Barnwell Industries, Inc. (NYSE American: BRN) (“Barnwell” or the

“Company”) today announced that it has informed Ned Sherwood, a

shareholder who recently submitted a control slate of five nominees

comprising friends and affiliates, that his nomination notice is

defective and insufficient. Sherwood’s nomination notice fails to

include material information required by the Company’s bylaws, and

in light of these material deficiencies and omissions required both

by the bylaws and federal securities regulations, the Executive

Committee of the Barnwell Board of Directors is strongly inclined

to reject the nomination notice as defective and insufficient and

to disqualify Sherwood’s nominees.

In light of the inherent conflicts of interest

of Sherwood’s candidates, one of who is a current Board member, the

Board has formed an Executive Committee comprising independent Vice

Chairman, Kenneth Grossman, independent director Joshua Horowitz

and Executive Chairman, Alexander Kinzler, to protect the interests

of all other shareholders.

The Executive Committee has requested that a

Special Committee consisting of independent directors Grossman and

Horowitz investigate, among other things, the facts and

circumstances of the relationship between Sherwood and his board

nominee, Ben Pierson, who has privately purchased shares of

Barnwell while also currently serving as the Chief Investment

Officer of Sherwood’s family office, to determine whether a

distribution under the Company’s Shareholder Rights Plan has been

triggered.

Sherwood is Nominating Himself, His

Friends and His Business Associates to Steal

Control of the Company

Notwithstanding the obvious conflicts, the Board

remains open to considering new candidates and intends to vet the

individuals proposed by Sherwood through its usual governance

process. However, the Executive Committee cautions shareholders

that a preliminary review shows clearly that two of the four

nominees other than Sherwood cannot be expected to exercise

judgement independent of Sherwood, and three of Sherwood’s five

nominees have no public company Board experience.

- Ben Pierson has been employed by the Sherwood Family Office as

its Chief Investment Officer since 2021.

- Doug Woodrum has been a Director at Barnwell since 2020 as

Sherwood’s designee having joined the Board following an earlier

proxy contest and then through a prior settlement with the Company.

Woodrum has been the mouthpiece for all of Sherwood’s misguided

policy proposals, including the sale of assets at fire sale prices

and various attempts at co-opting day-to-day control, which have

only resulted in damaging management morale and creating distrust

of Sherwood’s motives, as well as incurring significant costs for

the Company to address these matters.

- Woodrum has been reprimanded on multiple occasions for leaking

confidential board matters to Sherwood. Woodrum has also attempted

to end-run the Board of Directors by directly interfering with

management. Sherwood has stated many times he would elevate Woodrum

to CEO or CFO, but no member of management or director not

affiliated with Sherwood has endorsed or supports Woodrum as

qualified for either position.

The Company further notes that Sherwood’s

nomination of a control slate continues his long history of

disrupting the Company’s governance processes and interfering with

the Company’s operations, while creating significant expense to the

Company. Sherwood’s nomination of himself, his friends and business

associates, without any credible plan for the Company and without

paying a premium to shareholders for control, flies directly in the

face of shareholder interests.

Sherwood and His Director Appointees Have

Hid Investments and Acted to Intentionally

Undermine Management and the Board

- Sherwood made a significant investment in a Canadian

Oil and Gas venture founded and operated by one of his former

director designees, which investment was only belatedly

and incompletely disclosed. The Executive Committee believes this

arrangement was undertaken as a quid pro quo so that Sherwood’s

nominee would execute on Sherwood’s self-serving agenda.

- From 2021-2022, Sherwood and Woodrum offered a then-new

member of the Board, Colin O’Farrell, the Company’s CEO position.

Sherwood and Woodrum did so without consulting the Board and

seemingly to co-opt O’Farrell’s independence. This conduct

was in breach of a then-valid standstill agreement, resulted in a

costly investigation, severely damaged the morale of the

Canadian-based management team, and resulted in O’Farrell’s

resignation from the Board only seven months after his

appointment.

- In April 2024, without prior Board discussion or

direction, Sherwood and his director appointee Woodrum demanded

that management immediately begin a search for a Calgary-based CFO

and that Woodrum would help lead the search.

- Sherwood continues to interfere with the Company’s

executive leadership transition. Ten months ago, Craig

Hopkins succeeded Kinzler as CEO of the Company with the support of

Sherwood’s nominees and as part of an overall succession plan for

the retirement of the Company’s prior senior management and expense

reduction efforts. Both Kinzler and Russell Gifford, the Company’s

longtime CFO, have expressed their desire to retire from day-to-day

operations of the Company by the end of the fiscal year and have

indicated their willingness to support CEO Craig Hopkins during the

transition to the extent desired by him and the Board. Multiple

directors supported by Sherwood, including former director Laurance

Narbut, have expressed the belief that the decades of experience

and knowledge held by Kinzler and Gifford will enable the Company

to undertake a smooth transition and maintain its excellent track

record of accounting and legal compliance.

Despite Repeated Requests, Sherwood Has

Failed to Propose a Different Plan or Business

Strategy

Sherwood has NO PLAN for Barnwell Other

than to Take Over the Company Without Paying a

Control Premium

The Company has repeatedly asked Sherwood to

specify what Company plans and policies he opposes or would change.

The only response has been incessant demands “to shut down Hawaii,”

which lacks any semblance of thoughtful consideration. It has no

backing from a single budget, spreadsheet or alternative strategy

that would adequately support the back-office functions of a

publicly listed company. Barnwell can only conclude that Sherwood’s

current nomination notice is merely an attempt to take full control

of a company where he holds a 30% stake and no articulated plan to

change any personnel, policies or business practices. Sherwood and

his designees on the Board have been engaged in a steady stream of

actions interfering with management and compromising Board

confidentiality and function, all in pursuit of full control of the

Company and often in violation of the standstill agreement that the

Company and Sherwood entered into in 2023.

Sherwood has accused the Company of excessive

expenditures for lawyers and other professionals when the vast

majority of these expenditures were necessitated by the abusive,

improper and often illegal actions of Sherwood and his designees on

the Board. Sherwood’s group recently served the Company with a

books and records request, which will require significant legal

expense to address, ironically asking for shareholder records when

Sherwood’s own group has played fast and loose with their own

Section 16 and Section 13 SEC reporting obligations.

The Barnwell Executive Committee

Comprises Majority Independent and Highly

Experienced Directors Acting on Behalf of All

Shareholders

The current Board was expressly approved by

Sherwood under a 2023 settlement whereby the Company and Sherwood

each designated two directors and a fifth director, Joshua

Horowitz, was selected as a compromise board member who was vetted

by Sherwood and expressly endorsed by both parties to the

settlement agreement.

The current Board is overseeing the transition

out of the Company’s water well drilling activities and is

currently completing its final well project. The water well

subsidiary recently sold one of its rigs for approximately $585,000

and will shut down its operations and sell its remaining assets in

the near term. This is part of a larger plan to transition out of

the Company’s Hawaii main office and move those executives to

transitional roles, to streamline the Company’s accounting

operations and further reduce general and administrative expenses

in order to increase funds available for investment.

The Company’s Twining oil & gas property in

Alberta continues to be the engine for the Company’s future growth.

We are pleased that our newest development well is online and

producing as expected. There are approximately 50 additional wells

that can be drilled, which would enable the Company to grow its

revenues and results organically, as a major portion of the costs

of the operations are fixed.

Forward-Looking Statements

The information contained in this press release

contains “forward-looking statements,” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. A forward-looking

statement is one which is based on current expectations of future

events or conditions and does not relate to historical or current

facts. These statements include various estimates, forecasts,

projections of Barnwell’s future performance, statements of

Barnwell’s plans and objectives, and other similar statements.

Forward-looking statements include phrases such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “predicts,”

“estimates,” “assumes,” “projects,” “may,” “will,” “will be,”

“should,” or similar expressions. Although Barnwell believes that

its current expectations are based on reasonable assumptions, it

cannot assure that the expectations contained in such

forward-looking statements will be achieved. Forward-looking

statements involve risks, uncertainties and assumptions which could

cause actual results to differ materially from those contained in

such statements. The risks, uncertainties and other factors that

might cause actual results to differ materially from Barnwell’s

expectations are set forth in the “Forward-Looking Statements,”

“Risk Factors” and other sections of Barnwell’s annual report on

Form 10-K for the last fiscal year and Barnwell’s other filings

with the Securities and Exchange Commission. Investors should not

place undue reliance on the forward-looking statements contained in

this press release, as they speak only as of the date of this press

release, and Barnwell expressly disclaims any obligation or

undertaking to publicly release any updates or revisions to any

forward-looking statements contained herein.

Important Additional Information and

Where to Find It

Barnwell Industries, Inc. (the “Company”) plans

to file proxy materials with the U.S. Securities and Exchange

Commission (the “SEC”) in connection with the solicitation of

proxies for the Company’s 2025 annual meeting of stockholders (the

“2025 Annual Meeting”). Prior to the 2025 Annual Meeting, the

Company will file a definitive proxy statement (the “Proxy

Statement”) together with a WHITE proxy card. STOCKHOLDERS ARE

URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE

COMPANY WILL FILE WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Stockholders will be able to obtain, free of charge,

copies of the Proxy Statement, any amendments or supplements

thereto and any other documents (including the WHITE proxy card)

when filed by the Company with the SEC in connection with the 2025

Annual Meeting at the SEC’s website (http://www.sec.gov) or at the

Company’s website at https://ir.brninc.com/ or by contacting

Alexander Kinzler, Secretary and General Counsel of the Company, by

phone at (808) 531-8400, by email at akinzler@brninc.com or by mail

at Barnwell Industries, Inc., 1100 Alakea Street, Suite 500,

Honolulu, Hawaii 96813.

Certain Information Regarding

Participants

The Company, its directors and certain of its

executive officers and other employees may be deemed to be

“participants” (as defined in Section 14(a) of the Securities

Exchange Act of 1934, as amended) in the solicitation of proxies

from stockholders in connection with the 2025 Annual Meeting.

Additional information regarding the identity of these potential

participants and their direct or indirect interests, by security

holdings or otherwise, will be set forth in the Proxy Statement and

other materials to be filed with the SEC in connection with the

2025 Annual Meeting. Information relating to the foregoing can also

be found in the Company’s definitive proxy statement for its 2024

annual meeting of stockholders, filed with the SEC on April 2,

2024. To the extent holdings of such participants in the Company’s

securities have changed since the amounts described in the Proxy

Statement, such changes have been reflected on Statements of Change

in Ownership on Form 3 and Form 4 filed with the SEC:

Form 3, filed by Craig Hopkins, with the filings of the

Company on May 16, 2024; Form 4, filed by Craig Hopkins,

with the filings of the Company on May 20, 2024, August 29, 2024,

January 13, 2025 and January 17, 2025; Form 4, filed

by Joshua Horowitz, with the filings of the Company on

August 23, 2024 and October 28, 2024; Form 4, filed

by Kenneth Grossman, with the filings of the Company on

October 28, 2024; and Form 4, filed by Douglas Woodrum,

with the filings of the Company on October 28, 2024. These

filings can be found at the SEC’s website at www.sec.gov. More

detailed and updated information regarding the identity of

potential participants, and their direct or indirect interests (by

security holdings or otherwise), will be set forth in the proxy

statement and other materials to be filed with the SEC. These

documents can be obtained free of charge from the sources indicated

above.

|

CONTACT: |

Kenneth S. Grossman |

| |

Vice Chairman of the Board of

Directors |

| |

Email:

kensgrossman@gmail.com |

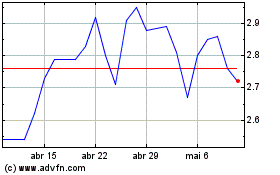

Barnwell Industries (AMEX:BRN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

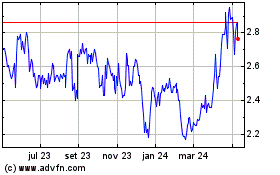

Barnwell Industries (AMEX:BRN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025