Correlation between cryptocurrencies and the S&P 500 increases

The correlation between cryptocurrencies and the S&P 500

(SPI:SP500) reached 0.67, a level unseen since 2022. This increase

reflects the impact of macroeconomic factors on cryptocurrency

markets, such as US interest rates and monetary policies. Analysts

expect this correlation to persist, especially with a soft landing

anticipated for the US economy, benefiting risk assets, including

cryptocurrencies. Optimism also grows with the potential for more

favorable crypto policies after the US presidential elections.

Riot Platforms ends acquisition attempt of Bitfarms and negotiates

new governance

Riot Platforms’ (NASDAQ:RIOT) attempt to acquire Bitfarms

(NASDAQ:BITF) concluded with a mutual agreement. Andres

Finkielsztain left Bitfarms’ board, replaced by Amy Freedman. Riot

withdrew its amended requisition and agreed not to increase its

stake above 20% without approval, provided it holds 15% or more of

Bitfarms’ outstanding common shares. Both companies agreed to

cooperate until 2026. The Bitfarms shareholder meeting, which will

decide on a new director and a rights plan, will take place by

November 20. Riot maintains a 19.9% stake and will review its

investment later.

BlackRock modifies Bitcoin ETF after investor pressure

BlackRock (NYSE:BLK), the world’s largest asset manager,

proposed an amendment to its iShares Bitcoin Trust ETF

(NASDAQ:IBIT) in response to concerns about Coinbase Custody

(NASDAQ:COIN). The new rule mandates that ETF withdrawals be

processed on-chain by Coinbase Custody within 12 hours. This

follows criticism about custody transparency, with investors

questioning if Coinbase was manipulating the Bitcoin market. The

company assured that all transactions are settled on-chain but

prefers to keep institutional transaction addresses

confidential.

Bitcoin ETFs attract $92 million inflows while Ethereum ETFs remain

mostly inactive

On September 20, Bitcoin ETFs recorded $92 million in inflows,

led by Fidelity’s (AMEX:FBTC) with $26.1 million, followed by Ark’s

(AMEX:ARKB) with $22 million. Bitwise’s (AMEX:BITB) added $15.1

million. Ethereum ETFs, meanwhile, saw little activity, with only

$2.9 million in inflows, all concentrated in Grayscale’s mini ETF

(AMEX:ETH). The disinterest in Ethereum ETFs highlights

institutional preference for Bitcoin.

Last week, crypto funds managed by companies like BlackRock and

Fidelity added $321 million after two weeks of outflows. According

to CoinShares, the FOMC’s dovish stance and a 50 basis point

interest rate cut boosted inflows. Total assets under management

rose 9%, reaching $9.5 billion.

Bitcoin and Ether rise with liquidations and US interest rate cut

boosting the market

The cryptocurrency market started the week with slight gains. In

the last 24 hours, Bitcoin (COIN:BTCUSD) increased by 0.3%,

surpassing $63,200, while Ether (COIN:ETHUSD) rose 3%, reaching

$2,665. Over the last seven days, BTC rose about 9.7%, while ETH

increased by 17%. According to CoinGlass, $64.23 million in short

positions and $54.42 million in long positions were liquidated in

the past 12 hours.

The 50 basis point interest rate cut in the US is influencing

trading, while a report by 10x Research highlights that Bitcoin

could see a significant rally by the end of 2024. The report

identifies catalysts including a possible $5 to $8 billion payment

from FTX and seasonal influences. Liquidity and macroeconomic

conditions could support the bullish momentum through 2025. Despite

the optimism, the history of up to 70% drops in previous cycles

warns of caution.

Core Scientific boosts stock with mega AI hosting deal

Core Scientific (NASDAQ:CORZ) is becoming a major player in AI

hosting after signing a 12-year contract with CoreWeave. Brokerage

Canaccord initiated coverage of the stock with a buy rating and a

$16 price target, driven by the transformative deal. Canaccord

highlighted AI revenue growth, better cash flow, and future

acquisitions. The company also maintains 230 MW of capacity for

Bitcoin mining, in addition to the 500 MW redirected for AI. Core

Scientific’s stock rose 4% during Monday’s trading.

Chinese miners still control over 55% of the Bitcoin network

Despite China’s cryptocurrency ban since 2021, Chinese mining

pools still control over 55% of the Bitcoin network, according to

Ki Young Ju, CEO of CryptoQuant. However, this dominance is waning,

with US pools managing about 40% of the network, focusing on

institutional miners. This shift reflects a gradual transition of

mining operations out of China, especially to the United States,

where activity continues to grow.

Sygnum obtains cryptocurrency license in Liechtenstein for EU

expansion

Swiss cryptocurrency bank Sygnum secured a cryptocurrency

license in Liechtenstein, allowing it to offer regulated digital

services, such as brokerage and custody. The license positions the

company to operate across the European Union by 2025, leveraging

the MiCA regulation, which standardizes crypto asset rules in the

region. Additionally, Sygnum plans to expand into Hong Kong and

strengthen its presence in markets like Luxembourg and Abu Dhabi,

aligning with its growing profitability and key new

partnerships.

Hong Kong advances to second phase of e-HKD with a focus on

tokenized deposits

The Hong Kong Monetary Authority launched the second phase of

the e-HKD pilot, exploring advanced uses such as tokenized deposits

and digital asset settlement. With participation from 11 companies,

the HKMA aims to integrate digital currencies into real-world

commercial scenarios. The initiative, now renamed Project e-HKD+,

seeks to expand the accessibility of e-HKD for individuals and

businesses, further developing the necessary technology and legal

framework.

Bankroll Network suffers hacker attack, losing $230,000

A hacker exploited the DeFi protocol Bankroll Network on

September 22, stealing about $230,000, according to Cointelegraph

Magazine. The attack involved several BNB (COIN:BNBUSD)

self-transfers, highlighted by the security platform TenArmor. The

transactions showed discrepancies, suggesting the hacker exploited

a vulnerability allowing them to withdraw more than deposited,

likely using flash loans. Bankroll Network’s team has yet to

confirm if this was an exploit, and the case is still under

investigation.

Class action lawsuit alleges unregistered securities sale on

OpenSea

Anthony Shnayderman and Itai Bronshtein, two OpenSea users, have

sued the platform, alleging it sold NFTs as unregistered

securities, violating US securities laws. They claim the NFTs

purchased, including those from the Bored Ape Yacht Club, lost

value due to their alleged illegality. The lawsuit also references

an SEC notice to OpenSea and highlights the sale of unregistered

securities, citing previous cases like Stoner Cats 2 and Impact

Theory.

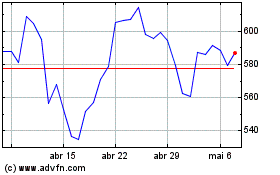

Binance Coin (COIN:BNBUSD)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

Binance Coin (COIN:BNBUSD)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024