. Data may not add due to rounding.

DORMAN PRODUCTS, INC. AND

SUBSIDIARIESConsolidated Balance Sheets (in thousands,

except share data)

|

(unaudited) |

12/31/22 |

|

12/25/21 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

46,034 |

|

|

$ |

58,782 |

|

|

Accounts receivable, less allowance for doubtful accounts of $1,363

and $1,326 |

|

427,385 |

|

|

|

472,764 |

|

|

Inventories |

|

755,901 |

|

|

|

531,988 |

|

|

Prepaids and other current assets |

|

39,800 |

|

|

|

13,048 |

|

|

Total current assets |

|

1,269,120 |

|

|

|

1,076,582 |

|

| Property, plant and equipment,

net |

|

148,477 |

|

|

|

114,864 |

|

| Operating lease right-of-use

assets |

|

109,977 |

|

|

|

59,029 |

|

| Goodwill |

|

443,035 |

|

|

|

197,332 |

|

| Intangible assets, net |

|

322,409 |

|

|

|

178,809 |

|

| Other assets |

|

48,768 |

|

|

|

46,503 |

|

|

Total assets |

$ |

2,341,786 |

|

|

$ |

1,673,119 |

|

| Liabilities and

shareholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

179,819 |

|

|

$ |

177,389 |

|

|

Accrued compensation |

|

19,490 |

|

|

|

26,636 |

|

|

Accrued customer rebates and returns |

|

192,116 |

|

|

|

188,080 |

|

|

Revolving credit facility |

|

239,363 |

|

|

|

239,360 |

|

|

Current portion of long-term debt |

|

12,500 |

|

|

|

— |

|

|

Other accrued liabilities |

|

35,007 |

|

|

|

33,583 |

|

|

Total current liabilities |

|

678,295 |

|

|

|

665,048 |

|

| Long-term debt |

|

482,464 |

|

|

|

— |

|

| Long-term operating lease

liabilities |

|

98,221 |

|

|

|

52,443 |

|

| Other long-term

liabilities |

|

28,349 |

|

|

|

4,916 |

|

| Deferred tax liabilities,

net |

|

11,826 |

|

|

|

17,976 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’

equity: |

|

|

|

|

Common stock, par value $0.01; authorized 50,000,000 shares; issued

and outstanding 31,430,632 and 31,607,509 shares in 2022 and 2021,

respectively |

|

314 |

|

|

|

316 |

|

|

Additional paid-in capital |

|

88,750 |

|

|

|

77,451 |

|

|

Retained earnings |

|

956,870 |

|

|

|

856,409 |

|

|

Accumulated other comprehensive loss |

|

(3,303 |

) |

|

|

(1,440 |

) |

|

Total shareholders’ equity |

|

1,042,631 |

|

|

|

932,736 |

|

|

Total liabilities and shareholders’ equity |

$ |

2,341,786 |

|

|

$ |

1,673,119 |

|

Selected Cash Flow Information (unaudited):

| |

Three Months Ended |

|

Twelve Months Ended |

| (in thousands) |

12/31/22 |

|

12/25/21 |

|

12/31/22 |

|

12/25/21 |

|

Cash provided by operating activities |

$ |

12,344 |

|

$ |

22,737 |

|

$ |

41,688 |

|

$ |

100,338 |

| Depreciation, amortization and

accretion |

$ |

13,546 |

|

$ |

10,262 |

|

$ |

44,677 |

|

$ |

35,193 |

| Capital expenditures |

$ |

14,103 |

|

$ |

4,566 |

|

$ |

37,883 |

|

$ |

19,840 |

| |

|

|

|

|

|

|

|

|

|

|

|

DORMAN PRODUCTS, INC. AND

SUBSIDIARIES Non-GAAP Financial Measures (in thousands,

except per-share amounts)

Our financial results include certain financial

measures not derived in accordance with generally accepted

accounting principles (GAAP). Non-GAAP financial measures should

not be used as a substitute for GAAP measures, or considered in

isolation, for the purpose of analyzing our operating performance,

financial position or cash flows. Additionally, these non-GAAP

measures may not be comparable to similarly titled measures

reported by other companies. However, we have presented these

non-GAAP financial measures because we believe this presentation,

when reconciled to the corresponding GAAP measure, provides useful

information to investors by offering additional ways of viewing our

results, profitability trends, and underlying growth relative to

prior and future periods and to our peers. Management uses these

non-GAAP financial measures in making financial, operating, and

planning decisions and in evaluating our performance. Non-GAAP

financial measures may reflect adjustments for charges such as fair

value adjustments, amortization, transaction costs, severance,

accelerated depreciation, and other similar expenses related to

acquisitions as well as other items that we believe are not related

to our ongoing performance.

Adjusted Net Income:

| |

Three Months Ended |

|

Twelve Months Ended |

|

| (unaudited) |

12/31/22 |

* |

12/25/21 |

* |

12/31/22 |

* |

12/25/21 |

* |

|

Net income (GAAP) |

$ |

17,836 |

|

|

$ |

34,080 |

|

|

$ |

121,549 |

|

|

$ |

131,532 |

|

|

| Pretax acquisition-related

intangible assets amortization [1] |

|

5,082 |

|

|

|

3,525 |

|

|

|

14,070 |

|

|

|

6,340 |

|

|

| Pretax acquisition-related

transaction and other costs [2] |

|

13,199 |

|

|

|

6,897 |

|

|

|

22,736 |

|

|

|

15,072 |

|

|

| Capitalized debt issuance fee

write-off [3] |

|

151 |

|

|

|

— |

|

|

|

151 |

|

|

|

— |

|

|

| Tax adjustment (related to above

items) [4] |

|

(4,450 |

) |

|

|

(2,402 |

) |

|

|

(8,375 |

) |

|

|

(4,589 |

) |

|

| Adjusted net income

(Non-GAAP) |

$ |

31,818 |

|

|

$ |

42,100 |

|

|

$ |

150,131 |

|

|

$ |

148,355 |

|

|

| |

|

|

|

|

|

|

|

|

| Diluted earnings per share

(GAAP) |

$ |

0.57 |

|

|

$ |

1.07 |

|

|

$ |

3.85 |

|

|

$ |

4.12 |

|

|

| Pretax acquisition-related

intangible assets amortization [1] |

|

0.16 |

|

|

|

0.11 |

|

|

|

0.45 |

|

|

|

0.20 |

|

|

| Pretax acquisition-related

transaction and other costs [2] |

|

0.42 |

|

|

|

0.22 |

|

|

|

0.72 |

|

|

|

0.47 |

|

|

| Capitalized debt issuance fee

write-off [3] |

|

0.00 |

|

|

|

— |

|

|

|

0.00 |

|

|

|

— |

|

|

| Tax adjustment (related to above

items) [4] |

|

(0.14 |

) |

|

|

(0.08 |

) |

|

|

(0.27 |

) |

|

|

(0.14 |

) |

|

| Adjusted diluted earnings per

share (Non-GAAP) |

$ |

1.01 |

|

|

$ |

1.33 |

|

|

$ |

4.76 |

|

|

$ |

4.64 |

|

|

| |

|

|

|

|

|

|

|

|

| Weighted average diluted shares

outstanding |

|

31,494 |

|

|

|

31,726 |

|

|

|

31,543 |

|

|

|

31,961 |

|

|

* Amounts may not add due to rounding.See accompanying notes at

the end of this supplemental schedule.

Adjusted Gross Profit:

| |

Three Months Ended |

|

Three Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.** |

|

12/25/21 |

|

Pct.** |

|

Gross profit (GAAP) |

$ |

157,774 |

|

31.5 |

|

$ |

131,417 |

|

33.0 |

| Pretax acquisition-related

transaction and other costs [2] |

|

6,719 |

|

1.3 |

|

|

6,372 |

|

1.6 |

| Adjusted gross profit

(Non-GAAP) |

$ |

164,493 |

|

32.8 |

|

$ |

137,789 |

|

34.6 |

| |

|

|

|

|

|

|

|

| Net sales |

$ |

501,281 |

|

|

|

$ |

398,176 |

|

|

| |

Twelve Months Ended |

|

Twelve Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.** |

|

12/25/21 |

|

Pct.** |

|

Gross profit (GAAP) |

$ |

564,450 |

|

32.6 |

|

$ |

462,916 |

|

34.4 |

| Pretax acquisition-related

transaction and other costs [2] |

|

11,070 |

|

0.6 |

|

|

9,438 |

|

0.7 |

| Adjusted gross profit

(Non-GAAP) |

$ |

575,520 |

|

33.2 |

|

$ |

472,354 |

|

35.1 |

| |

|

|

|

|

|

|

|

| Net sales |

$ |

1,733,749 |

|

|

|

$ |

1,345,249 |

|

|

Adjusted SG&A Expenses:

| |

Three Months Ended |

|

Three Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.** |

|

12/25/21 |

|

Pct.** |

|

SG&A expenses (GAAP) |

$ |

125,002 |

|

|

24.9 |

|

|

$ |

86,316 |

|

|

21.7 |

|

| Pretax acquisition-related

intangible assets amortization [1] |

|

(5,082 |

) |

|

(1.0 |

) |

|

|

(3,525 |

) |

|

(0.9 |

) |

| Pretax acquisition-related

transaction and other costs [2] |

|

(6,480 |

) |

|

(1.3 |

) |

|

|

(525 |

) |

|

(0.1 |

) |

| Adjusted SG&A expenses

(Non-GAAP) |

$ |

113,440 |

|

|

22.6 |

|

|

$ |

82,266 |

|

|

20.7 |

|

| |

|

|

|

|

|

|

|

| Net sales |

$ |

501,281 |

|

|

|

|

$ |

398,176 |

|

|

|

| |

Twelve Months Ended |

|

Twelve Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.** |

|

12/25/21 |

|

Pct.** |

|

SG&A expenses (GAAP) |

$ |

393,402 |

|

|

22.7 |

|

|

$ |

291,365 |

|

|

21.7 |

|

| Pretax acquisition-related

intangible assets amortization [1] |

|

(14,070 |

) |

|

(0.8 |

) |

|

|

(6,340 |

) |

|

(0.5 |

) |

| Pretax acquisition-related

transaction and other costs [2] |

|

(11,666 |

) |

|

(0.7 |

) |

|

|

(5,634 |

) |

|

(0.4 |

) |

| Adjusted SG&A expenses

(Non-GAAP) |

$ |

367,666 |

|

|

21.2 |

|

|

$ |

279,391 |

|

|

20.8 |

|

| |

|

|

|

|

|

|

|

| Net sales |

$ |

1,733,749 |

|

|

|

|

$ |

1,345,249 |

|

|

|

Adjusted Other Income, Net:

| |

Three Months Ended |

|

Three Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.** |

|

12/25/21 |

|

Pct.** |

|

Other income, net (GAAP) |

$ |

605 |

|

0.1 |

|

$ |

43 |

|

0.0 |

| Capitalized debt issuance fee

write-off [3] |

|

151 |

|

0.0 |

|

|

— |

|

— |

| Adjusted other income, net

(Non-GAAP) |

$ |

756 |

|

0.2 |

|

$ |

43 |

|

0.0 |

| |

|

|

|

|

|

|

|

| Net sales |

$ |

501,281 |

|

|

|

$ |

398,176 |

|

|

| |

Twelve Months Ended |

|

Twelve Months Ended |

|

(unaudited) |

12/31/22 |

|

Pct.** |

|

12/25/21 |

|

Pct.** |

|

Other income, net (GAAP) |

$ |

735 |

|

0.0 |

|

$ |

377 |

|

0.0 |

| Capitalized debt issuance fee

write-off [3] |

|

151 |

|

0.0 |

|

|

— |

|

— |

| Adjusted other income, net

(Non-GAAP) |

$ |

886 |

|

0.1 |

|

$ |

377 |

|

0.0 |

| |

|

|

|

|

|

|

|

| Net sales |

$ |

1,733,749 |

|

|

|

$ |

1,345,249 |

|

|

* *Percentage of sales. Data may not add due to rounding.

[1] – Pretax acquisition-related intangible

asset amortization results from allocating the purchase price of

acquisitions to the acquired tangible and intangible assets of the

acquired business and recognizing the cost of the intangible asset

over the period of benefit. Such costs were $5.1 million pretax (or

$3.8 million after tax) during the three months ended

December 31, 2022 and $14.1 million pretax (or $10.7 million

after tax) during the twelve months ended December 31, 2022

and were included in selling, general and administrative expenses.

Such costs were $3.5 million pretax (or $2.7 million after tax)

during the three months ended December 25, 2021 and $6.3

million pretax (or $4.8 million after tax) during the twelve months

ended December 25, 2021 and were included in selling, general

and administrative expenses.

[2] – Pretax acquisition-related transaction and

other costs include costs incurred to complete and integrate

acquisitions, adjustments to contingent consideration obligations,

inventory fair value adjustments and facility consolidation and

start-up expenses. During the three and twelve months ended

December 31, 2022, we incurred charges included in cost of

goods sold for integration costs, other facility consolidation

expenses and inventory fair value adjustments of $6.7 million

pretax (or $5.1 million after tax) and $11.1 million pretax (or

$8.4 million after tax), respectively. During the three and twelve

months ended December 31, 2022, we incurred charges included

in selling, general and administrative expenses to complete and

integrate acquisitions, adjustments to contingent consideration

obligations, and facility consolidation and start-up expenses of

$6.5 million pretax (or $4.9 million after tax) and $11.7 million

pretax (or $9.4 million after tax), respectively.

During the three and twelve months ended

December 25, 2021, we incurred charges included in cost of

goods sold for integration costs, other facility consolidation

expenses and inventory fair value adjustments of $6.4 million

pretax (or $4.9 million after tax) and $9.4 million pretax (or $7.3

million after tax), respectively. During the three and twelve

months ended December 25, 2021, we incurred charges included

in selling, general and administrative expenses to complete and

integrate acquisitions as well as accretion expenses related to

contingent consideration obligations of $0.5 million pretax (or

$0.4 million after tax) and $5.6 million pretax (or $4.8 million

after tax), respectively.

[3] – Capitalized debt issuance fee write-off

totaled $0.2 million (or $0.1 million after tax) during the three

and twelve months ended December 31, 2022.

[4] – Tax adjustments represent the aggregate

tax effect of all non-GAAP adjustments reflected in the table

above, and totaled $(4.5) million and $(8.4) million during the

three and twelve months ended December 31, 2022, respectively,

and $(2.4) million and $(4.6) million during the three and twelve

months ended December 25, 2021, respectively. Such items are

estimated by applying our statutory tax rate to the pretax amount,

or an actual tax amount for discrete items.

2023 Guidance:

The Company provided the following guidance ranges related to

their fiscal 2023 outlook:

| |

Year Ending 12/31/2023 |

|

(unaudited) |

Low End* |

|

High End* |

|

Diluted earnings per share (GAAP) |

$ |

4.35 |

|

|

$ |

4.55 |

|

| Pretax acquisition-related

intangible assets amortization |

|

0.69 |

|

|

|

0.69 |

|

| Pretax acquisition transaction

and other costs |

|

0.38 |

|

|

|

0.38 |

|

| Tax adjustment (related to above

items) |

|

(0.27 |

) |

|

|

(0.27 |

) |

| Adjusted diluted earnings per

share (Non-GAAP) |

$ |

5.15 |

|

|

$ |

5.35 |

|

| |

|

|

|

| Weighted average diluted shares

outstanding |

|

31,500 |

|

|

|

31,500 |

|

*Data may not add due to rounding.

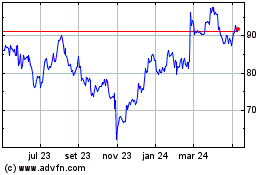

Dorman Products (NASDAQ:DORM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Dorman Products (NASDAQ:DORM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024