Nasdaq, S&P 500 Regain Ground But Dow Closes Modestly Lower

18 Novembro 2024 - 6:41PM

IH Market News

Following the sell-off seen during last Friday’s session, stocks

moved back to the upside during trading on Monday. The Nasdaq and

the S&P 500 regained ground, although the narrower Dow ended

the day modestly lower.

While the Nasdaq climbed 111.69 points or 0.6 percent to

18,791.81 and the S&P 500 (SPI:SP500) rose 23.00 points or 0.4

percent to 5,893.62, the Dow edged down 55.39 points or 0.1 percent

to 43,389.60.

The rebound on Wall Street may partly have reflected bargain

hunting, as traders looked to pick up stocks at somewhat subdued

levels following the steep drop seen last week.

The major averages pulled back well off their record highs last

week amid concerns about the outlook for interest rates along with

worries about the impact of President-elect Donald Trump’s proposed

policies and cabinet nominees.

Buying interest was somewhat subdued, however, as traders looked

ahead to the release of quarterly results from AI darling Nvidia

(NASDAQ:NVDA).

Nvidia, which has recently been a driver of the markets, is

scheduled to release its fiscal third quarter results after the

close of trading on Wednesday.

In U.S. economic news, the National Association of Home Builders

released a report showing homebuilder confidence has improved by

much more than anticipated in the month of November.

The report said the NAHB/Wells Fargo Housing Market Index

climbed to 46 in November after rising to 43 in October. Economists

had expected the index to inch up to 44.

With the much bigger than expected increase, the housing market

index reached its highest level since hitting 51 in April.

Sector News

Gold stocks moved sharply higher on the day, resulting in a 4.2

percent spike by the NYSE Arca Gold Bugs Index. The rally by gold

stocks comes amid a substantial increase by the price of the

precious metal.

Considerable strength was also visible among computer hardware

stocks, as reflected by the 2.8 percent surge by the NYSE Arca

Computer Hardware Index.

Super Micro Computer (NASDAQ:SMCI) led the sector higher after a

report from Barron’s said the company is expected to file a plan to

avoid being delisted from the Nasdaq.

Natural gas, steel and oil stocks also saw significant strength,

while airline stocks showed a notable move to the downside.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance during trading on Monday.

Japan’s Nikkei 225 Index slumped by 1.1 percent, while Hong Kong’s

Hang Seng Index advanced by 0.8 percent.

The major European markets also turned mixed over the course of

the session. While the German DAX Index edged down by 0.1 percent,

the French CAC 40 Index inched up by 0.1 percent and the U.K.’s

FTSE 100 Index climbed by 0.6 percent.

In the bond market, treasuries recovered from early weakness to

end the session modestly higher. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, dipped

1.4 basis points to 4.414 percent after reaching a high of 4.491

percent.

SOURCE: RTTNEWS

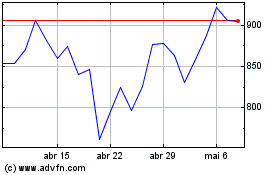

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024