U.S. index futures are mixed in Tuesday’s pre-market, following

record closes for the S&P 500 and Dow Jones on the previous

day. Focus is on major bank earnings, economic data on

manufacturing and consumption, and comments from Federal Reserve

members.

At 5:01 AM ET, Dow Jones futures rose by 69 points, or 0.16%.

S&P 500 futures lost 0.04%, and Nasdaq-100 futures fell by

0.16%. The 10-year Treasury yield stood at 4.073%.

In the commodities market, oil prices dropped after Israel’s

statement about targeting only Iranian military assets, easing

supply concerns. Uncertainty over China’s stimulus measures also

affected markets.

Citi Research revised its optimistic oil price forecast to $120

per barrel in Q4 2024 and Q1 2025, driven by the escalating

conflict in the Middle East. However, it maintained its base

forecast at $74 and $65 due to weak market fundamentals. In a

pessimistic scenario, it predicts OPEC+ will increase production in

December, reducing supply risks, potentially driving prices to $60

and $55, with a 20% chance.

OPEC revised its 2024 global oil demand growth forecast

downwards, now estimating an increase of 1.93 million barrels per

day (bpd), compared to a previous estimate of 2.03 million bpd.

China’s demand was revised from 650,000 bpd to 580,000 bpd. OPEC+

plans to increase production in December after delays caused by

falling oil prices.

West Texas Intermediate crude for November fell by 4.59% to

$70.44 per barrel, while Brent for December dropped by 4.43% to

$74.03 per barrel.

Iron ore prices dropped in Singapore as investors shifted focus

to increasing supply, with mining giants like BHP

(NYSE:BHP), Rio Tinto (NYSE:RIO), and

Vale (NYSE:VALE)reporting production updates.

Gold prices are up after a slight drop due to comments from a

Federal Reserve member suggesting a slower pace of interest rate

cuts. Demand for safe-haven assets has declined as concerns about

Middle Eastern conflicts eased. Gold (PM:XAUUSD) rose by 0.2% to

$2,653.77 per ounce.

On today’s U.S. economic agenda, the October Empire State

Manufacturing Survey will be released at 8:30 AM ET, with a median

forecast of 0.5, down from 11.5. Additionally, Federal Reserve

Governor Adriana Kugler will speak at 1:00 PM ET. San Francisco Fed

President Mary Daly and Atlanta Fed President Raphael Bostic will

also provide remarks throughout the day.

Asia-Pacific markets closed mixed. China’s CSI 300 fell by

2.66%, erasing Monday’s gains. Hong Kong’s Hang Seng dropped nearly

4% in the final hour of trading. In South Korea, the Kospi rose by

0.39%, while the Kosdaq gained 0.4%. Japan’s Nikkei 225 increased

by 0.77%, and the Topix rose by 0.64%. Australia’s S&P/ASX 200

added 0.79%.

China reported disappointing trade data for September, with

exports up 2.4% and imports rising 0.3%, both below expectations.

China may issue up to $846 billion (6 trillion yuan) in bonds over

three years to stimulate its economy, though the plan lacks

specifics. South Korea confirmed a trade surplus of $6.7 billion,

up from $3.7 billion in August.

In Singapore, new home sales surged in September, driven by

increased supply and lower U.S. interest rates. A total of 401

private units were sold, nearly double the August figure and the

highest since July.

In Australia, residential construction confidence is recovering

as new home sales stabilize and building approvals rise, according

to the Housing Industry Association. September sales remained

stable from August but increased by 8.6% over the last 12 months.

Consumer spending fell by 0.7% in September after a 1.6% rise in

August, driven by Father’s Day purchases.

In Japan, Tokyo Metro set its IPO price at

1,200 yen per share, the upper end of the expected range. The IPO

will raise 348.6 billion yen ($2.33 billion), making it Japan’s

largest in six years. The listing is scheduled for October 23 on

the Tokyo Stock Exchange.

In India, Hyundai Motor India raised $989.4 million from

institutional investors such as BlackRock

(NYSE:BLK) and Fidelity in its $3.3 billion IPO.

The offering included the sale of 17.5% of shares in the unit,

valued at up to $19 billion.

European markets are mixed, with the Stoxx 600 initially rising

before retreating. Travel stocks gained while oil and gas stocks

fell.

British workers saw smaller wage increases over the summer, with

average earnings rising by 4.9% through August, the lowest level in

two years. This reinforces expectations that the Bank of England

will cut interest rates by 25 basis points in November, as slower

wage growth eases inflationary pressures in the UK.

Among individual stocks, Workspace Group

(LSE:WKP) shares fell by 0.8% after comparable occupancy dropped by

0.7% in the second quarter due to an unusual number of large client

departures, despite strong demand for new leases. The company

signed 296 new contracts, but comparable rent fell by 1.4%.

However, rent per square foot rose by 1.6%.

Ericsson (TG:ERCB) boosted the telecom sector,

rising 9.1% after beating earnings expectations.

Reach PLC (LSE:RCH) gained 2.1% after reporting

a 2.5% drop in Q3 revenue but expressed confidence in meeting

annual expectations, forecasting digital growth in the final

quarter. Digital revenue rose by 2.5%, while print revenue declined

by 3.9%. The company maintained its adjusted operating profit

forecast of $127.6 million (£97.7 million).

Mitie Group (LSE:MTO) expects 13% revenue

growth in H1 2024, reaching $3.13 billion (£2.4 billion), driven by

new contracts and extensions. Total contract value increased by 45%

to £3.5 billion.

Bellway (LSE:BWY) is up 7.6% after maintaining

a positive outlook for the new fiscal year, despite pre-tax profit

falling to £226.1 million in 2024, compared to £532.6 million the

previous year.

Applied Nutrition plans to raise up to $287

million (£220 million) in its IPO, with shares priced between 136

and 160 pence. At the maximum price, the company would be valued at

£400 million.

Top U.S. stocks rose on Monday, with the Dow and S&P 500

reaching new record closes. The Dow added 0.5% to 43,065.22, the

Nasdaq gained 0.9%, and the S&P 500 increased by 0.8%.

Optimism was fueled by stable producer prices last Friday,

reinforcing an 86.1% chance of a 0.25% rate cut in November,

according to CME Group’s FedWatch. However, trading activity was

moderate due to Columbus Day.

Neel Kashkari, President of the Federal Reserve Bank of

Minneapolis, said modest rate cuts are likely as inflation

approaches the 2% target. He emphasized that future decisions will

be data-driven and, despite restrictive monetary policy, the labor

market remains robust.

Kashkari also stated that the growth of the private credit

market could reduce systemic risk in the U.S. financial system,

despite reluctance to increase bank capital requirements. He noted

that while the market has grown rapidly, these vehicles are less

leveraged and pose lower risk than traditional banks.

On the earnings front, reports are expected from

Walgreens Boots

Alliance (NASDAQ:WBA), UnitedHealth

Group (NYSE:UNH), Bank of

America (NYSE:BAC), Citi (NYSE:C), Johnson

& Johnson (NYSE:JNJ), Charles

Schwab (NYSE:SCHW), Goldman

Sachs (NYSE:GS), Progressive (NYSE:PGR), PNC

Financial Services (NYSE:PNC) and State

Street (NYSE:STT) before the opening bell.

After the close, reports are expected from United

Airlines (NASDAQ:UAL), Interactive

Brokers (NASDAQ:IBKR), J.B.

Hunt (NASDAQ:JBHT), Pinnacle Financial

Partners (NASDAQ:PNFP), Smart Global

Holdings (NASDAQ:SGH), Enerpac Tool

Group (NYSE:EPAC), Equity

Bancshares (NYSE:EQBK), Omnicom

Group (NYSE:OMC), Fulton Financial

Corp. (NASDAQ:FULT), and more.

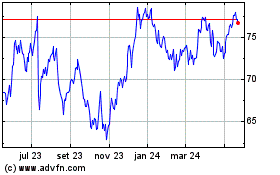

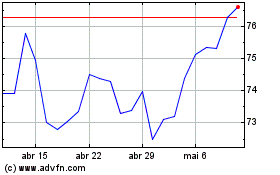

State Street (NYSE:STT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

State Street (NYSE:STT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024