Atlanticus Prices $55,000,000 Principal Amount Add-On Offering of 9.25% Senior Notes Due 2029

25 Julho 2024 - 7:00AM

Atlanticus Holdings Corporation (NASDAQ: ATLC) (“Atlanticus,” “the

Company”, “we,” “our” or “us”), a financial technology company that

enables its bank, retail and healthcare partners to offer more

inclusive financial services to millions of everyday Americans,

today announced the pricing of its underwritten registered public

add-on offering (the “Add-On Offering”) of $55,000,000 aggregate

principal amount of its 9.25% Senior Notes due 2029 (the

“Additional Notes”), at a public offering price of $24.70 per

Additional Note. The Company has granted the underwriters an option

to purchase up to an additional $8,250,000 aggregate principal

amount of the Additional Notes in connection with the Add-On

Offering. The Add-On Offering is expected to close on or about July

26, 2024, subject to customary closing conditions.

The Additional Notes constitute a further

issuance of the Company’s 9.25% Senior Notes due 2029, of which

$57,250,000 aggregate principal amount was previously issued (the

“Existing Notes”). The Additional Notes would have the same CUSIP

number and trade interchangeably with the Existing Notes. The

Company expects the Additional Notes to be fungible for U.S.

federal income tax purposes with the Existing Notes.

The Company expects to use the net proceeds of

this Add-On Offering to redeem a portion of the Class B preferred

units issued by one of the Company’s subsidiaries and/or for

general corporate purposes.

The Existing Notes trade and the Additional

Notes are expected to trade on the Nasdaq Global Select Market

(“Nasdaq”) under the symbol “ATLCZ.”

The Company and this issuance of Additional

Notes received an “A” rating from Egan-Jones Ratings Company, an

independent, unaffiliated rating agency. Ratings are not a

recommendation to purchase, hold or sell Additional Notes, inasmuch

as the ratings do not comment as to market price or suitability for

a particular investor. The ratings are based upon current

information furnished to the rating agency by the Company and

information obtained by the rating agency from other sources. The

ratings are only accurate as of the date thereof and may be

changed, superseded or withdrawn as a result of changes in, or

unavailability of, such information, and therefore a prospective

purchaser should check the current ratings before purchasing the

Additional Notes. Each rating should be evaluated independently of

any other rating.

B. Riley Securities, Inc., Janney Montgomery

Scott LLC, Lucid Capital Markets, LLC, and William Blair &

Company, L.L.C. are acting as book-running managers for this Add-On

Offering. A.G.P./Alliance Global Partners and Clear Street LLC are

acting as co-managers for this Add-On Offering.

The Add-On Offering of these Additional Notes is

being made pursuant to an effective shelf registration statement on

Form S-3, which was initially filed with the Securities and

Exchange Commission (the “SEC”) on May 10, 2024 and declared

effective by the SEC on May 21, 2024. The Add-On Offering will be

made only by means of a prospectus and prospectus supplement. A

copy of the prospectus and prospectus supplement relating to these

securities may be obtained, when available, from the website of the

SEC at http://www.sec.gov or by contacting: B. Riley Securities,

Inc., 1300 17th Street North, Suite 1300, Arlington, Virginia

22209, Attn: Prospectus Department, Email:

prospectuses@brileyfin.com, Telephone: (703) 312-9580.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Atlanticus Holdings

Corporation

Empowering Better Financial Outcomes for

Everyday Americans

Atlanticus’ technology allows bank, retail, and

healthcare partners to offer more inclusive financial services to

everyday Americans through the use of proprietary analytics. We

apply the experience gained and infrastructure built from servicing

over 20 million customers and $40 billion in consumer

loans over our more than 25 year operating history to support

lenders that originate a range of consumer loan products. These

products include retail and healthcare private label credit and

general purpose credit cards marketed through our omnichannel

platform, including retail point-of-sale, healthcare-point of-care,

direct mail solicitation, internet-based marketing, and

partnerships with third parties. Additionally, through our CAR

subsidiary, Atlanticus serves the individual needs of

automotive dealers and automotive non-prime financial organizations

with multiple financing and service programs.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. You generally can identify these statements by

the use of words such as “outlook,” “potential,” “continue,” “may,”

“seek,” “approximately,” “predict,” “believe,” “expect,” “plan,”

“intend,” “estimate” or “anticipate” and similar expressions or the

negative versions of these words or comparable words, as well as

future or conditional verbs such as “will,” “should,” “would,”

“likely” and “could.” These statements are subject to certain risks

and uncertainties that could cause actual results to differ

materially from those included in the forward-looking statements.

These risks and uncertainties include those risks described in the

Company’s filings with the Securities and Exchange Commission and

include, but are not limited to, risks related to the uncertain

economic environment, particularly the impact of inflation,

interest rates, labor availability and supply chains; the Company’s

ability to retain existing, and attract new, merchant partners and

funding sources; increases in loan delinquencies; its ability to

operate successfully in a highly regulated industry; the outcome of

litigation and regulatory matters; the effect of management

changes; cyberattacks and security vulnerabilities in its products

and services; and the Company’s ability to compete successfully in

highly competitive markets. The forward-looking statements speak

only as of the date on which they are made, and, except to the

extent required by federal securities laws, the Company disclaims

any obligation to update any forward-looking statement to reflect

events or circumstances after the date on which the statement is

made or to reflect the occurrence of unanticipated events. In light

of these risks and uncertainties, there is no assurance that the

events or results suggested by the forward-looking statements will

in fact occur, and you should not place undue reliance on these

forward-looking statements.

Contact:Investor Relations(770)

828-2000investors@atlanticus.com

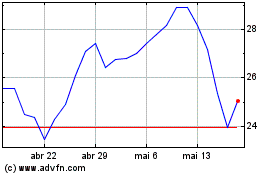

Atlanticus (NASDAQ:ATLC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Atlanticus (NASDAQ:ATLC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024