NOVAGOLD RESOURCES INC. (“NOVAGOLD” or the

“Company”) (NYSE American, TSX: NG) today released its 2024 third

quarter financial results and provided an update on its Tier One1

gold development project, Donlin Gold, which NOVAGOLD owns equally

with Barrick Gold Corporation (“Barrick”).

Details of the financial results for the quarter

ended August 31, 2024, are presented in the consolidated financial

statements and quarterly report filed on Form 10-Q on October 2,

2024, available on the Company’s website at www.novagold.com, on

SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov. All

amounts are in U.S. dollars unless otherwise stated.

In the third quarter of 2024, the

following milestones were achieved:

- Donlin Gold

activities included:

- Metallurgical test

work (pilot plant) to confirm flowsheet optimizations advanced with

completion expected by year-end.

- Submission of the

majority of the Dam Safety Certification preliminary design

packages to the Alaska Department of Natural Resources (ADNR) on

June 17, 2024, with the final documents expected to be submitted by

year-end. Comments from ADNR are anticipated to be received in

2025.

- Updated resource

modelling by the Donlin Gold team and a third-party consultant

nearing completion.

- Incorporation of

field and geochemical data to update groundwater and surface water

models for operational and closure planning.

- Subsequent to the

third quarter, NOVAGOLD and Barrick held a Donlin Gold workshop in

Alaska to review the substantial work completed to date and to

discuss next steps for the Donlin Gold project and related

activities for 2025.

- In collaboration

with Calista Corporation (“Calista”) and The Kuskokwim Corporation

(TKC), Donlin Gold achieved significant milestones in education,

health and safety, cultural preservation, and environmental

initiatives that include:

- Hosted Crooked

Creek and Georgetown residents on a tour of the Donlin Gold

project.

- Participated in a

public Open House in Anchorage, providing Alaskans with the

opportunity to learn more about the project and engage in open and

transparent discussions.

- Sponsored the RurAL

CAP Elder Mentor Program, connecting youth with Elders in Alaska

and fostering the sharing of values and knowledge between

generations.

- Increased

collaboration with the Alaska School Activities Association, a

statewide nonprofit organization dedicated to the development of

high school-level athletic, academic, and fine arts programs across

the State.

- NOVAGOLD reported

the following:

- Appointment of

Peter Adamek, a seasoned financial executive with over 20 years of

experience, as the Company’s new Vice President and Chief Financial

Officer.

- NOVAGOLD maintains

a strong financial position to continue to advance the Donlin Gold

project up the value chain, with a healthy treasury of $105.6

million in cash and term deposits as of August 31, 2024.

_______________1 NOVAGOLD defines a Tier One gold development

project as one with a projected production life of at least 10

years, annual projected production of at least 500,000 ounces of

gold, and average projected cash costs over the production life

that are in the lower half of the industry cost curve.

President’s Message

Focused on Finalizing Key Project

Activities to Drive the Donlin Gold Project

Development

During the third quarter of 2024, Donlin Gold advanced key

activities to position the project to update technical work and

cost estimates. Our commitment to a collaborative and inclusive

approach continues to benefit all shareholders and

stakeholders.

Principal activities included the advancement of metallurgical

test work at a pilot plant in Ontario, Canada to confirm proposed

optimizations to the flowsheet (with completion expected by

year-end), as well as updated resource modelling by the Donlin Gold

team and a third-party consultant that is also nearing completion.

In addition, recent Donlin Gold field data was used to update

groundwater and surface water models, while geochemical data

collection continues and will be used for closure planning. Our

work on the Dam Safety Certification continues to progress with the

majority of the preliminary design packages submitted to the ADNR

on June 17, 2024, with final documents expected to be submitted by

year-end. Comments from the ADNR on the Dam Safety Certification

preliminary design packages are anticipated in 2025.

These comprehensive efforts have delivered highly valuable

insights for the Donlin Gold LLC Board and its owners. Guiding our

strategy for the Donlin Gold project and its 2025 initiatives,

these activities were reviewed at our latest workshop in Alaska

with Barrick and will contribute critical data for advancing Donlin

Gold. NOVAGOLD is committed to advancing the project with a focus

on financial prudence, engineering excellence, environmental

responsibility, and a strong safety culture.

Our outreach in Alaska, particularly in the Yukon-Kuskokwim

(Y-K) region, and in Washington, D.C., has strengthened community

engagement and reinforces the project’s social license. The Company

appreciates the diligent contributions of the Donlin Gold team,

partners, and stakeholders, and remains dedicated to developing the

project to its full potential. With $105.6 million in cash and term

deposits as of August 31, 2024, NOVAGOLD is well-positioned to

support this effort.

We were very pleased to announce Peter Adamek’s appointment as

the Company’s new Vice President and Chief Financial Officer in the

third quarter. Peter is a seasoned financial executive with over 20

years of experience, most recently with Hudbay Minerals Inc. He

joins a leadership team that has consistently demonstrated

diligence and responsible capital stewardship while enhancing value

and upholding strong shareholder engagement.

Ongoing Engagement with Stakeholders and

Government to Enhance Donlin Gold’s Social License

In collaboration with Calista and TKC, the mineral and surface

rights holders, Donlin Gold LLC has made significant strides in

local community and government engagement across the Y-K region,

Alaska, and Washington, D.C. Strategically located on private land

designated by law for mineral development under the Alaska Native

Claims Settlement Act of 1971, the Donlin Gold project enjoys deep

involvement with Native Corporations, strengthening our connections

with people from the region and local government bodies.

Our enduring partnerships with Calista and TKC have been crucial

in advancing the project’s development and permitting efforts. Over

decades, our commitment to engaging with the 62 stakeholder

communities in the Y-K region has built meaningful relationships,

enhanced investment, and reinforced our social license. This

longstanding dedication underscores the approach of the Donlin Gold

project and its partners, Calista and TKC, to foster robust

relationships with both local communities and governmental entities

built on trust, transparency, respect and partnership.

In July, Donlin Gold hosted a project site tour for a group of

residents from Crooked Creek and the Native Village of

Georgetown.

In August, Calista, TKC, and Donlin Gold hosted a public Open

House in Anchorage, providing Alaskans with the opportunity to

learn more about the project and to engage in open and transparent

discussions. NOVAGOLD was in attendance to participate, interact,

and engage with key stakeholders.

These are just two examples of the many engagements Donlin Gold

prioritizes to raise awareness and maintain transparency around the

project.

Sustained Support and Participation in

Local Community and Environmental Initiatives Throughout the Y-K

Region

NOVAGOLD remains deeply committed to community and social

responsibility, upholding shared values at the Donlin Gold project

site and within the Y-K region. Through initiatives spanning

education, community wellness, cultural preservation, and

environmental stewardship, we support fisheries studies,

environmental activities, subsistence, cultural preservation

efforts, and various grants. Our collaboration with Calista and TKC

has driven a range of activities and projects over the past

quarter.

Since mid-2023, NOVAGOLD and Donlin Gold have intensified

efforts with our Alaska Native Corporation partners to monitor,

survey and engage in the dialogue on salmon fisheries in the

Kuskokwim and Yukon River watersheds. In the third quarter, we

focused on identifying opportunities to monitor, evaluate, and

strengthen salmon populations. Notably, we launched a salmon smolt

monitoring program on the George River, a tributary of the

Kuskokwim River, in partnership with the Village of Napaimute to

assess smolt health and migration patterns.

In addition, Donlin Gold and NOVAGOLD have supported the “In It

for The Long Haul” backhaul program for seven years now, collecting

and safely disposing of household hazardous and electronic waste

from Y-K villages. This year alone, approximately 140,000 pounds of

material were recycled, for an impressive total of approximately

803,000 pounds of hazardous materials removed from the Y-K region

since the program began in 2018.

Donlin Gold’s partnership with the Crooked Creek Traditional

Council has supported the Summer Youth Employment program,

providing local youth with hands-on experience in various work

environments while also assisting Elders. In the third quarter,

Donlin Gold continued sponsoring the RurAL CAP Elder Mentor

Program, which connects youth with Elders to foster

intergenerational knowledge and support academic engagement and

school readiness across the State. Donlin Gold also shipped

dictionaries to all school districts in the Y-K region for third

graders as part of The Dictionary Project, a national effort to

promote literacy and creative thinkers, a project they have

participated in annually since 2012.

Donlin Gold has also reaffirmed its commitment to the Alaska

School Activities Association, supporting high school-level

athletic, academic, and fine arts programs statewide. Donlin Gold’s

ongoing financial contributions highlight our steadfast dedication

to enhancing educational and extracurricular opportunities for

students throughout Alaska.

NOVAGOLD remains committed to stakeholder engagement and

community development working closely with Tribal communities and

Alaska Native Corporations to identify needs and collaboratively

develop solutions that enhance and uplift communities, fostering

sustainable growth and shared prosperity for future

generations.

Proactively Defending and Upholding

Current State and Federal Permits and Working to Secure Remaining

Key State Permits

Donlin Gold, in collaboration with Calista, actively supports

Federal and State agencies in defending the project’s permits

against legal challenges — a strategy that has proven highly

effective in maintaining permit approvals to date. The intricate

permitting process in the United States and Alaska demands years of

dedicated, transparent, and inclusive efforts to engage all

stakeholders, including those from the Y-K region. With a profound

understanding of the regulatory landscape, Donlin Gold and its

partners are committed to supporting Federal and State agencies

through any challenges to the project’s permits and are now

concentrating on securing the remaining State-level permits and

certificates needed for the project’s advancement. While

maintaining jurisdictional safety presents challenges, particularly

as regulations vary across regions, the State of Alaska stands out

as a stable and reliable investment environment. As the

second-largest gold-producing state in one of the world’s safest

countries for free enterprise2, Alaska offers investors stability

and certainty that their assets will remain secure. This makes the

rigorous permitting process a worthwhile endeavor in an

increasingly complex world.

Earthjustice filed their opening brief with the Alaska Superior

Court on January 5, 2024, appealing the Alaska Department of

Environmental Conservation Commissioner’s decision upholding the

401 Water Quality Certification. The briefing is complete and oral

arguments were held on August 30, 2024. A decision is anticipated

from the Alaska Superior Court by 2025.

In other State litigation, following an unsuccessful appeal to

the ADNR Commissioner, Earthjustice filed their opening brief with

the Alaska Supreme Court on January 4, 2024, appealing the Alaska

Superior Court’s decision on Donlin Gold’s water rights permits.

Additionally, briefing on Earthjustice’s appeal of the Alaska

Superior Court affirmation of ADNR’s issuance of the State pipeline

Right-of-Way (ROW) lease to the Alaska Supreme Court was completed

in February 2024. Oral arguments for both the water rights permits

and the State pipeline ROW are scheduled for November 12, 2024.

In the Federal litigation challenging the Donlin

Gold Joint Record of Decision, including the 404 permit and ROW for

portions of the pipeline crossing federal lands, the Court issued a

decision on September 30, 2024. The decision upheld the federal

agencies’ analysis on two of the three issues raised in the

litigation, but agreed with the plaintiffs that the federal

agencies took too narrow a view in analyzing the impact of a

theoretical release from the tailing storage facility. The Court

requested supplemental briefing on the appropriate remedy for

addressing this issue, which is due October 21, 2024, and response

briefing is due November 4, 2024. Donlin Gold is committed to

working with the federal agencies and all stakeholders on an

appropriate remedy to address the Court’s decision.

_______________2 Per the 2024 Mineral Commodity

Summaries Report

– https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-gold.pdf.

Dedicated to Advancing Donlin Gold for

the Benefit of All Shareholders and Stakeholders

NOVAGOLD strongly believes that the Donlin Gold project

represents a compelling investment opportunity in the gold market,

especially amidst the scarcity of high-quality assets in secure

jurisdictions and the gold price recently reaching an all-time

high. Situated in Alaska — a well-established mining destination —

Donlin Gold holds significant potential. The project boasts

approximately 39 million ounces of gold at a grade of 2.24 grams

per tonne in Measured and Indicated Mineral Resources, inclusive of

Proven and Probable Mineral Reserves3. This robust asset, with a

projected mine life of 27 years and average annual gold production

in excess of a million ounces per year, is not only projected to be

a low-cost, open-pit producer, but it also offers exploration

upside — extending beyond the currently defined resource areas,

which represent less than half of the presently identified

eight-kilometer mineralized trend.

Advancing Donlin Gold through its successive development phases

responsibly and effectively remains our top priority. Since 2012,

NOVAGOLD has enhanced the project’s value without additional equity

issuances, underscoring our dedication to strategic growth and

value creation. In the current macro environment, characterized by

complex and volatile market conditions, Donlin Gold stands out as a

rare and truly exceptional “Tier 1 Asset” located in one of the

world’s top mining jurisdictions. With its impressive profile,

low-cost structure, and substantial exploration potential, Donlin

Gold is well positioned to become one of the best gold development

projects which epitomizes both stability and opportunity.

These numerous accomplishments reflect the hard work and

diligence of our entire team — from managing Donlin Gold operations

to engaging with State and Federal agencies, conducting studies,

and reaching out to communities across a vast region. Our

environmental, educational, and social initiatives further

underscore our longstanding and genuine dedication. We extend our

heartfelt thanks to our colleagues and partners at Donlin Gold,

Calista, TKC, and NOVAGOLD, as well as to our Board of Directors

for their unwavering efforts and collaboration. We remain as

committed as ever to advancing the Donlin Gold project safely and

responsibly, with a clear focus on creating substantial value.

We deeply appreciate the unwavering support and trust of our

long-term shareholders, whose commitment and guidance have been

instrumental to the Company’s success. The remarkable dedication of

these esteemed investors, which include some of the most respected

names in the investment community, constitutes the cornerstone of

our progress. We deeply value their decision to invest in our

company as well as their constant and insightful engagement. As

custodians of NOVAGOLD, we remain resolutely focused on executing

our strategy and advancing the Donlin Gold project with the highest

standards of safety and social responsibility. Our paramount

objective is to enhance shareholder and stakeholder value, echoing

both the confidence and conviction that our shareholders have

placed in us.

Sincerely,

Gregory A. Lang

President & CEO

_______________3 Donlin Gold data as per the

report titled “NI 43-101 Technical Report on the Donlin Gold

Project, Alaska, USA” with an effective date of June 1, 2021 (the

“2021 Technical Report”) and the report titled “S-K 1300 Technical

Report Summary on the Donlin Gold Project, Alaska, USA” (the “S-K

1300 Technical Report Summary”), dated November 30, 2021. Donlin

Gold possesses Measured Resources of approximately 8 Mt grading

2.52 g/t and Indicated Resources of approximately 534 Mt grading

2.24 g/t, each on a 100% basis and inclusive of Mineral Reserves,

of which approximately 4 Mt of Measured Resources and approximately

267 Mt of Indicated Resources inclusive of Reserves is attributable

to NOVAGOLD through its 50% ownership interest in Donlin Gold LLC.

Exclusive of Mineral Reserves, Donlin Gold possesses Measured

Resources of approximately 1 Mt grading 2.23 g/t and Indicated

Resources of approximately 69 Mt grading 2.44 g/t, of which

approximately 0.5 Mt of Measured Resources and approximately 35 Mt

of Indicated Resources exclusive of Mineral Reserves is

attributable to NOVAGOLD. Donlin Gold possesses Proven Reserves of

approximately 8 Mt grading 2.32 g/t and Probable Reserves of

approximately 497 Mt grading 2.08 g/t, each on a 100% basis, of

which approximately 4 Mt of Proven Reserves and approximately 249

Mt of Probable Reserves is attributable to NOVAGOLD. Mineral

Reserves and Resources have been estimated in accordance with NI

43-101 and S-K 1300.

Financial Resultsin thousands of U.S. dollars,

except for per share amounts

|

|

Three monthsendedAugust 31,

2024$ |

|

Three monthsendedAugust 31,

2023$ |

|

Nine months endedAugust

31, 2024$ |

|

Nine monthsendedAugust 31,

2023$ |

|

|

General and administrative expense(1) |

5,120 |

|

5,243 |

|

18,982 |

|

16,385 |

|

|

Share of losses – Donlin Gold |

2,814 |

|

3,978 |

|

9,765 |

|

15,996 |

|

|

Total operating expenses |

7,934 |

|

9,221 |

|

28,747 |

|

32,381 |

|

|

|

|

|

|

|

|

Loss from operations |

(7,934) |

|

(9,221) |

|

(28,747) |

|

(32,381) |

|

| Interest

expense on promissory note |

(3,833) |

|

(3,433) |

|

(11,132) |

|

(9,589) |

|

| Interest

and dividend income |

1,194 |

|

1,501 |

|

4,265 |

|

4,180 |

|

|

Other income, net |

(14) |

|

(66) |

|

1,708 |

|

904 |

|

|

Accretion of notes receivable |

— |

|

145 |

|

— |

|

579 |

|

|

Income tax expense |

(156) |

|

— |

|

(855) |

|

(75) |

|

|

Net loss |

(10,743) |

|

(11,074) |

|

(34,761) |

|

(36,382) |

|

|

|

|

|

|

|

|

Net Loss per share, basic and diluted |

(0.03) |

|

(0.03) |

|

(0.11) |

|

(0.11) |

|

|

|

|

|

|

|

|

|

|

|

At |

|

At |

|

|

|

|

|

August 31,

2024$ |

|

November 30,2023$ |

|

|

Cash and term deposits |

|

|

105,572 |

|

125,749 |

|

|

Total assets |

|

|

114,731 |

|

133,290 |

|

|

Total liabilities |

|

|

152,540 |

|

141,513 |

|

(1) Includes

share-based compensation expense of $515 and $2,225 in the third

quarter of 2024 and 2023, respectively, and $5,319 and $6,526 in

the first nine months of 2024 and 2023, respectively.

In the third quarter of 2024, net loss decreased by $331 from

the comparable prior year period. The decrease was primarily due to

lower stock-based compensation expense related to forfeiture of

options and performance share units and lower field expenses at

Donlin Gold partially offset by higher general and administrative

costs, increased interest expense on the promissory note and lower

interest income on cash and term deposits. Donlin Gold expenses

were lower with reduced site activity in 2024, compared to

fieldwork and geotechnical drilling for the Alaska Dam Safety

certificates and hydrological drilling to support mine planning and

design in 2023. General and administrative expenses increased

primarily due to higher professional fees and employee

compensation. Professional fees increased due to consulting fees

primarily related to ongoing efforts to enhance the value of the

Donlin Gold project by evaluating alternatives to further advance

the project. Salaries and benefits increased primarily due to

hiring of additional staff. Income tax expense relates to passive

income taxable in Canada on a portion of interest income earned by

U.S. subsidiaries, and for withholding taxes on the sale of the San

Roque project in Argentina during the first quarter of 2024.

Liquidity and Capital

Resources

In the third quarter and first nine months of 2024, cash

equivalents decreased by $6,996 and $177, respectively, primarily

due to Donlin Gold funding and corporate general and administrative

costs, partially offset by interest income on cash and proceeds

from term deposits. The increase in cash used in operating

activities in the third quarter and first nine months of 2024 from

the comparable prior year periods was primarily due to increased

corporate general and administrative costs and a net change in

working capital. Funding requirements for Donlin Gold were

substantially lower in the first nine months of 2024 than the

comparable prior year period.

2024 Outlook

Our anticipated cash expenditures in fiscal year 2024 continue

to be approximately $31,200, including $14,250 to fund the Donlin

Gold project, and $16,950 for corporate general and administrative

costs.

NOVAGOLD’s primary goals in 2024 include continuing to advance

the Donlin Gold project toward a construction decision; maintaining

support for Donlin Gold among the project’s stakeholders; promoting

a strong culture on safety, sustainability, and the environment;

maintaining a favorable reputation of NOVAGOLD; and preserving a

healthy balance sheet. Our operations primarily relate to the

delivery of project milestones, including the achievement of

various technical, environmental, sustainable development, economic

and legal objectives, obtaining necessary permits, completion of

pre-feasibility and feasibility studies, preparation of engineering

designs and the financing to fund these objectives.

Conference Call & Webcast

Details

NOVAGOLD’s conference call and webcast to

discuss these results will take place on October 3, 2024, at 8:00

am PT (11:00 am ET). The webcast and conference call-in details are

provided below.

|

Video Webcast: |

|

www.novagold.com/investors/events |

|

North American callers: |

|

1-800-319-4610 |

|

International callers: |

|

1-604-638-5340 |

| |

|

|

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company, solely

focused on the responsible and sustainable development of its

flagship Donlin Gold project in Alaska, one of the safest mining

jurisdictions in the world4. The Donlin Gold project, in equal

partnership with Barrick, is positioned to be one of the world’s

largest gold mines, with approximately 39 million ounces of gold in

the Measured and Indicated Mineral Resource (541 million tonnes at

an average grade of approximately 2.24 grams per tonne, on a 100%

basis)5 categories, inclusive of Proven and Probable Mineral

Reserves. According to the 2021 Technical Report and the S-K 1300

Technical Report Summary (both as defined in footnote 3) Donlin

Gold is expected to produce an average of approximately one million

ounces of gold over a 27-year mine life on a 100% basis. There’s

substantial exploration potential beyond the designed footprint of

the Donlin Gold open pit, which currently covers three kilometers

of an approximately eight-kilometer-long gold-bearing trend.

Current activities at the Donlin Gold project focus on state

permitting, engineering studies, community and government

engagement, and other environmental, educational and cultural

initiatives in preparation for the eventual construction and

operation of this project. With a robust balance sheet, NOVAGOLD is

well positioned to finance its share of current activities.

_______________4 Per Mining Journal intelligence – World Risk

Report 2023 Alaska received an AA rating, ranks number 3 globally

on the Investment Risk index and is in the top quartile for

low-risk in each category (Legal, Governance, Social, Fiscal and

Infrastructure).5 Donlin Gold data as per the 2021 Technical Report

and the S-K 1300 Technical Report Summary. Please see footnote 3

above.

NOVAGOLD Contact:

Mélanie Hennessey Vice President, Corporate Communications

604-669-6227 or 1-866-669-6227

Cautionary Note Regarding

Forward-Looking Statements

This media release includes certain

“forward-looking information” and “forward-looking statements”

(collectively “forward-looking statements”) within the meaning of

applicable securities legislation, including the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements are frequently, but not always, identified by words such

as “expects”, “anticipates”, “believes”, “intends”, “estimates”,

“potential”, “possible”, and similar expressions, or statements

that events, conditions, or results “will”, “may”, “could”, “would”

or “should” occur or be achieved. Forward-looking statements are

necessarily based on several opinions, estimates and assumptions

that management of NOVAGOLD considered appropriate and reasonable

as of the date such statements are made, are subject to known and

unknown risks, uncertainties, assumptions, and other factors that

may cause the actual results, activity, performance, or

achievements to be materially different from those expressed or

implied by such forward-looking statements. All statements, other

than statements of historical fact, included herein are

forward-looking statements. These forward-looking statements

include statements regarding the anticipated timing of certain

judicial and/or administrative decisions; the 2024 outlook; the

timing and potential for commencing a new feasibility study on the

Donlin Gold project; our goals and expenditures for 2024; ongoing

support provided to key stakeholders including Native Corporation

partners; Donlin Gold’s continued support for the state and federal

permitting process; sufficiency of working capital; the potential

development and construction of the Donlin Gold project; the

sufficiency of funds to continue to advance development of Donlin

Gold, including to a construction decision; perceived merit of

properties; mineral reserve and mineral resource estimates; Donlin

Gold’s ability to secure the permits needed to construct and

operate the Donlin Gold project in a timely manner, if at all;

legal challenges to Donlin Gold’s existing permits and the timing

of decisions in those challenges; whether the Donlin Gold LLC board

will continue to advance the Donlin Gold project safely, socially

responsibly and to generate value for our stakeholders; continued

cooperation between the owners of Donlin Gold LLC to advance the

project; the Company’s ability to deliver on its strategy with the

Donlin Gold project, increasing shareholder and stakeholder wealth;

the success of the strategic mine plan for the Donlin Gold project;

the success of the Donlin Gold community relations plan; the

outcome of exploration drilling at the Donlin Gold project and the

timing thereof; the completion of test work and modeling and the

timing thereof. In addition, any statements that refer to

expectations, intentions, projections or other characterizations of

future events or circumstances are forward-looking statements.

Forward-looking statements are not historical facts but instead

represent the expectations of NOVAGOLD management’s estimates and

projections regarding future events or circumstances on the date

the statements are made. Important factors that could cause actual

results to differ materially from expectations include the need to

obtain additional permits and governmental approvals; the timing

and likelihood of obtaining and maintaining permits necessary to

construct and operate; the need for additional financing to explore

and develop properties and availability of financing in the debt

and capital markets; disease pandemics; uncertainties involved in

the interpretation of drill results and geological tests and the

estimation of reserves and resources; changes in mineral production

performance, exploitation and exploration successes; changes in

national and local government legislation, taxation, controls or

regulations and/or changes in the administration of laws, policies

and practices, expropriation or nationalization of property and

political or economic developments in the United States or Canada;

the need for continued cooperation between Barrick and NOVAGOLD for

the continued exploration, development and eventual construction of

the Donlin Gold property; the need for additional capital if

NOVAGOLD determined to proceed with an updated feasibility study on

its own; the need for cooperation of government agencies and Native

groups in the development and operation of properties; risks of

construction and mining projects such as accidents, equipment

breakdowns, bad weather, disease pandemics, non-compliance with

environmental and permit requirements, unanticipated variation in

geological structures, ore grades or recovery rates; unexpected

cost increases, which could include significant increases in

estimated capital and operating costs; fluctuations in metal prices

and currency exchange rates; whether or when a positive

construction decision will be made regarding the Donlin Gold

project; and other risks and uncertainties disclosed in NOVAGOLD’s

most recent reports on Forms 10-K and 10-Q, particularly the “Risk

Factors” sections of those reports and other documents filed by

NOVAGOLD with applicable securities regulatory authorities from

time to time. Copies of these filings may be obtained by visiting

NOVAGOLD’s website at www.novagold.com, or the SEC’s website at

www.sec.gov, or on SEDAR+ at www.sedarplus.ca. The forward-looking

statements contained herein reflect the beliefs, opinions and

projections of NOVAGOLD on the date the statements are made.

NOVAGOLD assumes no obligation to update the forward-looking

statements of beliefs, opinions, projections, or other factors,

should they change, except as required by law.

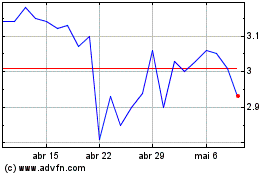

Novagold Resources (AMEX:NG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Novagold Resources (AMEX:NG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024