Tesla (NASDAQ:TSLA) – Tesla’s sales in China

increased by 19.2% in September, totaling over 72,000 electric

vehicles sold, its best performance of the year. Deliveries of

locally produced Model 3 and Model Y rose by 1.9% from the previous

month. In Q3, Tesla recorded a 12% growth in sales of Chinese-made

electric vehicles. BYD also had a strong month, with sales rising

45.6%. Tesla’s robotaxi, featuring two front seats and falcon-wing

doors, is expected to be unveiled at today’s event, where CEO Elon

Musk will also discuss the implementation of Full Self-Driving

software in the Semi truck. The release schedule for the vehicle,

dubbed Cybercab, is not yet defined. Tesla shares rose 1.1%

pre-market after closing down 1.4% on Wednesday.

GSK plc (NYSE:GSK) – GSK agreed to pay up to

$2.2 billion to settle 93% of U.S. lawsuits related to Zantac,

alleging the drug caused cancer. The settlement, announced

Wednesday, was lower than JPMorgan’s $3.5 billion projection.

Shares rose 0.3% pre-market after closing up 5.8% on Wednesday.

10x Genomics (NASDAQ:TXG) – 10x Genomics

forecasted Q3 revenue of $151.7 million, missing expectations of

$162.2 million. CEO Serge Saxonov stated that changes in commercial

and organizational processes disrupted client relationships more

than expected. Shares dropped 22.1% pre-market after closing up

3.5% on Wednesday.

Pfizer (NYSE:PFE) – Former Pfizer CEO Ian Read

and former CFO Frank D’Amelio have declined to support activist

investor Starboard Value’s push for changes at Pfizer. Both

expressed confidence in the current leadership, including CEO

Albert Bourla, and believe the company will deliver shareholder

value over time. Pfizer shares fell 1.7% pre-market after closing

up 3.4% on Wednesday.

Eli Lilly (NYSE:LLY) – Eli Lilly has sent

cease-and-desist letters to telehealth companies, compounding

pharmacies, and medspas to stop selling knockoffs of its weight

loss drugs Mounjaro and Zepbound. According to Bloomberg, these

copies were allowed during shortages, but the FDA’s recent ruling

has revoked that permission.

Viking Therapeutics (NASDAQ:VKTX) – Viking

Therapeutics announced promising results from an early trial for

its treatment of X-linked adrenoleukodystrophy (X-ALD). The new

drug, VK0214, significantly reduced levels of very long-chain fatty

acids, a disease marker. The treatment was well-tolerated, and the

company plans to continue development. Shares rose 0.7% pre-market

after closing down 6.1% on Wednesday.

Cigna (NYSE:CI) – Cigna filed a motion on

Wednesday to disqualify FTC Chair Lina Khan and other

commissioners, alleging bias in a case against the company. Cigna

claims Khan made inaccurate judgments about pharmacy benefit

managers (PBMs), which are under investigation for practices that

increase drug prices.

Nvidia (NASDAQ:NVDA) – Nvidia CEO Jensen Huang

stated that AI’s future will include services capable of

“reasoning,” but that computing costs must decrease for this to

happen. He predicted tools that will answer complex queries, and

Nvidia plans to increase chip performance annually to enable these

advancements. Impax Asset Management, led by Ian Simm, took

advantage of Nvidia’s stock decline to increase its stake,

believing that Nvidia’s current valuation above $3.2 trillion

remains low given the growing demand for AI chips. Nvidia shares

dropped 0.7% pre-market after closing down 0.2% on Wednesday.

Apple (NASDAQ:AAPL) – Dan Riccio, Apple’s

hardware veteran, is retiring after 26 years, during which he

oversaw innovations such as the Vision Pro headset. Riccio will

hand over leadership of the Vision Products Group to Mike Rockwell

and report to hardware chief John Ternus. Riccio emphasized the

importance of agility and a willingness to take risks in Apple’s

leadership. Apple shares fell 0.3% pre-market after closing up 1.7%

on Wednesday.

Meta Platforms (NASDAQ:META) – Meta is

expanding its AI chatbot, Meta AI, to 21 new locations, including

the U.K. and Brazil. The chatbot offers conversations and

recommendations across Facebook, Instagram, and WhatsApp, reaching

nearly 500 million monthly users. New languages, including Tagalog,

Arabic, and Thai, will also be added. Meta shares dropped 0.4%

pre-market after closing down 0.4% on Wednesday.

Alphabet (NASDAQ:GOOGL) – Two scientists from

Google DeepMind, Demis Hassabis and John Jumper, won the 2024 Nobel

Prize in Chemistry for their innovations in predicting protein

structures. They will share half the prize with David Baker from

the University of Washington, who created new proteins. The work by

Hassabis and Jumper is crucial for understanding diseases and

discovering new medicines. Alphabet shares fell 0.2% pre-market

after closing down 1.5% on Wednesday.

OpenAI – OpenAI reported that its AI models,

like ChatGPT, were used to create false content intended to

influence elections. In 2024, the company neutralized over 20

malicious attempts, including accounts generating articles about

the U.S. and Rwandan elections. OpenAI also revealed that a

suspected China-linked group, SweetSpecter, attempted a phishing

attack on its employees by posing as a ChatGPT user and sending

emails with malicious attachments. The attempt failed due to

OpenAI’s security measures.

Palantir Technologies (NYSE:PLTR) – Palantir

Technologies’ stock surged 150% in 2024, pushing the company close

to a $100 billion market capitalization. This rise makes Palantir

one of the world’s largest software companies, despite analysts’

divided opinions on its valuation. Palantir shares fell 0.4%

pre-market after closing up 4.1% on Wednesday.

Broadcom (NASDAQ:AVGO) – Broadcom shares hit a

new record close on Wednesday, rising 2.9% to $185.96. Shares fell

0.7% pre-market.

E2open Parent Holding (NYSE:ETWO) – E2open

lowered its revenue forecast for fiscal 2025, now estimating

between $607 million and $617 million, down from a previous range

of $630 million to $645 million, due to delays in closing large

deals.

Amazon (NASDAQ:AMZN) – Amazon announced that

Apple TV+, known for shows like Ted Lasso and The

Morning Show, will be available as a Prime Video channel in

the U.S. starting this month for $9.99 per month. Additionally,

Amazon developed the Vision Assisted Package Retrieval system to

improve delivery efficiency, using spotlights and cameras to

instantly read package labels on van roofs. The system will be

installed in 1,000 Rivian delivery vans next year. Amazon is also

investing more than $10 billion in Project Kuiper, aiming to create

a constellation of 3,236 satellites to expand global broadband

access. Although losses may initially rise, analysts at Evercore

ISI believe the long-term revenue opportunities could be

substantial. Amazon shares were flat pre-market after closing up

1.3% on Wednesday.

Walt Disney (NYSE:DIS) – Walt Disney World in

Florida will remain closed Thursday due to the approaching

Hurricane Milton, which may cause significant damage and prolonged

power outages. Other Orlando parks, including Universal Orlando and

SeaWorld, also announced closures. The disruptions could extend

through Sunday. Disney shares dropped 0.3% pre-market after closing

up 1.2% on Wednesday.

Marriott International (NASDAQ:MAR) – The U.S.

Federal Trade Commission required Marriott International to

implement an information security program to resolve charges of

multiple data breaches between 2014 and 2020, affecting 344 million

customers. Marriott also agreed to pay a $52 million fine and

provide customers with data opt-out options. Shares fell 0.9%

pre-market after closing up 2.1% on Wednesday.

Live Nation Entertainment (NYSE:LYV) – Live

Nation CEO Michael Rapino predicted that Oasis’ 2025 tour will be

the biggest of the year. However, he emphasized the need for ticket

market regulation, citing the use of bots for mass purchases and

price hikes in the secondary market. Rapino proposed that

authorities cap resale profits at 20%.

KinderCare Learning Companies (NYSE:KLC) –

KinderCare Learning Companies debuted on the NYSE with an

approximate $3.1 billion valuation, after its shares opened 12.5%

above the initial public offering price.

Unilever (NYSE:UL) – Unilever sold its Russian

subsidiary to local group Arnest, exiting the country following

Russia’s invasion of Ukraine. The sale includes factories in Russia

and Belarus and was valued at up to $411 million. Unilever shares

fell 0.5% pre-market after closing flat on Wednesday.

Etsy (NASDAQ:ETSY) – Etsy is exploring new

strategies to encourage its 95 million users to spend more by

leveraging AI and cloud technology. Retiring CFO Rachel Glaser

highlighted investments in tech and features like “gift mode” to

boost sales, despite recent declines.

Costco Wholesale (NASDAQ:COST) – Costco

reported a 9% sales increase in September, totaling $24.62 billion,

driven by a strong shopping week despite membership fee hikes.

Same-store sales grew 6.7%, and e-commerce sales jumped 22.9%.

Shares rose 2.1% on Wednesday.

AZZ Inc. (NYSE:AZZ) – AZZ reported adjusted

earnings of $1.37 per share for fiscal Q2, beating estimates by 5

cents. The company also raised its fiscal 2025 earnings

forecast.

ExxonMobil (NYSE:XOM) – A consortium led by

ExxonMobil will proceed with phase two of seismic research for gas

exploration on the island of Crete, Greece. The group collected

7,789 km of 2D seismic data, exceeding the necessary amount, and

will now gather 3D data over three years before deciding whether to

drill. Shares rose 0.2% pre-market.

Rio Tinto (NYSE:RIO) – Rio Tinto acquired

Arcadium Lithium for $6.7 billion to gain access to advanced direct

lithium extraction (DLE) technologies. DLE promises to transform

lithium production by extracting the metal in days instead of

months, using techniques similar to water filtration. With rising

demand for EV batteries, the DLE industry is expected to grow

exponentially in the coming years. Rio Tinto shares fell 0.7%

pre-market after closing down 0.5% on Wednesday.

Stellantis (NYSE:STLA) – Stellantis CEO Carlos

Tavares is planning a management overhaul following profit

warnings, inventory surpluses, and declining North American sales.

Tavares’ proposal may be presented at this week’s board meeting,

where his future at the company will also be discussed. Stellantis

shares fell 1.4% pre-market after closing up 1.8% on Wednesday.

Honda Motor (NYSE:HMC) – Honda is recalling 2

million vehicles in North America due to a steering issue that

could increase the risk of accidents. The recall covers 2022 to

2025 models, including the Civic and CR-V, following 10,328

complaints. The NHTSA has been investigating the issue since March

2023. Honda shares closed down 1.7% on Wednesday.

Boeing (NYSE:BA) – Boeing union negotiator Jon

Holden stated that striking workers are prepared to wait after wage

negotiations failed. He noted that Boeing made only small

improvements and that the union has a robust fund to support

members during the strike. S&P estimates the strike is costing

Boeing about $1 billion per month. Shares rose 0.3% pre-market

after closing down 3.4% on Wednesday.

Delta Air Lines (NYSE:DAL) – Delta Air Lines is

set to report earnings today. According to FactSet, earnings are

expected to be $1.52 per share, a 25% decline from last year,

partly due to a CrowdStrike-related incident that caused flight

cancellations. Sales are expected to reach $14.6 billion. Shares

fell 0.3% pre-market after closing up 0.7% on Wednesday.

Azul (NYSE:AZUL), Embraer

(NYSE:ERJ) – Azul’s $500 million debt-to-equity swap is positive

news for Embraer, alleviating concerns about the financial burden

on a key customer. Azul, which already operates 21 E2 jets, plans

to receive 15 to 18 new aircraft by 2025.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

announced that Chauncey McIntosh will become the new vice president

and general manager of the F-35 Lightning II Program starting

December 1, replacing Bridget Lauderdale, who is retiring after 38

years. McIntosh, with over 20 years of experience, will face

challenges like delays in the Technology Refresh 3 upgrade.

Berkshire Hathaway (NYSE:BRK.A) – Warren

Buffett’s Berkshire Hathaway raised $1.9 billion (281.8 billion

yen) through a yen-denominated bond issue, the largest in five

years. The funds will be used for general corporate purposes and

highlight Berkshire’s growing exposure to Japan, where it holds

significant stakes in the five largest trading houses.

BlackRock (NYSE:BX) – BlackRock is considering

acquiring HPS Investment Partners to strengthen its position in the

private credit market. The discussions come as HPS considers an

initial public offering, which could value the company at $10

billion. Other firms, including CVC Capital Partners, have also

expressed interest. BlackRock shares fell 0.5% pre-market after

closing down 0.7% on Wednesday.

UBS Group AG (NYSE:UBS) – UBS’s integration of

Credit Suisse’s clients and data into its platforms is progressing

as planned following a successful test, according to UBS’s head of

technology. The process involves migrating 1.3 million clients and

110 petabytes of data, making it the largest data migration in the

financial sector. UBS shares fell 0.8% pre-market after closing up

1.2% on Wednesday.

Toronto-Dominion Bank (NYSE:TD) – Canada’s TD

Bank will pay approximately $3 billion in fines as part of a

settlement with U.S. regulators over failures in anti-money

laundering monitoring related to drug cartels. The bank’s U.S. unit

will plead guilty, and an independent monitor will be appointed to

ensure compliance.

Stifel (NYSE:SF) – Stifel Nicolaus plans to

challenge an arbitration ruling that requires it to pay more than

$14 million over a structured note strategy. The firm considers the

compensation excessive, marking the first case resolved in Finra’s

forum, with 15 other claims against broker Chuck Roberts still

pending.

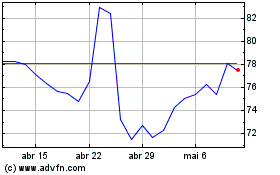

AZZ (NYSE:AZZ)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

AZZ (NYSE:AZZ)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024