BlackRock® Canada Announces Voting Results for Proposed Mergers and Adjournment of a Special Meeting of Unitholders

01 Março 2023 - 7:55PM

BlackRock Asset Management Canada Limited (“

BlackRock

Canada”), an indirect, wholly-owned subsidiary of

BlackRock, Inc. (“

BlackRock”) (NYSE: BLK), is

pleased to announce that at a special meeting held today,

unitholders approved the proposal to merge (the

“

Merger”) the iShares Short Term High Quality

Canadian Bond Index ETF (“

Merging ETF”) into the

iShares Core Canadian Short Term Bond Index ETF (the

“

Continuing ETF”)

The Merging ETF will be wound down following

completion of the Merger. Unitholders of the Merging ETF will

receive full units of the Continuing ETF based on the Continuing

ETF’s net asset value per unit, and cash in lieu of fractional

units.

BlackRock Canada expects that the Merger will be

implemented on or about March 27, 2023. The last day of trading of

the Merging ETF will be March 24, 2023.

The Merger is expected to take place on a

taxable basis, and for tax purposes, will generally be treated as a

disposition of the property and units of the Merging ETF.

The approved change aims to simplify product

offering and provide better diversification opportunities for

investors. The Merging ETF and Continuing ETF have substantially

similar underlying investment exposure. In addition, the Continuing

ETF has greater secondary market liquidity, measured by average

spreads and volumes, to that of the Merging ETF.

For more information about the Merging ETF and

Continuing ETF, please visit www.blackrock.com/ca.

Unitholders of the iShares High Quality Canadian

Bond Index ETF voted against approving the proposal to merge the

iShares High Quality Canadian Bond Index ETF into the iShares Core

Canadian Universe Bond Index ETF.

Helen Hayes, Head of iShares Canada,

BlackRock:

“BlackRock is continuously looking for ways to

innovate not just our product suite, but also how we meet changing

client needs and navigate evolving market conditions. The

priorities and needs of Canadian investors are key as we evolve our

ETF lineup to provide more investor choice. We would like to thank

unitholders for participating in the special meetings.”

BlackRock Canada is also announcing that, as the

quorum requirement with respect to the special meeting of the

unitholders of the iShares U.S. High Yield Fixed Income Index ETF

(CAD-Hedged) held on March 1, 2023 (the “Meeting”)

was not satisfied, the Meeting has been adjourned. The adjourned

meeting has been scheduled for 10:00 a.m. (Toronto time) on March

13, 2023, solely as a virtual (online) meeting by way of live audio

webcast online at

www.virtualshareholdermeeting.com/ishares2023.

At the adjourned meeting, the business of the

meeting will be transacted by those unitholders of the iShares U.S.

High Yield Fixed Income Index ETF (CAD-Hedged) present in person

(virtually) or represented by proxy. Unitholders who are entitled

to vote are encouraged to exercise their right to vote until 5:00pm

(Toronto time) on March 9, 2023 via the internet at

www.proxyvote.com or by telephone by calling 1-800-474-7493

(English) or 1-800-474-7501 (French), and using the 16-digit

control number listed on the form of proxy or voting instruction

form sent to unitholders. Eligible unitholders can also vote by

completing, dating, signing and returning the form of proxy or

voting instruction form, as applicable, to Broadridge at PO Box

3700, Stn Industrial Park, Markham, Ontario, L3R 9Z9, Attention:

Data Processing Centre so that it arrives before 5:00PM (Toronto

time) on March 9, 2023.

About BlackRock

BlackRock’s purpose is to help more and more

people experience financial well-being. As a fiduciary to investors

and a leading provider of financial technology, we help millions of

people build savings that serve them throughout their lives by

making investing easier and more affordable. For additional

information on BlackRock, please visit

www.blackrock.com/corporate.

About iShares

iShares unlocks opportunity across markets to

meet the evolving needs of investors. With more than twenty years

of experience, a global line-up of 1300+ exchange traded funds

(ETFs) and US$2.91 trillion in assets under management as of

December 31, 2022, iShares continues to drive progress for the

financial industry. iShares funds are powered by the expert

portfolio and risk management of BlackRock.

iShares® ETFs are managed by BlackRock Asset

Management Canada Limited.

Commissions, trailing commissions, management

fees and expenses all may be associated with investing in iShares

ETFs. Please read the relevant prospectus before investing. The

funds are not guaranteed, their values change frequently and past

performance may not be repeated. Tax, investment and all other

decisions should be made, as appropriate, only with guidance from a

qualified professional.

Contact for Media: Reem Jazar

Email: reem.jazar@blackrock.com

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

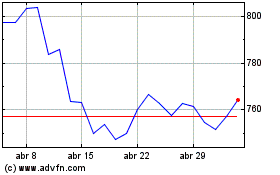

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024