U.S. index futures rose in Thursday’s

pre-market session following Donald Trump’s victory, which sent the

Dow Jones up over 1,500 points yesterday. Investors are watching

for the Federal Reserve’s interest rate decision, with CME Group’s

Fed Watch tool showing a 100% probability of a rate cut. Corporate

earnings, jobless claims data, and wholesale inventories will also

be closely monitored today.

As of 5:26 AM ET, Dow Jones futures (DOWI:DJI) were up 72

points, or 0.16%. S&P 500 futures gained 0.16%, while

Nasdaq-100 futures rose 0.21%. The 10-year Treasury yield was at

4.429%.

In commodities, West Texas Intermediate crude

for December fell 0.92% to $71.03 per barrel, and Brent for January

dropped 0.72% to $74.38 per barrel.

Oil prices declined due to a looming hurricane in the Gulf of

Mexico, a stronger dollar, and lower Chinese imports. Trump’s

election raised concerns about restrictions on Iranian and

Venezuelan oil, while the hurricane disrupted 17% of U.S. Gulf

production. Fluctuations were also influenced by Middle East

tensions and OPEC+ policy.

China’s October oil imports dropped to 44.7 million tons,

signaling weak demand. This figure was 2% lower than in September

and 9% down from last year.

Russell Hardy, CEO of Vitol, forecasts global oil prices between

$70 and $80 per barrel by 2025. He noted that geopolitical

uncertainty, including potential sanctions on Iran under Trump’s

presidency, will impact supply. Citigroup also indicated that new

trade tariffs on China could harm growth.

In today’s U.S. economic agenda, initial jobless claims for the

week ending November 2 are due at 8:30 AM ET, with a forecast of

220,000, up from the previous 216,000. Preliminary Q3 productivity

is expected to remain at 2.5%.

At 10 AM ET, September’s wholesale inventory report is expected

to show a 0.1% drop, following a 0.1% increase the prior month. At

2:00 PM, the FOMC will announce its rate decision, followed by Fed

Chair Jerome Powell’s press conference at 2:30 PM. Finally, at 3:00

PM, September consumer credit data is anticipated, with an expected

increase to $14.0 billion from $8.9 billion.

In Asia-Pacific markets, China’s CSI 300 rose 3.02%, hitting a

one-month high as investors await further stimulus measures

following the legislature meeting. Despite concerns over potential

trade tensions under Trump’s presidency, stocks rebounded,

supported by positive export data.

Chinese exports surged 12.7% in October, the largest increase in

over two years, as factories ramped up production ahead of new U.S.

tariffs under Trump. However, imports fell 2.3%, reflecting weak

domestic demand, while the trade surplus rose to $95.27

billion.

Japan’s Topix gained 1% on robust corporate earnings and share

buybacks, with Toray Industries and Taisei

Corp. rising over 12%. However, the Nikkei 225 fell 0.43%

due to concerns over Trump’s tighter trade policies affecting

semiconductor stocks.

South Korea’s Kospi rose marginally, while the Kosdaq fell

1.32%. In Australia, the S&P/ASX 200 gained 0.33%.

European markets rose this morning, boosted by Trump’s victory

and political instability in Germany. Most sectors were up except

for healthcare, retail, industrials, travel, leisure, and telecoms,

while major European companies’ earnings were released. Investors

are focused on the Fed’s and Bank of England’s monetary policy

decisions, with expected rate cuts.

In Germany, exports and industrial production dropped more than

expected in September, down 1.7% and 2.5%, respectively,

highlighting economic weaknesses. Additionally, Chancellor Olaf

Scholz dismissed Finance Minister Christian Lindner, ending the

three-party coalition and calling for a confidence vote in

Parliament on January 15.

The German 10-year bond yield surpassed its equivalent swap rate

for the first time, indicating increased debt sales. This

inversion, at its lowest since 2007, suggests expectations of more

debt in the market.

Commerzbank strategist Hauke Siemssen predicts that Lindner’s

departure, who opposed debt cap flexibility, has fueled market

expectations for even greater debt issuance.

In Norway, the Norges Bank held its rate at 4.5%, the highest

since 2008, citing a weak krone and high trade costs. This

contrasts with the Riksbank’s rate cut in Sweden, reflecting a

conservative stance as other G10 countries ease policies.

In corporate highlights, John Wood Group

(LSE:WG.) shares fell 43.8% after reporting lower adjusted profits

and weak Q3 revenue growth due to disappointing project

performance. Revenue was nearly $1.49 billion, with an 8% decline

in order book year-over-year.

Adyen (EU:ADYEN) shares fell 6.2% despite

increased Q3 sales. GN Store Nord (TG) performed well, with shares

rising over 10.6%.

Italy’s Banco BPM (BIT:BAMI), the country’s

third-largest bank, offered $1.7 billion to take full control of

Anima Holding (BIT:ANIM), boosting its shares.

Using its insurance unit, the bank reduces capital requirements,

leveraging favorable rules.

Swiss Re (TG:SR9) raised its U.S. liability

reserves to $2.4 billion in Q3, easing investor concerns about

adequacy. The company projects annual net income above $3

billion.

Mobico Group (LSE:MCG) announced it is on track

to meet its profit goal, driven by high passenger demand and

cost-cutting measures. Q3 revenue rose 12%, with significant gains

in Alsa and North America, though revenue fell in Germany and the

UK. Shares rose 5.1%.

Rolls-Royce (LSE:RR.) maintained its profit

growth forecast of at least 30% this year, driven by demand from

airlines, energy, and defense sectors, despite supply chain issues.

Shares fell 4.2%.

Daimler Truck (TG:DTG) reported €1.19 billion

Q3 profit, slightly above expectations, thanks to strong North

American performance despite European weakness. Shares are up

5.6%.

Air France-KLM (EU:AF) reported a

larger-than-expected Q3 operating loss of $1.27 billion, below

estimates. Olympic costs and high expenses weighed on results,

despite a 3.7% revenue increase. Shares are down 11.1%.

Wizz Air (LSE:WIZZ) posted a 33.2% lower

operating profit, with shares down 3.5%.

Telefónica (LSE:0A2Y) reaffirmed its financial

targets despite a loss in Peru. Shares fell 0.7%.

Sainsbury’s (LSE:SBRY) maintained its profit

growth forecast of up to 10% for the year, with H1 sales rising

3.7%, driven by strong food sales despite weak performance in other

products. Shares dropped 1.5%.

Delivery Hero (TG:DHER) expects annual gross

merchandise value (GMV) growth to reach the upper end of the 7%-9%

range after a 9% Q3 increase, totaling $13.12 billion. However, GMV

in Asia fell 6.6%. Shares rose 2.6%.

Howden Joinery Group (LSE:HWDN) shares fell

2.8% after reporting lower H2 revenue due to challenging market

conditions, now expecting pretax profit at the low end of

estimates. Revenue fell 0.1% year-over-year despite market share

gains. The company anticipates tough conditions next year and

estimates an additional £18 million in costs from insurance and

minimum wage increases.

On Wednesday, U.S. indices closed sharply higher following

Donald Trump’s presidential election win, fueled by expectations of

reduced regulation and tax cuts. The Dow gained 3.6%, the Nasdaq

3.0%, and the S&P 500 2.5%, led by financial and oil sectors.

Markets now await the Federal Reserve’s monetary policy decision,

with an anticipated 25-basis-point rate cut.

In quarterly reports, earnings from Vistra

Energy (NYSE:VST), Moderna (NASDAQ:MRNA), Barrick

Gold (NYSE:GOLD), Datadog (NASDAQ:DDOG), Halliburton (NYSE:HAL), GEO

Group (NYSE:GEO), Hershey (NYSE:HSY), Esperion (NASDAQ:ESPR), Medical

Properties Trust (NYSE:MPW)

and Cameco (NYSE:CCJ) are expected

before the market opens.

After the close, earnings from

DraftKings (NASDAQ:DKNG), Arista

Networks (NYSE:ANET), Block (NYSE:SQ), Rivian (NASDAQ:RIVN), Unity (NYSE:U), The

Trade

Desk (NASDAQ:TTD), Affirm (NASDAQ:AFRM), Airbnb (NASDAQ:ABNB), Fortinet (NASDAQ:FTNT)

and Pinterest (NYSE:PINS) will be

released.

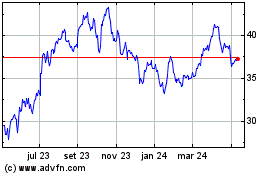

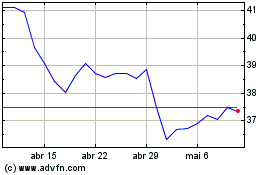

Halliburton (NYSE:HAL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Halliburton (NYSE:HAL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024