Dear Tesla:

Please stop complaining about China being the only source of

graphite

December 14, 2021 -- InvestorsHub

NewsWire -- via aheadoftheherd.com -- The electrification of

the global transportation system doesn't happen without lithium and

graphite needed for lithium-ion batteries that go into electric

vehicles.

An EV uses the same rechargeable

batteries as found in phones or laptops, only bigger. The cathode,

one of two components that stores and releases electricity,

requires lithium, and nickel, manganese and cobalt— expensive

metals found in one of the most common battery chemistries, NMC

8-1-1. (eight parts nickel to one part manganese and one part

cobalt)

The anode is made from graphite,

a critical metal that is harder to source than lithium. These

materials need to be mined and processed into high-purity chemical

compounds, then made into suitcase-sized battery packs, a procedure

that is dominated by China, which accounts for roughly 75% of

global lithium-ion battery capacity.

Lately Tesla has been talking

about the grip China has on automakers requiring battery raw

materials, in particular graphite, which is only mined in a handful

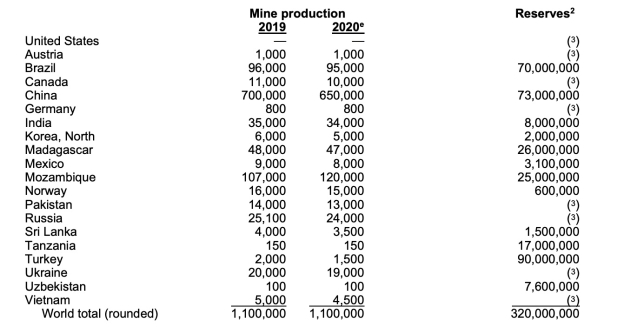

of countries. Over half of the world's graphite production in 2020

came from China (650,000 tonnes of 1.1Mt), followed by Mozambique

and Brazil at a respective 120,000t and 95,000t.

2020 mined

graphite production. Source: USGS

When it comes to coated spherical

graphite, the graphite end product needed in the battery anode,

China owns 100% of the world's production, because of the ready

availability of graphite there, weak environmental standards and

low costs. It doesn't matter where the graphite is

mined, if it is to become battery-grade, it gets sent to China for

processing.

(China also dominates the

production of synthetic graphite, used mostly in the electrodes

found in electric-arc furnaces for steelmaking; and graphite blocks

used in solar energy storage. Primary synthetic graphite is

manufactured in powder form for high-end lithium-ion batteries.

However, the process is expensive (and not so green), costing the

same amount as making an electrode)

Currently there are no producing

graphite mines in the United States, and only 10,000 tonnes a year

is being mined from two facilities in Canada. The fact is, for the United States to develop

a "mine to battery to EV" supply chain at home, right now it has no

choice but to import its battery-grade graphite from

China.

On top of this, doubts have been

raised over whether China can keep up with surging global graphite

demand. The top producer has already taken steps to retain its

graphite resources by restricting its export quota and imposed a

20% export duty.

It's thought that the increased

use of lithium-ion batteries could gobble up well over 1.6 million

tonnes of flake graphite per year (out of a total 2020 market, all

uses, of 1.1Mt) — only flake graphite, upgraded to 99.9% purity,

and synthetic graphite (made from petroleum coke, a very expensive

and polluting process) can be used in lithium-ion

batteries.

According to the World Bank,

graphite accounts for nearly 53.8% of the mineral demand in

batteries, the most of any. Lithium, despite being a staple across

all Li-ion batteries, accounts for only 4% of total

demand.

The US Geological Survey believes

that large-scale fuel cell applications are being developed that

could consume as much graphite as all other uses

combined.

Can the mining industry crank out

more graphite every year to match this demand? Color me skeptical.

Between 2018 and 2019, world mine production actually declined by

20,000 tonnes, or 1.8%. Global production in 2019 and 2020 was

exactly the same, 1.1 million tonnes.

Tesla is obviously aware of this

and in a recent Bloomberg article the company voiced its

displeasure at the situation.

Joining a host of other auto

suppliers looking for tariff exclusions on various parts, in a

comment to the US Trade Representative, Tesla says

"natural graphite is currently not available in the specifications

nor capacity outside of its current suppliers and China that is

required" for it

to manufacture EV batteries in the U.S. Tesla is

requesting waivers on various forms of artificial and natural

graphite.

The article

'If

Tela's Got Troubles, Everyone Should Worry' goes on to say that if Tesla

is struggling to procure a raw material only available in the form

it needs in China, so are other battery-makers.

Among them are SK

Innovation, a South Korean company investing billions in the United

States to build two battery plants in Georgia, the first of which

is scheduled to open early next year; the company is a supplier to Volkswagen

and Ford.

Where is SK Innovation planning

on getting its battery raw materials? Clearly China. In the article

the company says "there

is currently not enough infrastructure in the U.S. that can deliver

artificial graphite at the quantity and cost" it requires

— similar

to Tesla's submission. What's

more, the firm noted that, because this material is so

key, the

higher costs will be passed on to U.S. consumers and American

companies. If SK can't get it, then battery investment — a

highlight of the U.S.'s EV and manufacturing policy — could

struggle.

It is frustrating, to say the

least, to hear these companies complain about US graphite

dependence on China when the clear and obvious solution is to stop

buying it from there and start mining and processing it right here

in North America.

The United States (and Canada)

needs secure, cost-competitive and environmentally sustainable

sources of graphite, and that means developing graphite deposits

into mines.

A White House report on critical

supply chains showed that graphite demand for clean energy

applications will require 25 times more graphite by 2040 than was

produced worldwide in 2020.

There is no substitute for

graphite in an EV battery and lithium-ion batteries are expected to

be the technology that runs electric vehicles for the foreseeable

future, making graphite indispensable to the global shift towards

clean energy.

Fortunately, there is another

option that most industry observers have not cottoned onto. There

is plenty of North American graphite for local consumption, if

industry and government can find the collective will to "make it

so".

On February 24, 2021, President

Joe Biden signed an executive

order (EO) aimed at strengthening critical US

supply chains. Graphite was identified as one of four minerals

considered essential to the nation's "national security, foreign

policy and economy."

Earlier this year, the Federal

Permitting Improvement Steering Committee (FPISC) granted

High-Priority Infrastructure Project (HPIP) status

to Graphite One Inc.

(TSXV:GPH, OTCQX:GPHOF), which is aiming to develop America's first

high-grade producer of coated spherical graphite (CSG) integrated

with a domestic graphite resource at Graphite Creek,

Alaska.

The HPIP designation allows

Graphite One to list on the US government's Federal Permitting

Dashboard, which ensures that the various federal permitting

agencies coordinate their reviews of projects as a means of

streamlining the approval process.

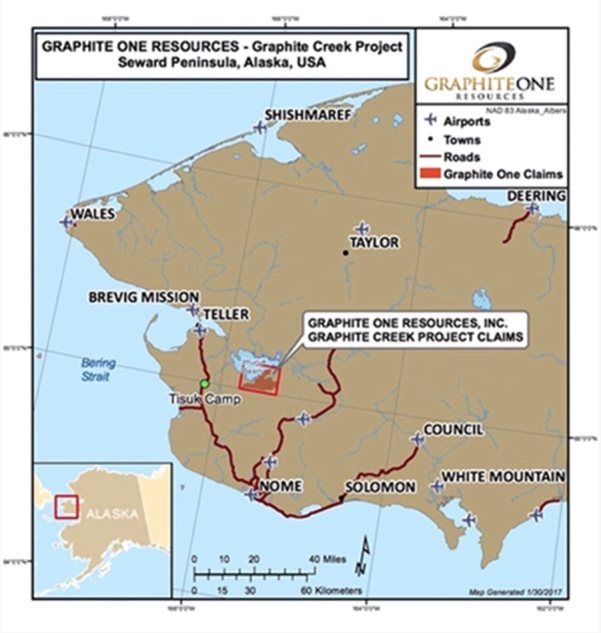

Graphite Creek is the

highest-grade and largest known flake graphite deposit in North

America, spanning 18 km.

The Graphite

Creek property is located 55 km north of Nome, Alaska.

The project is envisioned as a

vertically integrated enterprise to mine, process and manufacture

Coated Spherical Graphite ("CSG") for the lithium-ion electric

vehicle battery market. Graphite One aims to become the first US

vertically integrated domestic producer to do so.

The latest resource estimate

(March 2019) for Graphite Creek showed 10.95 million tonnes of

measured and indicated resources at a graphite grade of 7.8% Cg,

for some 850,000 tonnes of contained graphite. Another 91.9 million

tonnes were tagged as inferred resources, with an average grade of

8.0% Cg containing 7.3 million tonnes.

A preliminary

economic assessment (PEA) envisions a 40-year operation with a

mineral processing plant capable of producing 60,000 tonnes of

graphite concentrate (at 95% purity) per year.

Once in full production, Graphite

One's proposed graphite products manufacturing plant — the second

link in its proposed supply chain strategy — is expected to turn

graphite concentrates into 41,850 tonnes of battery-grade coated

spherical graphite and 13,500 tonnes of graphite powders per year.

A location in the Pacific Northwest is being considered.

Conclusion

So here's the irony: A large part

of the Biden administration's decarbonization strategy centers

around building electric vehicles and getting drivers to ditch

their gas-guzzling cars and trucks. The White House has set an

ambitious goal of stopping the sale of new fossil fuel-powered

vehicles by 2035.

None of this happens without

lithium, graphite and other battery metals such as nickel, cobalt

and manganese, not to mention copper for EV motors, wiring and

charging stations. Currently the only way for the US to make an EV

transformation is to source its graphite from China. There is no

substitute for graphite in the anode and there is no-one else but

China that processes coated spherical graphite; they have a

monopoly.

A country that is becoming more

and more belligerent by the day, economically, politically and

militarily. China's interests no longer align with the US and

Canada, more with Russia, and yet we are 100% dependent on this

totalitarian regime for making EV batteries that are seen as a key

technology for helping to mitigate the effects of climate change,

which is becoming glaringly apparent through annual droughts,

fires, storms and floods.

Everybody in the automaking game

is looking to China to supply graphite for their battery anodes.

That includes the 92 US companies that already consume it, the 11

US battery gigafactories currently in the works, the 11 EV

start-ups, along with the traditional car-makers nearly all of

which have plans to produce electric vehicles. For details

read Graphite

prices heading higher on market tightness

Billions are being invested in

battery cell plants and new US-based EV production lines yet few

people have bothered to check where they are going to get the raw

materials.

Expensive, polluting synthetic

graphite from China? Natural flake graphite upgraded to 99.9%

purity, also in China? We can do better than this.

Our proposal cuts out the Chinese

middleman and focuses on Graphite One's Graphite Creek project in

Alaska, the highest-grade and largest known flake graphite deposit

in North America.

Battery-grade graphite mined from

Graphite Creek and processed at a plant in the Pacific Northwest

will be cheaper and cleaner than any process done in

China.

The US government has already

identified Graphite Creek as a High-Priority Infrastructure Project

(HPIP), now let's fast-track it, give it the grants needed to build

a mine. Yes, it may take a couple of years, and it may require a

short offtake agreement with a major battery or automaker to ramp

up to full production.

But this is the answer to the

graphite security of supply problem that Tesla, SK Innovation and

others have been whining about. Unfortunately they are too focused

on their own profits and priorities to realize the solution is

right in front of their eyes, in a remote corner of Alaska that

could become the first link of a US mine to battery to EV supply

chain.

Graphite One

Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.89, 2021.12.08

Shares Outstanding

81.5m

Market cap Cdn$157.5m

GPH website

Richard (Rick)

Mills

aheadoftheherd.com

subscribe

to my free newsletter

Legal Notice

/ Disclaimer

Ahead of the Herd

newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the

entire Disclaimer carefully before you use this website or read the

newsletter. If you do not agree to all the AOTH/Richard Mills

Disclaimer, do not access/read this website/newsletter/article, or

any of its pages. By reading/using this AOTH/Richard Mills

website/newsletter/article, and whether you actually read this

Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard

Mills document is not, and should not be, construed as an offer to

sell or the solicitation of an offer to purchase or subscribe for

any investment.

AOTH/Richard Mills

has based this document on information obtained from sources he

believes to be reliable, but which has not been independently

verified.

AOTH/Richard Mills

makes no guarantee, representation or warranty and accepts no

responsibility or liability as to its accuracy or

completeness.

Expressions of

opinion are those of AOTH/Richard Mills only and are subject to

change without notice.

AOTH/Richard Mills

assumes no warranty, liability or guarantee for the current

relevance, correctness or completeness of any information provided

within this Report and will not be held liable for the consequence

of reliance upon any opinion or statement contained herein or any

omission.

Furthermore,

AOTH/Richard Mills assumes no liability for any direct or indirect

loss or damage for lost profit, which you may incur as a result of

the use and existence of the information provided within this

AOTH/Richard Mills Report.

You agree that by

reading AOTH/Richard Mills articles, you are acting at your OWN

RISK. In no event should AOTH/Richard Mills liable for any direct

or indirect trading losses caused by any information contained in

AOTH/Richard Mills articles. Information in AOTH/Richard Mills

articles is not an offer to sell or a solicitation of an offer to

buy any security. AOTH/Richard Mills is not suggesting the

transacting of any financial instruments.

Our publications

are not a recommendation to buy or sell a security – no information

posted on this site is to be considered investment advice or a

recommendation to do anything involving finance or money aside from

performing your own due diligence and consulting with your personal

registered broker/financial advisor.

AOTH/Richard Mills

recommends that before investing in any securities, you consult

with a professional financial planner or advisor, and that you

should conduct a complete and independent investigation before

investing in any security after prudent consideration of all

pertinent risks. Ahead of the Herd is not a

registered broker, dealer, analyst, or advisor. We hold no

investment licenses and may not sell, offer to sell, or offer to

buy any security.

Richard owns shares of

Graphite One

Inc. (TSXV:GPH). GPH is

a paid advertiser on Richards site aheadoftheherd.com

SOURCE: aheadoftheherd.com

Graphite One (TSXV:GPH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Graphite One (TSXV:GPH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024