(TSX: GDV, GDV.PR.A) Global Dividend Growth Split

Corp. (the “Fund”) is pleased to announce it has renewed its

at-the-market equity program (“ATM Program”) so that the Fund can

issue class A and preferred shares (the “Class A Shares” and

“Preferred Shares”, respectively) to the public from time to time,

at the Fund’s discretion. This ATM Program replaces the prior

program established in April 2023 that has terminated. Any Class A

Shares or Preferred Shares sold under the ATM Program will be sold

through the Toronto Stock Exchange (the “TSX”) or any other

marketplace in Canada on which the Class A Shares and Preferred

Shares are listed, quoted or otherwise traded at the prevailing

market price at the time of sale. Sales of Class A Shares and

Preferred Shares through the ATM Program will be made pursuant to

the terms of an equity distribution agreement dated November 14,

2024 (the “Equity Distribution Agreement”) with RBC Capital Markets

Inc. (the “Agent”).

Sales of Class A Shares and Preferred Shares

will be made by way of “at-the-market distributions” as defined in

National Instrument 44-102 Shelf Distributions on the TSX or on any

marketplace for the Class A Shares and Preferred Shares in Canada.

Since the Class A Shares and Preferred Shares will be distributed

at the prevailing market prices at the time of the sale, prices may

vary among purchasers during the period of distribution. The ATM

Program is being offered pursuant to a prospectus supplement dated

November 14, 2024 to the Fund’s short form base shelf prospectus

dated November 14, 2024. The maximum gross proceeds from the

issuance of the shares will be $100 million for each of the Class A

and Preferred Shares. Copies of the prospectus supplement and the

short form base shelf prospectus may be obtained from your

registered financial advisor or from representatives of the Agent

and are available on SEDAR+ at www.sedarplus.ca.

The volume and timing of distributions under the

ATM Program, if any, will be determined at the Fund’s sole

discretion. The ATM Program will be effective until December 14,

2026, unless terminated prior to such date by the Fund. The Fund

intends to use the proceeds from the ATM Program in accordance with

the investment objectives and investment strategies of the Fund,

subject to the investment restrictions of the Fund.

The Company invests in a diversified portfolio

(the “Portfolio”) of equity securities of large capitalization

global dividend growth companies selected by Brompton Funds Limited

(the “Manager”), the manager of the Company. In order to qualify

for inclusion in the Portfolio, at the time of investment and at

the time of each periodic reconstitution and/or rebalancing of the

Portfolio, each global dividend growth company included in the

Portfolio must (i) have a market capitalization of at least $10

billion, and (ii) have a history of dividend growth or, in the

Manager’s view, have high potential for future dividend growth.

The investment objectives for the Class A Shares

are to provide holders with regular monthly cash distributions and

to provide the opportunity for capital appreciation through

exposure to the Portfolio.

The investment objectives for the Preferred

Shares are to provide holders with fixed cumulative preferential

quarterly cash distributions, currently in the amount of $0.125 per

Preferred Share, and to return the original issue price to holders

of Preferred Shares on June 30, 2026.

Since inception, the Class A Shares have

delivered a 13.1% per annum total return based on net asset value,

outperforming the MSCI World High Dividend Yield Total Return Index

by 5.9% per annum and the MSCI World Total Return Index by 2.1% per

annum.(1) The Preferred Shares have returned 5.1% per annum since

inception, outperforming the S&P/TSX Preferred Share Total

Return Index by 1.7% per annum.(1)

About Brompton Funds

Founded in 2000, Brompton is an experienced

investment fund manager with income focused investment solutions

including exchange-traded funds (ETFs) and other TSX traded

investment funds. For further information, please contact your

investment advisor, call Brompton’s investor relations line at

416-642-6000 (toll-free at 1-866-642-6001), email

info@bromptongroup.com or visit our website at

www.bromptongroup.com.

(1) See Performance table below.

|

Global Dividend Growth Split Corp.Compound Annual

Returns to October 31, 2024 |

1-Yr |

3-Yr |

5-Yr |

Since Inception |

|

Class A Shares (TSX: GDV) |

75.8% |

11.3% |

13.7% |

13.1% |

| MSCI World High Dividend Yield

Total Return Index |

23.6% |

6.5% |

7.0% |

7.2% |

| MSCI

World Total Return Index |

34.2% |

6.9% |

12.6% |

11.0% |

|

Preferred Shares (TSX: GDV.PR.A) |

5.1% |

5.1% |

5.1% |

5.1% |

| S&P/TSX Preferred Share

Total Return Index |

31.1% |

1.0% |

6.2% |

3.4% |

|

|

|

|

|

|

Returns are for the periods ended October 31,

2024, and are unaudited. Inception date June 15, 2018. The table

shows the compound return on a Class A Share and Preferred Share

for each period indicated compared with the MSCI World Total Return

Index (“MSCI Index”), the MSCI World High Dividend Yield Total

Return Index (“High Dividend Index”) and the S&P/ TSX Preferred

Share Total Return Index (“Preferred Share Index”) (together the

“Indices”). The MSCI Index captures large and mid‑cap

representation across 23 developed markets countries and covers

approximately 85% of the free float‑adjusted market capitalization

in each country. The High Dividend Index targets companies from the

MSCI Index (excluding Real Estate Investment Trusts) with high

dividend income and quality characteristics and includes companies

that have higher than average dividend yields that are expected to

be both sustainable and persistent. The Preferred Share Index

tracks the performance, on a market weight basis and a total return

basis, of a broad index of preferred shares trading on the TSX that

met the criteria relating to size, liquidity and issuer rating. The

Fund is actively managed; therefore, its performance is not

expected to mirror that of the Indices, which have more diversified

portfolios and include a substantially larger number of companies.

The Indices’ performance is calculated without the deduction of

management fees, fund expenses and trading commissions whereas the

performance of the Fund is calculated after deducting such fees and

expenses. Additionally, the performance of the Class A Shares is

impacted by the leverage provided by the Preferred Shares.

The performance information shown is based on

the net asset value per Class A Share and the redemption price per

Preferred Share and assumes that cash distributions made by the

Fund during the periods shown were reinvested at the net asset

value per Class A Share or redemption price per Preferred Share in

additional Class A Shares or Preferred Shares of the

Fund. Past performance does not necessarily indicate

how the Fund will perform in the future.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the Fund on the TSX or

other alternative Canadian trading system (an “exchange”). If the

shares are purchased or sold on an exchange, investors may pay more

than the current net asset value when buying shares of the Fund and

may receive less than the current net asset value when selling

them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

fund. You can find more detailed information about the Fund in its

public filings available at www.sedarplus.ca. The indicated rates

of return are the historical annual compounded total returns

including changes in share value and reinvestment of all

distributions and does not take into account sales, redemption,

distribution or optional charges or income tax payable by any

securityholder that would have reduced returns. Investment funds

are not guaranteed, their values change frequently and past

performance may not be repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the Fund, to the future outlook of

the Fund and anticipated events or results and may include

statements regarding the future financial performance of the Fund.

In some cases, forward-looking information can be identified by

terms such as “may”, “will”, “should”, “expect”, “plan”,

“anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof and we assume no

obligation to update or revise them to reflect new events or

circumstances.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or any

applicable exemption from the registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy securities nor will there be any sale of such

securities in any state in which such offer, solicitation or sale

would be unlawful.

Certain information contained herein (the

“Information”) is sourced from/copyright of MSCI Inc., MSCI ESG

Research LLC, or their affiliates (“MSCI”), or information

providers (together the “MSCI Parties”) and may have been used to

calculate scores, signals, or other indicators. The Information is

for internal use only and may not be reproduced or disseminated in

whole or part without prior written permission. The Information may

not be used for, nor does it constitute, an offer to buy or sell,

or a promotion or recommendation of, any security, financial

instrument or product, trading strategy, or index, nor should it be

taken as an indication or guarantee of any future performance. Some

funds may be based on or linked to MSCI indexes, and MSCI may be

compensated based on the fund’s assets under management or other

measures. MSCI has established an information barrier between index

research and certain Information. None of the Information in and of

itself can be used to determine which securities to buy or sell or

when to buy or sell them. The Information is provided “as is” and

the user assumes the entire risk of any use it may make or permit

to be made of the Information. No MSCI Party warrants or guarantees

the originality, accuracy and/or completeness of the Information

and each expressly disclaims all express or implied warranties. No

MSCI Party shall have any liability for any errors or omissions in

connection with any Information herein, or any liability for any

direct, indirect, special, punitive, consequential or any other

damages (including lost profits) even if notified of the

possibility of such damages.

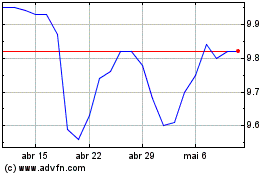

Global Dividend Growth S... (TSX:GDV)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Global Dividend Growth S... (TSX:GDV)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024