Strong Global Entertainment, Inc. (NYSE American:

SGE) (the “Company” or “Strong Global Entertainment”) today

announced operating results for the second quarter ended June 30,

2024.

Second Quarter Highlights -

- Revenue and gross profit from

continuing operations continued to improve, with growth in service

offerings and contributions from the recent ICS acquisition

contributing favorably.

- In April 2024, announced a

transaction to merge Strong/MDI Screen Systems, Inc. (“Strong/MDI”)

with FG Acquisition Corp., a Canadian special purpose acquisition

company, which will be renamed Saltire Holdings, Ltd. (“Saltire”)

- Proposed transaction values

Strong/MDI subsidiary at $30 million. Strong Global Entertainment

will retain a significant economic stake, participating in the

future growth and success of Strong/MDI and Saltire.

- The transaction is expected to

close in the third quarter of 2024.

- In May 2024, announced a

transaction to merge Strong Global Entertainment into Fundamental

Global Inc. (“Fundamental Global”)

- Stockholders of Strong Global

Entertainment will receive 1.5 common shares of Fundamental Global

for each share of Strong Global Entertainment.

- Proposed transaction expected to

reduce overhead associated with operating separate companies.

- The transaction is expected to

close in the third quarter of 2024.

Mark Roberson, Chief Executive Officer,

commented, “The second quarter operating results demonstrated

double digit growth with improvements at Strong Technical Services

and positive contributions from the ICS acquisition. We also

announced two merger transactions that we believe will continue to

streamline and reduce the overall overhead levels going forward.

The Strong/MDI transaction with Saltire represents a compelling

valuation and the potential to participate in their future growth.

The planned merger of Strong Global Entertainment into Fundamental

Global will reduce the burden and duplicate costs associated with

operating separate public companies.”

Select Financial Comparisons for

Continuing Operations -

As a result of the pending transaction between

Strong/MDI and FG Acquisition Corp., the current year and

historical results of operations of Strong/MDI have been

reclassified to discontinued operations and are not discussed

below.

- Revenue increased 18.7% to $8.1

million for the second quarter and increased 18.3% to $15.8 million

for the first half with increased sales of digital equipment and

increased demand for services. The increase in demand from cinema

customers was due to a combination of increased sales efforts,

expanded market share, laser projection upgrades and the

acquisition of ICS contributing favorably to overall revenue

growth.

- Gross profit increased $0.6 million

to $1.5 million or 18.8% of revenues in the second quarter and

increased $0.9 million to $2.8 million or 17.9% of revenue for the

first half. The increase in gross profit resulted primarily from

increased demand for installation and maintenance services, and

contributions from the Innovative Cinema Solutions, LLC (“ICS”)

acquisition.

- Loss from operations improved to

$0.7 million in the second quarter of 2024 compared to $1.6 million

during the second quarter of 2023 and $1.4 million in the first

half of 2024 compared to $1.6 million during the first half of

2023. Administrative expenses were higher in the second quarter for

2023 largely due to one-time costs incurred upon the completion of

the IPO in May 2023, which did not repeat in the current period.

However, we incurred higher general and administrative expenses in

connection with operating as an independent public company

following the separation in May 2023, which partially offset

increases in gross profit.

- Net loss from continuing operations

improved to $0.7 million in the second quarter of 2024 compared to

$1.3 million during the second quarter of 2023 and $1.5 million in

the first half of 2024 compared to $1.7 million during the first

half of 2023. The improvements in gross profit and favorable

comparison to the one-time IPO costs in the prior year were

partially offset by the increased expenses in connection with

operating as an independent public company.

- Adjusted EBITDA was ($0.2) million

in the second quarter of 2024 as compared to ($0.3) million during

the second quarter of 2023, and ($0.7) million in the first half of

2024 compared with ($0.8) million during the first half of

2023.

About Strong Global Entertainment,

Inc.

Strong Global Entertainment, Inc., a majority

owned subsidiary of Fundamental Global Inc., is a leader in the

entertainment industry, providing mission critical products and

services to cinema exhibitors and entertainment venues for over 90

years. The Company manufactures and distributes premium large

format projection screens, provides comprehensive managed services,

technical support and related products and services primarily to

cinema exhibitors, theme parks, educational institutions, and

similar venues. In addition to traditional projection screens, the

Company manufactures and distributes its Eclipse curvilinear

screens, which are specially designed for theme parks, immersive

exhibitions, as well as simulation applications. It also provides

maintenance, repair, installation, network support services and

other services to cinema operators, primarily in the United

States.

About Fundamental Global Inc.

Fundamental Global Inc. (Nasdaq: FGF, FGFPP) and

its subsidiaries engage in diverse business activities including

reinsurance, asset management, merchant banking, manufacturing and

managed services.

The FG® logo and Fundamental Global® are registered trademarks

of Fundamental Global LLC.

Use of Non-GAAP Measures

Strong Global Entertainment, Inc. prepares its

consolidated financial statements in accordance with United States

generally accepted accounting principles (“GAAP”). In addition to

disclosing financial results prepared in accordance with GAAP, the

Company discloses information regarding Adjusted EBITDA (“Adjusted

EBITDA”), which differs from the commonly used EBITDA (“EBITDA”).

Adjusted EBITDA both adjusts net income (loss) to exclude income

taxes, interest, and depreciation and amortization, and excludes

share-based compensation, impairment charges, severance, foreign

currency transaction gains (losses), transactional gains and

expenses, gains on insurance recoveries, and other cash and

non-cash charges and gains.

EBITDA and Adjusted EBITDA are not measures of

performance defined in accordance with GAAP. However, Adjusted

results EBITDA is used internally in planning and evaluating the

Company’s operating performance. Accordingly, management believes

that disclosure of these metrics offers investors, bankers and

other stakeholders an additional view of the Company’s operations

that, when coupled with the GAAP results, provides a more complete

understanding of the Company’s financial.

EBITDA and Adjusted EBITDA should not be

considered as an alternative to net income (loss) or to net cash

from operating activities as measures of operating results or

liquidity. The Company’s calculation of EBITDA and Adjusted EBITDA

may not be comparable to similarly titled measures used by other

companies, and the measures exclude financial information that some

may consider important in evaluating the Company’s performance.

EBITDA and Adjusted EBITDA have limitations as

analytical tools, and you should not consider them in isolation, or

as substitutes for analysis of the Company’s results as reported

under GAAP. Some of these limitations are: (i) they do not reflect

the Company’s cash expenditures, or future requirements for capital

expenditures or contractual commitments, (ii) they do not reflect

changes in, or cash requirements for, the Company’s working capital

needs, (iii) EBITDA and Adjusted EBITDA do not reflect interest

expense, or the cash requirements necessary to service interest or

principal payments, on the Company’s debt, (iv) although

depreciation and amortization are non-cash charges, the assets

being depreciated and amortized will often have to be replaced in

the future, and EBITDA and Adjusted EBITDA do not reflect any cash

requirements for such replacements, (v) they do not adjust for all

non-cash income or expense items that are reflected in the

Company’s statements of cash flows, (vi) they do not reflect the

impact of earnings or charges resulting from matters management

considers not to be indicative of the Company’s ongoing operations,

and (vii) other companies in the Company’s industry may calculate

these measures differently than the Company does, limiting their

usefulness as comparative measures.

Management believes EBITDA and Adjusted EBITDA

facilitate operating performance comparisons from period to period

by isolating the effects of some items that vary from period to

period without any correlation to core operating performance or

that vary widely among similar companies. These potential

differences may be caused by variations in capital structures

(affecting interest expense), tax positions (such as the impact on

periods or companies of changes in effective tax rates or net

operating losses) and the age and book depreciation of facilities

and equipment (affecting relative depreciation expense). The

Company also presents EBITDA and Adjusted EBITDA because (i)

management believes these measures are frequently used by

securities analysts, investors and other interested parties to

evaluate companies in the Company’s industry, (ii) management

believes investors will find these measures useful in assessing the

Company’s ability to service or incur indebtedness, and (iii)

management uses EBITDA and Adjusted EBITDA internally as benchmarks

to evaluate the Company’s operating performance or compare the

Company’s performance to that of its competitors.

Forward-Looking Statements

In addition to the historical information

included herein, this press release contains “forward-looking

statements” that are subject to substantial risks and

uncertainties. All statements, other than statements of historical

fact, contained in this press release are forward-looking

statements. Forward-looking statements contained in this press

release may be identified by the use of words such as “anticipate,”

“believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,”

“seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“target,” “aim,” “should,” “will” “would,” or the negative of these

words or other similar expressions, although not all

forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are

subject to inherent uncertainties, risks and assumptions that are

difficult to predict. Further, certain forward-looking statements

are based on assumptions as to future events that may not prove to

be accurate. These and other risks and uncertainties are described

more fully in the section titled “Risk Factors” in the final

prospectus related to the public offering filed with the SEC, our

Annual Report on Form 10-K for the year ended December 31, 2023,

and the Company’s other reports filed with the SEC. Forward-looking

statements contained in this announcement are made as of this date,

and the Company undertakes no duty to update such information

except as required under applicable law.

Investor Relations

Contacts:IR@strong-entertainment.com

|

Strong Global Entertainment, Inc. and

Subsidiaries |

|

Consolidated Balance Sheets |

|

(In thousands) |

|

|

| |

|

|

June 30, 2024 |

|

|

|

December 31, 2023 |

|

| |

|

|

(Unaudited) |

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,483 |

|

|

$ |

4,822 |

|

|

Accounts receivable, net |

|

|

4,308 |

|

|

|

3,528 |

|

|

Inventories, net |

|

|

2,548 |

|

|

|

1,482 |

|

|

Assets of discontinued operations |

|

|

12,730 |

|

|

|

14,329 |

|

|

Other current assets |

|

|

399 |

|

|

|

317 |

|

|

Total current assets |

|

|

23,468 |

|

|

|

24,478 |

|

|

Property, plant and equipment, net |

|

|

429 |

|

|

|

487 |

|

|

Operating lease right-of-use assets |

|

|

267 |

|

|

|

350 |

|

|

Finance lease right-of-use asset |

|

|

1,071 |

|

|

|

1,201 |

|

|

Other long-term assets |

|

|

- |

|

|

|

10 |

|

|

Total assets |

|

$ |

25,235 |

|

|

$ |

26,526 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,448 |

|

|

$ |

2,569 |

|

|

Accrued expenses |

|

|

2,302 |

|

|

|

1,712 |

|

|

Payable to Fundamental Global Inc. |

|

|

- |

|

|

|

129 |

|

|

Short-term debt |

|

|

43 |

|

|

|

18 |

|

|

Current portion of long-term debt |

|

|

271 |

|

|

|

270 |

|

|

Current portion of operating lease obligations |

|

|

180 |

|

|

|

183 |

|

|

Current portion of finance lease obligations |

|

|

264 |

|

|

|

253 |

|

|

Deferred revenue and customer deposits |

|

|

1,151 |

|

|

|

849 |

|

|

Liabilities of discontinued operations |

|

|

9,503 |

|

|

|

11,257 |

|

|

Total current liabilities |

|

|

17,162 |

|

|

|

17,240 |

|

|

Operating lease obligations, net of current portion |

|

|

129 |

|

|

|

216 |

|

|

Finance lease obligations, net of current portion |

|

|

836 |

|

|

|

971 |

|

|

Long-term debt, net of current portion |

|

|

166 |

|

|

|

301 |

|

|

Other long-term liabilities |

|

|

5 |

|

|

|

4 |

|

|

Total liabilities |

|

|

18,298 |

|

|

|

18,732 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments, contingencies and

concentrations |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, no par value |

|

|

- |

|

|

|

- |

|

|

Paid-in-capital related to: |

|

|

|

|

|

|

|

|

|

Class A Common stock, no par value |

|

|

|

|

|

|

|

|

|

Class B Common stock, no par value |

|

|

15,881 |

|

|

|

15,740 |

|

|

Accumulated deficit |

|

|

(3,377 |

) |

|

|

(2,712 |

) |

|

Accumulated other comprehensive loss |

|

|

(5,567 |

) |

|

|

(5,234 |

) |

|

Total stockholders' equity |

|

|

6,937 |

|

|

|

7,794 |

|

|

Total liabilities and stockholders' equity |

|

$ |

25,235 |

|

|

$ |

26,526 |

|

|

Strong Global Entertainment, Inc. and

Subsidiaries |

|

Consolidated Statements of Operations |

|

(In thousands, except per share amounts) |

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net product sales |

|

$ |

4,782 |

|

|

$ |

3,794 |

|

|

$ |

9,417 |

|

|

$ |

7,564 |

|

|

Net service revenues |

|

|

3,339 |

|

|

|

3,049 |

|

|

|

6,387 |

|

|

|

5,796 |

|

|

Total net revenues |

|

|

8,121 |

|

|

|

6,843 |

|

|

|

15,804 |

|

|

|

13,360 |

|

|

Cost of products |

|

|

3,973 |

|

|

|

3,542 |

|

|

|

7,874 |

|

|

|

6,875 |

|

|

Cost of services |

|

|

2,624 |

|

|

|

2,340 |

|

|

|

5,099 |

|

|

|

4,505 |

|

|

Total cost of revenues |

|

|

6,597 |

|

|

|

5,882 |

|

|

|

12,973 |

|

|

|

11,380 |

|

|

Gross profit |

|

|

1,524 |

|

|

|

961 |

|

|

|

2,831 |

|

|

|

1,980 |

|

|

Selling and administrative expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling |

|

|

369 |

|

|

|

161 |

|

|

|

655 |

|

|

|

397 |

|

|

Administrative |

|

|

1,866 |

|

|

|

2,372 |

|

|

|

3,588 |

|

|

|

3,212 |

|

|

Total selling and administrative expenses |

|

|

2,235 |

|

|

|

2,533 |

|

|

|

4,243 |

|

|

|

3,609 |

|

|

Loss from operations |

|

|

(711 |

) |

|

|

(1,572 |

) |

|

|

(1,412 |

) |

|

|

(1,629 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(21 |

) |

|

|

(17 |

) |

|

|

(55 |

) |

|

|

(31 |

) |

|

Foreign currency transaction loss |

|

|

(6 |

) |

|

|

- |

|

|

|

(5 |

) |

|

|

(4 |

) |

|

Other income, net |

|

|

2 |

|

|

|

1 |

|

|

|

28 |

|

|

|

11 |

|

|

Total other expense |

|

|

(25 |

) |

|

|

(16 |

) |

|

|

(32 |

) |

|

|

(24 |

) |

|

Loss from continuing operations before income taxes |

|

|

(736 |

) |

|

|

(1,588 |

) |

|

|

(1,444 |

) |

|

|

(1,653 |

) |

|

Income tax (benefit) expense |

|

|

(6 |

) |

|

|

279 |

|

|

|

(6 |

) |

|

|

(81 |

) |

|

Net loss from

continuing operations |

|

|

(742 |

) |

|

|

(1,309 |

) |

|

|

(1,450 |

) |

|

|

(1,734 |

) |

|

Net income

from discontinued operations |

|

|

150 |

|

|

|

893 |

|

|

|

785 |

|

|

|

1,694 |

|

|

Net loss |

|

$ |

(592 |

) |

|

$ |

(416 |

) |

|

$ |

(665 |

) |

|

$ |

(40 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing

operations |

|

$ |

(0.09 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.28 |

) |

|

Discontinued

operations |

|

|

0.02 |

|

|

|

0.14 |

|

|

|

0.10 |

|

|

|

0.27 |

|

|

Basic net loss per share |

|

$ |

(0.07 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing

operations |

|

$ |

(0.09 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.28 |

) |

|

Discontinued

operations |

|

|

0.02 |

|

|

|

0.14 |

|

|

|

0.10 |

|

|

|

0.27 |

|

|

Diluted net loss per share |

|

$ |

(0.07 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares used

in computing net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

7,904 |

|

|

|

6,553 |

|

|

|

7,891 |

|

|

|

6,278 |

|

|

Diluted |

|

|

7,904 |

|

|

|

6,553 |

|

|

|

7,891 |

|

|

|

6,278 |

|

|

Strong Global Entertainment, Inc. and

Subsidiaries |

|

Condensed Consolidated Statements of Cash

Flows |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

$ |

(1,450 |

) |

|

$ |

(1,734 |

) |

|

Adjustments to reconcile net income to net cash (used in) provided

by operating activities: |

|

|

|

|

|

|

|

|

|

Provision for (recovery of) doubtful accounts |

|

|

30 |

|

|

|

(26 |

) |

|

(Benefit from) provision for obsolete inventory |

|

|

(38 |

) |

|

|

30 |

|

|

Provision for warranty |

|

|

3 |

|

|

|

6 |

|

|

Depreciation and amortization |

|

|

207 |

|

|

|

126 |

|

|

Gain on acquisition of ICS assets |

|

|

(17 |

) |

|

|

- |

|

|

Amortization and accretion of operating leases |

|

|

94 |

|

|

|

32 |

|

|

Deferred income taxes |

|

|

- |

|

|

|

(432 |

) |

|

Stock-based compensation expense |

|

|

147 |

|

|

|

766 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(387 |

) |

|

|

(45 |

) |

|

Inventories |

|

|

(1,027 |

) |

|

|

395 |

|

|

Current income taxes |

|

|

(51 |

) |

|

|

9 |

|

|

Other assets |

|

|

1 |

|

|

|

438 |

|

|

Accounts payable and accrued expenses |

|

|

1,262 |

|

|

|

2,594 |

|

|

Deferred revenue and customer deposits |

|

|

304 |

|

|

|

(569 |

) |

|

Operating lease obligations |

|

|

(100 |

) |

|

|

(38 |

) |

|

Net cash (used in) provided by operating activities from continuing

operations |

|

|

(1,022 |

) |

|

|

1,552 |

|

|

Net cash used in operating activities from discontinued

operations |

|

|

(572 |

) |

|

|

(2,139 |

) |

|

Net cash used in operating activities |

|

|

(1,594 |

) |

|

|

(587 |

) |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(20 |

) |

|

|

(119 |

) |

|

Net cash used in investing activities from continuing

operations |

|

|

(20 |

) |

|

|

(119 |

) |

|

Net cash used in investing activities from discontinued

operations |

|

|

(59 |

) |

|

|

(283 |

) |

|

Net cash used in investing activities |

|

|

(79 |

) |

|

|

(402 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

Principal payments on short-term debt |

|

|

(32 |

) |

|

|

- |

|

|

Principal payments on long-term debt |

|

|

(135 |

) |

|

|

(18 |

) |

|

Payments of withholding taxes for net share settlement of equity

awards |

|

|

(6 |

) |

|

|

(104 |

) |

|

Proceeds from initial public offering |

|

|

- |

|

|

|

2,411 |

|

|

Payments on finance lease obligations |

|

|

(124 |

) |

|

|

(60 |

) |

|

Net cash transferred to parent |

|

|

- |

|

|

|

(2,283 |

) |

|

Net cash used in financing activities from continuing

operations |

|

|

(297 |

) |

|

|

(54 |

) |

|

Net cash provided by financing activities from discontinued

operations |

|

|

477 |

|

|

|

1,930 |

|

|

Net cash provided by financing activities |

|

|

180 |

|

|

|

1,876 |

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents from discontinued

operations |

|

|

(11 |

) |

|

|

(132 |

) |

| Net (decrease) increase in

cash and cash equivalents from continuing operations |

|

|

(1,339 |

) |

|

|

1,379 |

|

| Net decrease in cash and cash

equivalents from discontinued operations |

|

|

(165 |

) |

|

|

(624 |

) |

| Net (decrease) increase in

cash and cash equivalents |

|

|

(1,504 |

) |

|

|

755 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents from

continuing operations at beginning of period |

|

|

4,822 |

|

|

|

2,889 |

|

| Cash and cash equivalents from

continuing operations at end of period |

|

$ |

3,483 |

|

|

$ |

4,268 |

|

Strong Global Entertainment, Inc. and

SubsidiariesReconciliation of Net Loss to Adjusted

EBITDA(In

thousands)(Unaudited)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(592 |

) |

|

$ |

(416 |

) |

|

$ |

(665 |

) |

|

$ |

(40 |

) |

|

Net income from discontinued operations |

|

|

(150 |

) |

|

|

(893 |

) |

|

|

(785 |

) |

|

|

(1,694 |

) |

|

Net loss from continuing operations |

|

|

(742 |

) |

|

|

(1,309 |

) |

|

|

(1,450 |

) |

|

|

(1,734 |

) |

|

Interest expense, net |

|

|

21 |

|

|

|

17 |

|

|

|

55 |

|

|

|

31 |

|

|

Income tax (benefit) expense |

|

|

6 |

|

|

|

(279 |

) |

|

|

6 |

|

|

|

81 |

|

|

Depreciation and amortization |

|

|

104 |

|

|

|

67 |

|

|

|

207 |

|

|

|

301 |

|

|

EBITDA |

|

|

(611 |

) |

|

|

(1,504 |

) |

|

|

(1,182 |

) |

|

|

(1,321 |

) |

|

Stock-based compensation expense |

|

|

73 |

|

|

|

748 |

|

|

|

147 |

|

|

|

766 |

|

|

Transaction expenses |

|

|

370 |

|

|

|

- |

|

|

|

370 |

|

|

|

- |

|

|

IPO expenses |

|

|

- |

|

|

|

475 |

|

|

|

- |

|

|

|

475 |

|

|

Adjust gain on purchase of ICS |

|

|

5 |

|

|

|

- |

|

|

|

(17 |

) |

|

|

- |

|

|

Foreign currency transaction loss (gain) |

|

|

6 |

|

|

|

- |

|

|

|

5 |

|

|

|

(528 |

) |

|

Adjusted EBITDA |

|

$ |

(157 |

) |

|

$ |

(281 |

) |

|

$ |

(677 |

) |

|

$ |

(608 |

) |

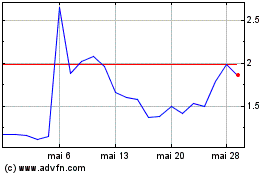

Strong Global Entertainm... (AMEX:SGE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Strong Global Entertainm... (AMEX:SGE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024