Rumble Shares Up 7% in Premarket After 27% Q2 Revenue Surge; More on Earnings

13 Agosto 2024 - 6:39AM

IH Market News

Rumble Inc (NASDAQ:RUM) – Rumble, a video and

digital content platform, reported a 27% sequential revenue growth,

reaching $22.5 million in the second quarter of 2024. Monthly

active users increased to 53 million, with ARPU rising 19% to

$0.37. The company set new audience records, launched products, and

expanded to Xbox, maintaining a strong cash position of $154.2

million. Shares rose 7% in pre-market trading.

Terawulf (NASDAQ:WULF) – Terawulf, a

sustainable Bitcoin miner, reported $35.6 million in revenue for

the second quarter of 2024, a 130.2% year-over-year increase. Gross

profit (excluding depreciation) increased by 109.4% to $21.7

million. Adjusted EBITDA rose 156.4% to $19.5 million, and

self-mining capacity grew by 80%. The company eliminated its debt

ahead of maturity despite a 21.4% drop in self-mined Bitcoin and

rising energy costs. Shares rose 3.6% in pre-market trading.

Home Depot (NYSE:HD) – Home Depot’s

second-quarter earnings are expected to reflect ongoing weakness in

the home improvement market. The company faces challenges due to

high interest rates and elevated home prices, which slow down

renovation projects. Home Depot is expected to report sales of

about $42.6 billion in the second quarter, a nearly 1% drop from

last year. Same-store sales may fall 2.2%, and adjusted earnings

are expected to be $4.53 per share, down from $4.65 last year.

Shares rose 0.3% in pre-market trading.

Freightcar America (NASDAQ:RAIL) – Freightcar

America, a railcar manufacturer, reported a 66% increase in

revenue, reaching $147.4 million in the second quarter of 2024,

with net income of $8.2 million. Adjusted EBITDA rose to $12.1

million. The company secured about 3,000 new orders and revised its

2024 projections, forecasting revenue between $560-$600 million and

adjusted EBITDA of $35-$39 million.

Arq Inc (NASDAQ:ARQ) – Arq, a renewable energy

and carbon capture company, reported $25.4 million in revenue in

the second quarter of 2024, a 24% year-over-year increase driven by

higher prices and a favorable product mix. Gross margin improved to

32%, and net loss was reduced to $2 million. The company also

reported positive adjusted EBITDA of $0.5 million, reflecting

significant operational improvements.

Adecoagro (NYSE:AGRO) – Adecoagro, a South

American agriculture, food, and renewable energy company, reported

a profit of $9.5 million in the second quarter of 2024, equivalent

to $0.09 per share. After adjustments, profit was $1.03 per share.

Total revenue amounted to $411.4 million.

DoubleDown Interactive Company (NASDAQ:DDI) –

DoubleDown Interactive, a developer of social and mobile games,

reported a 17% annual increase in revenue, totaling $88.2 million

in the second quarter of 2024, driven by contributions from

SuprNation. Net income rose to $33.3 million, or $0.67 per ADS,

while adjusted EBITDA grew 34% to $37.0 million. The company ended

the quarter with a solid cash position of $303 million.

Sun Life Financial (NYSE:SLF) – Sun Life

Financial, a global insurance and financial services company,

reported net income of $646 million in the second quarter, a 2%

decline due to a $138 million restructuring expense. However,

adjusted net income rose to $1 billion, driven by growth in Canada

and Asia. The company managed $1.47 trillion in assets, a 7%

year-over-year increase. Sun Life’s board declared a dividend of

$0.81 per common share, payable on September 27, 2024, to

shareholders of record at the close of business on August 28, 2024.

Dividends were also declared for several series of preferred

shares, with specific amounts per series, all payable on the same

date.

DHT Holdings (NYSE:DHT) – DHT Holdings, a

shipping company specializing in the transport of crude oil and

chemicals, reported $150.1 million in revenue for the second

quarter of 2024, slightly down from $152 million in the same period

in 2023. Net income was $44.5 million, or $0.27 per share, impacted

by a drop in tanker freight rates. The company declared a dividend

of $0.27 per share.

Perspective Therapeutics (AMEX:CATX) –

Perspective Therapeutics, a biotechnology research and development

company, reported $0.5 million in revenue in the second quarter of

2024, with a net loss of $11.7 million, or $0.18 per share. The

company made progress in clinical trials and is on track to bring

pre-IND assets to the clinic in 12-18 months, with a cash balance

of $293 million, sufficient through 2026.

Crescent Capital BDC (NASDAQ:CCAP) – Crescent

Capital BDC, a business development company, reported net

investment income of $0.59 per share in the second quarter of 2024.

Net asset value per share increased to $20.30, slightly above the

$20.28 reported in March 2024. The company declared a regular

dividend of $0.42 per share and a supplemental dividend of $0.09

per share.

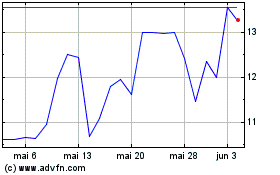

DoubleDown Interactive (NASDAQ:DDI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

DoubleDown Interactive (NASDAQ:DDI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024