U.S. index futures fell in pre-market trading on Thursday,

pressured by GDP readings that fell short of expectations, along

with disappointing earnings reports from Meta

(NASDAQ:META) and Microsoft (NASDAQ:MSFT). Reports

on the Personal Consumption Expenditures (PCE) price index, a

preferred inflation indicator by the Fed, and the October payroll

report are highly anticipated as they will influence investor

expectations for the upcoming interest rate decision.

At 6:25 AM, Dow Jones futures (DOWI:DJI) were down 214 points,

or 0.51%. S&P 500 futures lost 0.8%, while Nasdaq-100 futures

dropped 1.1%. The yield on 10-year Treasury bonds stood at

4.276%.

In the commodities market, West Texas Intermediate crude oil for

December rose 0.47% to $68.93 per barrel, while Brent for December

increased 0.39% to $72.83 per barrel.

Oil prices climbed on Thursday, supported by an unexpected drop

in U.S. oil and gasoline inventories, indicating

stronger-than-expected demand. Additionally, the potential decision

by OPEC+ to postpone a production increase provided further support

to prices, which had previously declined due to reduced tensions in

the Middle East. OPEC+ is scheduled to meet on December 1.

Gold was priced at $2,773.89, down 0.43%. Gold reached a record

of $2,790.10 an ounce, driven by a flight to safe-haven assets

ahead of the U.S. elections, despite positive economic data that

could influence Fed rate cuts. The metal has risen more than a

third this year, supported by central bank purchases and

geopolitical tensions.

In today’s U.S. economic agenda, at 8:30 AM, important data will

be released, including personal income for October, expected to

grow by 0.4%, up from the previous 0.2%, and personal spending,

also anticipated at 0.4%.

The PCE index, which measures inflation, is expected to rise by

0.2% in October, reaching 2.1% year-over-year, slightly below the

prior 2.2%. The core PCE is projected at 0.3% for the month, with a

yearly rate of 2.6%.

At the same time, initial jobless claims for October 26 are

forecasted at 235,000, up from 227,000. Also at 8:30 AM, the Q3

Labor Cost Index will be released, with expectations of 1.0%. At

9:45 AM, the Chicago PMI for October is expected to be reported at

46.1, down from the previous 46.6.

Among the major Asian indices, South Korea’s Kospi led the

losses, falling 1.45% to 2,556.15, its lowest level since

September. China’s CSI 300 closed virtually unchanged. Australia’s

S&P/ASX 200 dropped 0.25%. Japan’s Nikkei 225 ended down 0.5%

following the BOJ’s decision, while Hong Kong’s Hang Seng rose

0.13% in the final trading hour.

The Bank of Japan maintained its interest rates at 0.25%, citing

the need to assess global economic conditions. The bank projected

inflation near 2%, but indicated that it would only raise rates if

domestic economic recovery is consistent. Internal and external

political uncertainties, particularly following the loss of a

governing majority, influence the pace of adjustments.

Japan’s industrial production grew 1.4% in September, exceeding

the 0.8% forecast, driven by increases in automobile and chemical

manufacturing. However, production fell 2.8% compared to the

previous year. Retail sales declined 2.3% in September,

highlighting uncertainties about future demand.

In China, the largest banks reported increased profits for the

third quarter, driven by reduced provisions. AgBank saw a net

profit increase of 5.88%, while ICBC reported a rise of 3.8%.

However, net interest margins declined for some banks, reflecting

ongoing pressures due to government policies and moderate credit

demand.

China’s industrial activity expanded in October after six

months, with the PMI rising to 50.1. Beijing expects recent

stimulus to promote economic growth and revive investments, despite

challenges in the real estate sector and low consumer confidence.

Chinese service and construction activity grew slightly, with the

non-manufacturing PMI rising to 50.2, up from 50.0 in September,

according to the National Bureau of Statistics.

In South Korea, Kakao Corp. founder Brian Kim

was released after posting bail of $218,000 (300 million won) while

facing accusations of stock manipulation related to the acquisition

of SM Entertainment in 2023. Kim is accused of inflating SM’s stock

to surpass a rival bid, a case with potential implications for

Kakao and the country’s tech sector.

Samsung Electronics reported lower profits

compared to last year, primarily impacted by its semiconductor

unit, which posted an operating profit of $2.8 billion (3.86

trillion won), a 40% decline from the previous quarter.

European markets are trading lower, led by losses in the retail

sector, as investors review eurozone inflation data and corporate

earnings.

Eurozone inflation rose to 2% in October, surpassing

expectations of 1.9%. In September, the rate was revised to 1.7%.

Meanwhile, third-quarter economic growth of 0.4% surprised

positively but with forecasts of future slowdown.

Inflation in France remains below the ECB’s target, with

consumer prices in October up 1.5% year-over-year. This scenario

reinforces the possibility of further rate cuts, with the ECB

likely reducing rates for the third time in December. The French

economy is expected to slow down as the economic boost from the

Olympics fades and fiscal tightening looms.

Shares of BNP Paribas (EU:BNP) fell after the

bank reported a 2.6% decline in retail revenue in the third

quarter. Nevertheless, it reported a net profit of €2.87 billion, a

5.9% increase, in line with expectations of €2.86 billion, driven

by growth in investment banking and cost control. Total revenue of

€11.94 billion also met forecasts.

Geberit (LSE:0RQ0) exceeded expectations in the

third quarter with a net profit of 150.3 million Swiss francs,

above the forecast of 138.1 million, and revenue of 762 million

francs, surpassing the estimated 727.6 million.

In terms of quarterly reports, numbers are expected from

Uber (NYSE:UBER), Peloton (NASDAQ:PTON), Merck (NYSE:MRK), ConocoPhillips (NYSE:COP), SiriusXM (NASDAQ:SIRI), Altria (NYSE:MO), Mastercard (NYSE:MA), Estée

Lauder (NYSE:EL), Kellanova (NYSE:K)

and Norwegian Cruise Line (NYSE:NCLH)

before the market opens.

After the close, results from

Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Intel (NASDAQ:INTC), Atlassian (NASDAQ:TEAM), ICF

International (NASDAQ:ICFI), Eldorado

Gold (NYSE:EGO), Ardelyx (NASDAQ:ARDX), AES

Corporation (NYSE:AES), Nine Energy

Service (NYSE:NINE) and United States

Steel (NYSE:X), among others, are awaited.

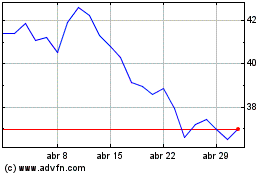

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024