ECN Capital Announces Review of Strategic Alternatives

07 Março 2023 - 6:10PM

ECN Capital Corp. (TSX: ECN) announced today that it has initiated

a review of strategic alternatives to maximize shareholder value.

In response to interest that has been received

by the Company, ECN will evaluate the full range of alternatives to

determine the best path forward to continue to drive growth and

maximize value for shareholders. Alternatives will include

strategic funding and capital relationships as well as other

options. ECN has retained external financial advisors to assist in

this process.

Steven K. Hudson, Chief Executive Officer of

ECN, stated: “Allocating capital to maximize shareholder value has

been the primary objective of ECN’s management and Board since

inception. Alongside our funding partners, ECN has acquired and

grown exceptional businesses, divested others when opportunity and

circumstances dictated, and returned capital to shareholders when

appropriate. The review process announced today will be focused on

achieving the best outcome for our shareholders over the coming

years in our manufactured housing, RV and marine, and inventory

finance businesses.”

There can be no assurance that this process will

result in any specific strategic plan or financial transaction and

no timetable has been set for its completion. The Company does not

plan to provide updates on the status of the review unless there

are material developments to report.

Given the strategic review announced today, the

Company is postponing its Investor Day, which had been previously

scheduled for March 8, 2023.

ECN also announced today that it intends to file

its financial statements and management discussion and analysis for

the three-month and year-end period ended December 31, 2022 after

markets close on Wednesday, March 22, 2023.

Forward-Looking Statements

This press release contains forward-looking

statements regarding ECN Capital and its business. Such statements

are based on the current expectations and views of future events of

ECN Capital’s management. In some cases, the forward-looking

statements can be identified by words or phrases such as “may”,

“will”, “expect”, “plan”, “anticipate”, “intend”, “potential”,

“estimate”, “believe” or the negative of these terms, or other

similar expressions intended to identify forward looking

statements. Forward-looking statements in this press release

include those relating to the strategic review process and its

intent to maximize shareholder value.

The forward-looking events and circumstances

discussed in this press release may not occur and could differ

materially as a result of known and unknown risk factors and

uncertainties affecting ECN Capital, including risks regarding the

equipment finance industry, economic factors, and many other

factors beyond the control of ECN Capital. There can be no

assurance whether a transaction, strategic change or outcome will

result from or be implemented as a result of the strategic review

process or whether the strategic review will ultimately result in

the maximizing of shareholder value. No forward-looking statement

can be guaranteed. Forward-looking statements and information by

their nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause our actual

results, performance or achievements, or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking statement

or information. Accordingly, readers should not place undue

reliance on any forward-looking statements or information. A

discussion of the material risks and assumptions associated with

such forward-looking statements or information can be found in ECN

Capital’s September 30, 2022 Management Discussion and Analysis and

the 2021 Annual Information Form dated March 30, 2022, which have

been filed on SEDAR and can be accessed at www.sedar.com.

Except as required by applicable securities laws, forward-looking

statements speak only as of the date on which they are made and ECN

Capital does not undertake any obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events, or otherwise.

About ECN Capital Corp.

With originated assets of more than US$14

billion, ECN Capital Corp. (TSX: ECN) is a leading provider of

business services to North American based banks, credit unions,

life insurance companies, pension funds and institutional investors

(collectively our “Partners”). ECN Capital originates, manages and

advises on credit assets on behalf of its Partners, specifically

consumer (manufactured housing and marine and recreational vehicle)

loans. Our Partners are seeking high quality assets to match with

their deposits or other liabilities. These services are offered

through two operating segments: (i) Manufactured Housing Finance,

and (ii) Marine and Recreational Vehicle Finance.

Contact

John

Wimsatt561-389-2334jwimsatt@ecncapitalcorp.com

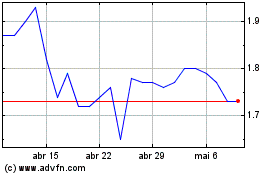

Ecn Capital (TSX:ECN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

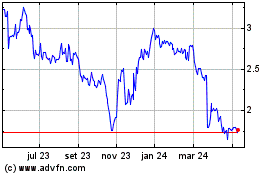

Ecn Capital (TSX:ECN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024