Tower Semiconductor (NASDAQ: TSEM & TASE: TSEM) reports today

its results for the first quarter ended March 31, 2024.

First Quarter of 2024 Results

Overview

Revenue for the first quarter

of 2024 was $327 million as compared to $352 million for the fourth

quarter of 2023. Revenue for the first quarter of 2023 was $356

million.

Gross profit for the first

quarter of 2024 was $73 million as compared to $84 million for the

fourth quarter of 2023. Gross profit for the first quarter of 2023

was $96 million.

Operating profit for the first

quarter of 2024 was $34 million, as compared to $45 million in the

fourth quarter of 2023. Operating profit for the first quarter of

2023 was $89 million and included $32 million restructuring income,

net from the

previously disclosed reorganization and restructure

of our Japan operations during 2022.

Net profit for the first

quarter of 2024 was $45 million, or $0.40 basic and diluted

earnings per share, as compared to net profit of $54 million, or

$0.49 basic and $0.48 diluted earnings per share for the fourth

quarter of 2023. Net profit in the first quarter of 2023 was $71

million, or $0.65 basic and $0.64 diluted earnings per share and

included $11 million restructuring income, net.

Cash flow generated from

operating activities in the first quarter of 2024 was $110 million.

Investments in equipment and other fixed assets were $98 million,

net and debt payments totaled $8 million, net.

In the fourth quarter of 2023, cash flow

generated from operating activities was $126 million, investments

in equipment and other fixed assets were $136 million, net and debt

payments totaled $9 million, net.

Corporate Credit RatingIn May

2024, Standard & Poor’s Maalot (an Israeli rating company that

is fully owned by S&P Global Ratings) completed its annual

rating review for the Company and re-affirmed its corporate credit

rating as “ilAA“/ stable.

Business OutlookTower

Semiconductor guides revenue for the second quarter of 2024 to be

$350 million, with an upward or downward range of 5%.

Mr. Russell Ellwanger, Chief Executive

Officer of Tower Semiconductor, stated: “As we move

through the year, we remain focused on and confident about

continuous growth, driven by the performance of several of our

differentiated technologies, critical to present market needs with

market leader customers who are true partners. This growth is

against the landscape of a not yet robust market. Recent customer

forecasts give reason to believe market recovery is

forthcoming.”

Teleconference and Webcast

Tower Semiconductor will host an investor conference call today,

Thursday, May 9, 2024, at 10:00 a.m. Eastern time (9:00 a.m.

Central time, 8:00 a.m. Mountain time, 7:00 a.m. Pacific time and

5:00 p.m. Israel time) to discuss the Company’s financial results

for the first quarter of 2024 and its business outlook.

This call will be webcast and can be accessed

via Tower Semiconductor’s website at www.towersemi.com or by

calling 1-888-281-1167 (U.S. Toll-Free), 03-918-0610 (Israel),

+972-3-918-0610 (International). For those who are not

available to listen to the live broadcast, the call will be

archived on Tower Semiconductor’s website for 90 days.

The Company presents its financial statements in

accordance with U.S. GAAP. The financial information included

in the tables below includes unaudited condensed financial data.

Some of the financial information, which may be used and/ or

presented in this release and/ or prior earnings related filings

and/ or in related public disclosures or filings with respect to

the financial statements and/ or results of the Company, which we

may describe as adjusted financial measures and/ or

reconciled financial measures, are non-GAAP financial measures as

defined in Regulation G and related reporting requirements

promulgated by the Securities and Exchange Commission as they apply

to our Company. These adjusted financial measures are calculated

excluding the following: (1) amortization of acquired intangible

assets as included in our operating costs and expenses, (2)

compensation expenses in respect of equity grants to directors,

officers, and employees as included in our operating costs and

expenses, (3) merger contract termination fees received from Intel,

net of associated cost and taxes following the previously announced

Intel contract termination as included in net profit and (4)

restructuring income, net, which includes income, net of cost and

taxes associated with the cessation of operations of the Arai

facility in Japan which occurred during 2022 as included in net

profit. These adjusted financial measures should be evaluated in

conjunction with, and are not a substitute for, GAAP financial

measures. The tables may also present the GAAP financial measures,

which are most comparable to the adjusted financial measures, as

well as a reconciliation between the adjusted financial measures

and the comparable GAAP financial measures. As used and/ or

presented in this release and/ or prior earnings related filings

and/ or in related public disclosures or filings with respect to

the financial statements and/ or results of the Company, as well as

may be included and calculated in the tables herein, the term

Earnings Before Interest Tax Depreciation and Amortization which we

define as EBITDA consists of operating profit in accordance with

GAAP, excluding (i) depreciation expenses, which include

depreciation recorded in cost of revenues and in operating cost and

expenses lines (e.g, research and development related equipment

and/ or fixed other assets depreciation), (ii) stock-based

compensation expense, (iii) amortization of acquired intangible

assets, (iv) merger contract termination fees received from Intel,

net of associated cost following the previously announced Intel

contract termination, as included in operating profit and (v)

restructuring income, net in relation to the Arai facility in

Japan, as included in operating profit. EBITDA is reconciled in the

tables below and/or in prior earnings-related filings and/ or in

related public disclosures or filings with respect to the financial

statements and/ or results of the Company from GAAP operating

profit. EBITDA and the adjusted financial information presented

herein and/ or prior earnings-related filings and/ or in related

public disclosures or filings with respect to the financial

statements and/ or results of the Company, are not a required GAAP

financial measure and may not be comparable to a similarly titled

measure employed by other companies. EBITDA and the adjusted

financial information presented herein and/ or prior

earnings-related filings and/ or in related public disclosures or

filings with respect to the financial statements and/ or results of

the Company, should not be considered in isolation or as a

substitute for operating profit, net profit or loss, cash flows

provided by operating, investing and financing activities, per

share data or other profit or cash flow statement data prepared in

accordance with GAAP. The term Net Cash, as may be used and/ or

presented in this release and/ or prior earnings-related filings

and/ or in related public disclosures or filings with respect to

the financial statements and/ or results of the Company, is

comprised of cash, cash equivalents, short-term deposits, and

marketable securities less debt amounts as presented in the balance

sheets included herein. The term Net Cash is not a required GAAP

financial measure, may not be comparable to a similarly titled

measure employed by other companies and should not be considered in

isolation or as a substitute for cash, debt, operating profit, net

profit or loss, cash flows provided by operating, investing and

financing activities, per share data or other profit or cash flow

statement data prepared in accordance with GAAP. The term Free Cash

Flow, as used and/ or presented in this release and/ or prior

earnings related filings and/ or in related public disclosures or

filings with respect to the financial statements and/ or results of

the Company, is calculated to be net cash provided by operating

activities (in the amounts of $110 million, $126 million and $73

million for the three months periods ended March 31, 2024,

December 31, 2023 and March 31, 2023, respectively (less cash

used for investments in property and equipment, net (in the

amounts of $98 million, $136 million and $105 million for the three

months periods ended March 31, 2024, December 31, 2023 and March

31, 2023, respectively). The term Free Cash Flow is not a required

GAAP financial measure, may not be comparable to a similarly titled

measure employed by other companies and should not be considered in

isolation or as a substitute for operating profit, net profit or

loss, cash flows provided by operating, investing, and financing

activities, per share data or other profit or cash flow statement

data prepared in accordance with GAAP.

About Tower SemiconductorTower

Semiconductor Ltd. (NASDAQ/TASE: TSEM), the leading foundry of

high-value analog semiconductor solutions, provides technology,

development, and process platforms for its customers in growing

markets such as consumer, industrial, automotive, mobile,

infrastructure, medical and aerospace and defense. Tower

Semiconductor focuses on creating a positive and sustainable impact

on the world through long-term partnerships and its advanced and

innovative analog technology offering, comprised of a broad range

of customizable process platforms such as SiGe, BiCMOS,

mixed-signal/CMOS, RF CMOS, CMOS image sensor, non-imaging sensors,

displays, integrated power management (BCD and 700V), photonics,

and MEMS. Tower Semiconductor also provides world-class design

enablement for a quick and accurate design cycle as well as process

transfer services including development, transfer, and

optimization, to IDMs and fabless companies. To provide multi-fab

sourcing and extended capacity for its customers, Tower

Semiconductor owns two facilities in Israel (150mm and 200mm), two

in the U.S. (200mm), two in Japan (200mm and 300mm) which it owns

through its 51% holdings in TPSCo, shares a 300mm facility in

Agrate, Italy, with ST, as well as has access to a 300mm capacity

corridor in Intel’s New Mexico facility. For more information,

please visit: www.towersemi.com.

CONTACTS: Noit Levy | Investor

Relations | +972 74 737 7556 | noitle@towersemi.com

This press release, including other projections

with respect to our business and activities, includes

forward-looking statements, which are subject to risks and

uncertainties. Actual results may vary from those projected or

implied by such forward-looking statements and you should not place

any undue reliance on such forward-looking statements. Potential

risks and uncertainties include, without limitation, risks and

uncertainties associated with: (i) demand in our customers’ end

markets, (ii) reliance on acquisition and/or gaining additional

capacity for growth, (iii) difficulties in achieving acceptable

operational metrics and indices in the future as a result of

operational, technological or process-related problems, (iv)

identifying and negotiating with third-party buyers for the sale of

any excess and/or unused equipment, inventory and/or other assets,

(v) maintaining current key customers and attracting new key

customers, (vi) over demand for our foundry services

resulting in high utilization and its effect on cycle time, yield

and on schedule delivery, as well as customers potentially being

placed on allocation, which may cause customers to transfer their

business to other vendors, (vii) financial results may fluctuate

from quarter to quarter making it difficult to forecast future

performance, (viii) our debt and other liabilities that may impact

our financial position and operations, (ix) our ability to

successfully execute acquisitions, integrate them into our

business, utilize our expanded capacity and find new business, (x)

fluctuations in cash flow, (xi) our ability to satisfy the

covenants stipulated in our agreements with our debt holders, (xii)

pending litigation, (xiii) meeting the conditions set in approval

certificates and other regulations under which we received grants

and/or royalties and/or any type of funding from the Israeli, US

and/or Japan governmental agencies, (xiv) receipt of orders that

are lower than the customer purchase commitments and/or failure to

receive customer orders currently expected, (xv) possible

incurrence of additional indebtedness, (xvi) effect of global

recession, unfavorable economic conditions and/or credit crisis,

(xvii) our ability to accurately forecast financial performance,

which is affected by limited order backlog and lengthy sales

cycles, (xviii) possible situations of obsolete inventory if

forecasted demand exceeds actual demand when we create inventory

before receipt of customer orders, (xix) the cyclical nature of the

semiconductor industry and the resulting periodic overcapacity,

fluctuations in operating results and future average selling price

erosion, (xx) obtain financing for capacity acquisition related

transactions, strategic and/or other growth or M&A

opportunities, including for funding Agrate fab’s significant 300mm

capacity investments and acquisition or funding of equipment and

other fixed assets associated with the capacity corridor

transaction with Intel as announced in September 2023, in addition

to other capacity expansion plans, and the possible unavailability

of such financing and/or the availability of such financing on

unfavorable terms, (xxi) operating our facilities at sufficient

utilization rates necessary to generate and maintain positive and

sustainable gross, operating and net profit, (xxii) the purchase of

equipment and/or raw material (including purchase beyond our

needs), the timely completion of the equipment installation,

technology transfer and raising the funds therefor, (xxiii) product

returns and defective products, (xxiv) our ability to maintain and

develop our technology processes and services to keep pace with new

technology, evolving standards, changing customer and end-user

requirements, new product introductions and short product life

cycles, (xxv) competing effectively, (xxvi) use of outsourced

foundry services by both fabless semiconductor companies and

integrated device manufacturers, (xxvii) our dependence on

intellectual property rights of others, our ability to operate our

business without infringing others’ intellectual property rights

and our ability to enforce our intellectual property against

infringement, (xxviii) the fab3 landlord’s alleged claims that the

noise abatement efforts made thus far are not adequate under the

terms of the amended lease that caused him to request a judicial

declaration that there was a material non-curable breach of the

lease and that he would be entitled to terminate the lease, as well

the ability to extend such lease or acquire the real estate and

obtain the required local and/or state approvals required to be

able to continue operations beyond the current lease term, (xxix)

retention of key employees and recruitment and retention of skilled

qualified personnel, (xxx) exposure to inflation, currency rates

(mainly the Israeli Shekel, the Japanese Yen and the Euro) and

interest rate fluctuations and risks associated with doing business

locally and internationally, as well fluctuations in the market

price of our traded securities, (xxxi) meeting regulatory

requirements worldwide, including export, environmental and

governmental regulations, as well as risks related to international

operations, (xxxii) potential engagement for fab establishment,

joint venture and/or capital lease transactions for capacity

enhancement in advanced technologies, including risks and

uncertainties associated with Agrate fab establishment and the

capacity corridor transaction with Intel as announced in September

2023, such as their qualification schedule, technology, equipment

and process qualification, facility operational ramp-up, customer

engagements, cost structure, required investments and other terms,

which may require additional funding to cover their significant

capacity investment needs and other payments, the availability of

which funding cannot be assured on favorable terms, if at all,

(xxxiii) potential liabilities, cost and other impact that may be

incurred or occur due to reorganization and consolidation of

fabrication facilities, including the impact of cessation of

operations of our facilities, including with regard to our 6 inch

facility, (xxxiv) potential security, cyber and privacy breaches,

(xxxv) workforce that is not unionized which may become unionized,

and/or workforce that is unionized and may take action such as

strikes that may create increased cost and operational risks,

(xxxvi) issuance of ordinary shares as a result of exercise and/ or

vesting of any of our employee stock options and/ or restricted

stock units, as well as any sale of shares by any of our

shareholders, or any market expectation thereof, as well as

issuance of additional employee stock options and/or restricted

stock units, or any market expectation thereof, which may depress

the market value of the Company and the price of the company’s

ordinary shares and in addition may impair our ability to raise

future capital, and (xxxvii) climate change, business interruption

due to flood, fire, pandemic, earthquake and other natural

disasters, the security situation in Israel, global trade “war” and

the current war in Israel, including potential inability to

continue uninterrupted operations of the Israeli fabs, impact on

global supply chain to and from the Israeli fabs, power

interruptions, chemicals or other leaks or damages as a result of

the war, absence of workforce due to military service as well as

risk that certain countries will restrict doing business with

Israeli companies, including imposing restrictions if hostilities

in Israel or political instability in the region continue or

exacerbate, and other events beyond our control . With respect to

the current war in Israel, if instability in neighboring states

occurs, Israel could be subject to additional political, economic,

and military confines, and our Israeli facilities’ operations could

be materially adversely affected. Any current or future hostilities

involving Israel or the interruption or curtailment of trade

between Israel and its present trading partners, or a significant

downturn in the economic or financial condition of Israel, could

have a material adverse effect on our business, financial condition

and results of operations.

A more complete discussion of risks and

uncertainties that may affect the accuracy of forward-looking

statements included in this press release or which may otherwise

affect our business is included under the heading "Risk Factors" in

Tower’s most recent filings on Forms 20-F and 6-K, as were filed

with the Securities and Exchange Commission (the “SEC”) and the

Israel Securities Authority. Future results may differ materially

from those previously reported. The Company does not intend to

update, and expressly disclaims any obligation to update, the

information contained in this release.

(Financial tables follow)

|

|

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

|

(dollars in thousands) |

|

|

|

|

March 31, |

|

December 31, |

|

|

2024 |

|

2023 |

|

ASSETS |

|

|

|

|

CURRENT ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

260,497 |

|

$ |

260,664 |

|

Short-term deposits |

848,522 |

|

790,823 |

|

Marketable securities |

133,611 |

|

184,960 |

|

Trade accounts receivable |

159,398 |

|

154,067 |

|

Inventories |

299,377 |

|

282,688 |

|

Other current assets |

42,049 |

|

35,956 |

|

Total current assets |

1,743,454 |

|

1,709,158 |

|

PROPERTY AND EQUIPMENT, NET |

1,180,569 |

|

1,155,929 |

|

GOODWILL AND OTHER INTANGIBLE ASSETS, NET |

11,666 |

|

12,115 |

|

OTHER LONG-TERM ASSETS, NET |

41,226 |

|

41,315 |

|

TOTAL ASSETS |

$ |

2,976,915 |

|

$ |

2,918,517 |

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

Short-term debt |

$ |

57,700 |

|

$ |

58,952 |

|

Trade accounts payable |

169,526 |

|

139,128 |

|

Deferred revenue and customers' advances |

19,732 |

|

18,418 |

|

Other current liabilities |

76,947 |

|

60,340 |

|

Total current liabilities |

323,905 |

|

276,838 |

|

LONG-TERM DEBT |

151,699 |

|

172,611 |

|

LONG-TERM CUSTOMERS' ADVANCES |

22,465 |

|

25,710 |

|

DEFERRED TAX AND OTHER LONG-TERM LIABILITIES |

16,277 |

|

16,319 |

|

TOTAL LIABILITIES |

514,346 |

|

491,478 |

|

TOTAL SHAREHOLDERS' EQUITY |

2,462,569 |

|

2,427,039 |

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

2,976,915 |

|

$ |

2,918,517 |

| TOWER

SEMICONDUCTOR LTD. AND SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |

| (dollars and

share count in thousands, except per share data) |

| |

| |

Three months ended |

| |

March 31, |

|

December 31, |

|

March 31, |

| |

2024 |

|

2023 |

|

2023 |

|

REVENUES |

$ |

327,238 |

|

$ |

351,711 |

|

|

$ |

355,611 |

|

| COST

OF REVENUES |

254,632 |

|

267,294 |

|

|

259,894 |

|

|

GROSS PROFIT |

72,606 |

|

84,417 |

|

|

95,717 |

|

|

OPERATING COSTS AND EXPENSES: |

|

|

|

|

|

|

|

|

Research and development |

19,951 |

|

20,849 |

|

|

19,331 |

|

|

Marketing, general and administrative |

18,670 |

|

18,401 |

|

|

18,629 |

|

|

Restructuring income, net * |

-- |

|

-- |

|

|

(31,655 |

) |

| |

38,621 |

|

39,250 |

|

|

6,305 |

|

| |

|

|

|

|

|

|

|

|

OPERATING PROFIT |

33,985 |

|

45,167 |

|

|

89,412 |

|

|

FINANCING AND OTHER INCOME, NET |

3,984 |

|

16,682 |

|

|

6,997 |

|

|

PROFIT BEFORE INCOME TAX |

37,969 |

|

61,849 |

|

|

96,409 |

|

|

INCOME TAX BENEFIT (EXPENSE), NET |

5,078 |

|

(10,130 |

) |

|

(15,041 |

) |

|

NET PROFIT |

43,047 |

|

51,719 |

|

|

81,368 |

|

| Net

loss (income) attributable to non-controlling

interest |

1,587 |

|

2,128 |

|

|

(9,966 |

) |

|

NET PROFIT ATTRIBUTABLE TO THE COMPANY |

$ |

44,634 |

|

$ |

53,847 |

|

|

$ |

71,402 |

|

|

BASIC EARNINGS PER SHARE |

$ |

0.40 |

|

$ |

0.49 |

|

|

$ |

0.65 |

|

|

Weighted average number of shares |

110,840 |

|

110,796 |

|

|

109,961 |

|

|

DILUTED EARNINGS PER SHARE |

$ |

0.40 |

|

$ |

0.48 |

|

|

$ |

0.64 |

|

|

Weighted average number of shares |

111,627 |

|

111,308 |

|

|

111,071 |

|

| *

Restructuring income, net resulted from the previously disclosed

reorganization and restructure of our Japan operations during

2022. |

|

RECONCILIATION FROM GAAP NET PROFIT ATTRIBUTABLE TO THE

COMPANY TO ADJUSTED NET PROFIT ATTRIBUTABLE TO THE

COMPANY: |

|

|

|

|

|

|

|

|

GAAP NET PROFIT ATTRIBUTABLE TO THE COMPANY |

$ |

44,634 |

|

$ |

53,847 |

|

|

$ |

71,402 |

|

|

Stock based compensation |

6,761 |

|

6,662 |

|

|

6,448 |

|

|

Amortization of acquired intangible assets |

448 |

|

442 |

|

|

499 |

|

|

Restructuring income, net ** |

-- |

|

-- |

|

|

(10,974 |

) |

|

ADJUSTED NET PROFIT ATTRIBUTABLE TO THE

COMPANY |

$ |

51,843 |

|

$ |

60,951 |

|

|

$ |

67,375 |

|

|

ADJUSTED EARNINGS PER SHARE: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.47 |

|

$ |

0.55 |

|

|

$ |

0.61 |

|

|

Diluted |

$ |

0.46 |

|

$ |

0.55 |

|

|

$ |

0.61 |

|

| |

| **

Restructuring income, net resulted from the previously disclosed

reorganization and restructure of our Japan operations during

2022, net of taxes. |

|

|

|

|

|

|

|

|

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES |

|

CONSOLIDATED SOURCES AND USES REPORT

(UNAUDITED) |

|

(dollars in thousands) |

|

|

| |

Three months ended |

| |

March 31, |

|

|

December 31, |

|

March 31, |

|

|

2024 |

|

|

2023 |

|

2023 |

|

CASH AND CASH EQUIVALENTS - BEGINNING OF

PERIOD |

$ |

260,664 |

|

|

$ |

314,816 |

|

|

$ |

340,759 |

|

|

Net cash provided by operating activities |

110,038 |

|

|

|

126,098 |

|

|

|

72,727 |

|

|

Investments in property and equipment, net |

|

(98,018 |

) |

|

|

(136,426 |

) |

|

|

(105,245 |

) |

|

Debt repaid and others, net |

|

(8,409 |

) |

|

|

(8,950 |

) |

|

|

(28,796 |

) |

|

Proceeds from an investment in a subsidiary |

-- |

|

|

|

-- |

|

|

|

1,932 |

|

|

Effect of Japanese Yen exchange rate change over cash

balance |

|

(2,665 |

) |

|

|

2,101 |

|

|

|

(637 |

) |

|

Investments in short-term deposits, marketable securities

and other assets, net of sale proceeds |

|

(1,113 |

) |

|

|

(36,975 |

) |

|

|

24,194 |

|

|

CASH AND CASH EQUIVALENTS - END OF PERIOD |

$ |

260,497 |

|

|

$ |

260,664 |

|

|

$ |

304,934 |

|

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) |

|

(dollars in thousands) |

|

|

| |

Three months ended |

|

|

March 31, |

|

December 31, |

|

March 31, |

|

|

2024 |

|

2023 |

|

2023 |

|

CASH FLOWS - OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

Net profit for the period |

$ |

43,047 |

|

|

$ |

51,719 |

|

|

$ |

81,368 |

|

|

Adjustments to reconcile net profit for the

period |

|

|

|

|

|

|

|

|

|

|

|

|

to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Income and expense items not involving cash

flows: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

* |

|

59,544 |

|

|

|

65,178 |

|

|

|

62,387 |

|

|

Effect of exchange rate differences and fair value

adjustment |

|

227 |

|

|

|

(6,852 |

) |

|

|

(926 |

) |

|

Other expense (income), net |

|

5,993 |

|

|

|

(7,692 |

) |

|

|

815 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Trade accounts receivable |

|

(6,716 |

) |

|

|

(1,861 |

) |

|

|

7,413 |

|

|

Other assets |

|

(13,454 |

) |

|

|

(6,418 |

) |

|

|

(1,138 |

) |

|

Inventories |

|

(23,703 |

) |

|

|

27,310 |

|

|

|

(57,420 |

) |

|

Trade accounts payable |

|

32,559 |

|

|

|

30,023 |

|

|

|

44,542 |

|

|

Deferred revenue and customers' advances |

|

(1,931 |

) |

|

|

(9,902 |

) |

|

|

(15,470 |

) |

|

Other current liabilities |

|

16,868 |

|

|

|

(15,745 |

) |

|

|

(45,053 |

) |

|

Other long-term liabilities |

|

(2,396 |

) |

|

|

338 |

|

|

|

(3,791 |

) |

|

Net cash provided by operating activities |

|

110,038 |

|

|

|

126,098 |

|

|

|

72,727 |

|

|

CASH FLOWS - INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

Investments in property and equipment, net |

|

(98,018 |

) |

|

|

(136,426 |

) |

|

|

(105,245 |

) |

|

Investments in short-term deposits, marketable securities

and other assets, net of sale proceeds |

|

(1,113 |

) |

|

|

(36,975 |

) |

|

|

24,194 |

|

|

Net cash used in investing activities |

|

(99,131 |

) |

|

|

(173,401 |

) |

|

|

(81,051 |

) |

|

CASH FLOWS - FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

Debt repaid, net |

|

(8,409 |

) |

|

|

(8,950 |

) |

|

|

(28,796 |

) |

|

Proceeds from an investment in a subsidiary |

|

-- |

|

|

|

-- |

|

|

|

1,932 |

|

|

Net cash used in financing activities |

|

(8,409 |

) |

|

|

(8,950 |

) |

|

|

(26,864 |

) |

|

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE

CHANGE |

|

(2,665 |

) |

|

|

2,101 |

|

|

|

(637 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DECREASE IN CASH AND CASH EQUIVALENTS |

|

(167 |

) |

|

|

(54,152 |

) |

|

|

(35,825 |

) |

|

CASH AND CASH EQUIVALENTS - BEGINNING OF

PERIOD |

|

260,664 |

|

|

|

314,816 |

|

|

|

340,759 |

|

|

CASH AND CASH EQUIVALENTS - END OF PERIOD |

$ |

260,497 |

|

|

$ |

260,664 |

|

|

$ |

304,934 |

|

|

|

|

* Includes amortization of acquired intangible assets and

stock based compensation in the amounts of $7,209, $7,104 and

$6,947 |

|

for the 3 months periods ended March 31, 2024,

December 31, 2023 and March 31, 2023, respectively. |

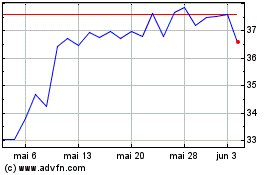

Tower Semiconductor (NASDAQ:TSEM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Tower Semiconductor (NASDAQ:TSEM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024