Iris Energy Limited (NASDAQ: IREN) ("Iris Energy" or "the

Company"), a leading owner and operator of institutional-grade,

highly efficient proprietary Bitcoin mining data centers powered by

100% renewable energy, today published a monthly investor update

for April 2023, containing its results from operations as well as

business updates.

Key Highlights1

|

Key metrics2 |

Apr-23 |

|

Average operating hashrate (PH/s) |

3,965 |

|

Bitcoin mined |

319 |

|

Mining revenue (US$’000) |

9,037 |

|

Electricity costs (US$’000) |

4,184 |

|

Revenue per Bitcoin (US$) |

28,331 |

|

Electricity costs per Bitcoin (US$) |

13,118 (12,563 adj)3 |

- Corporate:

- Increased operating

hashrate by 118% to 5.5 EH/s (as at May 3)

- Investor update

call to be held on May 10, 2023

- US$18.4m AEP refund

received

- New R&D

initiatives underway

- Further ordinary

shares acquired by a director, Mr. Michael Alfred

- Operations (for the

month of April 2023):

- Average operating

hashrate of 3,965 PH/s (+107% vs. March)

- Monthly operating

revenue of US$9.0 million (+109% vs. March)

- 319 Bitcoin mined

(+85% vs. March)

- Construction:

- Childress (20MW –

Texas, USA)

- 600MW bulk power

substation and 100MW primary substation energized

- 20MW data center

operational, with final commissioning activities

- 580MW of spare

power capacity for expansion, planning underway

Corporate update

Increase in self-mining capacity to 5.5 EH/s

complete

Iris Energy is pleased to advise that it has

increased its operating hashrate from 2.5 EH/s4 to a current level

of 5.5 EH/s, completing its recently announced increase in

self-mining capacity to 5.5 EH/s.

Investor update call on May 10

Iris Energy will host a webcast and conference

call to provide an update on its strategic priorities on Wednesday,

May 10, 2023, beginning at 5:00 p.m. USA Eastern Time. The webcast

will be recorded, and the replay will be accessible shortly after

the event at

https://investors.irisenergy.co/events-and-presentations

|

Webcast and Conference Call Details |

|

Date: |

Wednesday, May 10, 2023 |

|

|

Time: |

5:00 p.m. USA Eastern Time (2:00 p.m. Pacific Time or 7:00 a.m.

Australian Eastern Standard Time on Thursday, May 11, 2023) |

|

|

|

Participant |

Registration Link |

|

|

|

Live Webcast |

Use this link |

|

|

|

Phone Dial-In |

Use this link |

|

US$18.4m AEP refund received

On April 20, 2023, Iris Energy confirmed that

US$18.4m of deposits previously paid by the Company to AEP Texas

were released following energization of the 600MW bulk power

substation at Childress and connection of the site to the ERCOT

grid.

New R&D initiatives

As part of Iris Energy’s exploration and

investment in R&D initiatives to facilitate growth beyond its

first 5.5 EH/s, the Company acquired 200 of the latest generation

Bitmain S19 XP miners for testing across its sites.

Share acquisition by director

The Company advises that between March 13, 2023,

and May 4, 2023, an entity affiliated with Mr. Michael Alfred, a

director on the Company's Board of Directors, has acquired 555,461

ordinary shares in the Company (in aggregate) for total

consideration of approximately $1,790,210.

Canal Flats update (0.8 EH/s, 30MW

capacity) – BC, Canada

Canal Flats has been powered by 100% renewable

energy since inception5.

The project achieved average monthly operating

hashrate of 710 PH/s in April compared to 591 PH/s last month.

Mackenzie update (2.5 EH/s, 80MW

capacity) – BC, Canada

Mackenzie has been powered by 100% renewable

energy since inception5.

The project achieved average monthly operating

hashrate of 1,874 PH/s in April compared to 862 PH/s last

month.

Prince George update (1.6 EH/s, 50MW

capacity) – BC, Canada

Prince George has been powered by 100% renewable

energy since inception5.

The project achieved average monthly operating

hashrate of 1,292 PH/s in April compared to 458 PH/s last

month.

Childress update (0.6 EH/s, 20MW

capacity) – Texas, USA

During the month, Iris Energy energized the

600MW bulk power substation and the 100MW primary substation at its

Childress site.

The Company’s first 20MW data center (supporting

~0.6 EH/s) is now operational, with final commissioning

activities.

The project achieved average monthly operating

hashrate of 89 PH/s in April reflecting a partial month of

operations.

The Company’s significant upfront investment in

key infrastructure provides the ability to rapidly and efficiently

expand beyond the first 20MW. Planning is underway to utilize the

580MW of spare power capacity at the site.

Community engagement

Applications for the Community Grants Programs

in Mackenzie and Prince George are now open. Not-for-profit

organizations are encouraged to apply for up to C$10,000 towards

initiatives that support the local community. Please visit our

website to apply.

Iris Energy proudly sponsored a female

apprentice electrician in Canada through the Community Grants

Program last year, and we are delighted to report that Pamela Viau

has successfully completed her qualifications and is now working on

a full-time basis with Iris Energy. Grant recipient, Pamela

said:

“I would like to express my gratitude towards

Iris Energy who contributed to my career and my personal

development. Last year I went back to school to pursue the

schooling portion of my apprenticeship and finalize it. Through a

generous grant made by Iris Energy, I was able to put aside the

stressful burden that every student faces while at school – money,

and the freedom to focus only on my studies.”

Future development

sitesDevelopment works continued across additional sites

in Canada, the USA and Asia-Pacific, which have the potential to

support up to an additional >1GW of aggregate power capacity

capable of powering growth beyond the Company’s 760MW of announced

power capacity.

Operating and financial results

Daily average operating hashrate chart is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2b21976f-9143-43f4-8ecb-ddc55eab9a02

Technical commentary

The Company’s average operating hashrate was

3,965 PH/s in April (compared to 1,912 PH/s in March), with the

increase primarily attributable to the installation of additional

miners across our sites. The increase in Bitcoin mined (319 vs. 173

in March) and electricity costs ($4.2 million vs. $2.2 million in

March) were also primarily attributable to the increase in

installed miners. Adjusted electricity costs per Bitcoin was $12.6k

in April (compared to $11.5k in March), with the increase primarily

attributable to an increase in the difficulty-implied global

hashrate.

|

Operating |

Feb-23 |

Mar-23 |

Apr-23 |

|

Renewable energy usage (MW)6 |

54 |

59 |

119 |

|

Avg operating hashrate (PH/s) |

1,730 |

1,912 |

3,965 |

|

Financial (unaudited)2 |

Feb-23 |

Mar-23 |

Apr-23 |

|

Bitcoin mined |

156 |

173 |

319 |

|

Mining revenue (US$’000) |

3,539 |

4,324 |

9,037 |

|

Electricity costs (US$’000) |

1,869 |

2,172 |

4,184 |

|

Revenue per Bitcoin (US$) |

22,637 |

25,030 |

28,331 |

|

Electricity costs per Bitcoin (US$) |

11,956 (10,608 adj)3 |

12,570 (11,533 adj)3 |

13,118 (12,563 adj)3 |

|

Miner Shipping Schedule |

Hardware |

Units |

EH/s (incremental) |

EH/s(cumulative) |

|

Operating (as at May 3) |

S19j Pro7 |

54,875 |

5.5 |

5.5 |

|

Inventory – pending deployment or in transit |

S19j Pro8 |

2,311 |

0.2 |

5.7 |

|

Total* |

|

57,186 |

5.7 |

5.7 |

* As noted in the table below, the Company’s

existing data center capacity is estimated to support ~5.5 EH/s of

Bitmain S19j Pro miners.

|

Site |

Capacity (MW) |

Capacity (EH/s)9 |

Timing |

Status |

|

Canal Flats (BC, Canada) |

30 |

0.8 |

Complete |

Operating |

|

Mackenzie (BC, Canada) |

80 |

2.5 |

Complete |

Operating |

|

Prince George (BC, Canada) |

50 |

1.6 |

Complete |

Operating |

|

Total (BC, Canada) |

160 |

4.9 |

|

|

|

Childress (Texas, US) |

20 |

0.6 |

Final Commissioning |

Operating |

|

Total (Canada & USA) |

180 |

5.5 |

|

|

About Iris Energy

Iris Energy is a sustainable Bitcoin mining

company that supports the decarbonization of energy markets and the

global Bitcoin network.

- 100% renewables:

Iris Energy targets markets with low-cost, under-utilized renewable

energy, and where the Company can support local communities

- Long-term security

over infrastructure, land and power supply: Iris Energy builds,

owns and operates its electrical infrastructure and proprietary

data centers, providing long-term security and operational control

over its assets

- Seasoned management

team: Iris Energy’s team has an impressive track record of success

across energy, infrastructure, renewables, finance, digital assets

and data centers with cumulative experience in delivering >$25bn

in energy and infrastructure projects globally

Forward-Looking Statements

This investor update includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or Iris Energy’s future financial or operating

performance. For example, forward-looking statements include but

are not limited to the Company’s business strategy, expected

operational and financial results, and expected increase in power

capacity and hashrate. In some cases, you can identify

forward-looking statements by terminology such as “anticipate,”

“believe,” “may,” “can,” “should,” “could,” “might,” “plan,”

“possible,” “project,” “strive,” “budget,” “forecast,” “expect,”

“intend,” “target”, “will,” “estimate,” “predict,” “potential,”

“continue,” “scheduled” or the negatives of these terms or

variations of them or similar terminology, but the absence of these

words does not mean that statement is not forward-looking. Such

forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially

from those expressed or implied by such forward looking statements.

In addition, any statements or information that refer to

expectations, beliefs, plans, projections, objectives, performance

or other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking.

These forward-looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

Iris Energy’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to: Iris Energy’s limited

operating history with operating losses; electricity outage,

limitation of electricity supply or increase in electricity costs,

as well as limitations on the availability of electrical supply for

Bitcoin mining due to restrictions imposed by governmental

authorities or otherwise; long term outage or limitation of the

internet connection at Iris Energy’s sites; any critical failure of

key electrical or data center equipment; serial defects or

underperformance with respect to Iris Energy’s equipment; failure

of suppliers to perform under the relevant supply contracts for

equipment that has already been procured which may delay Iris

Energy’s expansion plans; supply chain and logistics issues for

Iris Energy or Iris Energy’s suppliers; cancellation or withdrawal

of required operating and other permits and licenses; customary

risks in developing greenfield infrastructure projects; Iris

Energy’s evolving business model and strategy; Iris Energy’s

ability to successfully manage its growth; Iris Energy’s ability to

raise additional financing (whether because of the conditions of

the markets, Iris Energy’s financial condition or otherwise) on a

timely basis, or at all, which could adversely impact the Company’s

ability to meet its capital commitments (including payments due

under any hardware purchase contracts or debt financing

obligations) and the Company’s growth plans; the failure of Iris

Energy’s wholly-owned special purpose vehicles to make required

payments of principal and/or interest under their limited recourse

equipment financing arrangements when due or otherwise comply with

the terms thereof, as a result of which the lender thereunder has

declared the entire principal amount of each loan to be immediately

due and payable, and is taking steps to enforce the indebtedness

and its rights in the Bitcoin miners with respect to certain of

such loans and other assets securing such loans, including

appointing a receiver with respect to such special purpose

vehicles, which is expected to result in the loss of the relevant

Bitcoin miners securing such loans and has materially reduced the

Company’s operating capacity, and could also lead to bankruptcy or

liquidation of the relevant special purpose vehicles, and

materially and adversely impact the Company’s business, operating

expansion plans, financial condition, cash flows and results of

operations; the terms of any additional financing or any

refinancing, restructuring or modification to the terms of any

existing financing, which could be less favorable or require Iris

Energy to comply with more onerous covenants or restrictions, any

of which could restrict its business operations and adversely

impact its financial condition, cash flows and results of

operations; competition; Bitcoin prices, global hashrate and the

market value of Bitcoin miners, any of which could adversely impact

its financial condition, cash flows and results of operations, as

well as its ability to raise additional financing and the ability

of its wholly owned special purpose vehicles to make required

payments of principal and/or interest on their equipment financing

facilities; risks related to health pandemics including those of

COVID-19; changes in regulation of digital assets; and other

important factors discussed under the caption “Risk Factors” in

Iris Energy’s annual report on Form 20-F filed with the SEC on

September 13, 2022, and the Company’s report on Form 6 K filed with

the SEC on February 15, 2023, as such factors may be updated from

time to time in its other filings with the SEC, accessible on the

SEC’s website at www.sec.gov and the Investor Relations section of

Iris Energy’s website at https://investors.irisenergy.co.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this investor update. Any

forward-looking statement that Iris Energy makes in this investor

update speaks only as of the date of such statement. Except as

required by law, Iris Energy disclaims any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Preliminary Financial

Information

The preliminary financial information for the

month of April 2023 included in this investor update is not subject

to the same closing procedures as our unaudited quarterly financial

results and has not been reviewed by our independent registered

public accounting firm. The preliminary financial information

included in this investor update does not represent a comprehensive

statement of our financial results or financial position and should

not be viewed as a substitute for unaudited financial statements

prepared in accordance with International Financial Reporting

Standards. Accordingly, you should not place undue reliance on the

preliminary financial information included in this investor

update.

Contacts

MediaJon SnowballDomestique+61 477 946 068

InvestorsLincoln TanIris Energy+61 407 423

395lincoln.tan@irisenergy.co

To keep updated on Iris Energy’s news releases and SEC filings,

please subscribe to email alerts at

https://investors.irisenergy.co/ir-resources/email-alerts.

______________________

1 All timing references in this investor update are to calendar

months, in each case unless otherwise specified.2 Bitcoin and

Bitcoin mined in this investor update are presented in accordance

with our revenue recognition policy which is determined on a

Bitcoin received basis (post deduction of mining pool fees as

applicable).3 The Company’s unadjusted electricity costs per

Bitcoin mined were elevated in April primarily due to excess demand

charges for our BC sites attributable to demand charges being

billed based on peak (vs. average) demand for the period (noting

the material ramp up in operating capacity during April). The

adjusted electricity costs per Bitcoin mined excludes such excess

demand charges (i.e., assumes demand charges based on average

demand for the period). As our operating capacity ramp up is

nearing completion, all else being equal, we currently expect our

electricity costs per Bitcoin mined to normalize from next month.4

As at March 31, 2023.5 Currently approximately 97% directly from

renewable energy sources; approximately 3% from purchase of RECs.6

Comprises actual power usage for Canal Flats, Mackenzie, Prince

George, and Childress.7 Includes mix of lower efficiency hardware,

which is estimated to represent less than 2% of the operating 5.5

EH/s.8 Includes S19 XP hardware which is estimated to represent

~16% of miners pending deployment or in transit. Excludes some

lower efficiency hardware.9 Reflects estimated hashrate capacity by

site assuming full utilization of available data center capacity

with Bitmain S19j Pro miners.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/29602262-aad5-40d1-b599-9f4716ad59de

https://www.globenewswire.com/NewsRoom/AttachmentNg/80df4f70-a2de-475d-a6c2-3e74f0997d0b

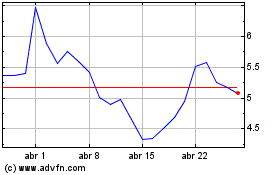

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024