BlackRock® Canada Announces Certain Changes to XEC and XSEM

13 Março 2023 - 6:36PM

BlackRock Asset Management Canada Limited (“

BlackRock

Canada”), an indirect, wholly-owned subsidiary of

BlackRock, Inc. (“

BlackRock”) (NYSE: BLK), has

determined to change the manner in which the investment strategies

of iShares Core MSCI Emerging Markets IMI Index ETF

(“

XEC”) and iShares ESG Aware MSCI Emerging

Markets Index ETF (“

XSEM”, and together with XEC,

the “

iShares ETFs”) are implemented. The changes

are expected to reduce the negative effect of foreign withholding

taxes on XEC and XSEM’s performance.

To pursue its investment objective, XEC is

commencing investing primarily in equity securities of companies

from emerging markets that are included in the MSCI Emerging

Markets Investable Market Index (the “XEC Index”),

such that the resulting portfolio will have characteristics that

closely match the characteristics of the XEC Index. This direct

investment strategy will be a change from how XEC currently

implements its investment strategy by investing in shares of the

iShares Core MSCI Emerging Markets ETF (IEMG), a U.S. iShares

Fund.

To pursue its investment objective, XSEM is

commencing investing primarily in equity securities of companies

from emerging markets that are included in the MSCI Emerging

Markets Extended ESG Focus Index (the “XSEM

Index”), such that the resulting portfolio will have

characteristics that closely match the characteristics of the XSEM

Index. This direct investment strategy will be a change from how

XSEM currently implements its investment strategy by investing in

shares of the iShares ESG Aware MSCI EM ETF (ESGE), a U.S. iShares

Fund.

These changes are being implemented in

accordance with the iShares ETFs’ current prospectus disclosure.

The investment objectives of the iShares ETFs, the XEC Index and

the XSEM Index will remain unchanged. As a result of these changes

in investment strategy implementation, each iShares ETF will

significantly reduce its exposure to U.S. withholding taxes. While

foreign withholding taxes will continue to apply to dividends paid

on certain emerging market equity securities included in the XEC

Index and XSEM Index, it is expected that the changes in investment

strategy implementation will reduce the overall amount of

withholding taxes borne directly or indirectly by each iShares

ETF.

BlackRock Canada’s current expectation is that

each iShares ETF will realize net capital losses as a result of the

changes to such iShares ETF’s portfolio.

The adjustment to change to the way XEC and XSEM

strategies are implemented is in line with BlackRock’s ongoing

commitment to provide a comprehensive range of ETF solutions

spanning asset classes, geographies, and investment styles to

address a variety of investor needs.

For more information about the iShares ETFs,

please visit www.blackrock.com/ca.

About

BlackRock

BlackRock’s purpose is to help more and more

people experience financial well-being. As a fiduciary to investors

and a leading provider of financial technology, we help millions of

people build savings that serve them throughout their lives by

making investing easier and more affordable. For additional

information on BlackRock, please visit

www.blackrock.com/corporate.

About iShares

iShares unlocks opportunity across markets to

meet the evolving needs of investors. With more than twenty years

of experience, a global line-up of 1300+ exchange traded funds

(ETFs) and US$2.91 trillion in assets under management as of

December 31, 2022, iShares continues to drive progress for the

financial industry. iShares funds are powered by the expert

portfolio and risk management of BlackRock.

iShares® ETFs are managed by BlackRock Asset

Management Canada Limited.

Commissions, trailing commissions, management

fees and expenses all may be associated with investing in iShares

ETFs. Please read the relevant prospectus before investing. The

funds are not guaranteed, their values change frequently and past

performance may not be repeated. Tax, investment and all other

decisions should be made, as appropriate, only with guidance from a

qualified professional.

Contact for Media: Reem Jazar

Email: reem.jazar@blackrock.com

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

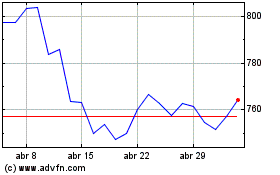

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024