ABM (NYSE: ABM), a leading provider of facility solutions, today

announced financial results for the third quarter of fiscal 2024.

“ABM’s strong third quarter performance is

further validation that our strategy is working. Our investments in

the energy resiliency markets, particularly in microgrids, which

grew significantly, as well as those investments in technology,

including tools that improve labor efficiency and our go-to-market

approach, helped us deliver another quarter of solid organic growth

on an enterprise level and resilient margins,” said Scott Salmirs,

President & Chief Executive Officer. “This performance was

supported by our focus on market segmentation, especially our

purposeful weighting towards higher performing Class A properties,

which enabled us to once again perform well in our Business &

Industry segment, despite a still choppy commercial real estate

environment.”

1) When the company provides

expectations for adjusted EPS on a forward-looking basis, a

reconciliation of the differences between these non-GAAP

expectations and the corresponding GAAP measure generally is not

available without unreasonable effort. See “Outlook” and “Use of

Non-GAAP Financial Information” below for additional

information

Mr. Salmirs continued, “We are pleased with the

progress we have made delivering our core janitorial and

engineering services through advanced use of data and analytics. We

have begun to see the benefits of this technology in terms of

improved efficiency and client outcomes, and look forward to more

broadly implementing these newly developed tools. Beyond that, we

were thrilled to acquire Quality Uptime Services during the

quarter, a leader in uninterrupted power supply system and battery

maintenance, serving the fast-growing data center market and other

mission critical applications. Taken together, our strategy to

enhance our core abilities and expand in complementary high growth

markets is actively enhancing long-term shareholder value.”

Mr. Salmirs concluded, “In all, our third

quarter results, which came in modestly above our expectations,

coupled with our confidence in sustained performance for the

remainder of the year, support our increased full year

outlook.”

Third Quarter Fiscal 2024

Results

The Company reported revenue of $2.1 billion, up

3.3% over the prior year period, including 2.8% organic growth and

the remainder from acquisitions. Revenue growth was led by

Technical Solutions (“ATS”) and Aviation, which grew 25% and 13%,

respectively, while Education was up 4%. ATS’ high growth was

largely driven by the significant year-over-year increase in our

microgrid service line, while Aviation’s growth was reflective of

robust markets and recent wins. Business & Industry’s

(“B&I”) revenue declined 1%, as ongoing softness in the broader

commercial real estate market was largely offset by B&I’s

diversification and market segmentation. Manufacturing &

Distribution’s revenue also declined 1%, mainly reflecting the

expected rebalancing of certain work by a large client.

Net income was $4.7 million, or $0.07 per

diluted share, compared to $98.1 million, or $1.47 per diluted

share, last year, respectively. The decline was primarily

attributable to a $73.2 million year over year impact from

adjustments to contingent consideration related to the Ravenvolt

acquisition, and the absence of a $22.4 million Employee Retention

Credit received in the prior year period. This quarter’s adjustment

to contingent consideration was driven by Ravenvolt’s significantly

improved 2024 performance and brighter outlook, and is reflective

of the increased likelihood of a cash payout under the original

earn-out provision of the Ravenvolt acquisition agreement. Net

income was further impacted by unfavorable prior-year

self-insurance adjustments, and higher corporate investments, as

planned. These items were partially offset by higher segment

operating earnings and lower Elevate costs. Diluted EPS was also

positively impacted by a lower share count.

Adjusted net income was $59.5 million, or $0.94

per diluted share, compared to $52.8 million, or $0.79 per diluted

share, in the prior year period, up 13% and 19%, respectively.

These increases were driven by higher segment earnings,

particularly in ATS and Aviation, including lower

acquisition-related amortization costs, partially offset by higher

corporate investments. Adjusted EPS was also positively impacted by

a lower share count. Adjusted EBITDA increased 2% to $128.1 million

and adjusted EBITDA margin was flat at 6.4%. Adjusted results

exclude items impacting comparability. A description of items

impacting comparability can be found in the “Reconciliation of

Non-GAAP Financial Measures” table.

Net cash provided by operating activities was

$79.5 million, and free cash flow was $64.1 million, versus $149.1

million and $138.3 in the prior year, respectively. These results

were largely due to the timing of payments of accounts payable, and

the absence of the Employee Retention Credit received in the third

quarter of the prior year, partially offset by lower ELEVATE

expenses. For the first nine months of fiscal 2024, net cash from

operating activities was $196.3 million, and free cash flow was

$151.8 million, up 89% and 119%, over the prior year period,

respectively. A reconciliation of net cash provided by

operating activities to free cash flow can be found in the

“Reconciliation of Non-GAAP Financial Measures” table.

Liquidity & Capital

Structure

The Company ended the third quarter with total

indebtedness of $1,416.8 million, including $57.9 million in

standby letters of credit, resulting in a total leverage ratio, as

defined by the Company's credit facility of 2.5x. The Company had

available liquidity of $513.9 million, inclusive of cash and cash

equivalents, of $86.3 million.

Quarterly Cash Dividend

Subsequent to the end of the third quarter, the

Company’s Board of Directors declared a cash dividend of $0.225 per

common share which is payable on November 4, 2024, to shareholders

of record on October 3, 2024. This will be the Company’s 234th

consecutive quarterly cash dividend.

Outlook

Based on its expectations for a solid finish to

the year following its strong third quarter results, ABM is raising

its outlook for fiscal year 2024 (“FY24”) adjusted EPS. The Company

now expects FY24 adjusted EPS to be in the range of $3.48 to $3.55,

as compared to the prior range of $3.40 to $3.50.

The Company cannot provide a reconciliation of

the differences between the non-GAAP expectations and corresponding

GAAP measure for adjusted EPS in 2024 without unreasonable effort,

as we believe a GAAP range would be too large and variable to be

meaningful due to the uncertainty of the amount and timing of any

gains or losses related to, but not limited to, items such as

adjustments to contingent consideration, prior-year self-insurance

adjustments, acquisition and integration related costs, legal costs

and other settlements, as well as transformation initiative

costs.

Conference Call Information

ABM will host its quarterly conference call for

all interested parties on Friday, September 6, 2024, at 8:30

AM (ET). The live conference call can be accessed via audio webcast

at the “Investors” section of the Company's website, located

at www.abm.com, or by dialing (877) 451-6152 (domestic) or

(201) 389-0879 (international) approximately 15 minutes prior to

the scheduled time.

A supplemental presentation will accompany the

webcast on the Company's website.

A replay will be available approximately three

hours after the webcast through September 20, 2024, and can be

accessed by dialing (844) 512-2921 and then entering ID #13747517.

A replay link of the webcast will also be archived on the ABM

website for 90 days.

About ABM

ABM (NYSE: ABM) is one of the world’s largest

providers of integrated facility solutions. A driving force for a

cleaner, healthier, and more sustainable world, ABM provides

essential services and forward-looking solutions that improve the

spaces and places that matter most. From curbside to rooftop, ABM

provides comprehensive facility services that include janitorial,

engineering, parking, electrical & lighting, energy solutions,

HVAC & mechanical, landscape & turf, and mission critical

solutions. ABM delivers these custom facility solutions to

properties across a wide range of industries – from commercial

office buildings to universities, airports, hospitals, data

centers, manufacturing plants and distribution centers,

entertainment venues and more. Founded in 1909, ABM today has

annualized revenue exceeding $8 billion and more than 100,000 team

members in 350+ offices throughout the United States, United

Kingdom and other international locations. For more information,

visit www.abm.com.

Cautionary Statement under the Private

Securities Litigation Reform Act of 1995

This press release contains both historical and

forward-looking statements about ABM Industries Incorporated

(“ABM”) and its subsidiaries (collectively referred to as “ABM,”

“we,” “us,” “our,” or the “Company”). We make forward-looking

statements related to future expectations, estimates and

projections that are uncertain, and often contain words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “likely,” “may,” “outlook,” “plan,” “predict,” “should,”

“target,” or other similar words or phrases. These statements are

not guarantees of future performance and are subject to known and

unknown risks, uncertainties, and assumptions that are difficult to

predict. For us, particular uncertainties that could cause our

actual results to be materially different from those expressed in

our forward-looking statements include: our success depends on our

ability to gain profitable business despite competitive market

pressures; our results of operations can be adversely affected by

labor shortages, turnover, and labor cost increases; we may not be

able to attract and retain qualified personnel and senior

management we need to support our business; investments in and

changes to our businesses, operating structure, or personnel

relating to our ELEVATE strategy, including the implementation of

strategic transformations, enhanced business processes, and

technology initiatives may not have the desired effects on our

financial condition and results of operations; our ability to

preserve long-term client relationships is essential to our

continued success; our use of subcontractors or joint venture

partners to perform work under customer contracts exposes us to

liability and financial risk; our international business involves

risks different from those we face in the United States that could

have an effect on our results of operations and financial

condition; decreases in commercial office space utilization due to

hybrid work models could adversely affect our financial conditions;

negative changes in general economic conditions, such as

recessionary pressures, high interest rates, durable and

non-durable goods pricing, changes in energy prices, or changes in

consumer goods pricing, could reduce the demand for services and,

as a result, reduce our revenue and earnings and adversely affect

our financial condition; acquisitions, divestitures, and other

strategic transactions could fail to achieve financial or strategic

objectives, disrupt our ongoing business, and adversely impact our

results of operations; we may experience breaches of, or

disruptions to, our information technology systems or those of our

third-party providers or clients, or other compromises of our data

that could adversely affect our business; our ongoing

implementation of new enterprise resource planning and related

boundary systems could adversely impact our ability to operate our

business and report our financial results; we manage our insurable

risks through a combination of third-party purchased policies and

self-insurance, and we retain a substantial portion of the risk

associated with expected losses under these programs, which exposes

us to volatility associated with those risks, including the

possibility that changes in estimates to our ultimate insurance

loss reserves could result in material charges against our

earnings; our risk management and safety programs may not have the

intended effect of reducing our liability for personal injury or

property loss; unfavorable developments in our class and

representative actions and other lawsuits alleging various claims

could cause us to incur substantial liabilities; we are subject to

extensive legal and regulatory requirements, which could limit our

profitability by increasing the costs of legal and regulatory

compliance; a significant number of our employees are covered by

collective bargaining agreements that could expose us to potential

liabilities in relation to our participation in multiemployer

pension plans, requirements to make contributions to other benefit

plans, and the potential for strikes, work slowdowns or similar

activities, and union organizing drives; our business may be

materially affected by changes to fiscal and tax policies; negative

or unexpected tax consequences could adversely affect our results

of operations; future increases in the level of our borrowings or

in interest rates could affect our results of operations;

impairment of goodwill and long-lived assets could have a material

adverse effect on our financial condition and results of

operations; if we fail to maintain proper and effective internal

control over financial reporting in the future, our ability to

produce accurate and timely financial statements could be

negatively impacted, which could harm our operating results and

investor perceptions of our Company and as a result may have a

material adverse effect on the value of our common stock; our

business may be negatively impacted by adverse weather conditions;

catastrophic events, disasters, pandemics, and terrorist attacks

could disrupt our services; and actions of activist investors could

disrupt our business. For additional information on these and other

risks and uncertainties we face, see ABM’s risk factors, as they

may be amended from time to time, set forth in our filings with the

Securities and Exchange Commission, including our most recent

Annual Report on Form 10-K and subsequent filings. We urge readers

to consider these risks and uncertainties in evaluating our

forward-looking statements.

Use of Non-GAAP Financial

Information

To supplement ABM’s consolidated financial

information, the Company has presented net income and net income

per diluted share as adjusted for items impacting comparability for

the third quarter and nine months of fiscal years 2024 and 2023.

These adjustments have been made with the intent of providing

financial measures that give management and investors a better

understanding of the underlying operational results and trends as

well as ABM’s operational performance. In addition, the Company has

presented earnings before interest, taxes, depreciation and

amortization, and excluding items impacting comparability (adjusted

EBITDA) for the third quarter and nine months of fiscal years 2024

and 2023. Adjusted EBITDA is among the indicators management uses

as a basis for planning and forecasting future periods. Adjusted

EBITDA margin is defined as adjusted EBITDA divided by revenue

excluding management reimbursement. We cannot provide a

reconciliation of forward-looking non-GAAP adjusted EBITDA margin

measures to GAAP due to the inherent difficulty in forecasting and

quantifying certain amounts that are necessary for such

reconciliation. The Company has also presented Free Cash Flow which

is defined as net cash provided by (used in) operating activities

less additions to property, plant and equipment. The presentation

of these non-GAAP financial measures is not meant to be considered

in isolation or as a substitute for financial statements prepared

in accordance with accounting principles generally accepted in the

United States of America. (See accompanying financial tables for

supplemental financial data and corresponding reconciliations to

certain GAAP financial measures.)

We round amounts to millions but calculate all

percentages and per-share data from the underlying whole-dollar

amounts. As a result, certain amounts may not foot, crossfoot, or

recalculate based on reported numbers due to rounding. Unless

otherwise noted, all references to years are to our fiscal year,

which ends on October 31.

| Contact: |

|

| Investor Relations: |

Paul Goldberg |

| |

(212) 297-9721 |

| |

ir@abm.com |

ABM INDUSTRIES INCORPORATED AND

SUBSIDIARIESCONSOLIDATED INCOME STATEMENT

INFORMATION (UNAUDITED)

| |

Three Months Ended July 31, |

|

|

|

| (in millions, except per share

amounts) |

|

2024 |

|

|

|

2023 |

|

|

Increase / (Decrease) |

|

|

Revenues |

$ |

2,094.2 |

|

|

$ |

2,028.2 |

|

|

|

3.3 |

% |

| Operating expenses |

|

1,831.0 |

|

|

|

1,765.8 |

|

|

|

3.7 |

% |

| Selling, general and

administrative expenses |

|

211.8 |

|

|

|

104.3 |

|

|

NM* |

| Amortization of intangible

assets |

|

14.0 |

|

|

|

19.2 |

|

|

|

(27.3 |

)% |

| Operating

profit |

|

37.4 |

|

|

|

138.9 |

|

|

|

(73.1 |

)% |

| Income from unconsolidated

affiliates |

|

1.8 |

|

|

|

1.2 |

|

|

|

44.4 |

% |

| Interest expense |

|

(21.2 |

) |

|

|

(20.9 |

) |

|

|

(1.5 |

)% |

| Income before income

taxes |

|

18.0 |

|

|

|

119.3 |

|

|

|

(84.9 |

)% |

| Income tax provision |

|

(13.3 |

) |

|

|

(21.2 |

) |

|

|

37.0 |

% |

| Net income |

$ |

4.7 |

|

|

$ |

98.1 |

|

|

|

(95.2 |

)% |

| Net income per common

share |

|

|

|

|

|

|

|

Basic |

$ |

0.07 |

|

|

$ |

1.48 |

|

|

|

(95.3 |

)% |

|

Diluted |

$ |

0.07 |

|

|

$ |

1.47 |

|

|

|

(95.2 |

)% |

| Weighted-average

common and common equivalentshares

outstanding |

|

|

|

|

|

|

|

Basic |

|

63.1 |

|

|

|

66.3 |

|

|

|

|

|

Diluted |

|

63.5 |

|

|

|

66.6 |

|

|

|

|

| Dividends declared per

common share |

$ |

0.225 |

|

|

$ |

0.220 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

*Not meaningful (due to variance greater than or equal to

+/-100%)

ABM INDUSTRIES INCORPORATED AND

SUBSIDIARIESCONSOLIDATED INCOME STATEMENT

INFORMATION (UNAUDITED)

| |

Nine Months Ended July 31, |

|

|

| (in millions, except per share

amounts) |

|

2024 |

|

|

|

2023 |

|

|

Increase / (Decrease) |

|

Revenues |

$ |

6,182.0 |

|

|

$ |

6,003.5 |

|

|

|

3.0 |

% |

| Operating expenses |

|

5,420.8 |

|

|

|

5,230.7 |

|

|

|

3.6 |

% |

| Selling, general and

administrative expenses |

|

526.3 |

|

|

|

411.5 |

|

|

|

27.9 |

% |

| Amortization of intangible

assets |

|

42.2 |

|

|

|

58.2 |

|

|

|

(27.5 |

)% |

| Operating

profit |

|

192.8 |

|

|

|

303.1 |

|

|

|

(36.4 |

)% |

| Income from unconsolidated

affiliates |

|

4.7 |

|

|

|

3.0 |

|

|

|

60.2 |

% |

| Interest expense |

|

(63.1 |

) |

|

|

(61.8 |

) |

|

|

(2.2 |

)% |

| Income before income

taxes |

|

134.4 |

|

|

|

244.2 |

|

|

|

(45.0 |

)% |

| Income tax provision |

|

(41.3 |

) |

|

|

(55.7 |

) |

|

|

25.9 |

% |

| Net income |

$ |

93.1 |

|

|

$ |

188.5 |

|

|

|

(50.6 |

)% |

| Net income per common

share |

|

|

|

|

|

| Basic |

$ |

1.47 |

|

|

$ |

2.84 |

|

|

|

(48.2 |

)% |

| Diluted |

$ |

1.46 |

|

|

$ |

2.83 |

|

|

|

(48.4 |

)% |

| Weighted-average

common and common equivalentshares

outstanding |

|

|

|

|

|

| Basic |

|

63.3 |

|

|

|

66.3 |

|

|

|

| Diluted |

|

63.6 |

|

|

|

66.7 |

|

|

|

| Dividends declared per

common share |

$ |

0.675 |

|

|

$ |

0.660 |

|

|

|

ABM INDUSTRIES INCORPORATED AND

SUBSIDIARIESSELECTED CONSOLIDATED CASH FLOW

INFORMATION (UNAUDITED)

| |

Three Months Ended July 31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

| Net cash provided by

operating activities(a) |

$ |

79.5 |

|

|

$ |

149.1 |

|

| Additions to property, plant

and equipment |

|

(15.4 |

) |

|

|

(10.9 |

) |

| Purchase of businesses, net of

cash acquired |

|

(114.3 |

) |

|

|

— |

|

| Other |

|

0.3 |

|

|

|

(12.0 |

) |

| Net cash used in

investing activities |

$ |

(129.4 |

) |

|

$ |

(22.8 |

) |

| Proceeds from issuance of

share-based compensation awards, net |

|

0.8 |

|

|

|

0.7 |

|

| Repurchases of common stock,

including excise taxes |

|

— |

|

|

|

(27.1 |

) |

| Dividends paid |

|

(14.1 |

) |

|

|

(14.5 |

) |

| Borrowings from debt |

|

356.0 |

|

|

|

218.5 |

|

| Repayment of borrowings from

debt |

|

(290.1 |

) |

|

|

(278.6 |

) |

| Changes in book cash

overdrafts |

|

23.5 |

|

|

|

0.5 |

|

| Repayment of finance lease

obligations |

|

(1.1 |

) |

|

|

(0.7 |

) |

| Net cash provided by

(used in) financing activities |

$ |

75.0 |

|

|

$ |

(101.2 |

) |

| Effect of exchange

rate changes on cash and cash equivalents |

|

0.6 |

|

|

|

1.3 |

|

| |

(a) The three months ended July 31, 2023,

includes $22.4 million Employee Retention Credit (ERC) refunds

received from the Internal Revenue Service.

ABM INDUSTRIES INCORPORATED AND

SUBSIDIARIESSELECTED CONSOLIDATED CASH FLOW

INFORMATION (UNAUDITED)

| |

Nine Months Ended July 31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

| Net cash provided by

operating activities(a) |

$ |

196.3 |

|

|

$ |

104.1 |

|

| Additions to property, plant

and equipment |

|

(44.6 |

) |

|

|

(34.6 |

) |

| Purchase of businesses, net of

cash acquired |

|

(114.3 |

) |

|

|

— |

|

| Other |

|

0.9 |

|

|

|

(10.3 |

) |

| Net cash used in

investing activities |

$ |

(157.9 |

) |

|

$ |

(45.0 |

) |

| Taxes withheld from issuance

of share-based compensation awards, net |

|

(7.9 |

) |

|

|

(11.3 |

) |

| Repurchases of common stock,

including excise taxes |

|

(23.8 |

) |

|

|

(27.1 |

) |

| Dividends paid |

|

(42.4 |

) |

|

|

(43.5 |

) |

| Borrowings from debt |

|

912.0 |

|

|

|

794.0 |

|

| Repayment of borrowings from

debt |

|

(887.4 |

) |

|

|

(738.4 |

) |

| Changes in book cash

overdrafts |

|

29.5 |

|

|

|

(10.5 |

) |

| Financing of energy savings

performance contracts |

|

— |

|

|

|

0.5 |

|

| Repayment of finance lease

obligations |

|

(3.1 |

) |

|

|

(2.2 |

) |

| Net cash used in

financing activities |

$ |

(23.0 |

) |

|

$ |

(38.4 |

) |

| Effect of exchange

rate changes on cash and cash equivalents |

|

1.4 |

|

|

|

3.9 |

|

| |

(a) The nine months ended July 31, 2023, includes a $66 million

payment for deferred payroll taxes under the Coronavirus Aid Relief

and Economic Security Act (“CARES Act”) and $22.4 million Employee

Retention Credit (ERC) refunds received from the Internal Revenue

Service.

ABM INDUSTRIES INCORPORATED AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEET

INFORMATION (UNAUDITED)

| (in millions) |

July 31, 2024 |

|

October 31, 2023 |

| ASSETS |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

86.3 |

|

|

$ |

69.5 |

|

|

Trade accounts receivable |

|

1,322.7 |

|

|

|

1,365.0 |

|

|

Costs incurred in excess of amounts billed |

|

152.3 |

|

|

|

139.2 |

|

|

Prepaid expenses |

|

86.4 |

|

|

|

78.5 |

|

|

Other current assets |

|

75.7 |

|

|

|

58.6 |

|

|

Total current assets |

|

1,723.4 |

|

|

|

1,710.7 |

|

| Other investments |

|

29.0 |

|

|

|

28.8 |

|

| Property, plant and

equipment |

|

148.5 |

|

|

|

131.5 |

|

| Right-of-use assets |

|

106.2 |

|

|

|

113.4 |

|

| Other intangible assets, net

of accumulated amortization |

|

296.1 |

|

|

|

302.9 |

|

| Goodwill |

|

2,574.2 |

|

|

|

2,491.3 |

|

| Other noncurrent assets |

|

163.0 |

|

|

|

155.0 |

|

| Total assets |

$ |

5,040.4 |

|

|

$ |

4,933.7 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities |

|

|

|

|

Current portion of long-term debt, net |

$ |

31.6 |

|

|

$ |

31.5 |

|

|

Trade accounts payable |

|

278.7 |

|

|

|

299.1 |

|

|

Accrued compensation |

|

239.1 |

|

|

|

249.7 |

|

|

Accrued taxes—other than income |

|

67.0 |

|

|

|

58.9 |

|

|

Deferred Revenue |

|

79.4 |

|

|

|

90.1 |

|

|

Insurance claims |

|

191.2 |

|

|

|

177.0 |

|

|

Income taxes payable |

|

16.9 |

|

|

|

17.9 |

|

|

Current portion of lease liabilities |

|

26.9 |

|

|

|

32.5 |

|

|

Other accrued liabilities |

|

315.4 |

|

|

|

261.2 |

|

|

Total current liabilities |

|

1,246.1 |

|

|

|

1,217.9 |

|

| Long-term debt, net |

|

1,305.1 |

|

|

|

1,279.8 |

|

| Long-term lease

liabilities |

|

95.8 |

|

|

|

98.8 |

|

| Deferred income tax liability,

net |

|

66.1 |

|

|

|

85.0 |

|

| Noncurrent insurance

claims |

|

420.4 |

|

|

|

387.5 |

|

| Other noncurrent

liabilities |

|

67.9 |

|

|

|

61.1 |

|

| Noncurrent income taxes

payable |

|

3.9 |

|

|

|

3.7 |

|

|

Total liabilities |

|

3,205.3 |

|

|

|

3,133.8 |

|

|

Total stockholders’ equity |

|

1,835.0 |

|

|

|

1,799.9 |

|

| Total liabilities and

stockholders’ equity |

$ |

5,040.4 |

|

|

$ |

4,933.7 |

|

ABM INDUSTRIES INCORPORATED AND

SUBSIDIARIESREVENUES AND OPERATING PROFIT BY

SEGMENT (UNAUDITED)

| |

Three Months Ended July 31, |

|

Increase/ (Decrease) |

| (in millions) |

|

2024 |

|

|

|

2023 |

|

|

| Revenues |

|

|

|

|

|

|

Business & Industry |

$ |

1,010.6 |

|

|

$ |

1,021.4 |

|

|

|

(1.1 |

)% |

| Manufacturing &

Distribution |

|

377.1 |

|

|

|

381.9 |

|

|

|

(1.2 |

)% |

| Education |

|

228.3 |

|

|

|

219.1 |

|

|

|

4.2 |

% |

| Aviation |

|

268.4 |

|

|

|

238.0 |

|

|

|

12.8 |

% |

| Technical Solutions |

|

209.7 |

|

|

|

167.9 |

|

|

|

24.9 |

% |

| Total

Revenues |

$ |

2,094.2 |

|

|

$ |

2,028.2 |

|

|

|

3.3 |

% |

| Operating

profit |

|

|

|

|

|

| Business & Industry |

$ |

77.8 |

|

|

$ |

78.9 |

|

|

|

(1.3 |

)% |

| Manufacturing &

Distribution |

|

40.9 |

|

|

|

38.1 |

|

|

|

7.5 |

% |

| Education |

|

18.0 |

|

|

|

15.9 |

|

|

|

13.3 |

% |

| Aviation |

|

17.8 |

|

|

|

11.7 |

|

|

|

51.6 |

% |

| Technical Solutions |

|

17.9 |

|

|

|

11.4 |

|

|

|

56.1 |

% |

| Corporate(1) |

|

(130.6 |

) |

|

|

(15.9 |

) |

|

NM* |

| Adjustment for income from

unconsolidated affiliates, included in Aviation and Technical

Solutions |

|

(1.8 |

) |

|

|

(1.2 |

) |

|

|

(44.4 |

)% |

| Adjustment for tax deductions

for energy efficient government buildings, included in Technical

Solutions |

|

(2.6 |

) |

|

|

— |

|

|

NM* |

| Total operating

profit |

|

37.4 |

|

|

|

138.9 |

|

|

|

(73.1 |

)% |

| Income from unconsolidated

affiliates |

|

1.8 |

|

|

|

1.2 |

|

|

|

44.4 |

% |

| Interest expense |

|

(21.2 |

) |

|

|

(20.9 |

) |

|

|

(1.5 |

)% |

| Income before income

taxes |

|

18.0 |

|

|

|

119.3 |

|

|

|

(84.9 |

)% |

| Income tax provision |

|

(13.3 |

) |

|

|

(21.2 |

) |

|

|

37.0 |

% |

| Net

income |

$ |

4.7 |

|

|

$ |

98.1 |

|

|

|

(95.2 |

)% |

*Not meaningful (due to variance greater than or equal to

+/-100%)

(1) The three months ended July 31, 2024,

includes a $36.0 million fair value adjustment to increase the

contingent consideration related to the RavenVolt Acquisition. The

three months ended July 31, 2023, includes a $37.2 million fair

value adjustment to decrease the contingent consideration and $22.4

million Employee Retention Credit (ERC) refunds received from the

Internal Revenue Service.

ABM INDUSTRIES INCORPORATED AND

SUBSIDIARIESREVENUES AND OPERATING PROFIT BY

SEGMENT (UNAUDITED)

| |

Nine Months Ended July 31, |

|

Increase/ (Decrease) |

| (in millions) |

|

2024 |

|

|

|

2023 |

|

|

| Revenues |

|

|

|

|

|

|

Business & Industry |

$ |

3,033.4 |

|

|

$ |

3,056.4 |

|

|

|

(0.8 |

)% |

| Manufacturing &

Distribution |

|

1,166.6 |

|

|

|

1,135.5 |

|

|

|

2.7 |

% |

| Education |

|

674.0 |

|

|

|

650.7 |

|

|

|

3.6 |

% |

| Aviation |

|

756.1 |

|

|

|

677.5 |

|

|

|

11.6 |

% |

| Technical Solutions |

|

551.9 |

|

|

|

483.4 |

|

|

|

14.2 |

% |

| Total

Revenues |

$ |

6,182.0 |

|

|

$ |

6,003.5 |

|

|

|

3.0 |

% |

| Operating

profit |

|

|

|

|

|

| Business & Industry |

$ |

235.0 |

|

|

$ |

231.1 |

|

|

|

1.7 |

% |

| Manufacturing &

Distribution |

|

125.9 |

|

|

|

119.7 |

|

|

|

5.1 |

% |

| Education |

|

42.3 |

|

|

|

39.5 |

|

|

|

7.1 |

% |

| Aviation |

|

40.6 |

|

|

|

43.6 |

|

|

|

(7.1 |

)% |

| Technical Solutions |

|

41.4 |

|

|

|

28.8 |

|

|

|

43.6 |

% |

| Corporate(1) |

|

(285.0 |

) |

|

|

(156.7 |

) |

|

|

(81.9 |

)% |

| Adjustment for income from

unconsolidated affiliates, included in Aviation and Technical

Solutions |

|

(4.7 |

) |

|

|

(3.0 |

) |

|

|

(60.2 |

)% |

| Adjustment for tax deductions

for energy efficient government buildings, included in Technical

Solutions |

|

(2.6 |

) |

|

|

(0.1 |

) |

|

NM* |

| Total operating

profit |

|

192.8 |

|

|

|

303.1 |

|

|

|

(36.4 |

)% |

| Income from unconsolidated

affiliates |

|

4.7 |

|

|

|

3.0 |

|

|

|

60.2 |

% |

| Interest expense |

|

(63.1 |

) |

|

|

(61.8 |

) |

|

|

(2.2 |

)% |

| Income before income

taxes |

|

134.4 |

|

|

|

244.2 |

|

|

|

(45.0 |

)% |

| Income tax provision |

|

(41.3 |

) |

|

|

(55.7 |

) |

|

|

25.9 |

% |

| Net

income |

$ |

93.1 |

|

|

$ |

188.5 |

|

|

|

(50.6 |

)% |

| |

|

|

|

|

|

*Not meaningful (due to variance greater than or equal to

+/-100%)

(1) The nine months ended July 31, 2024,

includes a $36.0 million fair value adjustment to increase the

contingent consideration related to the RavenVolt Acquisition. The

nine months ended July 31, 2023, includes a $45.6 million fair

value adjustment to decrease the contingent consideration and $22.4

million Employee Retention Credit (ERC) refunds received from the

Internal Revenue Service.

ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

(in millions, except per share amounts)

| |

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Reconciliation of Net

Income to Adjusted Net Income |

|

|

|

|

|

|

|

| Net income |

$ |

4.7 |

|

|

$ |

98.1 |

|

|

$ |

93.1 |

|

|

$ |

188.5 |

|

| Items impacting

comparability(a) |

|

|

|

|

|

|

|

|

Prior year self-insurance adjustment(b) |

|

8.3 |

|

|

|

(5.3 |

) |

|

|

17.9 |

|

|

|

(1.8 |

) |

|

Legal costs and other settlements |

|

0.2 |

|

|

|

— |

|

|

|

0.2 |

|

|

|

— |

|

|

Acquisition and integration related costs(c) |

|

3.9 |

|

|

|

3.9 |

|

|

|

7.6 |

|

|

|

11.1 |

|

|

Transformation initiative costs(d) |

|

11.1 |

|

|

|

15.3 |

|

|

|

27.8 |

|

|

|

45.9 |

|

|

Change in fair value of contingent consideration(e) |

|

36.0 |

|

|

|

(37.2 |

) |

|

|

36.0 |

|

|

|

(45.6 |

) |

|

Employee Retention Credit(f) |

|

— |

|

|

|

(22.4 |

) |

|

|

— |

|

|

|

(22.4 |

) |

|

Other(g) |

|

2.7 |

|

|

$ |

0.5 |

|

|

|

3.5 |

|

|

|

0.4 |

|

| Total items impacting

comparability |

|

62.2 |

|

|

|

(45.1 |

) |

|

|

93.0 |

|

|

|

(12.3 |

) |

| Income tax benefit(h)(i) |

|

(7.4 |

) |

|

|

(0.2 |

) |

|

|

(16.3 |

) |

|

|

(10.6 |

) |

| Items impacting comparability,

net of taxes |

|

54.8 |

|

|

|

(45.4 |

) |

|

|

76.6 |

|

|

|

(22.9 |

) |

| Adjusted net income |

$ |

59.5 |

|

|

$ |

52.8 |

|

|

$ |

169.7 |

|

|

$ |

165.6 |

|

| |

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Reconciliation of Net

Income to Adjusted EBITDA |

|

|

|

|

|

|

|

| Net Income |

$ |

4.7 |

|

|

$ |

98.1 |

|

|

$ |

93.1 |

|

|

$ |

188.5 |

|

|

Items impacting comparability |

|

62.2 |

|

|

|

(45.1 |

) |

|

|

93.0 |

|

|

|

(12.3 |

) |

|

Income taxes provision |

|

13.3 |

|

|

|

21.2 |

|

|

|

41.3 |

|

|

|

55.7 |

|

|

Interest expense |

|

21.2 |

|

|

|

20.9 |

|

|

|

63.1 |

|

|

|

61.8 |

|

|

Depreciation and amortization |

|

26.7 |

|

|

|

30.2 |

|

|

|

79.5 |

|

|

|

91.3 |

|

| Adjusted EBITDA |

$ |

128.1 |

|

|

$ |

125.3 |

|

|

$ |

370.0 |

|

|

$ |

384.9 |

|

| |

|

|

|

|

|

|

|

| Net Income margin as a %

of revenues |

|

0.2 |

% |

|

|

4.8 |

% |

|

|

1.5 |

% |

|

|

3.1 |

% |

| |

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues Excluding

Management Reimbursement |

|

|

|

|

|

|

|

| Revenue |

$ |

2,094.2 |

|

|

$ |

2,028.2 |

|

|

$ |

6,182.0 |

|

|

$ |

6,003.5 |

|

|

Management Reimbursement |

|

(79.6 |

) |

|

|

(77.9 |

) |

|

|

(236.6 |

) |

|

|

(223.8 |

) |

| Revenues excluding management

reimbursement |

$ |

2,014.6 |

|

|

$ |

1,950.3 |

|

|

$ |

5,945.4 |

|

|

$ |

5,779.7 |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA margin as

a % of revenues excluding management reimbursement |

|

6.4 |

% |

|

|

6.4 |

% |

|

|

6.2 |

% |

|

|

6.7 |

% |

| |

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| Reconciliation of Net

Income per Diluted Share to Adjusted Net Income per Diluted

Share |

|

|

|

|

|

|

|

| Net income per diluted share |

$ |

0.07 |

|

|

$ |

1.47 |

|

|

$ |

1.46 |

|

$ |

2.83 |

|

|

Items impacting comparability, net of taxes |

|

0.86 |

|

|

|

(0.68 |

) |

|

|

1.20 |

|

|

(0.34 |

) |

| Adjusted net income per diluted

share |

$ |

0.94 |

|

|

$ |

0.79 |

|

|

$ |

2.67 |

|

$ |

2.48 |

|

| Diluted shares |

|

63.5 |

|

|

|

66.6 |

|

|

|

63.6 |

|

|

66.7 |

|

| |

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Reconciliation of Net

Cash Provided by Operating Activities to Free Cash

Flow |

|

|

|

|

|

|

|

| Net cash provided by operating

activities(j) |

$ |

79.5 |

|

|

$ |

149.1 |

|

|

$ |

196.3 |

|

|

$ |

104.1 |

|

| Additions to property, plant and

equipment |

|

(15.4 |

) |

|

|

(10.9 |

) |

|

|

(44.6 |

) |

|

|

(34.6 |

) |

| Free cash flow |

$ |

64.1 |

|

|

$ |

138.3 |

|

|

$ |

151.8 |

|

|

$ |

69.5 |

|

| |

(a) The Company adjusts income to exclude the

impact of certain items that are unusual, non-recurring, or

otherwise do not reflect management's views of the underlying

operational results and trends of the Company.

(b) Represents the net adjustments to our

self-insurance reserve for general liability, workers’

compensation, automobile and health insurance claims related to

prior period accident years. Management believes these prior

period reserve changes do not illustrate the performance of the

Company’s normal ongoing operations given the current year's

insurance expense is estimated by management in conjunction with

the Company's outside actuary to take into consideration past

history and current costs and regulatory trends. Once the Company

develops its best estimate of insurance expense premiums for the

year, the Company fully allocates such costs out to the business

leaders to hold them accountable for the current year costs within

operations. However, since these prior period reserve changes

relate to claims that could date back many years, current

management has limited ability to influence the ultimate

development of the prior year changes. Accordingly, including the

prior period reserve changes in the Company's current operational

results would not depict how the business is run as the Company

holds its management accountable for the current year’s operational

performance. The Company believes the exclusion of the

self-insurance adjustment from net income is useful to investors by

enabling them to better assess our operating performance in the

context of current year profitability. For the three and nine

months ended July 31, 2024 our self-insurance general

liability, workers’ compensation, and automobile insurance claims

related to prior period accident years increased by $8.3 million

and $17.9 million, respectively. For the three and nine months

ended July 31, 2023, our self-insured general liability,

workers’ compensation, and automobile insurance claims and health

insurance claims related to prior period decreased by $5.3 million

and $1.8 million, respectively.

(c)Represents acquisition and integration

related costs primarily associated with Able acquisition.

(d) Represents discrete transformational costs

that primarily consist of general and administrative costs for

developing technological needs and alternatives, project

management, testing, training and data conversion, consulting and

professional fees for i) new enterprise resource planning system,

ii) client facing technology, iii) workforce management tools and

iv) data analytics. These costs are not expected to recur beyond

the deployment of these initiatives.

(e) Represents an adjustment to the estimate of

the fair value of the contingent consideration associated with the

RavenVolt acquisition.

(f) Represents Employee Retention Credit (ERC)

refunds received from the IRS.

(g) Primarily represents severance costs related

to the permanent elimination of the role of Executive Vice

President, Chief Strategy & Transformation Officer.

(h) The Company's tax impact is calculated using

the federal and state statutory rate of 28.11% for FY2024 and FY

2023. For purposes of calculating the tax impact, the change in the

fair value of the contingent consideration related to RavenVolt

acquisition is deemed to be an non-taxable item. We calculate tax

from the underlying whole-dollar amounts, as a result, certain

amounts may not recalculate based on reported numbers due to

rounding.

(i) The nine months ended July 31, 2024 include

a $0.3 million benefit for uncertain tax positions with expiring

statues. The three and nine months ended July 31, 2023 include a

$5.1 million charge related to ERC refunds received from IRS.

(j) The three months ended July 31, 2023,

includes $22.4 million Employee Retention Credit (ERC) refunds

received from the Internal Revenue Service. The nine months ended

July 31, 2023, includes a $66 million payment for deferred payroll

taxes under the Coronavirus Aid Relief and Economic Security Act

(“CARES Act”) and $22.4 million Employee Retention Credit (ERC)

refunds received from the Internal Revenue Service.

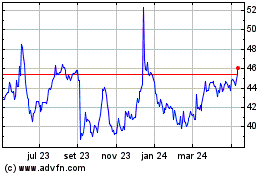

ABM Industries (NYSE:ABM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

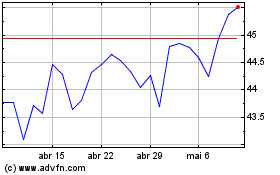

ABM Industries (NYSE:ABM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024