Mohawk Group Holdings, Inc. (NASDAQ: MWK) China

Exposure Could Help the Company, As Country Rebounds From

Coronavirus Outbreak

March 24, 2020 -- InvestorsHub NewsWire -- via Spotlight Growth --

The novel coronavirus, or COVID19, has blind-sided the world, as

the virus outbreak continues to

spread and disrupt the global economy. It is fair to say that some

countries have had better responses to the outbreak than others,

but every single country has made missteps while handling the

pandemic.

As of March 19, 2020, there are 228,451 global cases

of coronavirus, with 9,357

deaths and 86,254 recoveries. According to the World Health

Organization, COVID19 has a global death rate of around 3.4%, up

from an initial estimate of 2% in early March 2020.

However, there is some good new beginning to emerge from the

pandemic. For the first time since the outbreak began in December

2019, China reported no new

domestic cases of coronavirus on Thursday, March 19, 2020. This

marks the fifth consecutive day where China is seeing a noticeable

drop in new infections, which gives experts hope that the outbreak

is beginning to subside in China.

With global markets facing severe losses, China’s stock market

has quietly been outperforming in recent weeks. For companies that

do business in China, like Mohawk Group Holdings, Inc. (NASDAQ:

MWK), this is a welcoming sign, which could see manufacturing

and production activity return to normal in the coming weeks.

Companies With Chinese Exposure Coming Back Into

Focus

China is beginning to attract attention again, as economic

activity begins to normalize. Major Chinese companies like Baidu,

Inc. (NASDAQ:

BIDU), JD.com (NASDAQ:

JD), and Pinduoduo.com (NASDAQ:

PDD), have all made upbeat comments in recent weeks regarding

seeing activity beginning to revert to normal.

Source: Mohawk Group

As a result, “China-related equities could serve as a good

option to hedge against the current market turmoil,” according

to Aiden Research. While Aiden

does note that anything is possible, such as a resurgence of the

outbreak and a global recession, but given the current landscape of

the virus’s spread and relative economic activity, China is one

area that is beginning to shine again.

Chinese manufacturing and production activities are estimated to

be running back at normal capacity by the end of March, according

to major manufacturing firms like Foxconn Technology. This will

help the technology supply

chain recover, after being severely disrupted over the

past several months.

Mohawk Group is one such company with ties to China, which could

see a boost as economic activity returns to normal. The company has

manufacturing partnerships in China, which are responsible for

developing and producing Mohawk’s consumer products. China also

represents an important location for Mohawk in terms of sales.

Mohawk has a team based out of Shenzhen, China as well, which is

considered the “Chinese Silicon Valley.” With workers beginning to

return and activity normalizing, e-commerce should see a healthy

rebound as well.

MWK: Strong Outlook Despite Potential Virus Headwinds,

Positive Adj. EBITDA Still Seen For Q3 2020

In Mohawk’s recent earnings conference call, management

spoke to shareholders regarding recent results, 2020 outlook, and

impact from the coronavirus outbreak. During full-year 2019, Mohawk

saw revenues surge 56.2% to $114.5 million, compared to $73.2

million a year ago. The growth came as a result of increases in

direct sales volume from existing and new products.

For full-year 2020, management issued net revenue estimates in

the range of $160 million to $170 million, as new product launches

from 2019 and 2020 help drive new sales. Management noted that this

outlook does include any "potential inventory constraints for

existing products and potential delays in new product launches

primarily in the second half of the year, due to the impact from

COVID19," according to the recent earnings call. However, the

company does still estimate positive-adjusted EBITDA to be reported

during the third quarter of 2020.

Source: MWK Investor Presentation

“As I look forward to 2020, I see many signs pointing to an

acceleration of the market-based business model and a massive

opportunity to capitalize on a formidable transformation in one of

the world’s largest industries. We’re looking to build a very large

and profitable company and consider ourselves in very early stages

of this journey. It will take time for many to understand us and

probably in hindsight, only some will realize what we’re seeing

now. Myself and the management team are committed to this journey,”

noted Mohawk CEO Yaniv Sarig during the conference call.

Mohawk’s Third-Party Logistics Providers Allows Company

to Side-Step Amazon Fulfillment Shutdown, Offer One-Day Prime

Shipping Coverage to 90% of Continental U.S.

For retailers across the world, it has been “all hands-on deck.”

Essential household items are flying off the shelves, as consumers

hoard due to virus outbreak fears. As a result of the increased

demand for household staple and essential items, some retailers are

blocking inventory buildup for non-essential items, in an effort to

give more warehouse space to the critical items.

Amazon is one such company that has recently announced that

its warehouses will only

accept essential supplies. This essentially means that Amazon’s

fulfillment services are shutdown to a majority of businesses,

unless they happen to produce or supply consumer staples. Amazon

says it will continue to prioritize essential items in its

warehouses until April 5, 2020. This means Amazon shoppers could

see longer delays on items such as electronics and clothing.

Source: MWK Investor Presentation

Fortunately for Mohawk Group, the company’s efforts to build a

third-party operational and shipping warehouse network through

logistics providers, will help the company side-step the shutdown

at Amazon. As noted in the recent earnings call, Mohawk currently

has access to eight operational and shipping warehouses, with a

ninth location planning to become operational at the end of

March.

This third-party logistical network means Mohawk will have

“one-day prime shipping coverage of over 90% of the continental

U.S. population,” according to management.

On March 20, 2020, Mohawk

announced that it is making its proprietary AIMEE AI-based platform

available to other Amazon sellers and businesses that rely on its

fulfillment services during the shutdown.

Source: MWK Investor Presentation

“Yaniv Sarig, Co-Founder and Chief Executive Officer of Mohawk

Group, stated, “During these difficult times it is incumbent on us

all to do our part to help alleviate the challenges currently

facing everyone. Making the Mohawk AIMEE platform available to

sellers who rely on Amazon’s fulfillment services will allow them

to maintain operations, while freeing up Amazon to focus on

delivering essential products, and all of this ultimately allowing

consumers to stay at home and safe.”

In a time when Amazon is beginning to shift to one-day shipping

options and closing off access temporarily to non-essential items,

the Mohawk management team’s insight to diversify beyond Amazon

fulfillment was genius.

Overall, the global sell-off has gotten extremely

out-of-control. We are now in a state of over-correction, as we

have seen years' worth of gains evaporate in just a few weeks. With

China rebounding from the coronavirus outbreak, some analysts and

equity research analysts are seeing the country as a potential

hedge against the global turmoil currently taking place in other

equity markets.

Mohawk is one such company that has been unfairly-beaten down

with the broader market. The recent earnings call provided several

strong silver linings for the company and its future, which is only

further supported by rebounding economic activity in China. Mohawk

looks to be severely cheap currently, as the company prepares for a

strong 2020 and potential positive adjusted EBITDA coming in the

third quarter. Chaos creates opportunity, Chinese-related equities

appear to be enticing in the current market landscape.

Disclaimer:

Spotlight Growth is compensated, either directly or via a third

party, to provide investor relations services for its

clients. Spotlight Growth creates exposure for companies

through a customized marketing strategy, including design of

promotional material, the drafting and editing of press releases

and media placement.

All information on featured companies is provided by the

companies profiled, or is available from public sources. Spotlight

Growth and its employees are not a Registered Investment Advisor,

Broker Dealer or a member of any association for other research

providers in any jurisdiction whatsoever and we are not qualified

to give financial advice. The information contained herein is based

on external sources that Spotlight Growth believes to be reliable,

but its accuracy is not guaranteed. Spotlight Growth may create

reports and content that has been compensated by a company or

third-parties, or for purposes of self-marketing. Spotlight Growth

was compensated five thousand dollars for the creation and

dissemination of this content by the company.

This material does not represent a solicitation to buy or sell

any securities. Certain statements contained herein constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements may

include, without limitation, statements with respect to the

Company's plans and objectives, projections, expectations and

intentions. These forward-looking statements are based on current

expectations, estimates and projections about the Company's

industry, management's beliefs and certain assumptions made by

management.

The above communication, the attachments and external Internet

links provided are intended for informational purposes only and are

not to be interpreted by the recipient as a solicitation to

participate in securities offerings. Investments referenced

may not be suitable for all investors and may not be permissible in

certain jurisdictions.

Spotlight Growth and its affiliates, officers, directors, and

employees may have bought or sold or may buy or sell shares in the

companies discussed herein, which may be acquired prior, during or

after the publication of these marketing materials. Spotlight

Growth, its affiliates, officers, directors, and employees may sell

the stock of said companies at any time and may profit in the event

those shares rise in value. For more information on our

disclosures, please visit: http://spotlightgrowth.com/index.php/disclosures/

SOURCE: Spotlight Growth

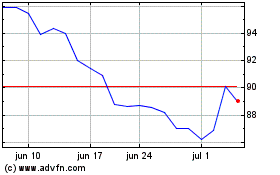

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024