Bitcoin ETFs see large inflows following Trump victory and record

high

Bitcoin (COIN:BTCUSD) rose by 1.35% over the last 24 hours,

reaching $76,665.65, surpassing its previous record following

Donald Trump’s election win. Investors are now eyeing a potential

25-basis-point rate cut by the Fed, with traders seeing a high

probability of the reference rate falling to 4.5%-4.7%, which may

have a limited effect on the crypto market. The FOMC will announce

its rate decision at 2:00 PM, followed by Fed Chair Jerome Powell’s

press conference at 2:30 PM.

On November 6, Bitcoin ETFs saw total inflows of $621.9 million.

Fidelity’s fund (AMEX:FBTC) attracted $308.8 million, while

Grayscale’s (AMEX:BTC) and (AMEX:GBTC) funds brought in $108

million and $30.9 million, respectively. Bitwise (AMEX:BITB) and

Ark (AMEX:ARKB) garnered $100.9 million and $127.0 million.

BlackRock (NASDAQ:IBIT) and Valkyrie (AMEX:BRRR) were the only

funds to record outflows, with $69.1 million and $2.6 million,

respectively.

The “Coinbase Premium” index for Bitcoin, reflecting the price

gap between Coinbase and Binance, hit 0.09, its highest since

April, indicating rising institutional demand in the U.S. According

to CryptoQuant on Wednesday, the growing premium highlights renewed

interest in the asset following Trump’s victory.

Cointelegraph also reported that two “whales” collectively

purchased $142 million in BTC yesterday. Some analysts predict the

favorable political environment could drive BTC past $100,000 by

the end of 2024, particularly with supportive crypto-positive

policies.

Ethereum ETFs log largest inflow since September 27; staking could

attract more investors

On November 6, spot Ether ETFs in the U.S. registered a net

inflow of $52.3 million, marking their highest in six weeks. Driven

by the post-election market surge, the Fidelity Ethereum Fund

(AMEX:FETH) led with $26.9 million, followed by the Grayscale

Ethereum Mini Trust (AMEX:ETH) with $25.4 million. Leading ETF,

BlackRock’s iShares Ethereum Trust (NASDAQ:ETHA), and other

remaining Ethereum Spot ETFs recorded zero net flow.

Recently, former 21.co crypto analyst Tom Wan stated that

staking could transform Ethereum ETFs in the U.S. by helping reduce

management fees and increasing investor appeal through yield,

potentially adding between 550,000 and 1.3 million ETH to total

staked assets, further bolstering the Ethereum network.

Ethereum surge yields massive profit for whale; Trump-linked crypto

project also gains

Ethereum (COIN:ETHUSD) is up 5.3%, trading at $2,868.16. An

Ethereum whale who acquired 11,000 ETH at $3.46 in 2016 cashed in

for an estimated profit of $30.5 million today, November 7 — more

than 800 times the initial $38,000 investment.

The whale could have earned over $52.8 million by selling at the

$4,800 peak in 2021 or around $44 million in May this year when ETH

exceeded $4,000.

Trump-backed DeFi project World Liberty Financial (WLFI)

achieved $1 million in unrealized gains from Ether’s price

increase. On October 31, the company reduced its fundraising target

from $300 million to $30 million due to low demand, selling about

half of the new target. However, WLFI tokens are

“non-transferable,” limiting investor liquidity, with potential

changes subject to future governance.

Ethereum launches Mekong testnet for Pectra update testing

The Ethereum Foundation (COIN:ETHUSD) introduced the Mekong

Testnet, a temporary test network allowing developers to explore

new features in the Pectra update before its mainnet release.

Mekong includes all Ethereum Improvement Proposals (EIPs) for

Pectra, focusing on user experience, staking, and deposit and

withdrawal processes. Inspired by the Prague and Electra versions,

the update will introduce Verkle Trees to reduce node and fee

requirements, enhancing network scalability and security.

Celestia eyes rally amid record exchange outflows

Celestia (COIN:TIAUSD), up 10.9% this week and priced at $5.25

at writing, recorded its highest November exchange outflows, with

about $5.62 million in TIA withdrawn. This trend indicates optimism

among holders and may signal a prolonged rally, supported by

growing on-chain volume, which surpassed $350 million. If TIA

breaks Ichimoku Cloud resistance, it could reach $6.15, although

increased inflows could alter this outlook.

Hut 8 expands hashrate with new Bitcoin miner purchase

Bitcoin miner Hut 8 (NASDAQ:HUT) announced a 66% increase in its

self-mining hashrate to 9.3 EH/s with the acquisition of 31,145

Bitmain Antminer S21+ machines, set for early 2025 delivery. The

purchase is expected to optimize returns and efficiency, with a 37%

reduction in fleet energy consumption. The company also plans to

expand its hashrate to 24 EH/s by Q2 2025 with an additional

purchase option.

Galaxy Digital shifts Bitcoin mining to AI for profit

Michael Novogratz’s Galaxy Digital is repurposing its 800 MW

energy capacity for artificial intelligence (AI) computing due to

Bitcoin mining’s low profitability. Partnering with a U.S.-based

hyperscaler, Galaxy is diversifying revenue by capitalizing on the

rising demand for computing power, following the trend of other

major miners adapting their operations for AI.

Google Cloud strengthens Cronos network as leading blockchain

validator

Google Cloud is now the main validator on the Cronos blockchain,

enhancing its role in Web3 and bolstering network security.

Partnering with Cronos Labs (COIN:CROUSD), Google (NASDAQ:GOOGL) is

providing technical innovation expected to attract more developers.

Google’s secure infrastructure, combined with AI and data analysis

capabilities, will enable new decentralized applications.

UBS launches UBS Digital Cash for corporate blockchain payments

UBS (NYSE:UBS) has tested UBS Digital Cash, a blockchain-based

payment solution for greater transparency and speed in

international transactions for corporate clients. Designed to

reduce settlement delays and costs, UBS Digital Cash streamlines

liquidity management and improves cash reserve visibility. The

pilot included multi-currency payments and underscored

interoperability as essential for the financial sector, optimizing

tokenized asset settlement and cross-border payment efficiency.

Blockchain and AI revolutionize African agriculture, driving

financial inclusion

Blockchain technology is driving change in Africa’s agricultural

sector, addressing challenges such as credit access and market

expansion. Projects like One Million Avocados and Project Mocha

tokenize trees, allowing farmers to secure financing by selling

digital assets representing trees. This improves access to

resources for farm rehabilitation and enhances transparency.

Additionally, IoT technology aids in crop condition monitoring.

With strategic collaborations, blockchain and AI are promoting

sustainability and financial inclusion for small farmers,

transforming their economic realities.

Lamborghini launches digital vehicle NFTs with Transak for

exclusive experiences

Despite the NFT market decline, Lamborghini is betting on

long-term digital experiences for niche communities. Partnering

with Transak, Lamborghini will allow users to create NFTs of their

Revuelto models, offering driving experiences in games by Animoca

Brands. Part of the Fast ForWorld partnership, Transak facilitates

checkout payments via card and bank transfers.

Kraken criticizes SEC tactics in crypto lawsuit

Kraken’s legal team, led by Michael O’Connor, criticized the SEC

for attempting to dismiss defenses like the “major questions

doctrine.” O’Connor stated that the agency avoids exposing flawed

policies that, he argues, harm the American economy. He likened the

SEC’s approach to its unsuccessful effort in the Ripple case and

questioned the timing of the SEC’s motion, filed on election day,

suggesting it disregards the public’s voice. The SEC alleges Kraken

has operated as an unregistered exchange since September 2018,

violating securities laws.

Poland warns of Crypto.com’s unauthorized activities in the country

Poland’s Financial Supervisory Authority (KNF) issued a warning

about Foris DAX MT, operating as Crypto.com, for potential

unauthorized financial activity in Poland. While the warning

informs investors of risks, it does not halt the platform’s

operation.

Former Alameda CEO Caroline Ellison to begin two-year sentence in

November

Caroline Ellison, former Alameda Research CEO, is set to begin a

two-year prison sentence on November 7, following her conviction

for crimes involving FTX. Judge Kaplan ordered Ellison to report to

a minimum-security facility, likely in Danbury, Connecticut.

Ellison, who pleaded guilty in 2022, testified against Sam

Bankman-Fried and has faced significant public backlash since FTX’s

collapse.

Fake Curve Finance app reappears on App Store, exposing users to

fraud

A fake Curve Finance (COIN:CRVUSD) app has resurfaced on the App

Store, targeting unsuspecting users. Masquerading as a legitimate

DeFi platform, it promises token swap and liquidity staking

features but leads to unauthorized withdrawals and fund

disappearance, as reported in user reviews.

Dune launches dashboard mapping $2.5 billion in crypto crimes

Dune launched a comprehensive dashboard documenting over 5,500

cybercrimes in the blockchain ecosystem, including hacks, exploits,

and phishing scams. Since 2016, about $2.5 billion has been stolen,

with data from sources like Scamsniffer and Forta Network. The

dashboard tracks stolen fund flows, highlighting destinations like

Tornado Cash and DeFi platforms. The tool provides transparency to

the public concerned with crypto security, and it is open and

accessible.

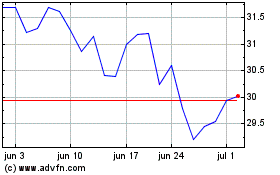

UBS (NYSE:UBS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

UBS (NYSE:UBS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024